-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: CPI Set-Up; Tsys, Stocks Surge

US TYS SUMMARY: Bonds, Stocks Bounce Ahead CPI

No data on amid relative sedate trade in rates -- holding to narrow/higher band after making most of the rally in early overnight trade. CPI and $38B 10Y auction R/O Wed. Positive correlation (the new negative) between equities and Treasury futures continues: strong Treasury futures more than made up for Monday's weak finish, as are equities after the bell: S&Ps +76.5, NASDAQ over 530.0 higher, Dow Industrials +215.0.- Yield curves bull flattening, large late overnight flattener block contributing to move: -30,085 FVM 123-22.5, sell through 123-23.75 post time bid (dv01 $1.583M) vs. +18,650 TYM 132-10.5, buy through 132-08 post time offer (dv01 $1.657M)

- Midmorning 5s and 10s Block: 11,900 FVM 123-25.25 ($650k dv01) through the 123-24.5 post-time offer; 6,227 TYM 132-11 ($530k dvo1) through the 132-10 post-time offer. Desks still debating if double buy or a continuation of large flattener Block overnight -- leaning toward the latter.

- While implieds did not weaken significantly, option accts took advantage of rally in underlying to buy more puts at cheaper premium.

- Tsys gained after US Tsy $58B 3Y Note auction (91282CBR1) drew 0.355% high yield (0.196% last month) vs. 0.357% WI, 2.69 bid/cover vs. 2.39 previous -- sigh of relief after the 7Y auction tailed 4bp two weeks ago.

- The 2-Yr yield is up 0.2bps at 0.1647%, 5-Yr is down 3.4bps at 0.8197%, 10-Yr is down 4.7bps at 1.5437%, and 30-Yr is down 5.6bps at 2.26%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07713% (-0.00050/wk)

- 1 Month +0.00113 to 0.10713% (+0.00388/wk)

- 3 Month -0.00525 to 0.17725% (-0.00813/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00675 to 0.18950% (-0.00638/wk)

- 1 Year -0.00062 to 0.27963% (+0.00188/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.02%, $928B

- Broad General Collateral Rate (BGCR): 0.01%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $339B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $13.415B submission

- Next scheduled purchase:

- Wed 3/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- hu 3/11 1500 Next scheduled release schedule

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 Blue Sep 80/88 put over risk reversals, 1.5 vs. 98.48/0.5%

- -10,000 Green Dec 87 puts, 18-19.0

- -8,000 long Green Dec 75 puts, 12.5

- +3,000 Blue Jun 77/80 put spds, 6.5

- Block, +10,000 short Sep 95/96/97 put flys, 2.0 at 1201:15ET adds to appr +45k at 2.0-2.5 earlier on screen/in pit

- +6,000 short Sep 95/96/97 put flys, 2.5 adds to pre-open screen buy

- +3,000 long Green Dec'23 95 calls, 13.0 vs. 98.92/0.15%

- +4,000 Red Mar'22 97 puts, 7.0

- -1,000 Gold Jun 81/82 strangles, 35.5

- -2,000 Blue Jun 81/83/86 put flys, 4.0

- Overnight trade

- +33,000 short Sep 95/96/97 put flys, 2.5

- 2.250 Sep 99.56/99.68/99.81 put flys

- 2,500 Blue Dec 97.37/98.00 put spds

- 3,500 Blue Apr 85 puts vs. 1,750 Blue Mar 87/88 put spds

- 2,500 Green Mar 99.56 calls, 0.5

- 2,000 Green Dec 88/91/95 put trees

- 1,000 TYM 135/TYK 133.5 call strip, 36

- 3,200 TYM 130.5/132 put spds, 29

- 2,000 TYK 134.5/136 call spds, 8

- 5,000 TYK 132 puts 19 over TYM 129 puts

- over +5,000 FVM 122.5/125 put over risk reversals, 12 vs. 123-24-24.5

- -22,700 TYM 134 calls, 29-28

- Overnight trade

- 10,000 TYJ 131/131.5 put spds, 13

- 7,800 TYJ 130 puts, 5-8

- 7,700 TYJ 132 puts mostly 28-32

- 11,000 USK 159 calls, small lots on wide range (111-130)

Bonds/EGBs-GILTS CASH CLOSE: Bull Flattening Move Fades Post-ECB Data

Core FI curves finished Tuesday's session flatter, but yields failed to hold intraday lows. Periphery spreads saw steady compression.

