-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

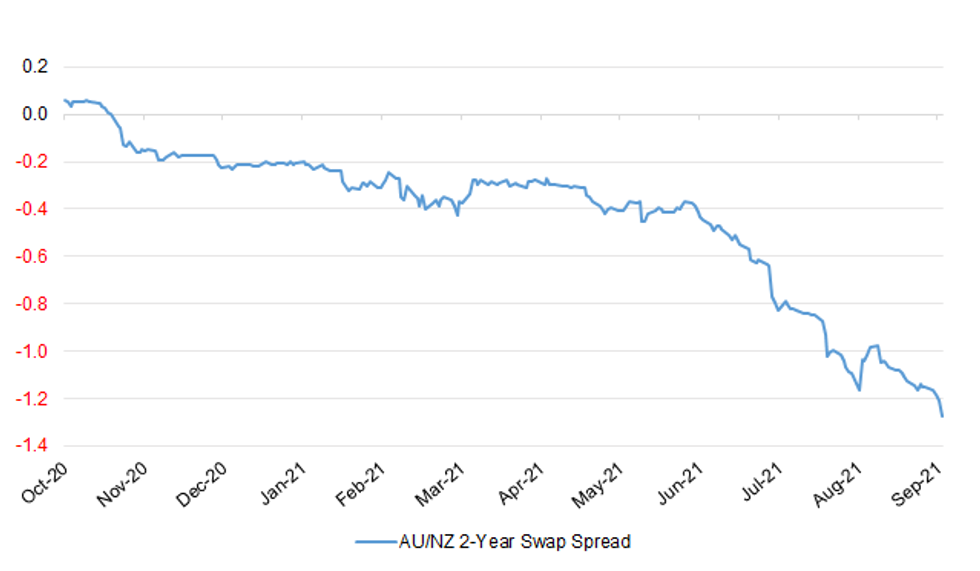

Antipodean Cross Extends Losses Amid Central Bank Outlook Divergence

Data released out of the Antipodean countries today has applied some further pressure to AUD/NZD, sending the rate to its worst levels since Apr 7, 2020. The rate trades -22 pips at NZ$1.0297 at typing, after bottoming out at NZ$1.0284. Bears need the rate to pass the next technical milestone at NZ$1.0243 (76.4% retracement of the 2020 rally) before setting their sights on the NZ$1.0200 mark. Bulls look for a rebound above Sep 7 high of NZ$1.0454, which would bring the 50-DMA at NZ$1.0488 into play.

- New Zealand's quarterly economic growth in Q2 topped not only BBG median estimate but also expectations of all economists taking part in the survey. The kiwi drew support from the release, despite its backward-looking nature and a slight downward revision to the previous reading (albeit it was coupled with an upgrade to the prior reading of annual GDP growth).

- Australian labour market report was noisy, the unemployment rate unexpectedly plunged to 4.5% but the decline in employment was wider than suggested by BBG median estimate, while the participation rate fell slightly more than forecast. Developments in the labour market were affected by lockdown dynamics across the country.

- In the grand scheme of things, AUD/NZD has been on a downward trajectory for the bulk of this year amid continued central bank outlook divergence. Earlier this week, RBA Gov Lowe explicitly downplayed market pricing of rate hikes in '22 & '23. Meanwhile, the RBNZ stand ready to pull the trigger on OCR hikes, after being prevented from doing so last month by the implementation of a nationwide lockdown at the 11th hour before the decision.

- This divergence has become even more acute as upbeat New Zealand's GDP data prompted participants to boost hawkish RBNZ bets, with the OIS strip pricing 36bp worth of tightening at the October meeting as we type, up from 27bp seen yesterday. AU/NZ 2-Year swap spread has tightened further and last sits at its lowest point since mid-2015.

Fig. 1: Australia/New Zealand 2-Year Swap Spread

Source: MNI Market News/Bloomberg

Source: MNI Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.