-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

Manufacturing PMI Improvement Comes With Cautionary Themes

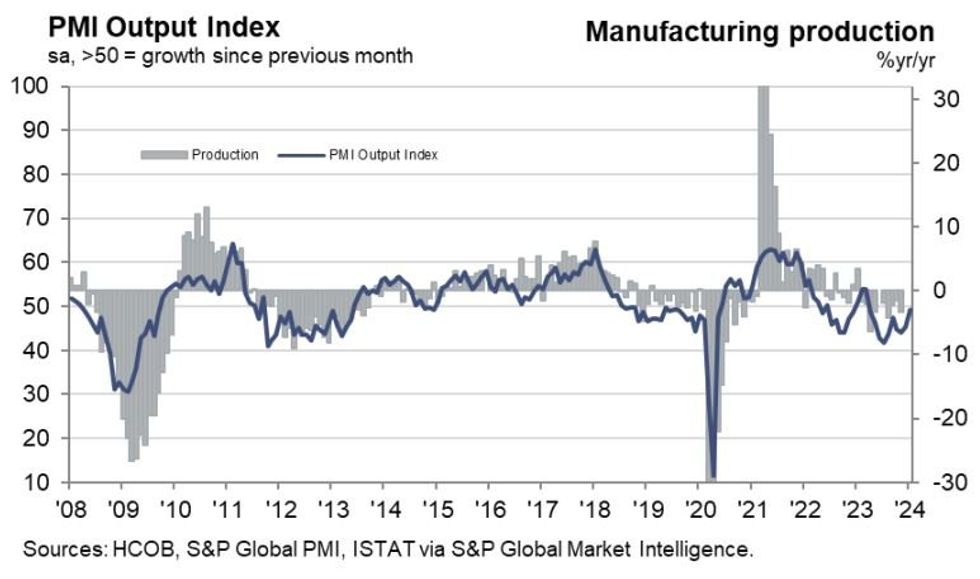

Italian manufacturing PMI accelerated more quickly than expected in January, to 48.5 (vs 46.8 expected, 45.3 prior).

- This was the best reading since March 2023, with HCOB/S&P Global report characterizing January as "another challenging month" for manufacturers, but with "some glimmers of hope".

- The uptick in the index mirrored similar improvements elsewhere in the eurozone, but so too did cautionary themes including demand weakness and potential disruptions from Red Sea shipping. Employment dynamics appeared to be weak, with both input and output deflation evident.

Highlights from the report:

- "Slower declines in output and new work and the return of average lead time lengthening all contributed" to the higher reading.

- "new orders recorded a solid decrease... but the slowest decline in the current sequence"

- "Firms linked the decline to demand weakness and geopolitical tensions, which also negatively impacted new orders from abroad. In particular, panellists blamed the disruption to Red Sea shipping routes and economic weakness across Northern Europe and the US."

- "Output remained just inside contraction territory in January to signal a tenth successive monthly decline in production ... influenced by subdued order numbers and poor economic conditions. However, the rate at which output fell was the slowest in the current sequence and marginal"

- "With the rate of decline in demand outstripping that of output, firms reduced backlogs again"

- "The return of job cuts was another sign of spare capacity"

- "strong reduction in buying activity ..marking the twentieth consecutive month of decreases"

- "reduced need to carry stocks of inputs... inventories fell for a tenth month running...input orders were postponed and stocks were depleted while demand conditions remained subdued."

- "average lead times for the delivery of inputs increased ... for the first time in nearly a year. Panellists noted that supply chain disruption in the Red Sea caused the rise in delivery times."

- "cost burdens faced by Italian manufacturers dropped again ... Respondents attributed the latest decrease to falling raw material prices amid ongoing demand weakness. Moreover, the rate of deflation recorded a five-month high. To stimulate demand, firms responded by reducing selling prices moderately."

- "confidence towards the next 12 months picked up... that said, some firms remained worried about geopolitical tensions."

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.