-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

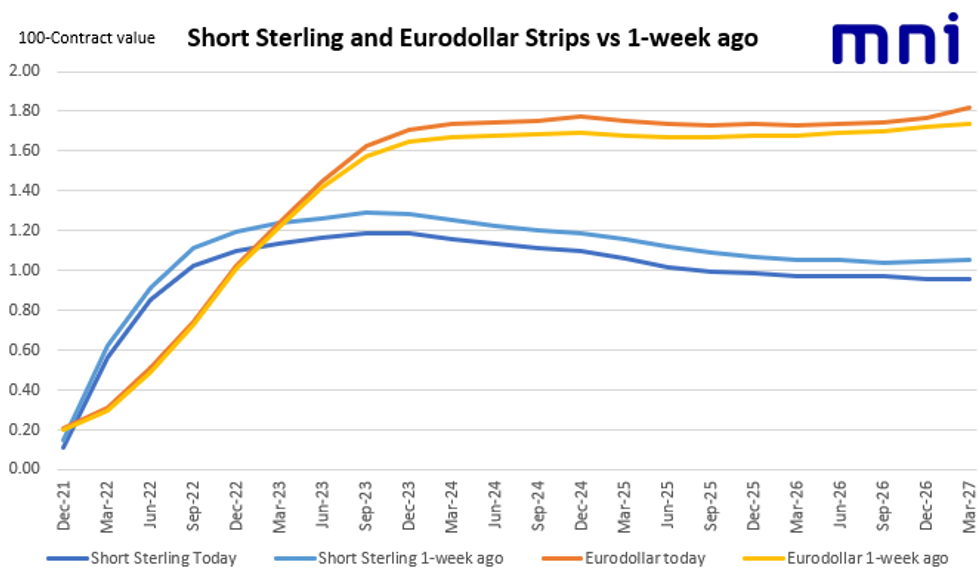

Free AccessDivergence continues between short sterling and Eurodollars

Divergence has continued between Eurodollar futures and short sterling futures this morning.

- The short sterling strip continues to push higher after the announcement yesterday that the government's Plan B for Covid-19 restrictions would be brought in. This involves bringing back the recommendation to work from home if you can, mask wearing in more areas as well as Covid passports for large events. A 15bp December hike is now only around 20% priced by short sterling markets. However, the Mar-22 contract is still almost fully pricing Bank Rate at 0.50% by the March MPC meeting with rates expected at 1.00% by the end of 2022. So hikes have been pushed back and a hike to 1.25% is no longer largely priced for next year (as was the case just a week ago), but markets still expect a decent, front-loaded hiking cycle from the BoE in 2022.

- The Eurodollar strip by contrast has edged a little lower (implying more rate hikes) but remains much less steep in 2022. There are however more hikes priced through 2023. The positive news yesterday on booster jabs being more effective against the Omicron variant continues to dominate, particularly with inflation data tomorrow due to show a further pickup in CPI and with the FOMC seemingly wanting to increase the pace of tapering to allow more flexibility on earlier rate hikes.

- The chart below shows the contrasting picture with the dark blue line (short sterling implied rates today) having moved substantially lower than the light blue line (short sterling implied rates a week ago). The Eurodollar curve today is in orange with last week's Eurodollar curve in yellow.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.