-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMLF Operation Preview

The PBoC is scheduled to conduct its latest round of MLF operations on Wednesday, with CNY600bn of 1-Year MLF provisions set to mature today. The BBG survey shows that consensus looks for most of the maturing CNY600bn to be rolled over, with sell-side expectations for the size of Wednesday's MLF operation sitting between CNY400-600bn. Tuesday saw the state-owned Securities Daily run a piece that reflected the broader consensus re: the size of today's operation, citing a researcher. None of those surveyed expect a cut to the interest rate applied to the MLF operations. Note that PBoC OMO rates and the LPR benchmarks have been left unchanged for some time now.

- August's PMI surveys provided the latest signs of worry re: the Chinese economy. The monthly economic activity data for August is due later today, and the Y/Y growth rates for all of the major metrics within that data suite are expected to slow. Still, recent PBoC rhetoric and surging producer prices have dampened expectations surrounding the chances of an imminent RRR cut, with fiscal support seen as the first lever of defence in most quarters. However, the scope for notable short-term fiscal stimulus remains in doubt, given the formal outlining of deficit targets and government bond issuance quotas in China, so it may be a case of some of next year's local government bond quotas being bought forward into Q421 after the remaining quotas are allotted (note that H121 saw a below pro-rata run rate of issuance in that space), while the PBoC may continue to tinker with targeted measures until the wider spread impact of the recent COVID-related lockdowns is better defined.

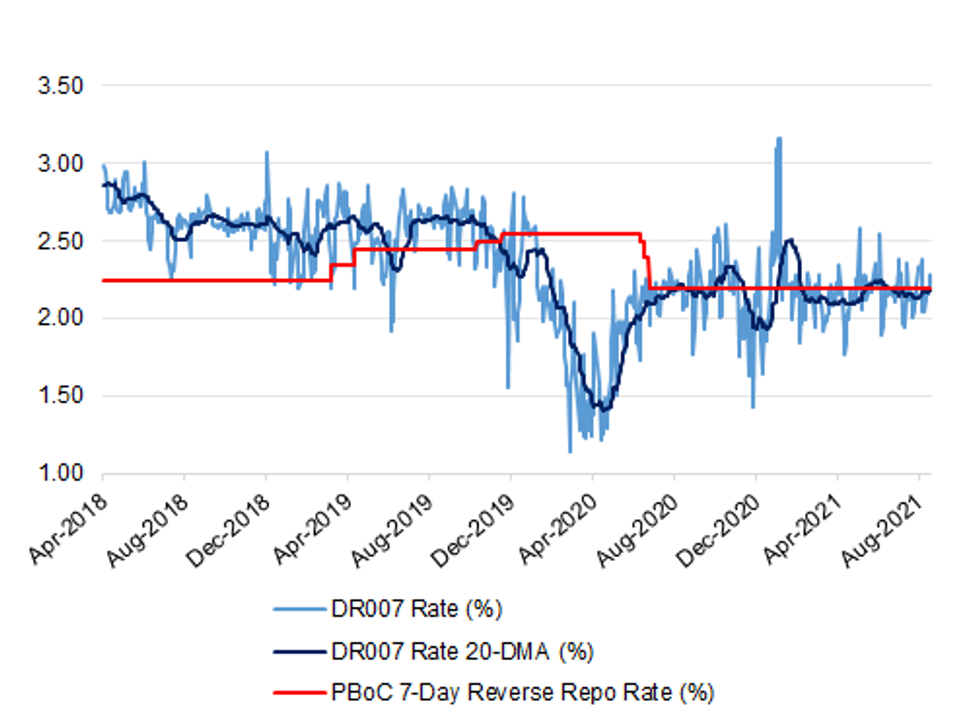

- Onshore USD/CNY 1-Year swap points surged to the highest levels seen since late '17 on Tuesday, pointing to demand for CNY liquidity given the more than ample level of foreign currency deposits in the Chinese banking system. The DR007 rate has been ticking higher in recent days, but that comes in the wake of a dip after the month-end liquidity uptick that was witnessed in late August. The 20-DMA of the DR007 rate is holding just below the PBoC's 7-day reverse repo rate, pointing to no heightened levels of stress in terms of liquidity provisions at depository institutions, even as onshore institutions scurry to swap USDs into CNY.

- This could change given the usual round of month-end liquidity demand and liquidity needs surrounding the upcoming Chinese holiday period. The Evergrande credit situation and worries surrounding any systemic impact could also add to the demand for liquidity. However, the PBoC has pointed to the need for balanced liquidity in recent weeks, so we shouldn't expect anything like a liquidity 'flood' unless there is an abrupt change in circumstances.

Fig. 1: DR007 Rates Vs. PBoC 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.