-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Not Enough PEPP To Keep Tsys Bid

US TYS SUMMARY: $25B Verizon Mega-Deal Outstrips 30Y Bond Auction

Tsys trade mixed after the bell, yield curves steeper (5s30s cracked 150.0) with the long end weaker all session.- Tsy futures traded lower post-wkly claims (712k vs. 725k est), had already trimmed knock-on gains tied to rally in EGBs post ECB annc: left rate, refi and marginal lending steady while Bunds surged on faster purchase pace of PEPP. Decent two-way in TYM after better buyers. Large 2s5s steepener Block: +12,619 TUM, 110-23.38, post-time offer at 0927:23ET vs. -10,275 FVM 124-00.25 through the 124-00.5 bid.

- Sideways rate trade (as equities powered higher, ESH1 +45.0 late) as markets prepared to absorb $24B 30Y bond auction re-open. Massive $25B Verizon mega-deal: 9-tranche issue had many guessing after first caught wind of it late Wed. Size not know (rumored only) until after the bond auction that drew 2.295% high yield (1.933% last month) vs. 2.290% WI; w/ 2.28 bid/cover.

- Huge $25B 9pt issue at the low end of the estimate, appears some prop/fast$ accounts had anticipated larger issuance and had sold along with hedges -- contributed to the bounce in Tsys after the 30Y Bond R/O auction tailed slightly.

- Speaking of supply: US Treasury responding to the passage of the $1.9T Covid relief package by increasing next weeks 13W and 26W bill auctions by $3B each, the 42D CMB by $5B.

- The 2-Yr yield is down 1.4bps at 0.1389%, 5-Yr is down 1.6bps at 0.773%, 10-Yr is up 0.7bps at 1.5248%, and 30-Yr is up 3.5bps at 2.273%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00088 at 0.07813% (+0.00050/wk)

- 1 Month +0.00012 to 0.10600% (+0.00275/wk)

- 3 Month -0.00025 to 0.18388% (-0.00150/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00088 to 0.19275% (-0.00313/wk)

- 1 Year -0.00138 to 0.27725% (-0.00050/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $228B

- Secured Overnight Financing Rate (SOFR): 0.02%, $914B

- Broad General Collateral Rate (BGCR): 0.01%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $344B

- (rate, volume levels reflect prior session)

- Fri 3/12 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 3/15 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 3/16 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 3/17 No buy operation due to FOMC

- Thu 3/18 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

OVERNIGHT REPO: Repo Specials Continue, Some Improvement in 10s

Continued overnight repo at special across the curve -- some improvement in 10s. Current levels: T-Bills: 1M 0.0228%, 3M 0.0304%, 6M 0.0456%; Tsy General O/N Coll. 0.03%

| Duration | Current | Old Issue |

| 2Y | 0.02% | 0.02% |

| 3Y | -0.17% | 0.03% |

| 5Y | -0.13% | -0.07% |

| 7Y | -0.10% | 0.02% |

| 10Y | -1.72% | -0.09% |

| 30Y | -0.13% | -0.01% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 11,000 Gold Sep 97 puts, 9.0

- 4,100 Green Jun 99.68 calls

- 10,500 Red Jun 95 puts vs. Red Dec 88/93 put spds

- +20,000 Green Mar 93 puts, 0.5

- +/-5,000 Green Mar 97 puts, 6.5 vs. 98.795/0.42%

- +8,000 Green Jun 88/91/93 put flys vs. 4,000 Green Jun 99.56 calls, 7.5

- +5,000 Blue Dec 80/85 2x1 put spds, 1.0 looking for more offere

- Update, over -60,000 short Sep 95/97 put spds, 6.0 vs. 99.705-.70 w/ recent addition of 19,299 Block post, likely roll-down in strike