- Bunds began weakening from session's best levels just after 1400GMT. This was (perhaps not coincidentally) after data showed fairly limited ECB asset redemptions last week, meaning that the flat weekly net purchases revealed yesterday were largely a consequence of the bank failing to ramp up bond purchases as many had expected it would.

- On that note, the question of the ECB's reaction function amid rising yields is the theme of our Governing Council decision preview published today (click here for PDF).

- Supply came from the UK (Gilts, GBP2.25bn), the Netherlands (DSL, EUR2.330bn), and the EU SURE syndication (E9bn).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.681%, 5-Yr is down 1.5bps at -0.609%, 10-Yr is down 2.4bps at -0.301%, and 30-Yr is down 2bps at 0.205%.

- UK: The 2-Yr yield is down 1.4bps at 0.084%, 5-Yr is down 2.5bps at 0.333%, 10-Yr is down 2.7bps at 0.727%, and 30-Yr is down 4.3bps at 1.242%.

- Italian BTP spread down 4bps at 99.3bps / Spanish spread down 1.2bps at 66.4bps

OPTIONS/EUROPE SUMMARY: Largely Downside In Stg, Upside In Euribor

Tuesday's options flow included:

- RXJ0 173c, bought for 15 in 1.4k

- DUU1/DUM1 112.20/112.30cs spread, bought the June for 1.25 in 2.5k

- ERM1 100.25/100.37/100.50c fly 1x3x2, bought for half in 2.5k

- ERM1 100.50c, bought for 5.5 in 4k (ref 100.535)

- 0LM1 99.75/99.62/99.50p fly sold at 1.5 in 3k

- 0LM1 99.875/99.75/99.625 put ladder bought for 4.25 in 4k

- 2LM1 99.125 put bought for up to 2.5 in 23k

- 2LU1 99.00/98.75ps 1x1.25 vs 2LJ1 99.25/99.00ps 1x1.25, bought the Sep for 1 in 13k

- 3LU1 99.12/98.87/98.62p fly sold at 3 in 3k

- 3LM1 99.00/98.75ps 1x1.5, bought for 3 in 6k

FOREX: Greenback Softer After Monday Strength

- Markets hit reverse Tuesday, with equities higher led by tech, while the dollar edged off Monday's cycle highs. Markets looked to book profits on the recent run higher in the greenback, with the USD index faltering before any test on the 200-dma resistance at 92.924. Tuesday's move lower has relieved the technically overbought conditions that were starting to show after Monday's rally. This week, the RSI for the USD Index touched levels not seen since March's greenback rally.

- Similarly, CHF prices bounced firmly after trading in a solid downtrend since the middle of February. USD/CHF touched multi-month highs at 0.9376 before falling to fresh weekly lows ahead of the US close.

- Implied vols were subdued as markets stabilised, but the pullback from cycle highs in USD/JPY helped prop up demand for JPY upside hedges, supporting the front end of the implied curve.

