-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

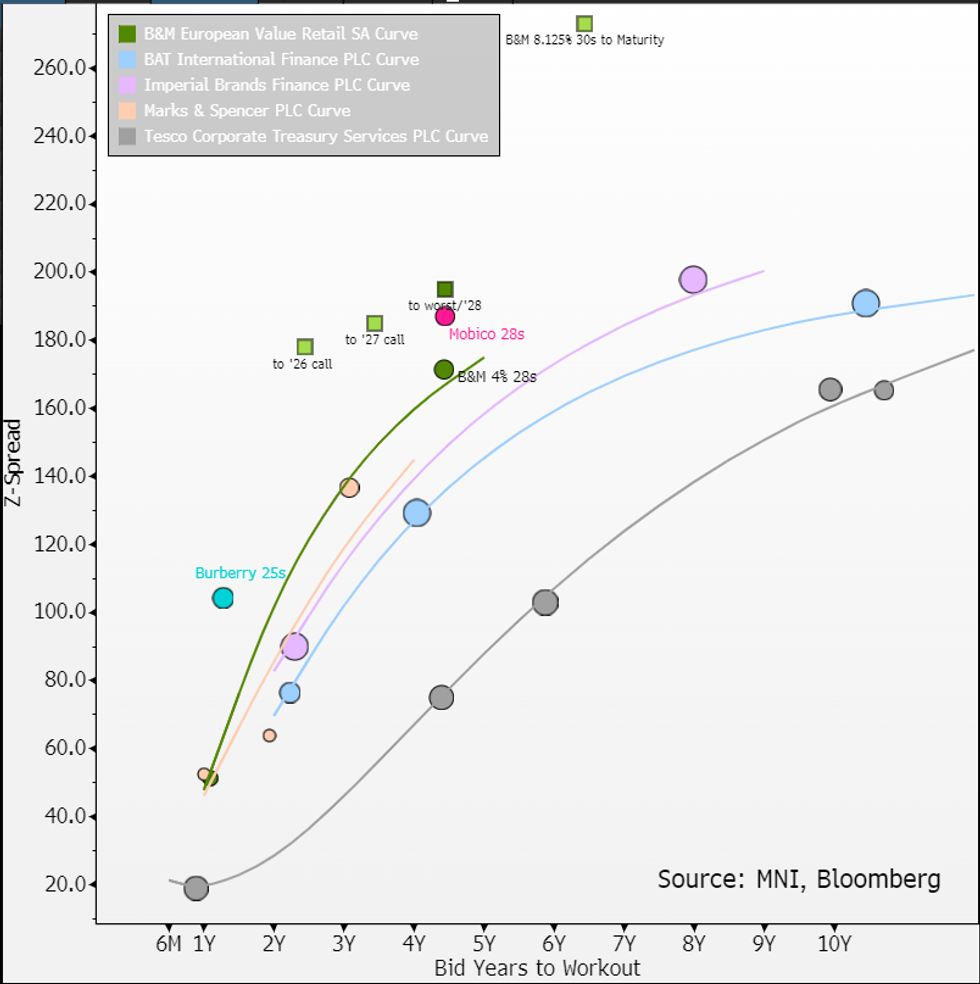

B&M (BMELN; Ba1/BB+; Stable) £30s Cheap

We see value in the B&M30s, a view that we have priced at £107.5, well through BVAL offer side (mids at £106.9). Main point of caution is supply to refi the £155m remaining July '25 and a £300m TL due in 1H. Risk to our view is it if it issues shorter than the current 30s/6.4Y. It continued to emphasise "long dated debt structure of 7-8yrs" as attractive given "interest rate environment we are in" and refused to give any direct colour outside "at the right moment in time, we'll extend the maturity on that remaining stub." in earnings call last week.

Key Points;

- The 30s were issued at UKT+408 (!!) or 8.125% in Nov last year. That was at par and its rallied +6.9pts since. It's now pricing to the first par call in Nov '28 at YTW of 6.16%/T+202/Z+195.

- Considering the €B&M28s are also due in November that year (both £250m lines) and is much cheaper funding (trades at £93 on 4% coupon) a earlier call (possibly starting from '26) on the 30s is a distinct possibility.

- Rating upside is very unlikely in the near term. It introduced a leverage target of net 1-1.5x (ex. leases) and raters used that for the upgrades into BB+ at issuance of the 30s. Its currently 1.2x.* The co's stated target equates (at 1.5x) to Moody's & S&P adjusted gross (including leases) leverage of 3x. It receives no uplift for secured bonds given all term loans & revolvers are guaranteed and rank pari passu.

- All call scenarios plotted below at £107.5. To maturity may look attractive/steep but this cheap view is a shorter duration one; we prefer a 26/27 call and at worst call in '28.

Background on co;

- The company is mixed discount retailer with a split between food (grocery like) and goods (general merchandise). It's run gross margin north of 37% in recent years and EBITDA margin at 11.5%.

- It's targeting a fast growing presence (unlike many peers) with 78 gross stores opened in FY24. Its pointing to another 45 UK B&M stores in FY25 (12m ending March). UK B&M is main segment (80% of revenues) and highest margin at 12.6% (88% of group EBITDA).

- Remaining two segments split equally between B&M France and Heron Foods (a discount UK supermarket chain that it acquired). It is guiding to another 20 Heron food stores and 10 stores in France B&M.

- It is coming off mixed FY24 results (beat on headline, miss on EPS) and no numeric FY25 guidance. Analyst are concerned about headline growth on falling inflation alongside any margin pressure. Still consensus sees growth at 2% for UK same store sales. Adj. EBITDA is expected to be up 6%yoy on margins that are holding in the c11% area.

- B&M has $2.3b in gross debt including leases, £919m ex. leases and net of the £182m in cash it reported net £737m of debt. Against adj. EBITDA of £629m it left it 3.6x, 1.5x & 1.2x respectively. It targets 1-1.5x on the latter (i.e. net ex. leases) - Moody's & S&P see this translating to 3x on their gross adj. basis.

- Ordinary dividend target is 30-40% of net income (1/3 in interim, 2/3 in final) but special dividends is common occurrence. Last year total payout was £348m from net income of £367m. S&P expects specials to total £200-£225m in addition to ordinary £140-£170m in years ahead. We (and raters) see dividends as discretionary and being pulled back if leverage target is pressured.

- A Q1 trading update (3m ending June) should come soon.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.