-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS

US TSY SUMMARY: Huge Range, Volatile Session, 10s Track Weaker Stocks

Unexpectedly hectic day for rates, broadly weaker 10Y futures in lock-step with S&P futures on the day. The dramatic rise in Tsy yields has been fast if not a smooth transition since the start of the year: 10YY 0.9132% Jan 1 to 1.6085% high post auction, 30YY 1.8347% on Jan 1 to 2.3944% high.

- Yld curves mixed: short end steeper while 5s30s fell below 148.5 from 165.39 high earlier. Yields had pull back from 1Y highs/futures pared losses after mixed data: lower than expected weekly claims, stronger durables, softer GDP.

- Second half trigger: Tsys gapped lower after a terrible $62B 7Y Note auction tailed 4bp: US Tsy $62B 7Y Note auction (91282CBP5) drew high yield 1.195% vs. 1.155% WI; (had stopped through last month on high yield of 0.754% vs. 0.757% WI) ; 2.30 bid/cover vs. 2.04 prior.

- Dealers are cranking out their negative convexity trigger points ahead of today's move -- may need to expand their horizons: one stated convexity selling doesn't start until doesn't start until around 1.35% 10YY and tapers off at 1.60% -- which happens to be near TODAY's range for 10YY! TD Security had it right unwinding their long 5s30s steepener at 159 (165 high today, it collapsed to 148.456 low, 150.652 last).

- Official central bank line: not worried about a spike in inflation etc, while mkt basically right where we were at start of pandemic. Opinions vary around banks trying to talk economy up after telegraphing willing to let market run hot for a while -- remains to be seen. No surprise reveal from NY Fed Williams on YCC or other measures after today's volatile session.

- The 2-Yr yield is up 4.9bps at 0.172%, 5-Yr is up 21.8bps at 0.8181%, 10-Yr is up 15.5bps at 1.5303%, and 30-Yr is up 6.3bps at 2.2956%.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00025 at 0.08038% (+0.00225/wk)

- 1 Month +0.00063 to 0.11513% (-0.00032/wk)

- 3 Month +0.00075 to 0.19050% (+0.01525/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00125 to 0.20063% (+0.00463/wk)

- 1 Year +0.00225 to 0.28025% (-0.00625/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $212B

- Secured Overnight Financing Rate (SOFR): 0.02%, $870B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $340B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $5.530B submission

- Next scheduled purchases:

