-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS - Vaccine Euphoria Fading

EGBs-GILTS CASH CLOSE: Gilts Bull Flatten Amid Mixed Brexit News

An impressive rally at the long-end in core FI, particularly in Gilts, with 30-Yr yields down over 8bps amid a strong bull flattening in the curve. Overall theme has been fading positive early week vaccine news.

- Gilts were boosted by continued mixed news on Brexit talk progress [BBC sources piece suggesting stalemate], helping push yields to session lows in the afternoon.

- Periphery EGB spreads closed mixed, BTPs very much outperforming; Greek short-end (2Yr) went into negative yield territory.

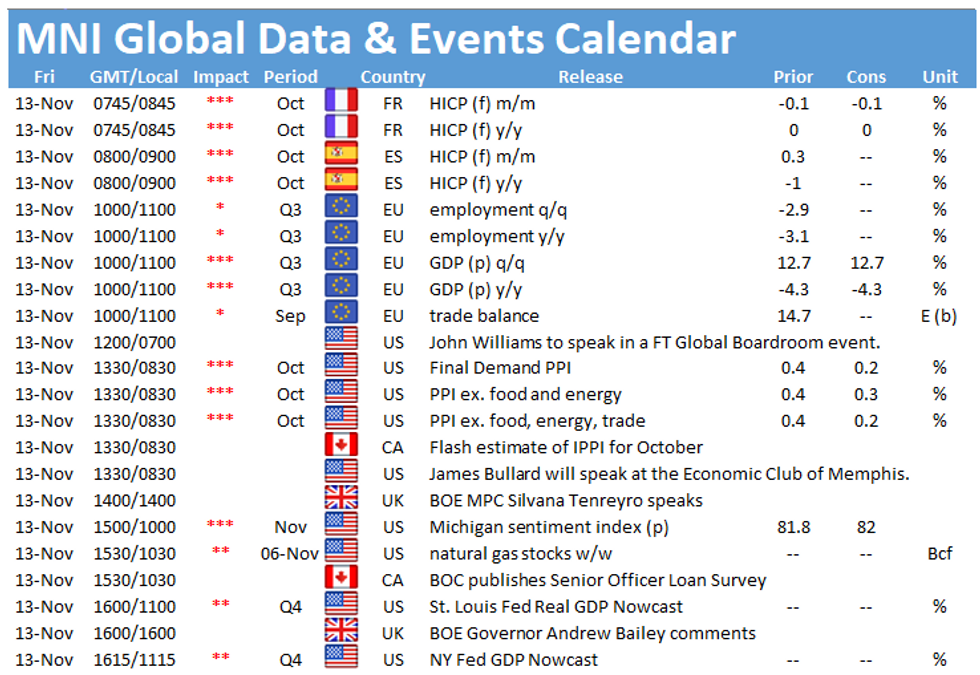

- On Friday, Eurozone Q3 prelim GDP highlights the data docket, while we get several BoE and ECB speakers.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.8bps at -0.723%, 5-Yr is down 2bps at -0.73%, 10-Yr is down 2.9bps at -0.536%, and 30-Yr is down 3.9bps at -0.112%.

- UK: The 2-Yr yield is down 3.7bps at -0.036%, 5-Yr is down 4.4bps at 0.015%, 10-Yr is down 6.5bps at 0.348%, and 30-Yr is down 8.3bps at 0.932%.

