-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBaht Slips After Second Straight Day Of Net Equity Outflows

Spot USD/THB trades +0.025 at THB36.635, oscillating within yesterday's range. A clearance of Sep 2 high of THB36.845 would allow bulls to set their sights on Jul 21 cycle high of THB36.945. Conversely, bears need a dip under the 50-DMA (THB36.191) to get some initial reprieve.

- The baht has been the second-worst performer in emerging Asia this week, with only the KRW posting deeper losses against the greenback. Heightened political uncertainty surrounding PM Prayuth's term-limit case may be adding to baht vulnerability, with the final ruling expected on Sep 30.

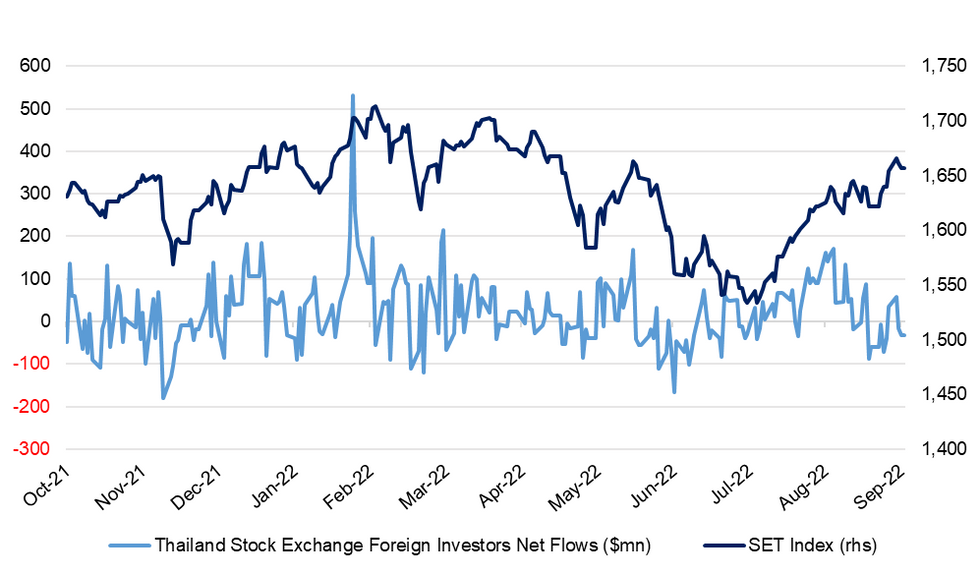

- Offshore investors sold a net $33.4mn in Thai equities Wednesday, the second consecutive day of outflows. Recovery in foreign demand for Thai stocks that began in Jun has seemingly run its course, as suggested by data on daily equity flows, yet in the grand scheme of things the SET index has managed to keep pushing higher. Despite opening sharply lower Wednesday, the index clawed back the bulk of its initial losses by the end of the day.

- BoT Asst Gov Siritida holds a media briefing today, while FinMin Arkhom will appear at an award presentation. Looking further afield, the central bank will provide its weekly update on foreign reserves this Friday.

Fig. 1: Thailand Stock Exchange Foreign Investors Net Flows vs. SET Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.