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

EURODOLLAR/TREASURY OPTIONS: Summary

Eurodollar Options:- Block 20,000 Green Jun 88/91 put spds, 3.5 at 1411:53ET

- -20,000 Blue Jun 85/87 put spds w/ 86/88 put spds, 25.0 vs. 98.615/0.40%

- +10,000 Blue Apr 81/83/86 put flys, 3.5

- Block 25,000 Green Jun 87/90 put spd w/ 87/91 put spd 5.5-6.0

- Block, 12,750 Green Sep 90 puts, 11.0

- +8,000 Blue Mar 91/92/93 call flys, 1.0

- Block, +10,000 Sep 95 puts, 1.0

- Block, +35,000 Green Dec 96 calls, 2.5 vs. 99.075/0.10%

- -22,000 Green Dec 88/92/93 broken put flys, 4.0

- +5,000 Green Sep 92 straddles, 33.0

- Overnight trade

- Block, +20,000 short Sep 96/97 put spds 2.0 over 98 calls vs. 99.735/0.44%

- Block, -30,000 Blue Sep 82 puts, 9.5

- -20,000 Green Sep 91 puts, 12.5

- +13,000 Blue Mar 91/92/93 call flys, 1.5 vs. 98.995-.00/0.10%

- +6,000 short Dec 95/96 put spds 3.5-4.0

- +5,000 Dec 90 puts, 0.5

- +4,000 Green Jun 91/93 put spds 2.5 over 96 calls vs. 99.44/0.48%

- +10,000 FVJ 124/124.5 call spds, 16.5 vs. 123-29.25/0.18%

- +7,500 TYM 130 puts 26-27

- +3,000 TYM 129/129.5 put strip 44

- +5,000 TYM 131/136 put over risk reversals 12-13

- -2,000 TYK 135 puts, 218

- +1,500 TYK 132 puts, 33

- -1,500 TYK 131.5 puts, 25

- +3,000 TYM 137 calls, 12 vs. 134-21/0.13%

- 12,000 TYJ 134/135 2x1 put spds, 22-24

- Overnight trade

- +13,000 TYJ 132/132.5/133/133.5 put condors, 5 vs. 133-23.5/0.05%

- -10,000 TYJ 133.5/134 put spds, 14

- 2,000 TYJ 131.5/132.5/133.5 put flys, 1

- +5,000 FVK 123.5/123.75/124/124.25 put condors, 1.5

- +5,000 FVJ 123.5/124 put spds, 5

- 3,500 USJ 152 puts, 15

BONDS/EGBs-GILTS CASH CLOSE: Tough Day For The Belly

Bunds and Gilts found a bit of a footing toward the end of Thursday's session, but make no mistake that it was a very tough day across the curves. BTP spreads widened too, with French 10-Yr yields going positive for the first time since June 2020.

- While the main theme globally was belly/10-Yr weakness, perhaps notable was the relatively stronger performance in 30-Yr Gilts - the UK curve bear flattened as BoE cuts were priced out.

- Italy saw lowest cover ratio for a 5-yr BTP since June 2020 (though this was somewhat expected due to large size); Tesoro released Green Bond framework.

- Bunds briefly ticked higher on comments by ECB's Lane reiterating the bank watching yields closely. But mixed confidence data this morning largely shrugged off.

