-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - COVID Stim, EU/UK Heads Uncertain

US TSY SUMMARY: Rates AND Equities Higher, Stim Heads Inconclusive

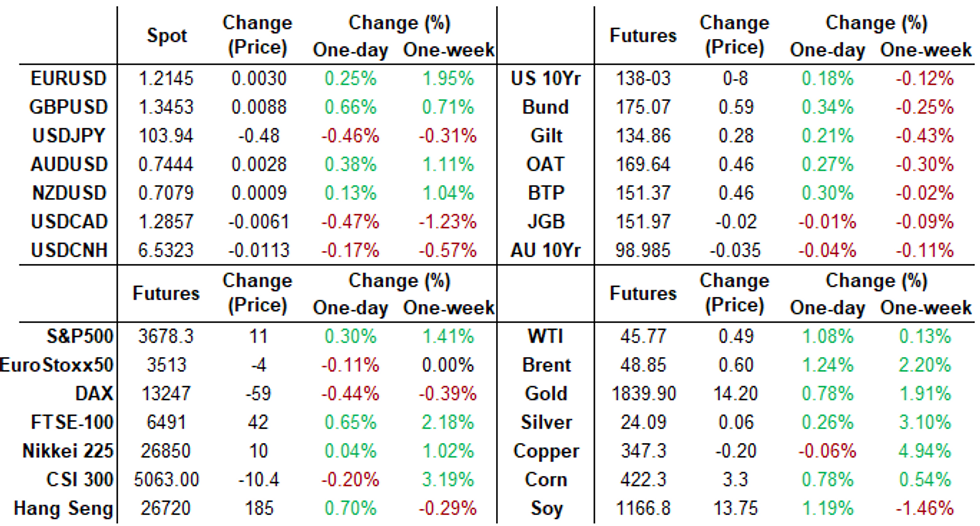

Rates held higher levels all session, trading near midday highs through the close even as equities powered higher (DJIA over 30,030.0).

- Rates dipped briefly after weekly claims slipped -75K to 712K and continuing claims fell -0.569M to 5.520M. ISM Services PMI dropped 0.7pt to 55.9, coming in weaker than 56.1 exp.

- Aside from data, mkts remained focused on COVID relief. Bbg headlines inconclusive: "MCCONNELL SAYS STIMULUS COMPROMISE IS WITHIN REACH," however: "SCHUMER SAYS MCCONNELL DOES NOT SEEM INCLINED TO COMPROMISE." Later in the session: House Speaker Pelosi on CNN saying will have a stim deal agreement before House leaves for Dec 11 recess.

- Cross-FX intertest, Pound Sterling receded after late headlines cast doubt over EU/UK talks: "U.K. OFFICIAL SAYS CHANCES OF BREXIT BREAKTHROUGH RECEDING".

- More moderate session volumes, two-way flow with better buying on moderate volumes (TYH just over 1.04M) as accts square up ahead Fri's headline November employ data (+478k est vs. +638k in Oct), yld curves modestly flatter after trading steeper in first half.

- The 2-Yr yield is down 0.6bps at 0.1525%, 5-Yr is down 1.4bps at 0.4003%, 10-Yr is down 1.8bps at 0.9178%, and 30-Yr is down 2.1bps at 1.6642%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.08275% (+0.00250/wk)

- 1 Month +0.00062 to 0.15275% (-0.00200/wk)

- 3 Month -0.00512 to 0.22538% (+0.00000/wk)

- 6 Month -0.00087 to 0.25738% (+0.00000/wk)

- 1 Year +0.00200 to 0.33638% (+0.00600/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $167B

- Secured Overnight Financing Rate (SOFR): 0.08%, $926B

- Broad General Collateral Rate (BGCR): 0.06%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $338B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $4.437B submission

- Next scheduled purchase:

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:

- 7,200 Jun 100 calls, 0.5

- 5,250 Blue Mar 90/92 put spds, 3.5 vs. 99.41/0.18%, large offer

- 13,600 Mar 97/98 put spds, 2.0

- +5,000 short Jun 97/98 call spds vs. Green Jun 97 calls, 0.5 net db bull curve steepener

- BLOCK +20,000 Blue Mar 91/92 put spds 1.5 over 96/97 call spds, another 16k on screen adds to large combo bought Wed

