-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - Risk Appetite Cools

GLOBAL MARKET/OPINION: Highlights from BofA's Fund Manager Survey

The most bullish FMS of 2020 on the back of vaccine, election, macro.

- November survey shows a big drop in cash, big jump in equity, small cap & emerging market exposure; reopening rotation can continue in Q4.

- However, BofA caution that "sell the vaccine" could be the theme in coming weeks/months as they think markets are close to "full bull".

- COVID remains number 1 tail risk, but survey respondents continue to pull forward their timing of a credible vaccine. This is now expected in Jan'21, brought forward by one month.

- FMS records a new all-time high in those expecting a steeper yield curve. The allocation to equities is now the highest since Jan'18 and close to extreme bullish.

- On 2021, most favoured 2021 trades include long Emerging Markets, long S&P 500 and long oil.

US TSY SUMMARY: Rates Higher, Risk Unwound

Tsy futures are broadly higher after the bell, near top end of the session range with equities trading weaker after clawing off lows since midmorning. Several factors at play.

- Steady bid overnight as global spread of Covid-19 continues, nations balancing shut-down to curb spd vs. negative effect on economy. Lower than exp retail sales (+0.3% vs. 0.5% exp) and revisions spurred better buying across the curve in early NY trade.

- Multiple Fed speakers to absorb again, Former NY Fed Pres Dudley on Bbg TV said US in "much worse place than we were in October" in relation to the virus; extending maturity of Fed bond buying makes sense.

- Rates see-sawed near highs all session. Equities, however, bounced around 1000ET after talk of targeted fiscal support resumed. Equities sold off after the rate close on reports of rocket attack near US Baghdad embassy (this on heels of Trump annc troop drawdown in Iraq and Afghanistan).

- Flow-wise, fast$ joined prop and real$ buying across curve, heavy rate lock sales as mkt absorbed near $40B high-grade corp debt, Dec/Mar roll getting underway.

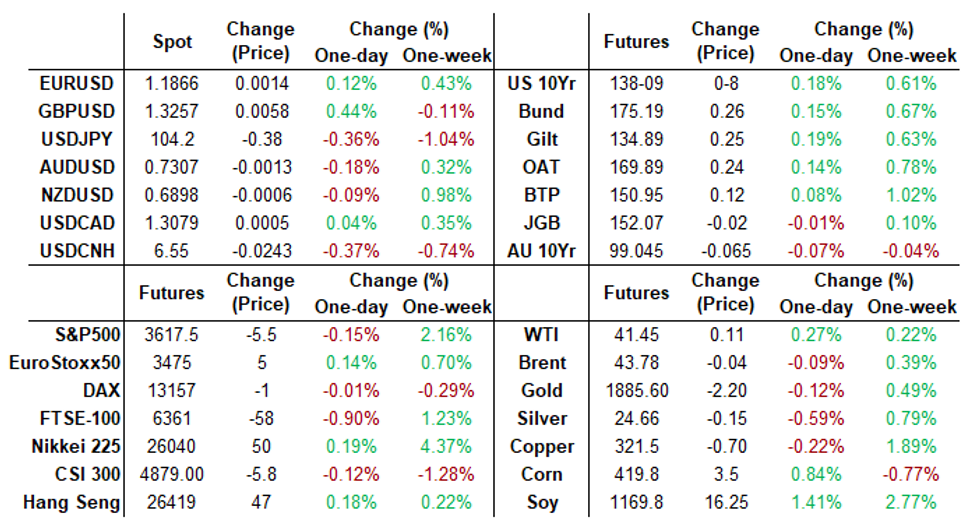

- The 2-Yr yield is down 0.4bps at 0.1732%, 5-Yr is down 2.1bps at 0.3856%, 10-Yr is down 3.3bps at 0.8734%, and 30-Yr is down 3.4bps at 1.629%.

US TSYS: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00150 at 0.08213% (-0.00112/wk)

- 1 Month +0.00600 to 0.14950% (+0.01312/wk)

- 3 Month +0.01062 to 0.23100% (+0.00900/wk)

- 6 Month +0.00900 to 0.25800% (+0.01200/wk)

- 1 Year -0.00088 to 0.33875% (-0.00063/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $157B

- Secured Overnight Financing Rate (SOFR): 0.10%, $953B

- Broad General Collateral Rate (BGCR): 0.08%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $320B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.475B submission

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $38.330B submission

- Next scheduled purchases:

- Wed 11/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

EGBs-GILTS CASH CLOSE: Bonds Supported as Equities Stall

The gilt curve bull flattened on the day alongside weak trading in equities. Cash yields were up to 3bp lower, with the long-end outperforming. The DMO earlier sold GBP3.25bn of the 0.125% Jan-24 Gilt and GBP2.00bn 0.625%Oct-50 Gilt.

