-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessJapanese Home Bias Maintained On Steep JGB Curve, Vol. & FX-Hedge Costs

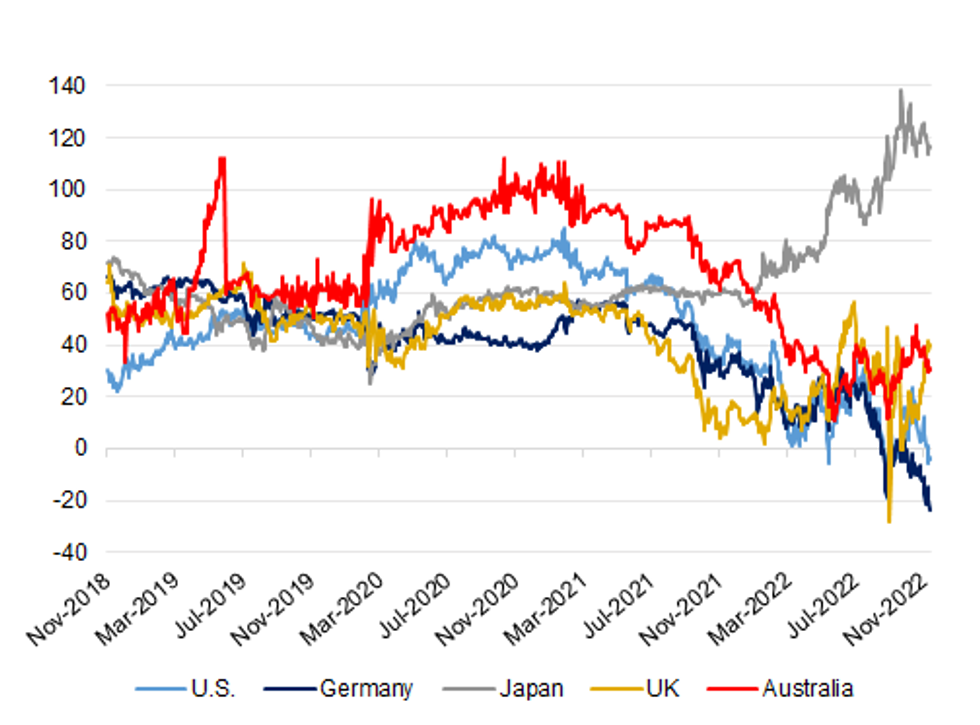

While it is a topic we have flagged on many occasions in recent months, it is worth remembering that the steepness of the 10-/30-Year JGB curve (albeit owing to the BoJ’s YCC policy, which some are speculating will be altered in ’23, although that is a topic for another time), alongside ongoing market vol. and elevated FX hedging costs, have facilitated a home bias for the Japanese life insurer and pension fund cohort.

- This has resulted in several rounds of record monthly net foreign bond sales on the part of Japanese insurers during ’22, most recently in November, when they recorded a net sale of ~Y1.93tn of offshore bonds (this represented the ninth consecutive month of net sales).

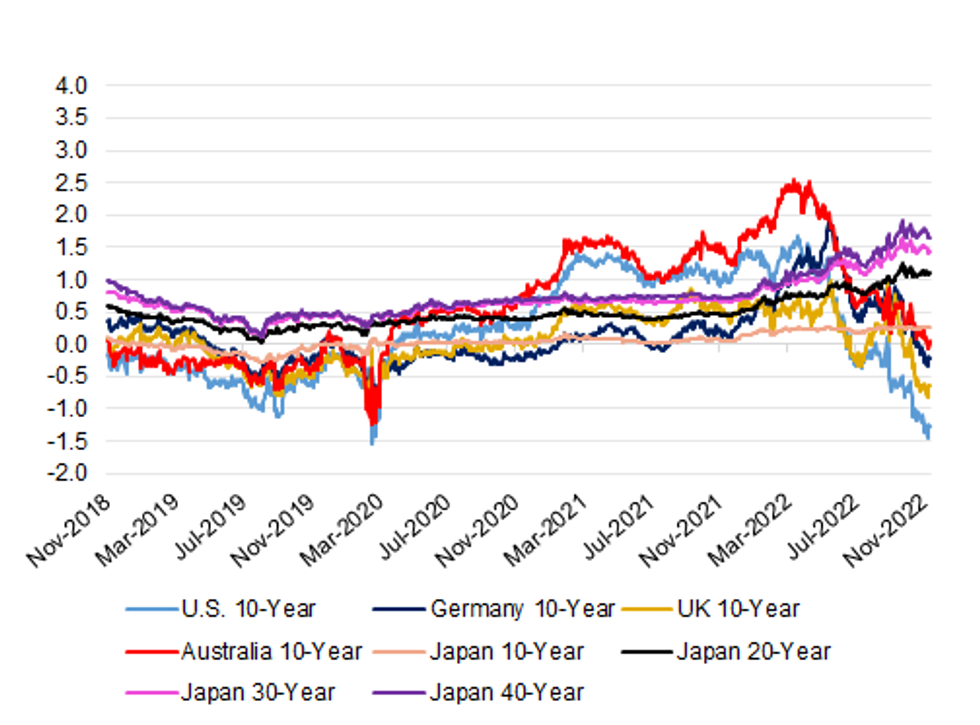

- The second figure highlights the yield pickup that 10- to 40-Year JGBs provides vs. the major 10-Year core global FI alternatives (adjusted for rolling 3-month FX hedging costs from the perspective of a Japanese investor).

- There will be a point whereby offshore paper becomes a little more attractive for this investor cohort, but we haven’t reached that point yet. This week’s central bank decisions are (of course) keenly awaited.

Fig. 1: 10-/30-Year JGB Yield Spread Vs. Major Global Counterparts (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Fig. 2: 10- To 40-Year JGB Yields Vs. The Major 10-Year Core Global FI Alternatives, FX-Hedged From The Perspective Of A Japanese Investor (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.