- +3,500 short Dec 93 puts, 7-7.5

- Overnight trade

- 3,000 short Aug 99.31 puts vs. short Sep 99.37/99.62 put spds

- 3,000 Green Jun 99.31/99.43/99.56 call flys

- 4,500 Green Apr 95 calls, 2.5

- 1,500 Blue May 86/87/88 call trees

- 2,000 Blue Apr 82/83/86 put flys

- 2,250 Blue Apr 82/83/85 put flys

- Blocks, 28,000 Blue May 82 puts, 4.0 vs. 98.74/0.16%

- Block, 3,500 Blue Jun 80/82 3x2 put spds, 3.0 2-legs over

- Block, 10,000 Blue Apr 82 puts, 2.5

- -5,200 TYM 135 calls, 16

- -3,000 TYJ 132.75/133.5 call spds, 22

- Overnight trade

- +5,200 FVK 124 puts, 24

- 5,800 TYJ 133.5 calls, from 10-15, 15 last

- 5,100 TYK 134 calls, from 20-22, 20 last

- 8,600 TYK 131.5 puts, wide range from 24-36, 25 last

- 4,800 TYM 129 puts, 15

- 2,900 TYM 128 puts, 10

- 6,500 FVK 123 puts, from 13.5-17

- 5,200 FVK 123.75 puts, 20

BONDS/EGBs-GILTS CASH CLOSE: BTPs Soar As ECB Set To Pick Up The Pace

The ECB announced Thursday that it would significantly increase the pace of purchases under its PEPP programme from tomorrow. EGBs rallied, but the final impact was mixed.

- 10-Yr Bund yields dropped 4.4bps following the decision statement, but the fall was pared to just 1.8bps by the end of Lagarde's press conference. Conversely, BTP spreads led the periphery rally, falling sharply and continuing to compress over the rest of the session.

- Reuters sources story post-ECB said the PEPP monthly buying target "well above" E60bn, but <E100bn (implying between E15-25bn of weekly buys): ECB's been buying avg ~E14bn a week so far in 2021.

- Earlier in the session, Italy and Ireland sold E1.5bn and E8bn in bonds, respectively.

