-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEGB Supply for W/C September 19, 2022

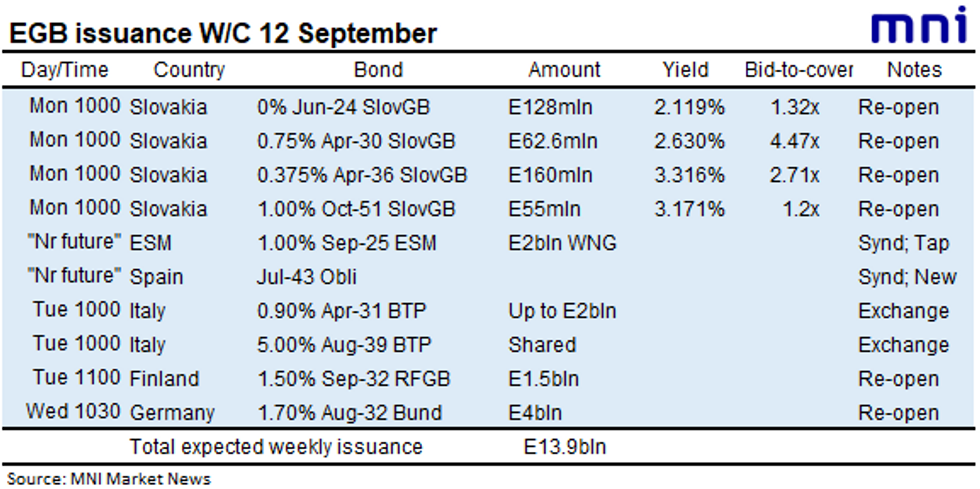

Austria, Italy and Germany all still look to come to the market today. Spain, the ESM and Slovenia have held syndications while Slovakia and Finland have held auctions so far this week. We look for gross nominal issuance of E17.4bln from announced operations, down significantly from last week’s E47.4bln.

- Today, Austria will look to issue a new 4-year RAGB via syndication, maturing Jul-26. MNI expects a transaction size of E3.5-4.5bln.

- Italy will hold an exchange auction this morning for up to E2bln. The MEF looks to sell the 0.90% Apr-31 BTP (ISIN: IT0005422891) and the 5.00% Aug-39 BTP (ISIN: IT0004286966). The MEF will buyback the 0% Jul-23 CCTeu (ISIN: IT0005185456), the 0% Nov-23 BTP Short Term (ISIN: IT0005482309), the 0% Dec-23 CCTeu (ISIN: IT0005399230) and the 0% Jan-24 BTP (ISIN: IT0005424251).

- Finally today, Germany will look to sell E4bln of the 10-year 1.70% Aug-32 Bund (ISIN: DE0001102606).

For a full calendar of all announced EGB/EU/ESM/EFSF auctions see the MNI EZ/UK Bond Supply Calendar here.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.