-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Conviction Scarce Ahead Wed's FOMC

US TYS SUMMARY: Pre-FOMC Consolidation, Strong 20Y Auction R/O

Choppy session in rates, day one of two day FOMC vigil. Post-Retail Sales Sell-Off: strong net revisions saw the early bid in Tsys evaporate, better selling from prop, fast$ and program accts in 10s-30s on decent volumes.- No real trigger, but after SPUs marked new all-time high (ESM1 3970.75) around midmorning, waves of midday consolidation took the hot air out of stocks.

- Focus turned to the 20Y Bond auction w/Tsys trading heavy (10YY1.6144%, 30YY 2.3879). 20Y Swap spd narrowed, cash 20s hammered, specs/prop desks set up for another debacle on par w/7Y auction.

- Option desks back to better buying of puts all morning but volumes not exceptionally large, no significant adds or openers ahead Wed's FOMC. FOMO: Go-along steepener interest, curves near Feb 25 multi-yr highs again (5s30s 158.3).

- Rates Gapped higher after strong 20Y stopped 2.5bp through $24B 20Y: 2.290% (1.920% last month) vs. 2.315% WI, bid/cover 2.51 vs. 2.15%.

- See-saw action continued through the close: post auction bid gave way to renewed consolidation in stocks, wash/rinse/repeat after the bell.

- The 2-Yr yield is down 0.6bps at 0.145%, 5-Yr is down 1bps at 0.8176%, 10-Yr is up 0.4bps at 1.6092%, and 30-Yr is up 1.7bps at 2.3746%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00050 at 0.07850% (+0.00037/wk)

- 1 Month +0.00063 to 0.10813% (+0.00200/wk)

- 3 Month +0.00800 to 0.19000% (+0.00050/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00038 to 0.19788% (+0.00388/wk)

- 1 Year -0.00025 to 0.28075% (+0.00262/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.01%, $898B

- Broad General Collateral Rate (BGCR): 0.01%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $344B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $5.999B accepted vs. $15,633B submission

- Next scheduled purchases

- Wed 3/17 No buy operation due to FOMC

- Thu 3/18 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

US TSYS/OVERNIGHT REPO: Still Hot, Little Net Change From Monday

Overnight repo remains at special across the curve. Current levels:

T-Bills: 1M 0.0101%, 3M 0.0152%, 6M 0.0456%; Tsy General O/N Coll. 0.02%

| Duration | Current | Old Issue |

| 2Y | -0.01% | 0.00% |

| 3Y | 0.01% | -0.30% |

| 5Y | -0.23% | -0.08% |

| 7Y | -0.15% | 0.00% |

| 10Y | -0.16% | -0.12% |

| 30Y | -0.01% | -0.07% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +1,500 Red Mar'23 -through Green Dec'23 55 put strips, mostly 12.0

- 2,300 Jun 99.81/99.87/99.93 call flys

- Block, 10,000 Green Jun 88/91 put spds, 3.0

- +10,000 Jul 96 puts, 5.0 vs. 99.99.675/0.40%

- Block, -12,000 Blue Apr 83/86 put spds, 7.5 vs. 98.63/0.25%

- +2,500 Green Apr 91/92 put spds 1.5 over 95 calls

- -2,000 Sep 96 puts, 13.5

- Overnight trade

- Block, +6,400 short Sep 96 puts, 7.0 vs. 99.675/0.40%

- +3,500 TYM 131/133.5 put over risk reversals, 15-16

- 2,000 USJ 155/157 put spds, 50

- 1,300 TYJ 130.75/133.25 put over risk reversal vs. TYM 129.5/134.5 put over reversal, 9.0 net, Jun over

- over 3,000 TYJ 133/133.5/134 call trees 4-4.5

- Overnight trade

- Block, +20,000 FVJ 123.5/124.25 strangles, 20

- 3,000 FVJ 123 puts, 5

- 2,300 USJ 157 calls, wide range, mostly 46-48, 43 last

EGBs-GILTS CASH CLOSE: Greek 30-Yr Mandate Hits GGBs

The UK and German curves saw fairly limited changes Tuesday, with periphery spreads wider on the session.

- Gilts and Bunds toward the close, following a slow grind lower over the morning and early afternoon.

- Greek bonds underperformed (10-Yr +4.4bps to Bunds) after the country issued a mandate for a 30-Yr bond syndication, while France sold E7bn of 2044 Green OAT. UK sold GBP5.0bn of nominal +linker Gilts, Germany allotted EUR3.9bn of Schatz, and Finland sold E1bn of RFGB.