- 5,300 Red Mar'22 100.5 calls, 0.5

- Overnight trade

- 5,000 Mar 97 calls, 5.5

- 5,500 Blue Mar 90/92/93 put flys

- -2,000 TYG 136/139 put over risk reversals, 0.0 vs. 137-22/0.40%

- 4,000 FVF 125.5/126 call over risk reversals, 2

- +10,000 FVH 124.5 puts, 4 vs. 125-25.5/0.10%

- 2,000 TYH 136.5 puts, 30

- 1,000 USF 174/USH 180 2x3 call spds, 5-2

- 2,000 USH 180 calls, 34

- +7,000 TYF 137 puts, 14

- Overnight trade

- 10,000 TYF 139.5 calls, 2

- 2,000 USF 171/USG 170 put diagonal calendar

- 3,000 USF 178 calls, 7/64

EGBs-GILTS CASH CLOSE: Core Closes Strong

Bunds rallied for most of the session, sandwiched between stretches of sideways trade. Gilts rose steadily, BTP spreads stayed flat. Both German and UK yields closed on the lows.

- Talk of a Brexit deal being reached by the weekend rebuffed by later headlines pointing to continued UK-EU divides. This was compounded by news that the UK parliament would take up the controversial internal markets bill Monday, seen as a potential obstacle to a deal.

- Largely positive morning data (the only real miss was on Italy Nov Svcs PMI) was shrugged off.

- Friday's highlights include German factory orders and speeches by BOE's Saunders and Tenreyro.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 2.1bps at -0.737%, 5-Yr is down 3.5bps at -0.75%, 10-Yr is down 3.7bps at -0.556%, and 30-Yr is down 3.5bps at -0.14%.

- UK: The 2-Yr yield is down 2.1bps at -0.047%, 5-Yr is down 2.2bps at 0.003%, 10-Yr is down 3.2bps at 0.322%, and 30-Yr is down 2.6bps at 0.893%.

- Italian BTP spread up 0.7bps at 115.8bps

- Spanish bond spread up 0.5bps at 62.7bps

EUROPE SUMMARY: Bund Downside, Stg Upside

Thursday's options flow included:

- LU1 100.12/100.37 1x1.5 cs, bought for 2.5 in 11.75k

- 0LH1/LG1 100.00/100.12/100.25c fly spread, bought the mid for 0.25 in 3k

- 0LU1 99.875/99.75ps 1x2, bought the 1 for 0.25 in 4.6k

- 3LH1 99.62/99.37ps bought for 3.5 in 3.6k vs 3RH1 100.37p, sold at 3.25 in 2k

- 3RM1 100.37/100.12ps vs 100.50/100.75cs, bought the ps for 1.5 in 4k

- RXF1 174 put, bought for 3 in 6k

- RXH1 177/176/172 1x1x2 p ladder, sold at 7.5 in 2.75k

FOREX: Lofty Sterling as Market Still Sees Deal as Likely

GBP was the strongest in G10 Thursday, as the market remains of the view that a post-transition period trade deal could in the offing. Reports continue to suggest some intra-EU divisions, with The Times reporting that Ireland are pressuring France to not sacrifice any workable trade deal on the less important details. In response, GBP/USD rallied to touch 1.35 for the first time since last December's General Election.- Elsewhere, the USD sank further, pressing the USD index to its lowest levels since H1 2018, helping provide a major leg higher for most pairs. JPY traded well despite better equity markets in the US, while oil-tied currencies bounced back from early weakness.