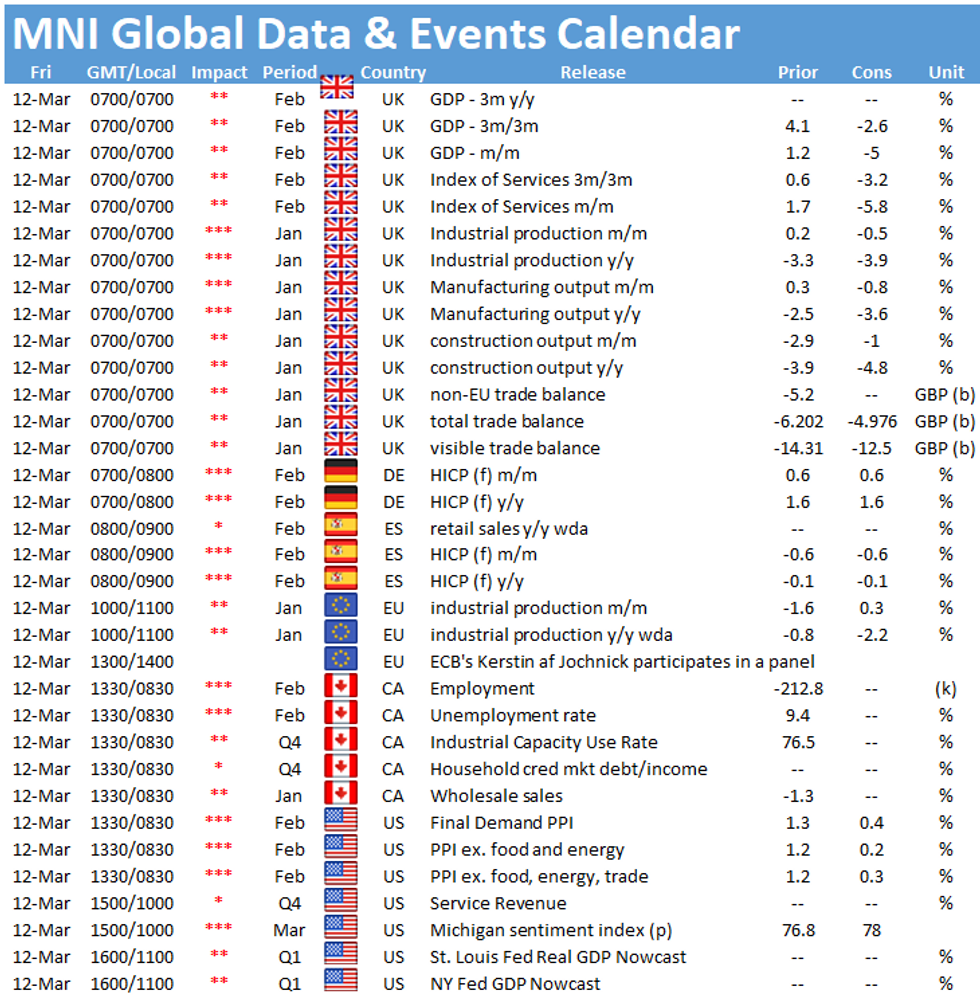

- Gilt yields ended the day higher. Attention first thing Friday will be on UK GDP figures.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.9bps at -0.691%, 5-Yr is down 1.6bps at -0.632%, 10-Yr is down 2.1bps at -0.334%, and 30-Yr is down 0.3bps at 0.181%.

- UK: The 2-Yr yield is up 1.4bps at 0.08%, 5-Yr is up 0.8bps at 0.327%, 10-Yr is up 2.1bps at 0.735%, and 30-Yr is up 3.1bps at 1.26%.

- Italian BTP spread down 5.3bps at 93.5bps / Spanish spread down 3.5bps at 63bps

OPTIONS/EUROPE SUMMARY: Schatz Upside, Sterling Vol Selling

Thursday's options flow included:

- DUJ1 112.10/112.20/112.30c fly, bought for 2 in 1.25k

- DUK1 112.10/112.20/112.30c fly, bought for 2 in 4k

- DUK1 112.20/112.30cs,1x2 bought for half in 5k

- DUM1 112.10/112.20/112.30c fly, bought for 1.75 in 5k

- DUM1 112.20/30cs, bought for 2 in 10k

- ERM1 100.37/50/62/75c condor, sold at 11 in 2.8k

- ERM1 /ORM1 100.62/100.75cs strip, bought for 1 in 3k

- ERM1 100.50/100.625 combo, sells the put at 1 in 8k

- 2LZ1 99.37^, sold at 40.5 in 3.5k

- 3LZ1 99.125^ sold at 51 in 5k

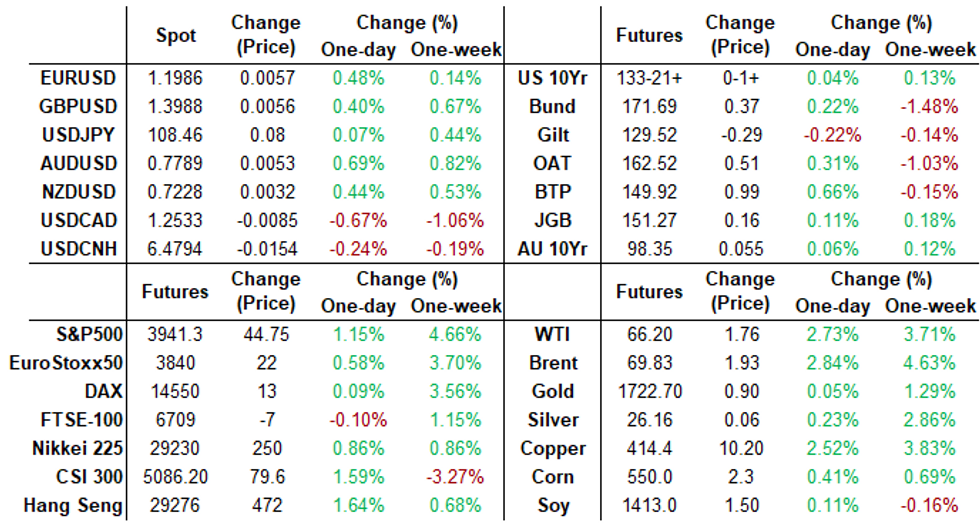

FOREX: Dollar Sold as Equity Hotstreak Continues

- The USD suffered Thursday, firstly in response to the ECB rate decision, in which the ECB made clear that an accelerated pace of PEPP purchases did not mean more stimulus was forthcoming. The greenback came under further pressure after the London close, however, following the 30y auction, in which a small yield tail at auction resulted in 10y yields dropping 3bps, pulling the rug out from under the USD index.

- Equities traded firmly throughout, with US indices narrowing the gap with all time highs. The e-mini S&P traded 10 points shy of the record highs posted in February, a move that coincided with EUR/JPY making a test on 2021's best levels - which mark a three year high for the cross.

- The upcoming Bank of Japan meeting (next week) is still a focus, with source reports this morning further suggesting the board could tweak their yield curve control approach as part of their policy review. JPY was one of the sole currencies to underperform the USD Thursday.

- Focus Friday turns to UK industrial and manufacturing production data, the Canadian jobs report for February and US PPI. There are no central bank speakers of note.

FX OPTIONS: Expiries for Mar12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E574mln), $1.1925-30(E1.1bln), $1.1995-1.2000(E2.4bln), $1.2100-10(E1.2bln)

- USD/JPY: Y108.30-35($2.2bln)

- AUD/USD: $0.7720-25(A$1.1bln-AUD puts), $0.7745-60(A$1.1bln)

- AUD/NZD: N$1.0730(A$1.3bln-AUD puts)

- USD/MXN: Mxn20.30($1.1bln)

PIPELINE: $25B Verizon Mega-Deal Launched

Huge $25B 9pt issue at the low end of the estimate, appears some prop/fast$ accounts had anticipated larger issuance and had sold along with hedges -- contributed to the bounce in Tsys after the 30Y Bond R/O auction tailed slightly. Verizon holds record of largest debt launch ever at $49B total in August 2013.

- Date $MM Issuer (Priced *, Launch #)

- 03/11 $1.75B #Verizon 3Y +45, $750M 3Y FRN SOFR+50

- 03/11 $2.75B #Verizon 5Y 70, $750M FRN SOFR+79

- 03/11 $3B #Verizon 7Y +90

- 03/11 $4.25B #Verizon 10Y +107

- 03/11 $3.75B #Verizon 20Y +120

- 03/11 $4.5B #Verizon 30Y +130

- 03/11 $3.5B #Verizon 40Y +145

EQUITIES: Stocks Cut Gap With All Time Highs, Tech Leads

- Stocks traded solidly into the Thursday close, with the e-mini S&P trimming the gap with alltime highs to just 10 points after the London close. The underlying bullish theme was reinforced by consumer discretionary, tech and cyclical stocks outperforming relative to defensive utilities and consumer staples.

- The tech-led NASDAQ outperformed smartly, with futures extending the recovery from the March lows printed mid-last week to over 7%.

- Across Europe, indices traded in minor positive territory across the board, with core French and peripheral Spanish, Italian indices outperforming. UK's FTSE-100 was again the laggard, closing higher by just 0.2%.

COMMODITIES: Crude Futures Extend Session Gains, Strikes Aid Copper Recovery

- Both WTI and Brent crude futures have increased their gains to ~2.5% on the day, having fully retraced Tuesday and Wednesday's sell-off. Yesterday's DoE inventories data continued to underpin the supportive price action.

- Precious metals were unable to extend on gains made in the first half of the European session. Despite the weaker US dollar, momentum waned and both spot gold and silver suffered as a result, posting small losses on the session of 0.16% and 0.5% respectively.

- Copper maintained a bullish tone. Continuing wage talks following strikes at Antofagasta's top Chile mine have kept copper futures buoyant, rising just under 3% on the day, close to the best levels of the week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.