-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS - Tsys Weather New Equity Highs

US TSY SUMMARY: Subdued Rate Rally

Tsys held higher levels after the close, Just off midmorning highs on a narrow overall range even as equities clawed to new all-time highs (ESZ0 3708.0).

- Equity bid belied a session that kicked off with a risk-off tone as a Covid relief package has still not been hammered out by Congress.

- Trading volumes were relatively subdued, two-way option position squaring ahead the year-end holidays.

- Little reaction to small tail in US Tsy $56B 3Y Note auction (91282CBA8) draws 0.211% high yield (0.250% last month) vs. 0.208% WI, on a bid/cover 2.28 vs. 2.40 previous. Indirects drew 49.25% vs. 38.89% prior, directs 15.87% vs. 14.28% prior, dealers w/ 34.88% vs. 46.83% prior.

- The 2-Yr yield is up 0.8bps at 0.1488%, 5-Yr is up 0.3bps at 0.3893%, 10-Yr is down 0.5bps at 0.9179%, and 30-Yr is down 1.3bps at 1.6662%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00038 at 0.08250% (-0.00075/wk)

- 1 Month +0.00300 to 0.14875% (-0.00330/wk)

- 3 Month -0.00038 to 0.23000% (+0.00412/wk)

- 6 Month +0.00025 to 0.25338% (-0.00237/wk)

- 1 Year -0.00100 to 0.33725% (+0.00050/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $154B

- Secured Overnight Financing Rate (SOFR): 0.08%, $951B

- Broad General Collateral Rate (BGCR): 0.07%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $338B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $5.777B submission

- Next scheduled purchases:

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

EURODOLLAR/TREASURY OPTIONS: Summary

US EURODLR OPTIONS: December Expiration Friday

Reminder, December Eurodollar futures and options expire Friday (lead quarterly options expire Mon morning at 6:00 am ET while Red through Purple midcurves expire at 5:00 pm ET Fri). Final OI coming into session according to CME Group Data below:

- * Dec quarterly OI: 8,158,701 (2,162,617 calls, 5,996,084 puts);

- * Dec 1yr midcurve (Red) OI: 1,582,609 (982,188 calls, 600,421 puts);

- * Dec 2yr midcurve (Green) OI: 1,125,456 (442,517 calls, 682,939 puts);

- * Dec 3yr midcurve (Blue) OI: 808,909 (349,540 calls, 459,369 puts);

- * Dec 4yr midcurve (Gold) OI: 78,275 (12,417 calls, 65,858 puts);

- Total of options 11,753,950 options coming off the sheets (3,595,249 of which

- are midcurves) compares to 17,188,942 last December.

Eurodollar Options:

- -4,000 Dec/Jan 97 put spds, 1.0 net cr

- 2,000 short Jan 100 calls, cab

- -5,000 Dec 97/98 1x2 call spds, 0.75

- -5,000 short Jun 96/97 put spds, 2.5

- -5,000 short Mar 97/98 call spds, 3.25 legged

- -3,000 Green Sep 92/96 put over risk reversals, 1.5 vs. 99.525/0.50%

- +2,000 Red Jun/Sep 96/97 put spd strip, 8.0

- 2,000 Mar 96/97 put spds

- Overnight trade

- +15,900 Mar 96 puts, 0.5

- +13,800 Mar 97 puts, 1.0

- +6,700 Jun 97 puts, 1.0

- +9,000 TYG 134/135 put strips, 9

- +6,500 TYF 137 puts, 7/64

- over 15,000 FVG 126.25 calls, up to 7.5 adds to O/N block/screen

- more TYF 135.5 puts, 2

- Overnight trade

- Block, 20,000 FVG 126.25 calls, 7 w/another 12k on screen from 6.5-7

- +24,300 TYF 135.5 puts, 2/64

EGBs-GILTS CASH CLOSE: Bull Flattening As Brexit Intrigue Continues

Strong bull flattening in both the Bund and Gilt curves on Tuesday, though the UK outperformed as Brexit intrigue continued, with no macro drivers otherwise. Periphery spreads traded sideways.

- News that the EU and UK had reached an agreement on the outstanding issues in the Withdrawal Agreement was treated fairly equivocally, initially modestly bearish Gilts but that move faded.