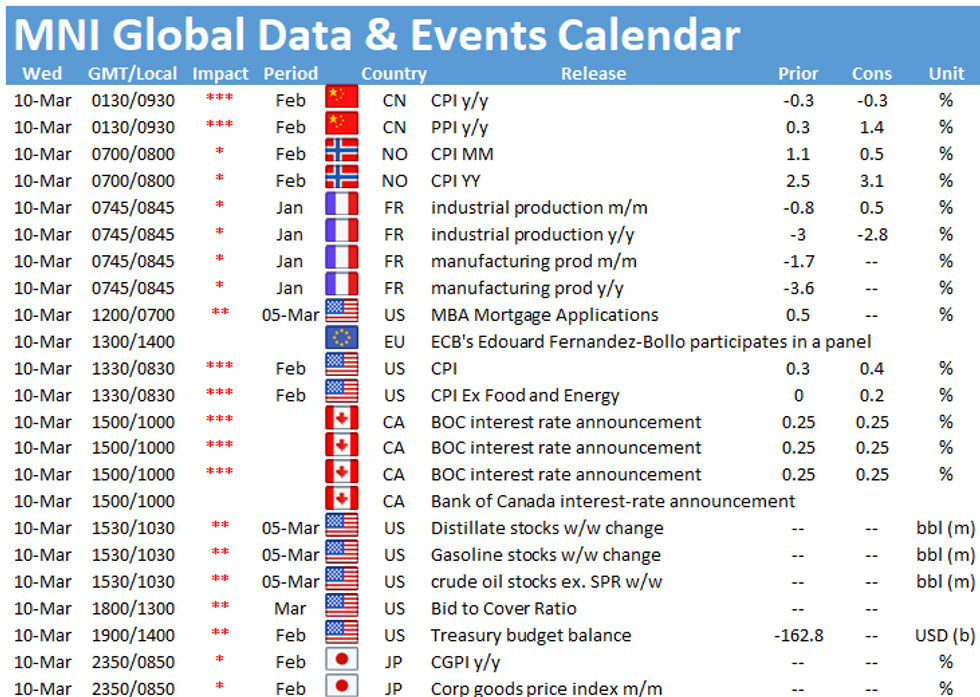

- Focus Wednesday turns to Chinese CPI & PPI data, French industrial production, US CPI and the Bank of Canada rate decision. The BoC are seen keeping rates unchanged at 0.25%.

FX OPTIONS: Expiries for Mar10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950(E569mln), $1.2000-10(E1.3bln), $1.2050-55(E550mln)

- USD/JPY: Y105.80($1.4bln), Y106.80-90($610mln), Y107.25-30($631mln)

- AUD/USD: $0.7500(A$1.3bln), $0.7600-05(A$798mln), $0.7725(A$643mln), $0.7750-55(A$862mln)

PIPELINE: $3B JP Morgan 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/09 $3B #JP Morgan $2B 3NC2 +53, $1B 3NC2 FRN SOFR+58

- 03/09 $Benchmark Swedbank 3Y +55a, 6NC5 dropped

- On tap for later in week:

- 03/10 $500M IADB 7Y FRN SOFR+27a

- 03/12 $800M Pitney Bowes 6NC3, 8NC3

EQUITIES: Firm Tech-Led Bounce Could Mark Bottom for NASDAQ-100

- Markets took the other side of Monday's trade throughout the Tuesday session, as tech shares bounced sharply to lead a firmer day in US cash equity markets. The NASDAQ-100 rose as much as 4% ahead of the close, reversing the mini-downtrend posted since mid-February. The index needs to break and close above the 50-dma at 13,146.85 to confirm a resumption of the multi-month uptrend seen since the 2020 low print.

- In the S&P 500, consumer discretionary names outperformed tech, with both sectors rallying sharply. Energy and financials were the underperformers and were the sole sectors to head into the close lower.

- The VIX traded lower as equities climbed toward new cycle highs, with the index showing below 23 points for the first time since early last week.

COMMODITIES: Softer Dollar Provides Reprieve For Precious Metals

- One-way price action in gold and silver today as they both recovered from their most recent bearish trend. The dollar index reversed gains from Monday, providing a solid foundation for precious metals to rally. Spot gold is up 2.01% at 1717.63 and spot silver is registering 3.56% gains on the day.

- Oil retreated further from recent multi-year highs, posting a second consecutive day of losses, as of writing. Further bullish exhaustion may have led to the temporary path of least resistance being lower. WTI futures lost 1.5% to trade back to $64, with Brent giving back 0.9%, currently trading $67.60.

- Some notable moves in base metals as optimism in the equity space was not echoed in copper and iron ore. Copper futures traded back below 400, dropping 2%. Iron ore futures fell around 6% after breaking some important lows from mid-February at 1090.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.