-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessDemand An Ongoing Issue, Next Test Is 20Y Sale (2/2)

The weak 30Y auction comes in the first refunding since last week's quarterly Treasury supply announcement, which was seen as less onerous than anticipated, particularly the implication that next quarter's coupon size increases were envisaged as being the last.

- Still, the duration that the market is being asked to absorb is significant - the $24B of 30Y nominal sold was below the pandemic highs of $27B but at that time the Fed was engaging in QE.

- The roughly $38B DV01 / $48B 10Y equivalent DV01 represented by yesterday's 30Y auction may have been lower than the net impact of those 2021 auctions (the Aug 2021 auction which was the last $27B was around $70B 10Y equivalent), but again the Fed was buying $8B monthly on the secondary market. The backdrop is less accommodative now.

- The 30Y auction showed a continued lack of end-user demand (see the high dealer takeup previously referenced), mirroring similar results in October's poor sales - the 3Y, 10Y, and 30Y auctions all tailed over 3 consecutive days, each showing higher primary dealer takeup.

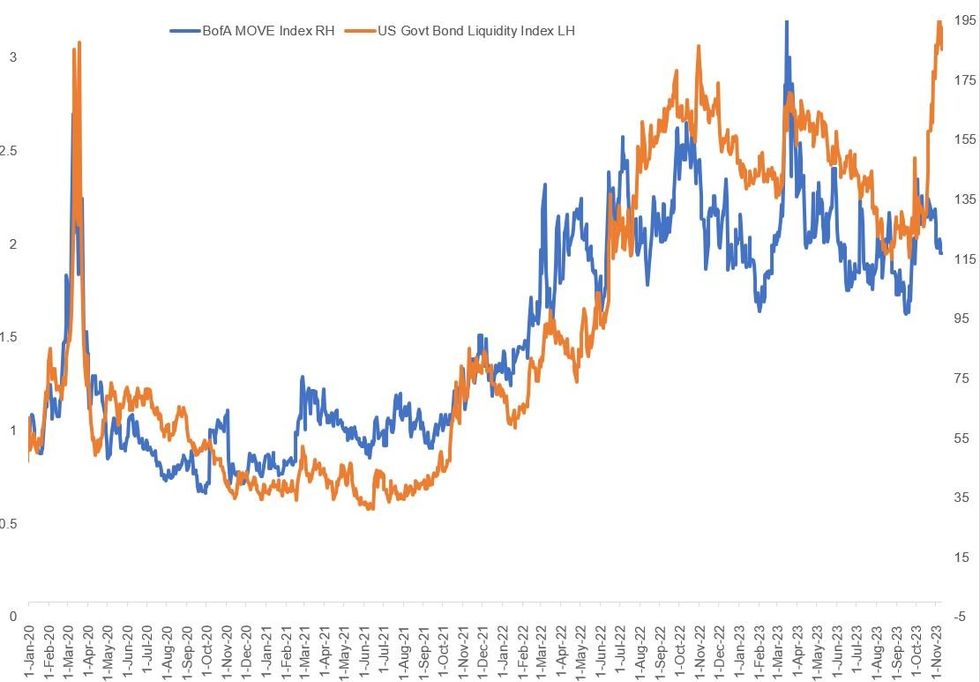

- To be sure, the 10Y sale this week saw only a modest tail, with decent periphery stats. And in terms of broader dislocations, we haven't really seen many major cracks appearing in Treasury markets apart from the sharp drop in prices. Fed facility usage remains unremarkable, while implied Tsy option volatility has been well behaved (see BofA MOVE).

- But greater volatility is testing liquidity (see the Bloomberg-calculated Gov't Bond Liquidity Index, which calculates persistent Tsy yield errors vs a fitted curve, which hit levels this week indicating even less liquidity than in 2020's pandemic panic). In that sense, with yields fluctuating so significantly, it's probably no surprise to see such a messy auction.

- As such the backdrop keeps primary issuance at the forefront for the next couple of months, with the 20Y sale on the 20th set to be the next major test.

Source: BofA, BBG, MNI

Source: BofA, BBG, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.