- More attention on repeated reports that EU's Barnier saw odds of a deal as slim.

- Main focus is on PM Johnson's upcoming trip to Brussels, timing still TBD. Wednesday's calendar looks thin, with supply (UK and German auctions) the main area of interest.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.4bps at -0.773%, 5-Yr is down 1.7bps at -0.794%, 10-Yr is down 2.5bps at -0.607%, and 30-Yr is down 2.9bps at -0.185%.

- UK: The 2-Yr yield is down 0.6bps at -0.081%, 5-Yr is down 1bps at -0.04%, 10-Yr is down 2.6bps at 0.257%, and 30-Yr is down 5.5bps at 0.799%.

- Italian BTP spread up 0.5bps at 119.7bps

- Spanish bond spread up 0.2bps at 63.6bps/Portuguese up 0.2bps at 60.1bps

EUROPE OPTIONS SUMMARY: Prominent Schatz Downside

Tuesday's options flow included:

- RXF1 177/176.50ps, bought for 9 in 1k

- RXF1 177/176.00ps, bought for 10.5 in 2.5k

- DUF1 112.30/112.20ps, bought for 1 and 1.5 in 4.6k

- DUF1 112.30 put bought for 1.5 in 5.5k

- DUG1 112.30/20 1x2 put spread bought for 0.5 in 2k

- DUG1 112.20/112.00ps, bought for 1 in 1.5k

- DUG1 112.40/30/20 put fly bought for 2.25 in 2.5k

- DUG1 112.30/20/00 put fly bought for 1.25 in 5k

- LH1 100^, bought for 8 in 3k

- 0LF1 100.12c, sold at 0.5 in 5k

- 0LU1 99.87/99.62ps, bought for 5.5 in 3.5k (ref 99.94)

FOREX: Ebb & Flow of Brexit Still Dominating Force

The ebb and flow of Brexit newsflow continues to dominate markets, with another sizeable GBP/USD trading range for spot. Front-end GBP implied vols continue to ratchet higher, indicating the market's caution over the outcome of the ongoing negotiations. The latest reports suggest that both sides are preparing documents and briefings ahead of the face-to-face meeting between EU's VdL and UK's Johnson due to take place on an unspecified day later this week. GBP/USD fluctuated between 1.3290 and 1.3393.- The greenback traded well, with the USD index inching higher despite a generally favourable equity backdrop. CHF was the strongest in G10, while SEK was the weakest.

