-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Not Easy Being a (Stock) Bear

US TSY SUMMARY: Not Easy Being a (Stock) Bear

Rates opened and held weaker levels throughout the session, inside range day with small variations in the first half: Tsy and equities bounced after Appaloosa's David Tepper said it's "difficult to be bearish on stocks" during a CNBC interview. S&Ps reversed gains after Tsy close to mildly weaker, NDX extended losses (-260.0) while Dow Indu's held strong gains +428.0).

- No react to second tier data: Jan Wholesale inventories 1.3%; Sales 4.9%. Federal Reserve in media blackout through the March 17 FOMC annc. That said, Fed annc: EXTENDS PAYCHECK PROTECTION PROGRAM FACILITY THRU JUNE; CLOSURE OF THREE 13(3) FACILITIES AS SCHEDULED MARCH 31; CLOSE COMM PAPER, MONEY MARKET, PRIMARY DEALER FACILITIES.

- Yield curves hold mixed levels, spds vs. long end flatter: 5s30s near session lows late: 145.483, -4.344. 30YY near steady (2.3059% +.0085) despite the drop in Bond futures, 10s30s curve underperforming for couple reasons, sources citing a rise in inflation premium and SLR exemption is set to expire March 31 with no signs yet of extension.

- Large Eurodollar spread volumes: +65,000 Red Mar/Red Jun spds, 0.040-0.050. Modest long put unwinds while core positions remain long rate hike insurance covering latter half 2022 to 2023. Several put spd over call spd skew plays in 1Y midcurves bought on day.

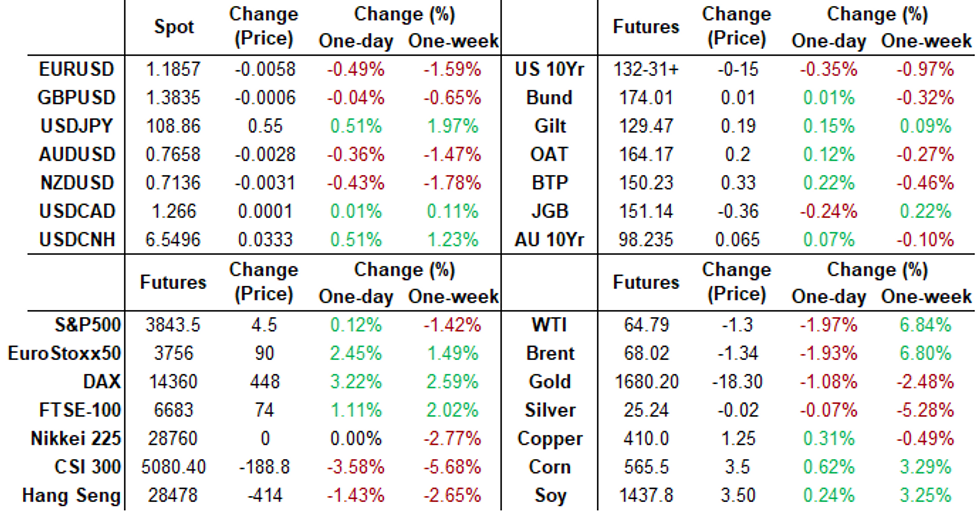

- The 2-Yr yield is up 2.4bps at 0.1607%, 5-Yr is up 5bps at 0.8487%, 10-Yr is up 2.6bps at 1.5924%, and 30-Yr is up 0.5bps at 2.3028%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00000 at 0.07763% (-0.00637 total last wk)

- 1 Month +0.00275 to 0.10600% (-0.01525 total last wk)

- 3 Month -0.00288 to 0.18250% (-0.00300 total last wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00037 to 0.19625% (-0.00712 total last wk)

- 1 Year +0.00250 to 0.28025% (-0.00600 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $210B

- Secured Overnight Financing Rate (SOFR): 0.02%, $933B

- Broad General Collateral Rate (BGCR): 0.01%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $339B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $4.211B submission

- Next scheduled purchase:

- Tue 3/9 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Wed 3/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- hu 3/11 1500 Next scheduled release schedule

EURODOLLAR/TREASURY OPTIONS

- Eurodollar Options:

- Block, +10,000 short Dec 91/95 put spds 4.0 over short Dec 97/100 call spds

- Block, 10,000 Green Dec 88/91/95 put trees, 10.0 vs. 98.86/0.28% at 1303:10ET

- Block +14,000 short Jul 91/96 put spds 1.0 over short Jul 97/100 call spds vs. 99.685/0.84% w/

- Block +14,000 short Sep 91/96 put spds 0.5 over short Sep 97/100 call spds vs. 99.685/0.84%

- Block, +10,000 Red Jun 99.50/99.75 put spds 2.5 over the Red Jun 99.87/100.12 call spds at 1103:11ET, adds to 4k in pit at +2.0

- Block, 28,000 short Aug 95/96/97, 3.0 net/wings over vs. 99.69/0.12% at 1037:10ET

