-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Finnair (FOY; NR/BB+ S) New 29s; thoughts on its widening

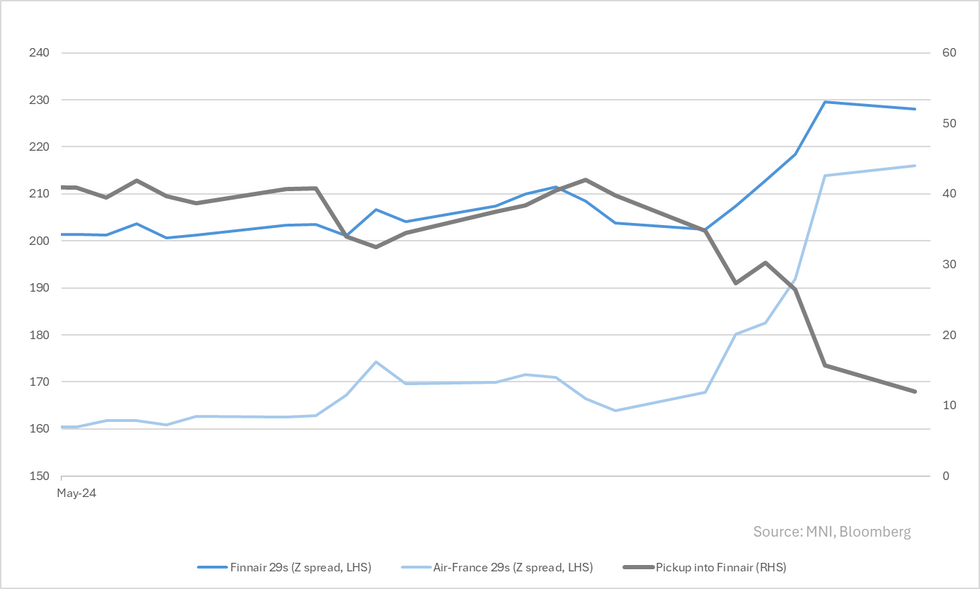

- As a rehash of this bond; it priced a week after the new AFFP29s which came at MS+190. By the time Finnair was pricing AFFP had moved -28bp in (to +162), we gave Finnair a 8bp discount to that for scale, weaker standalone metrics and lack of CDS.

- FOY came well north on final at +200 and triggered a cheap view from us. Since then AFFP29s has come out +53bps vs. Finnair +30bp (below). With it at tights against AFFP question for us is, is it still value, and adding to that if sector exposure is worth it - considering both names have underperformed €BBs +21bp move.

- Answer for us is yes on FOY29s but again caution on sizing into single carrier/country risk.

- Latest update was on Friday when Moody's affirmed Government of Finland (Aa1/AA+/AA+) at a Aa1 rating. Weakest sub-rating from it is for "susceptibility to event risk driven by political risk" with it adding geographical proximity to Russia was a issue . It did note that on balance it was similar to most NATO countries risk, given it was a member.

- The proximity has had some issues already with authorities reporting 4 Russian military aircraft were involved in airspace violation last week - the first since it joined Nato. See here.

- Government ratings are relevant because the state is the majority owner (55.7%) and credit benefits from 2-notch uplift at S&P. Most raters take a look at Finland twice a year; Fitch will come again on the 9th of August, S&P 25th of October (key risk event) & Moody's on 13th of December.

- The 2-notch uplift does have real value to us; during Covid government support included hybrid loans that came with favourable equity treatment for FOY, participation in equity raises and acting as guarantor on pension premium loans.

- Re. spreads to AFFP; AFFP does not receive uplift from S&P despite the 28% French and 9% from Netherlands. It's hard to see that changing anytime soon with S&P pulling Aeroport's 1-notch uplift last week despite 50.5% state ownership. Arguably this should make beta to France issues lower...it hasn't thus far.

- Our bigger issues with AFFP is 1) potential supply if it decides to refi-out its ~€3.5b in quasi equity/hybrid instruments (it says it will refi over time into bonds), 2) weak operating performance (not helped by strikes) and 3) expected weak FCF as capex runs high (guidance for net €3b).

- Also note when we say Finnair has one of the weakest metrics, its EBIT margin at 6.2% is still higher than Air-France's 5.7%. Though FOY's target of 6% is not that ambitious and should see AFFP reverse higher in coming years.

- Re. FOY29s vs. broader HY risk; 230 now for sub 5Y risk is hard to get (as it should be for airlines). Among those that do give spread pickup for equal ratings is consumer curve Elo/Auchan (French) but the risks we see as different (private co on the down still).

- For now we still see value at +230 noting 1) we don't expect supply given most of the 25s was tendered down on 29s issuance (€61.2m outstanding) and 2) co's guidance for near term capex requirements are for it to be "limited".

- Next key event is 1H earnings (6m ending June) that come on 19th of July noting we will have monthly traffic data to June by then so should have some read-through to the headline.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.