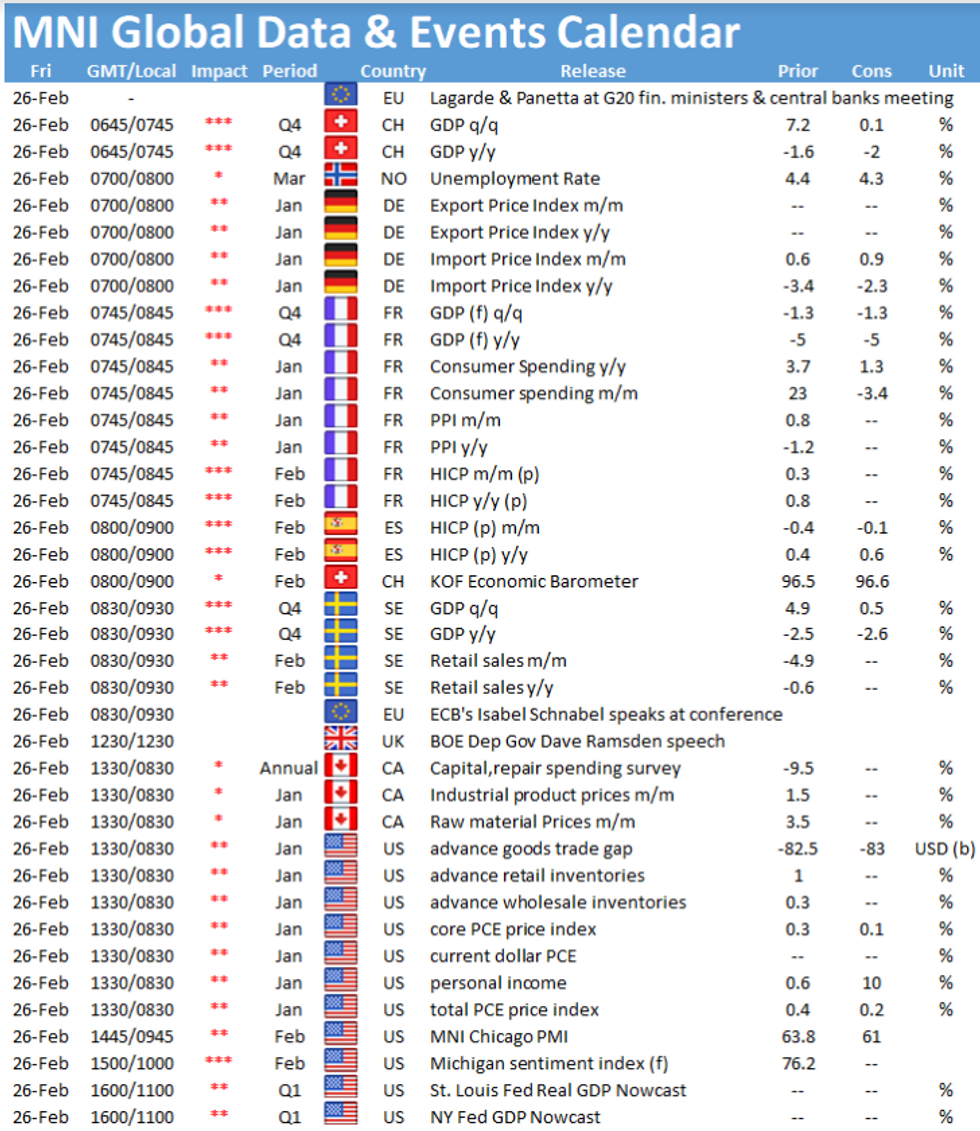

- Friday sees some prelim inflation data and a few cenbank speakers (Schnabel, Haldane).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 3bps at -0.652%, 5-Yr is up 6.5bps at -0.545%, 10-Yr is up 7.2bps at -0.232%, and 30-Yr is up 3.5bps at 0.244%.

- UK: The 2-Yr yield is up 7.5bps at 0.107%, 5-Yr is up 8.8bps at 0.366%, 10-Yr is up 5.2bps at 0.784%, and 30-Yr is up 1.2bps at 1.389%.

- Italian BTP spread up 4bps at 103.1bps / Spanish spread up 1.3bps at 70.8bps

OPTIONS/EUROPE SUMMARY: Vol Buying Emerges Just As It Becomes More Expensive

Thursday's options flow included:

- RXM1 169.50/168ps 1x1.5, bought for 22 in 6k total all day

- RXM1 170.50/167.50 1X1.5 put spread bought for 77.5 in 4.5k

- RXM1 170.00 straddle bought for 307 in 1.5k (vol 4.66%)

- Bund package: RXJ1 170.50/168ps, bought for 67 in 20k/ RXJ1 170p, sold at 66 in 5k / RXJ1 172c sold at 41 in 15k

- DUJ1 112.10/20/30c fly, bought for 2 in 4kDUJ1 112.20/10ps 1X2, bought for 1.5 in 1.25k

- 3RJ1 100.25/100.12ps, bought for 3.25 in 4k

- 3RM1 100.37/100.50cs bought for 2.5 in 100k

- 0LM1 99.75^ bought for 15 in 3k

- 0LZ1 99.50/100.00 combo, pays 2 for the put in 6k (ref 99.715)

- 3LZ1 99.37/99.12ps vs 0LZ1 99.75p, bought the 1yr for 1.5 in 2k

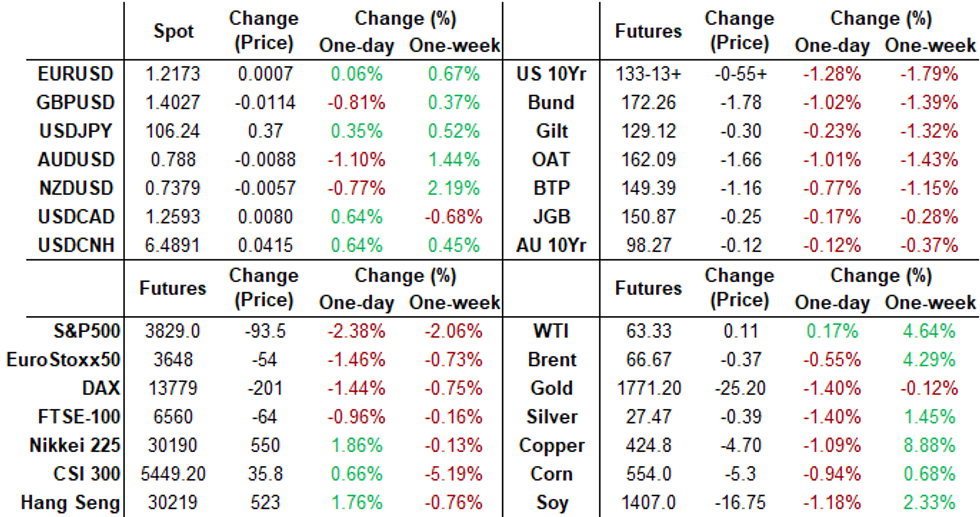

FOREX: A Volatile US Yield Curve Leads USD to Outperform

After a shaky start to the Thursday session, the US dollar rallied into the close after the US Treasury yield curve underwent an acute bout of volatility. After a sloppy 7yr bond auction, US 10y yields shot higher to the best levels since February last year and just above 1.6%. This prompted a short, sharp bout of risk-off, with the US dollar benefiting as a result.