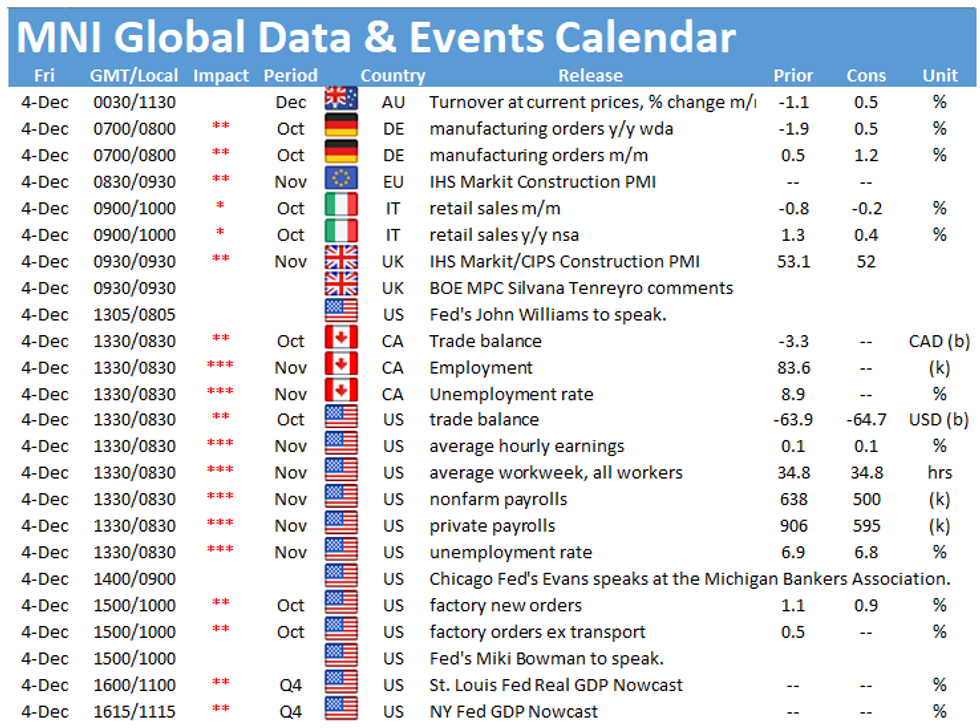

- Focus Friday turns to the November nonfarm payrolls release, with the US expected to have added 475,000 jobs over the month and the unemployment rate seen shedding another 0.1 ppts to 6.8%. The street is a little more bullish, with the whisper number at 505,000.

OPTIONS: Expiries for Dec4 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1810-25(E574mln), $1.1850-55(E548mln), $1.1890-1.1900(E1.1bln), $1.2000(E2.1bln, E1.78bln of EUR calls), $1.2250(E928mln-EUR calls)

- USD/JPY: Y102.00($718mln), Y103.00($871mln), Y104.00-20($646mln), Y105.00($864mln)

- EUR/GBP: Gbp0.8900(E587mln), Gbp.0.9000-15(E520mln)

- USD/CAD: C$1.2900($540mln), C$1.3000($743mln)

- USD/CNY: Cny6.60($917mln)

EQUITIES: US Stocks Hit New Alltime High While Europe Lags

US equities hit all-time highs Thursday, with the e-mini S&P topping Tuesday's best levels to touch 3679.75 before fading slightly into the close. Utilities and materials were the laggards, while energy and industrials topped the sector table.- In Europe, stocks lagged, although losses were shallow and contained within recent ranges. UK's FTSE-100 was the outperformer, rising around 0.4%.

- The VIX was broadly flat into the close, but has continued the grind higher after the gap lower at Tuesday's open. Nonetheless, prices remain in close proximity to the 19.51 printed last week - the lowest reading for the index since February.

PIPELINE: $8.6B To Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 12/03 $1.5B #Barclays 4NC3 +80

- 12/03 $1.5B #Citigroup PerpNC5, 4.0%

- 12/03 $1.5B #BMO $900M 3Y +27, $600M 3Y FRN SOFR+35

- 12/03 $1B #FS KKR Capital 5Y +325 *upsized from $400M

- 12/03 $1B Seagate Tech 8.6NC3, 10.6NC5

- 12/03 $800M #Juniper Networks 5Y +80a, 10Y +115a

- 12/03 $750M #National Bank of Canada 4NC3 +40

- 12/03 $550M *AIG Global 3Y +28

COMMODITIES: OPEC+ Agree to Slowly, Steadily Ratchet Up Output

WTI and Brent crude futures traded higher into the close, with WTI edging back above $45.50 as OPEC+ finally reached an agreement on slowly, but surely, increasing output throughout 2021 and easing the group off their current output curb agreement. This saw WTI crude futures narrow the gap with the late November highs at $46.26.

Gold held its ground throughout the Thursday, but came off new weekly highs ahead of the close as US equities traded well. This prompts traders to target 1844.02 on the way higher before the 50-dma can be considered at $1880.24.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.