- Otherwise, most of the day's headlines were devoted to the suspension of AstraZeneca vaccine administration across Europe over safety concerns, and the associated political and economic fallout. The EMA said today it would provide guidance on the vaccine on Thursday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.69%, 5-Yr is down 0.1bps at -0.647%, 10-Yr is down 0.2bps at -0.336%, and 30-Yr is unchanged at 0.201%.

- UK: The 2-Yr yield is down 0.4bps at 0.093%, 5-Yr is down 0.8bps at 0.367%, 10-Yr is down 1.3bps at 0.785%, and 30-Yr is down 1bps at 1.319%.

- Italian BTP spread up 2.9bps at 96.2bps /Spanish spread up 1.7bps at 65bps

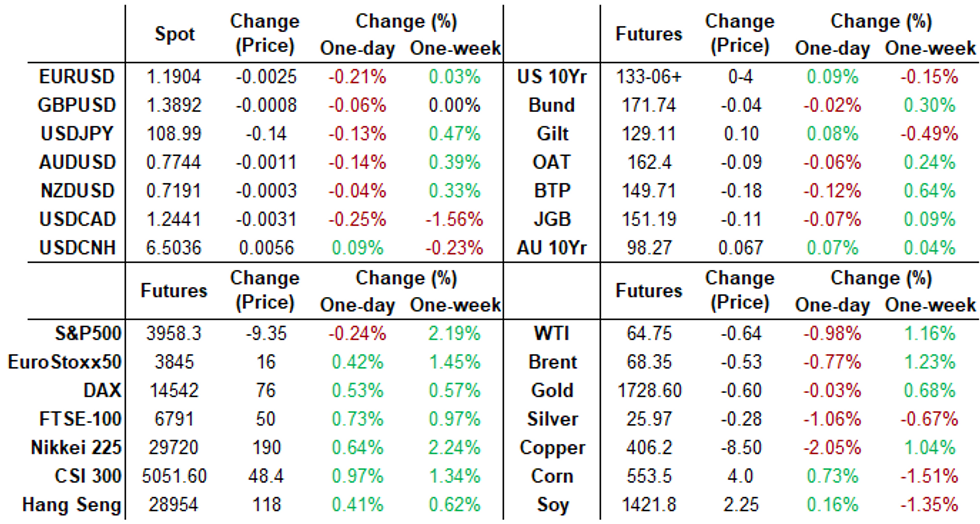

FOREX: USD Index in Holding Pattern Ahead of the Fed

- Following the London close, a particularly strong pre-Fed US 20y bond auction worked against the USD, helping buoy EUR/USD off the day's lowest levels.

- CAD was among the session's best performers, keeping USD/CAD's recent lows under pressure. A break below Monday's 1.2441 extends the current downtrend and would target 1.2278, the downtrendline drawn off the May 2015 low.

- The single currency was among the session's poorest performers, falling against all others in G10. EUR/CHF's pullback from the 2021 highs accelerated, with prices now looking to correct back below 1.10.

