-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMedium-Term Rate Expectations Converge To US

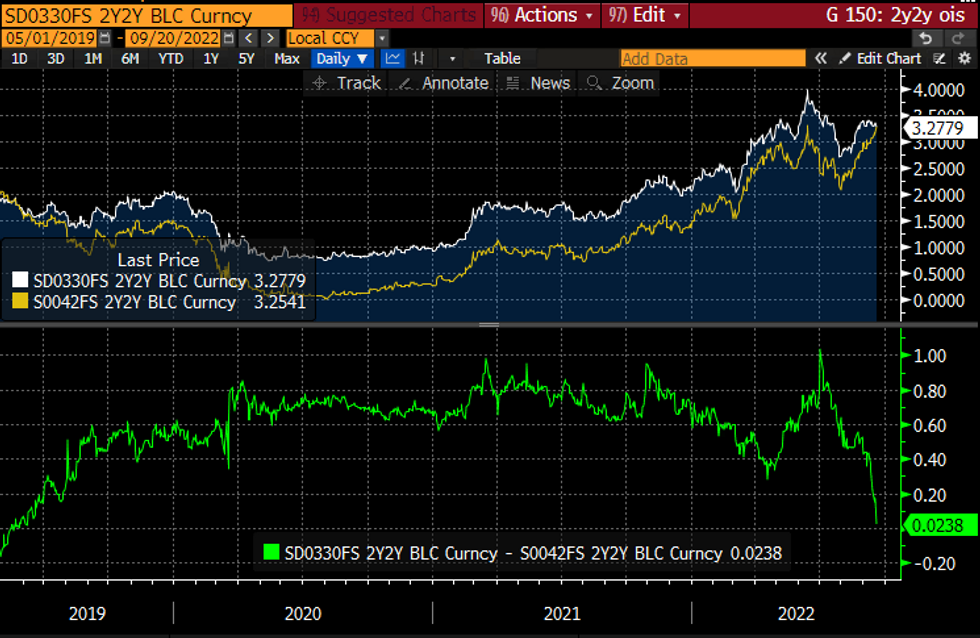

- Canadian 2Y2Y OIS rates have dipped 4bps to 3.28% today as near-term rate expectations were trimmed on a notable miss for CPI inflation, although in broad terms keeps to the plateauing seen this month.

- The trend remains sharply at odds with that of the US, which has climbed to 3.25%, closer to pre–June FOMC highs of 3.29% on the expectations of rates remaining higher for longer in a slower pullback from a terminal OIS implied rate that has surged since last week to almost 4.5%.

- The differing trends see a Can-US differential of just +2bps, the lowest since Jun'19, compared to the +40-80bps seen both in the run-up to the pandemic plus it's impact/recovery in what likely reflected stronger longer term growth expectations.

2Y2Y OIS for Canada (white), US (yellow) and Can-US differential (green)Source: Bloomberg

2Y2Y OIS for Canada (white), US (yellow) and Can-US differential (green)Source: Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.