- 2,500 Blue Jun 83/86/88 3x5x2 2 net/body over

- +5,000 Green Mar 95/Blue Mar 91 put spds, 34

- +11,750 short Sep 98 calls, 1.5 adds to block

- Block, 10,000 short Sep 98 calls, 1.5 vs. 99.695/0.14%

- Overnight trade

- Block +5,000 Gold Sep 75/78 put spds, 10.0

- 3,000 Blue Jun 90 puts

- Treasury Options:

- 6,000 TYJ 134.5 calls, 2

- 6,500 wk2 FV 124.5 calls, 0.5

- +2,000 USJ 153 calls, 5

- Update, +11,000 TYK 129.5/130.5 call spds, 13-15

- +12,000 TYK 128/131.5 put spds, 45-46

- -4,000 FVM 121/122.5 put spds 14 vs. 123-21.75

- total 13,700 TYJ 131.5 puts, 32 last from 28-36

- 1,500 FVM 122.75/123.75 put spds

- -+1,300 USK 143 puts, 109-107

- -13,400 USK 153/157 put spds, 124-120-118

- Overnight trade

- 2,000 TYM 127/128/130 2x3x1 broken put flys

- 2,000 TYK 131/132.5 put spds vs. TYM 130.5/132 put spds

- 3,000 USJ 158 calls, 50-56

EGBs-GILTS CASH CLOSE: ECB Week Begins With Bund Weakness

A strong performance by European equities saw Bunds weaken, though Gilts were a little stronger on the session Monday.

- Bund yields moved to session highs alongside MNI's Exclusive on ECB policy ("hawks and doves within the Governing Council are biding their time ahead of a bigger battle over the long-term future of its monetary toolkit") published late afternoon.

- Periphery spreads were lower on the session; Greece (10Y -4.1bps/Bunds) outperformed. This despite 'disappointing' ECB net asset purchase data which saw a small downtick in PEPP buys.

- BoE's Bailey added little new in his appearance today.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.68%, 5-Yr is up 2.1bps at -0.594%, 10-Yr is up 2.5bps at -0.277%, and 30-Yr is up 1.6bps at 0.225%.

- UK: The 2-Yr yield is down 0.2bps at 0.098%, 5-Yr is down 0.8bps at 0.358%, 10-Yr is down 0.2bps at 0.754%, and 30-Yr is down 0.2bps at 1.285%.

- Italian BTP spread down 2.3bps at 103.3bps/ Spanish spread down 1.9bps at 67.6bps

OPTIONS/EUROPE SUMMARY: Vol Selling

Monday's options flow included:

- DUJ1/DUM1 112.20/30cs spread, bought the June for 1.25 in 7.5k total

- DUK1 112.20/112.30cs, was bought for 2 in 10k

- OEM1 134/133.75ps, bought for 5 in 1k

- RXM1 171^ sold at 277 in 1.25k

- 0RH1 100.50^ sold at 2.25 in 2k

- 0LZ1 99.125 + 99.25 put strip bought for 6 in 10k (v 99.64, 23d)

- 2LJ1 v 2LM1 99.25 put calendar bought for 2.75 in 8k

- 3LM1 99.875/98.625 1x1.5 put spread bought for up to 2.25 in 12k (v 99.22)

FOREX: JPY Sags as Equities Rip to New All Time Highs

- The JPY was among the poorest performers in G10 Monday, with USD/JPY extending the recent sequence of higher highs to ten consecutive sessions. The move coincided with further upside in US equities, with the recovery rally now boosting the Dow Jones Industrial Average through the late February highs to record levels.

- The buoyant risk sentiment correlated with a stronger dollar, as the USD Index extended the recent bull run.

- EUR traded weaker, with the expected uptick in PEPP purchases failing to materialise in last week's bond holdings data. This will likely continue to be a market focus headed into this Thursday's ECB meeting.