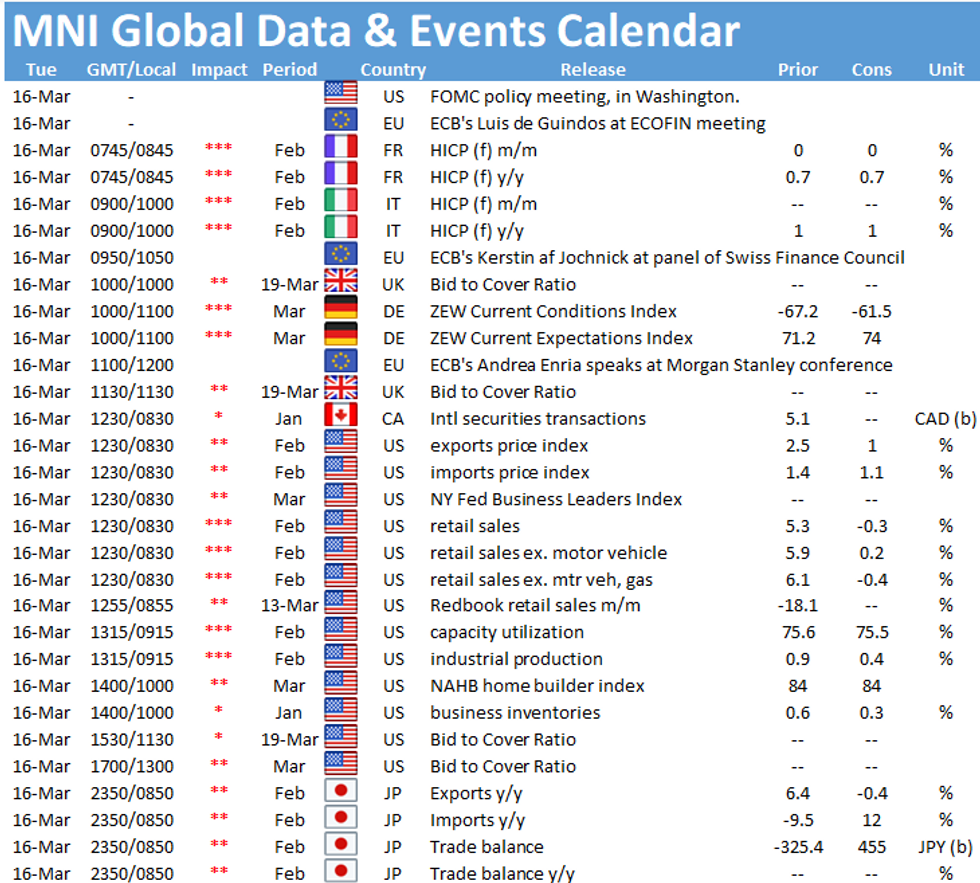

- Focus Wednesday shifts to the FOMC rate decision, in which the Fed will be eyed for any comment on the recent volatility in US government bond yields, which had unsettled markets in recent weeks. Elsewhere, Canadian CPI for February and US housing starts/building permits cross. The Brazilian central bank rate decision crosses after the US close.

FX OPTIONS: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E1.4bln-EUR puts), $1.2000(E1.2bln), $1.2040-55(E1.6bln)

- USD/JPY: Y108.30($630mln), Y108.50-55($1.2bln)

- GBP/USD: $1.3885-90(Gbp614mln)

- EUR/GBP: Gbp0.8600(E1.2bln), Gbp0.8750(E621mln)

- AUD/USD: $0.7745-50(A$539mln)

- USD/CAD: C$1.2685($793mln)

PIPELINE: $13.75B To Price Tuesday

Still waiting for T-Mobile

- Date $MM Issuer (Priced *, Launch #)

- 03/16 $4B #Schwab $1.5B 3Y +43, $1.25B 3Y FRN SOFR+50, $1.25B 7Y +75

- 03/16 $3B T-Mobile 5NC2, 8NC3, 10NC5

- 03/16 $2.5B *African Development Bank (AFDB) 5Y +5

- 03/16 $1B #Illumina $500M 2Y +40, $500M 10Y +95

- 03/16 $800M #Deutsche Bank 5Y +87

- 03/16 $750M #Welltower Inc +10Y +1223

- 03/16 $600M *Petronas WNG 7Y +85

- 03/16 $600M #WEC Energy 3Y +48

- 03/16 $500M #Standard Chartered WNG 4NC3 +88

EQUITIES: Stocks Consolidating Pre-Fed

- Across the continent, stock markets finished higher, with UK's FTSE-100 outperforming to close higher by 0.8%. The US was more mixed. The Dow Jones Industrial Average consolidated recent gains to trade slightly underwater, while the tech stock recovery helped buoy the NASDAQ-100 to the best levels since March 2nd.

- The VIX worked to further close the pandemic gap higher posted in March, slipping to the lowest levels in just over a year ahead of the Wednesday Fed decision. The VIX has traded lower for 8 consecutive sessions.

- In the US, tech and communication services firms outperformed, with energy and financials lagging, as a pullback in oil prices undermined oil & gas extractors and exploration firms.

COMMODITIES: Oil Recovers In Subdued Session, Futures Moderately Lower

- Oil markets are modestly lower ahead of the close, with WTI and Brent crude futures off by around 1%. The extension of Monday's weakness in the oil complex has opened a gap of just under $4/bbl with the cycle highs posted on March 8th. Despite struggling equity indices price action in crude futures during the US session has been subdued but supportive as markets await the FOMC meeting/statement tomorrow.

- Spot gold popped above last week's high at $1,740 but immediately retraced and remains in a fairly contained range, trading almost exactly flat on the session in line with US dollar indices. This keeps the technical outlook for gold unchanged, with market focus still on last week's bullish engulfing candle that continues to prop up prices. Slightly more pessimistic price action in Silver, slipping 1.5% on the day.

- Copper bulls' patience continues to be tested with a 4% fall from the spike high on the week's open. Copper futures (HGA) have sold off by ~2.5%, despite continued wage talks in Chile 'posing a real possibility of strikes', according to analysts at BTG Pactual.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.