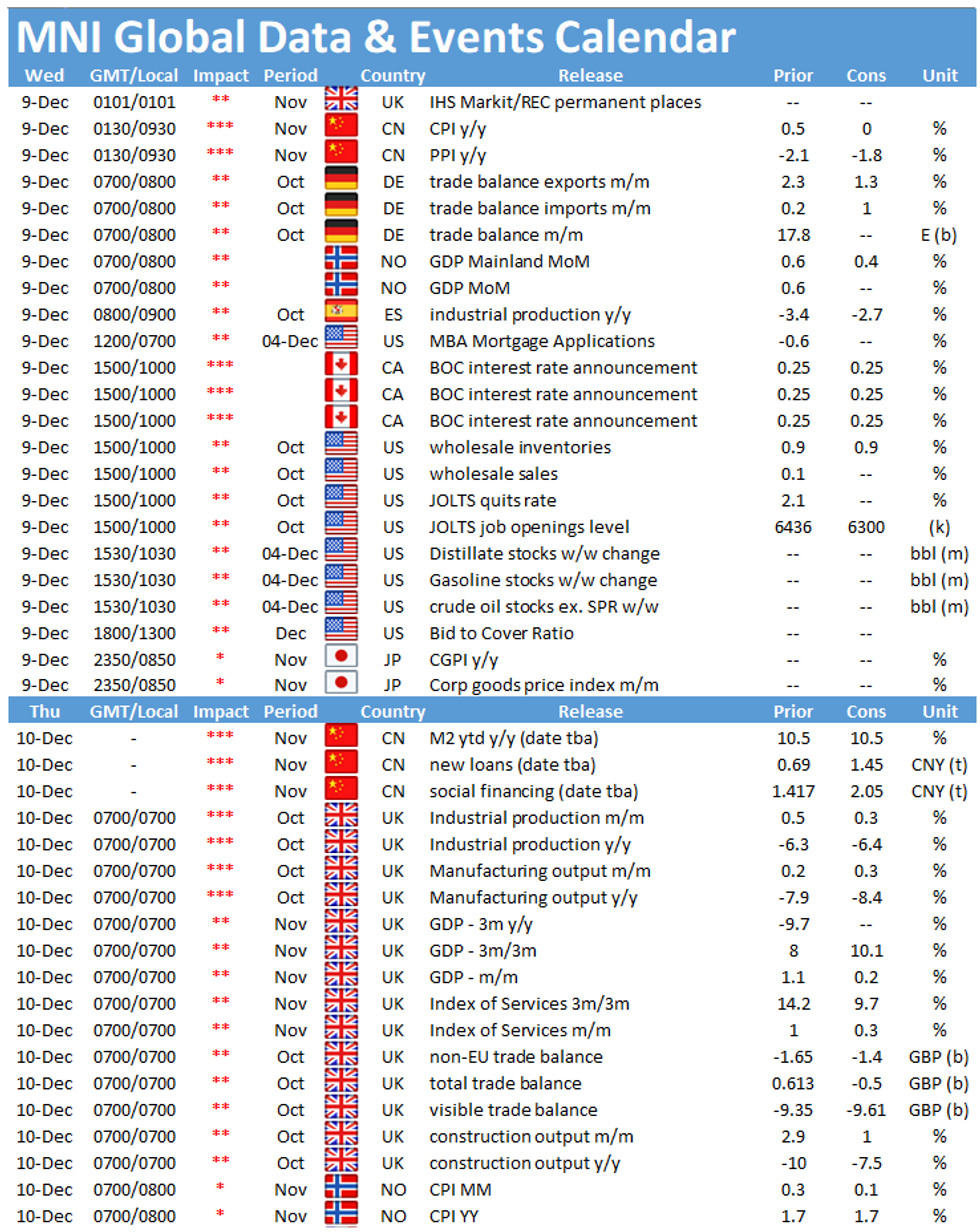

- Focus Wednesday turns to Chinese inflation data for November and rate decisions from the Canadian and Brazilian central banks. Both institutions are seen keeping rates unchanged.

FX OPTIONS: Expiries for Dec9 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2130-40(E567mln), $1.2190-00(E544mln)

- USD/JPY: Y104.65-80($1.1bln)

- USD/CAD: C$1.2900($561mln)

EQUITIES: Stocks Erase Early Weakness

After a negative start to the session, US indices helped give European stocks a boost into the close, with most markets erasing early weakness to close broadly flat. UK & German equities outperformed, while Spanish and Italian stocks sagged. This price action was mirrored in US equities, prompting minor gains and more pressure on all-time highs for the S&P 500.- In the US, energy and consumer staples outperformed, while consumer discretionary and communication services provided an anchor.

- Notable individual performers included Equifax after a business update disclosed notable strength in their mortgage business. Other outperformers included Pfizer after the first COVID vaccine dose was administered in the UK.

PIPELINE: $10.766B To Price Tuesday

Date $MM Issuer (Priced *, Launch #)

- 12/08 $2.5B #Charles Schwab PerpNC10 4%

- 12/08 $2B #Charles Schwab $1.25B 5Y +53, $750M 10Y +75

- 12/08 $3B #Kingdom of Morocco $750M 7Y +175, $1B 12Y +200, $1.25B 30Y +4%

- 12/08 $1.5B #Occidental Petroleum $750M 5Y 5.5%, $1.25B 10Y 6.12%

- 12/08 $1.266B #Dominican Republic 2032 Tap 4.1%

- 12/08 $500M #CBOE 10Y +78

COMMODITIES: Recent Ranges Respected

On the whole commodities largely respected the week's range, with WTI crude futures erasing early weakness as equities recovered into the close. A gap remains with the Friday multi-month high of $46.68, which remains the key bull trigger going forward. Focus turns to the API crude oil inventories due after-market as well as Wednesday's DoE equivalent.- Spot gold extended the recent rally, although the pace slowed markedly. The 50-dma acts as resistance going forward, crossing Tuesday at $1878.96. This extends the recovery from the recent lows to over $100/oz.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.