- Italian BTP spread down 2.5bps at 122bps

- Spanish bond spread up 0.4bps at 66.8bps

- Portuguese PGB spread up 0.7bps at 64bps

- Greek bond spread up 1.3bps at 134.1bps

EUROPE OPTIONS SUMMARY: Sterling Midcurve Trades Dominate

Today's options flow included:

- RXZ0 176/175/174p fly, sold at 35.5 in 1.25k

- 0LH1 100/100.12/100.25c fly, bough for 1 in 3k

- 0LM1 99.87/100.00^^bought up to 12.5 in circa 10k all day

- 0LM1 with 0LU1 99.75 put strip, sold at 9.5 in 4k

- 0LM1 100.00/99.875/99.75p fly, bought for 3.5 circa 4k

- 0LZ0 100.00/100.125 call spread sold at 2.5 in 2.5k

- 2LM1 99.87^ vs LM1 100^, sold the 2yr at 10.75 in 1.5k

US TSY SUMMARY: Early Week Vaccine Euphoria Fading

Rates trade broadly higher after the bell, just off late session highs as concerns over spread of COVID-19 likely to trigger lock-downs/closings with holidays a couple weeks away. Equities ground lower (ESZ0 -50.0). Heavier volumes heavy again, TYZ>1.5M. Long end lead rally, yield curves consistently flatter.

- Long end lead continued to climb higher after brief dip on weak 30Y Bond auction tailed 8bp: $27B 30Y bond auction (912810SS8) yields 1.680% (1.578% last month) vs. 1.672% WI; w/ 2.29 bid/cover (2.29 prior).

- Off early week pave corporate issuance remained robust, $5.75B JP Morgan 3pt lead better issuance from banks, insurers; supra-sovereigns: Italy looking to issue 5Y and 30Y bonds in near term.

- Equity performance, particularly large banks has boosted GSIB (global systemically important banks) scores, easing year-end funding expectations in theory -- and spurring heavy selling in short end Eurodollar futures this week.

- The 2-Yr yield is down 0.6bps at 0.1748%, 5-Yr is down 5.9bps at 0.3948%, 10-Yr is down 9.5bps at 0.8799%, and 30-Yr is down 9.6bps at 1.6455%.

EURODOLLAR/TREASURY OPTIONS

Salient trade focus on selling calls covering late 2022 sector of curve, underscores not only lower for longer, but no negative rates either. Paper sold well over 50,000 long green Dec 96 calls, 10.5-11.0. Early Block sales accompanied by sale of 28,477 short Sep 96 puts.

Eurodollar Options:- -22,900 long Green Dec 96 calls, 10.5-1.0

- +10,000 Blue Feb 91/92 put spds, 2.0

- -5,000 Red Jun 96 calls, 9.0

- +5,000 Sep 97 puts, 2.0

- Another 11,830 Long Green Dec 96 calls, 10.5 at 0837:45ET, adds to 20k prior blocks

- Odd ratio at 0835:25ET

- Block, 28,477 short Sep 96 puts, 5.5 vs.

- Block, 20,483 Green Sep 93 puts, 6.5

- total -17,500 short Mar 96 straddles 2.5 over Blue Mar 92 puts

- 1,500 Mar 97/98/100 call trees, 3.5

- Block, -10,000 Long Red Jun 96 calls, 9.0 w/

- Block, -10,000 Long Green Dec 96 calls, 10.5 at 0826:30ET

- Another 10k Green Dec calls blocked at 0833:06ET

- Overnight trade,

- Block, +9,500 Jun 97 puts, 1.5 vs. -5k Blue Blue Feb 93 calls, 9.0

- Block, +5,000 Blue Feb 93/95/96 call flys, 3.5

- -3,000 Mar 96/97 put spds, 0.75

- -2,500 Blue Dec 91/93 put spds, 2.0

- +2,000 TYF 136/137 2x1 put spds, 3

- Update, over 16,500 TYZ 138 calls, 17/64

- -8,400 TYZ 138/138.5/139/139.5 put condors, 8/64

- 3,000 TYZ 137.5/138 put spds, 13

- -2,500 TYZ 138 straddles 34-33

- 1,300 USF 169/176 strangles, 1-15

- over 10,000 FVF 124.5/125 2x1 put spds 0.5

- Overnight trade

- -5,300 TYZ 138.5 put vs. TYG 136 puts, 25db

- -5,000 TYF 137.5 puts, 44-42

- +3,000 FVZ 125.5 calls, 2.0

- +4,600 USG 167 puts, 49-54

FOREX: Havens on Front Foot as Vaccine Trades Unwind

Markets continue to unwind the vaccine-induced reflation trades put on earlier in the week, with equities inching lower across Europe and the US - the tech sector's been recovering, while profit-taking in cyclical stocks proves a drag on most indices.