EGBs were mixed, but core German and French bonds saw support as the equity rally stalled.

Closing Levels / 10-Yr Periphery EGB Spreads:- Germany: The 2-Yr yield is unchanged at -0.744%, 5-Yr is down 1.1bps at -0.780%, 10-Yr is down 1.7bps at -0.564%, and 30-Yr is down 2.2bps at -0.162%.

- UK: The 2-Yr yield is down 0.8bps at -0.044%, 5-Yr is down 1.2bps at 0.003%,10-Yr is down 2.5bps at 0.321%, and 30-Yr is down 3.3bps at 0.909%.

- Italian BTP spread up 0.5bps at 119.9bps

- Spanish bond spread down 0.7bps at 63.3bps

- Portuguese PGB spread down 1.7bps at 60.0bps

- Greek bond spread down 2.8bps at 122.2bps

FOREX: Markets Reverse Vaccine Trade, Working Against Antipodeans

After securing an alltime high close Monday on Moderna's vaccine news, markets ebbed lower Tuesday, with profit-taking the most likely culprit. US equities shed around 0.5%, helping underpin a further JPY rise. USD/JPY sank through the Monday low with relatively little difficulty, although the Y104 handle support stands for now.

This worked against the likes of AUD, CAD and NZD, which were the worst performing currencies in G10 Tuesday.

GBP traded well, helping GBP/USD trade within 40 pips of the multi-month high at 1.3312 printed last week. Markets are now beginning to eye the end of next week as a key date by which to secure a Brexit deal after sources reported to Bloomberg that negotiating teams were honing in on a deal.

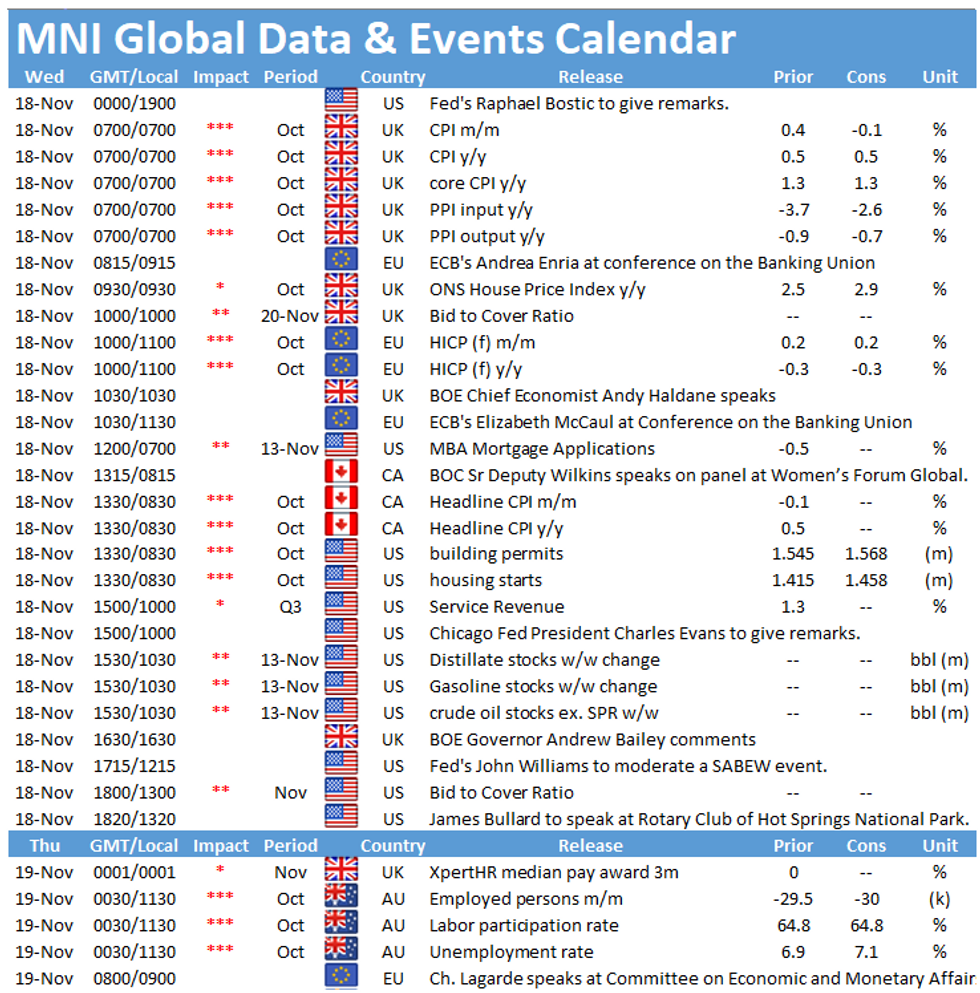

Focus Wednesday turns to UK and Canadian inflation data for October and US Building Permits. BoE's Haldane, BoC's Wilkins and Fed's Williams, Bullard & Kaplan are on the docket.