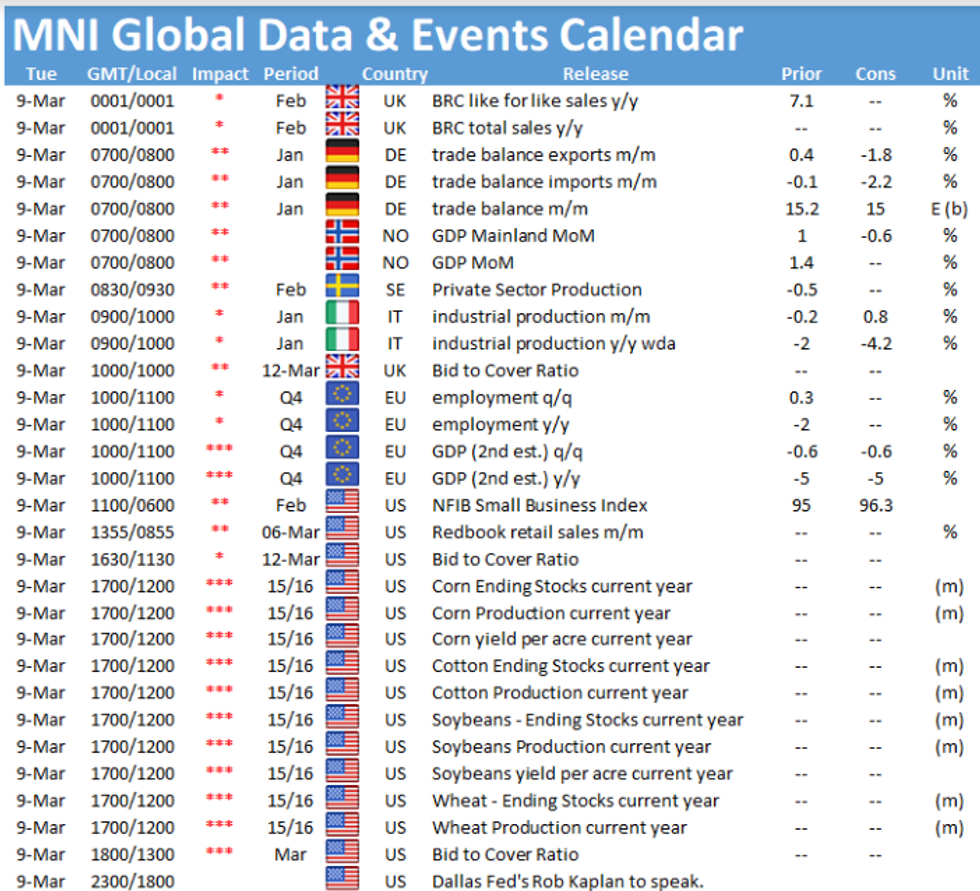

- Focus Tuesday turns to German trade balance data for January and final Q4 GDP readings for the Eurozone. RBA Governor Lowe is also due to speak.

FX OPTIONS: Expiries for Mar09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E632mln), $1.1835(E555mln), $1.1880-00(E632mln)

- AUD/USD: $0.7700(A$524mln)

- USD/CAD: C$1.2550($545mln), C$1.2595-00($742mln), C$1.2725($610mln)

- USD/CNY: Cny6.56($500mln)

PIPELINE: $5.5B Bank of America 4Pt Leads

- Date $MM Issuer (Priced *, Launch #)

- 03/08 $5.5B #Bank of America $2.5B 6NC5 +80, $2B 11NC10 +105, $1B 31NC30 +115

- 03/08 $5B American Airlines $2.5B 5NC, $2.5B 8NC

- 03/08 $3B #Teledyne $300M 2Y +50, $450M 3NC1 +65, $450M 5Y +75, $700M 7Y +100, $1.1B 10Y +120

- 03/08 $2.4B #Pacific Gas & Electric $1.5B 2NC.5 +120, $450M 10Y +167, $450M 20Y +200

- 03/08 $2B #Santander UK $1.4B 4NC3 +75, $600M 11NC10 +130

- 03/08 $1.1B #CenterPoint Energy $400M 10Y +80, $700M 30Y +105

- 03/08 $1B #AmFam Holdings $500M 10Y +120, $500M 30Y +150

- 03/08 $500M #Southwestern Electric 5Y +80

- 03/08 $Benchmark Anthem 2Y +60a, 5Y +85a, 10Y +120a, 30U +145a

- 03/08 $Benchmark One Gas 2NC.5 +80a, 2NC.5 FRN L equiv, 3NC.5 +90a, 3NC.5 FRN L equiv

- 03/08 $Benchmark Sasol investor calls re: 5Y, 10Y

- 03/08 $Benchmark Deutsche Bank investor calls

EQUITIES: Stocks Erase Early Weakness, DJIA Hits New Record Levels

- Despite initial weakness, US equity futures rebounded during NY hours, with bluechip names driving the gains. The Dow Jones Industrial Average topped the late February highs to touch record levels, driven by solid gains in the likes of Goldman Sachs, Walt Disney and Visa. Markets look to see if the e-mini S&P can follow suit, which still retains a decent gap with the all time highs.

- Across the US, materials and financials outperformed, while technology and communication services traded lower.

- The resumption of equity strength in the US added some pressure to the VIX, which fell through Friday's lows.

- In Europe, Germany's DAX outperformed, clocking gains of over 3.3%, with Italy's FTSE-MIB not far behind.

COMMODITIES: Bullish Exhaustion, Strong Dollar Halt Crude Momentum

- Attacks on critical Saudi oil facilities in the Eastern Province on Sunday claimed by Yemen's Houthi rebels sent benchmark Brent crude prices above $70 per barrel for the first time since May 2019. WTI futures (front-month) rose to a high of $67.98, the highest since October 2018. Concerns have risen that escalating tensions could put more energy infrastructure into jeopardy.

- Following the higher open, bullish momentum faded as US dollar demand became the dominant driver during the European and US sessions. Both Brent and WTI futures are exhibiting losses of 2% on the day, however, both remain above Friday's opening levels.

- A similar theme in precious metals as both spot gold and silver erased early gains amid consistent USD demand. Spot gold is softer once again and has broken last Friday's low of $1687.34, continuing to make new 2021 lows. The technical bearish theme remains intact.

- A volatile opening few hours for Copper futures trading up to 417, but sharply reversing over 4% to print 400 in early European trade. Underlying demand amid consistent upgrades to price forecasts sees the front month contract up 0.7% on the day as of writing.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.