- The poorest performers were commodity-tied currencies after oil markets flatlined near recent highs. This led the likes of NOK, AUD and NZD to underperform most others, and dragged AUD/USD off a new multi-year high.

- Spiralling equity markets on yield volatility fears fed into a strong move for haven currencies, with CHF and JPY close to the top of the pile.

- Focus Friday turns to French prelim CPI, US trade balance and personal income/spending numbers for January and the MNI Chicago PMI. Speakers include ECB's Schnabel and BoE's Haldane & Ramsden.

FX OPTIONS: Expiries for Feb26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E682mln), $1.2150(E698mln), $1.2175(E1.6bln-EUR puts), $1.2200(E792mln), $1.2235-50(E694mln), $1.2275(E786mln)

- USD/JPY: Y105.25($750mln), Y105.80-00($1.2bln), Y106.25-35($602mln), Y106.50($655mln)

- GBP/USD: $1.3900(Gbp1.3bln), $1.3930(Gbp614mln), $1.4000(Gbp607mln), $1.4030(Gbp2.3bln-GBP puts), $1.4060(Gbp1.2bln-GBP puts), $1.4120(Gbp879mln)

- EUR/GBP: Gbp0.8600-20(E2.4bln), Gbp0.8650(E854mln), Gbp0.8665-75(E1.8bln-EUR puts), Gbp0.8750-65(E1.2bln-EUR puts)

- AUD/USD: $0.7590-0.7600(A$1.2bln), $0.7770-80(A$1.6bln-AUD puts), $0.7850(A$1.7bln-AUD puts), $0.7900(A$5.2bln-AUD puts), $0.7975(A$2.2bln-AUD puts)

- NZD/USD: $0.7400(N$676mln)

- USD/CAD: C$1.2500($1.9bln), C$1.2530($1.8bln), C$1.2630($1.5bln)

- USD/CNY: Cny6.41($550mln), Cny6.44($680mln). Cny6.45($1.1bln)

- USD/MXN: Mxn19.70($1.2bln)

PIPELINE: Daimler Launched Despite Market Vol

- Date $MM Issuer (Priced *, Launch #)

- 02/25 $3B #Daimler Finance $1.5B 3Y +48, $1B 5Y +70, $500M 10Y +95

- 02/25 $1.25B #Truist Financial 6NC5 fix-FRN +50

- 02/25 $900M *Williams Cos 10Y +115

- 02/25 $520M *Development Bank Japan (DBJ) 3Y +14

EQUITIES: Wave of Risk Off Follows US Yield Spike

US equity markets circled session lows after the London close on a wave of risk-off that followed US 10y yields being run up to 1.6% on the back of a weak 7yr auction.

- Consumer discretionary and Tech firms were solidly the underperformers, with both sectors posting losses of close to 3% apiece.

- Tech underperformance bled into indices, with the NASDAQ Composite the underperformer (down around 2.8% at pixel time). The VIX benefited from the sell-off, rising back above 25 points and opening a gap with the post-COVID lows printed in mid-February.

- The 50-dma in the e-mini S&P is once again being eyed as support after the successful hold earlier in the week - crossing at 3799.99.

COMMODITIES: Recent Surge Halted Amid Safe Haven Demand

- Crude futures made fresh highs before then coming under some pressure amid some extremely volatile moves in yields and equities. Taking a back-seat ranges were fairly contained with both WTI and Brent crude futures broadly unchanged on the session.

- For Brent crude futures, markets earlier extended the sequence of higher highs to 16 of the past 19 sessions. Developments in broader risk sentiment will determine if this bullish sequence will continue.

- EIA published U.S. NatGas Stockpiles -338 Bcf, roughly in line with a median estimate. -334 Bcf.

- Metals – The late surge in the US dollar led to weakness in precious metals. Both spot gold and silver have retreated 1.5%. Copper's impressive rally was also finally capped. Despite losing 0.75% today HG1 futures are consolidating above 422-423 highs made earlier in the week.

- Spiralling equity markets on yield volatility fears certainly halted the advance in the commodities space, generally evident by the Bloomberg Commodity Index giving back 0.55%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.