FX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1770-90(E1.3bln), $1.1995-1.2000(E996mln-EUR calls)

USD/JPY: Y104.95-00($580mln)

USD/CAD: C$1.3000($1.1bln), C$1.3195-00($645mln)

TECHS: Key Price Signal Summary

- E-Mini S&P futures key resistance at 3668.00. The outlook is bullish however. A break of 3668.00, Nov 9 high would resume the uptrend and open 3699.03, a Fibonacci projection. Price action on Nov 9 is a shooting star candle though and a reversal threat. Watch key support at 3498.25, former bear channel resistance.

- EURUSD key directional triggers identified. 1.1920, Nov 9 high and 1.1746, Nov 11 low mark the key directional triggers. A break of 1.1920 would open this year's high print of 1.2011. On the downside, 1.1603, Nov 4 low is exposed should 1.1746 give way.

- Long legged Doji candle in Bund fut. yesterday. Yesterday's price action is a potential reversal signal and if correct, suggests the recent corrective bounce has run its course. Watch support and the intraday bear trigger at 174.45, Nov 16 low. Key resistance for today is 175.29.

- Elsewhere, watch key support in gold at $1848.8, Sep 28 low and in Brent (F1) at $42.63 and WTI (Z0) at $40.06, the Nov 13 lows.

EQUITIES: US Indices Edge Off Highs, With Profit-Taking the Driver

Markets reversed (albeit to a much smaller degree) the moves seen Monday after Moderna's vaccine update, with tech slightly outperforming reflation trades, leading the NASDAQ to modestly rise, while the Dow Jones and S&P fell.

As a result, energy names populated the biggest fallers on the S&P 500, alongside pharmacy names including Walgreens & CVS Health after Amazon announced plans to move into the drug prescription markets with their Prime product.

The E-mini S&P saw slightly below average volumes, retaining the Monday high at 3637.00 and alltime high at 3668.00 as the primary targets.

PIPELINE: Surge In Domestic/Foreign Corporate Debt Issuance

- $34.9B To Price Tuesday; IBRD, Saudi Aramco, Volkswagen Lead

- Date $MM Issuer (Priced *, Launch #)

- 11/17 $8B *World Bank (IBRD) $3B 3Y +2, $5B 7Y +14

- 11/17 $7.5B #Saudi Aramco $500M 3Y +110, $1B 5Y +125, $1.5B 10Y +145, $2.25B 30Y 3.3% yld, $2.25B 50Y 3.65% yld

- 11/17 $4B #VW AM $1B 2Y +60, $1.25B 3Y +70, $1.25B 5Y +90, $500M 7Y +105

- 11/17 $3B *Rep of Italy +5Y +85 (+30Y still considered)

- 11/17 $2B #Deutsche Bank 6NC5 fix/FRN +175

- 11/17 $2B #HSBC 6.5NC5.5 +120

- 11/17 $1.7B #American Tower $500M 3Y +43, $650M 7Y +87.5, $550M 30Y +137.5

- 11/17 $1.5B #ANZ 15NC10 +170

- 11/17 $1.2B #Air Lease $600M 5Y tap +220, $600M 10Y +250

- 11/17 $1.1B #Entergy Louisiana 3NC1 +40

- 11/17 $1B *BNG Bank 5Y +10

- 11/17 $1B #BCFM +3Y +47

- 11/17 $900M Alexander Funding 3Y +162a

COMMODITIES: Brent, WTI Lower as OPEC+ Fail to Decide on Supply Plans

After holding their ground for much of early Tuesday, WTI and Brent crude futures turned lower into the NY close as the OPEC+ committee meeting failed to reach an agreement on any delay to their current output hike plans. They meet again in around two week's time - at which markets still expect OPEC+ to take the step, curbing supply for a further six months.

Gold and silver were largely flat, with any support from fading equity markets faltering as the greenback held its ground.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.