As a result, haven currencies are were the strongest performers Thursday. JPY and CHF outperformed, but EUR buying was evident throughout, as markets price out the chances of any imminent ECB rate cut after Lagarde's speech Wednesday.

GBP started, and finished, the session poorly with UK representatives stressing that significant gaps remain between EU and UK negotiators as meetings drag into the end of the week. GBP traded lower against all others in G10, with GBP/USD reverting back below 1.3150 ahead of the London close.

Focus Friday turns to Eurozone GDP & trade balance data and PPI, Uni of Michigan numbers from the US. The speaker schedule will again draw focus, with speeches due from ECB's Rehn, de Cos, & Weidmann, BoE's Bailey, Tenreyro & Cunliffe and Fed's Williams & Bullard.

Expiries for Nov12 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1735-40(E935mln), $1.1795-00(E1.2bln), $1.1840-55(E1.6bln), $1.1870(E673mln), $1.1900(E512mln), $1.2000(E1.78bln-EUR calls)

USD/JPY: Y101.00($995mln-USD puts), Y104.65-75($502mln), Y105.50($560mln)

EUR/GBP: Gbp0.8950(E586mln), Gbp0.9045-50(E797mln)

AUD/USD: $0.7300(A$599mln), $0.7325-35(A$763mln)

USD/CAD: C$1.3125($745mln)

USD/CNY: Cny6.60($1.1bln), Cny6.75($600mln)

USD Index Techs: A Medium-Term Assesment

The USD Index hasn't weakened since the low print of 91.75 on Sep 1. The medium-term chart however continues to highlight a bearish USD theme.

- Moving average analysis highlights a downtrend. Both the 20- and 50-day EMAs remain in a bear mode condition.

- Momentum, looking at the 14-day RSI, is not highlighting any structure that would provide an early warning sign of base building.

- Key resistance levels worth noting are:

- 93.17/44, the area between the 20- day and 50-day EMAs.

- 94.30, Nov 4 high

- 94.74, Sep 25 high and the key reversal trigger. A break would signal a change in the medium-term direction

- Key support levels to watch:

- 92.13, Nov 9 low.

- 91.75, the key bear trigger and Sep 1 low. A break would resume the broader downtrend that started in March and open levels around 90.60.

EQUITIES: Stocks Weaker, Narrowing Gap With Monday Open

E-mini S&P weakness accelerated Thursday, falling through the overnight lows of 3538.25 to hit the worst levels of the session. As was the case from the open, energy and financials are performing particularly poorly in a further reversal of the moves seen since Pfizer's vaccine news on Monday.

Individual performers reflect this sentiment, with COVID-sensitive firms the hardest hit (Wynn Resorts, Carnival Corp) on likely profit taking.

Volumes have picked up after the quieter Wednesday session, although headline activity remains below average for this time of day.

First support for the e-mini S&P sits at the Wednesday low of 3531 and 3522.50, which would leave the index flat on the week.

COMMODITIES: Oil Resilient Despite Big Build in Inventories

WTI and Brent crude futures headed into the close in minor positive territory despite the headline DoE oil inventories showing an unexpected build of over 4mln bbls in the week ending Nov 6th. Oil remains supported as markets continue to anticipate an extension to OPEC oil output cuts, but the larger than expected draw in gasoline and distillate reserves also contributed.

WTI crude futures remain either side of $41.50, but a break above Wednesday's $43.06 would open the best levels since August and would open $44.33, the August 26th high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.