-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEurozone Macro Signal – May 2024: Slowly Gaining Steam

Eurozone Macro Signal – May 2024: Slowly Gaining Steam

MNI Point of View: Slowly Gaining Steam

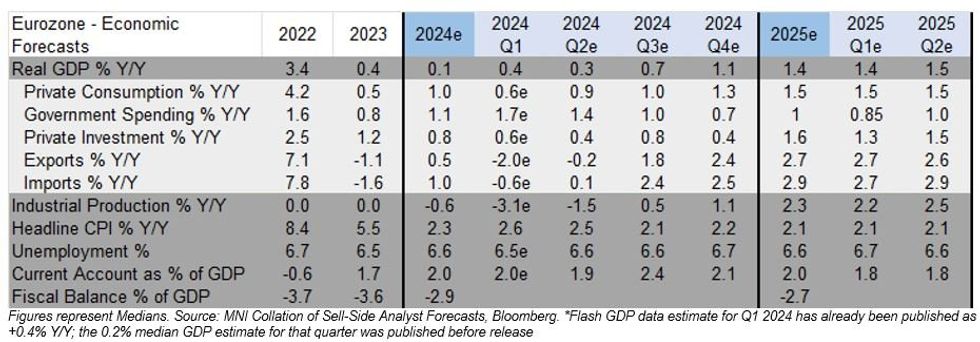

Eurozone economic growth momentum has started to pick up, but a potential recovery will most likely be characterised by a still-sluggish pace of expansion held back by restrained fixed investment and household demand.

- Latest Developments: GDP

growth came in stronger than expected for Q1 in each of the four largest Eurozone

economies. Industrial production has stabilized after a prolonged period of decline, but the broader recovery looks export-led so far, with retail sales, consumer confidence and other data pointing toward improved but ultimately still-soft household consumption.

- The Eurozone labour market has shown signs of loosening in recent months, helping wage pressures gradually moderate from their recent peak. This inaugural edition of Eurozone Macro Signal takes a deeper-dive look at recent dynamics (see pages 8-9).

- Latest inflation data are compatible with an ECB rate cut at the June meeting, as the bank has communicated (and markets fully expect) is its base case. But the path beyond June is more uncertain, as ECB governing council members have stressed that further adjustments will be dependent on incoming data.

- Medium-Term Outlook: Growth in the Eurozone is set to pick up in the coming quarters after a prolonged period of weakness, but the pace of recovery will be subdued, with limitations both structural (eg German industrial weakness / transition to higher energy costs) and cyclical (eg employment gains maxed out).

- Consumer spending is recovering and is seen driving growth in H2 2024 as a tight (if loosening) labour market and softer inflation allows real wages to continue catching up after post-pandemic declines, but the rate of growth is seen remaining well below 2% Y/Y keeping household consumption volumes well below the pre-pandemic trend.

- Export growth is picking up relatively quickly against an improved global demand backdrop, but private sector investment will remain subdued, and government spending growth is now seen as more front-loaded in 2024 and set to pull back later in the year.

Full PDF Analysis:

2024_05_Eurozone_Macro_Signal.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.