- Home

- Policy

- G10 Markets

- Emerging Markets

- Commodities

- Data

- MNI Research

- About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

- PolicyPolicy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: - G10 MarketsG10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts - Emerging MarketsEmerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

- CommoditiesCommodities

Real-time insight of oil & gas markets

- Data

- MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

- About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Surge

US TSY SUMMARY: Tsy Ylds Jump in Lead-Up To FOMC

Treasury futures under pressure all day saw bonds extend session lows through the second half, while recovering slightly after some chunky Block buys in 5s and 10s.

Mixed data, housing robust as consumer confidence climbs to 121.7 from 109.0 prior while Richmond Fed factory index held steady to prior moth at 17.0 -- well off 22.0 estimate. Focus on Wed's FOMC rate annc.

- Bonds lead midday sell-off, trading desks cited auction set-ups ahead the $62B 7Y auction, rollers in 2s and 5s, fast$ selling 7s. Otherwise rather quiet on the headline front (lull ahead Wed's FOMC, heavy earning slate next week and NFP next week Fri (current median est +900k), though EXXON and JPM planning on re-staffing offices in May and July respectively provides some positive news.

- Decent $62B 7Y Tsy-note auction (1.306% high yld vs. 1.305% WI). 30YY currently 1.2743% highs -- back near last week Wednesday's highs. Trade volumes rather sedate, however, participants migrating to sidelines ahead Wed's FOMC policy annc.

- Desks posited large 11k FVM1 Block buy at 123-26.5 (through the 123-26.25 offer at time) may have been first half of legged of steepener as 30Y bonds continue to grind lower. 30YY currently 2.2942% -- puts it back to middle of last week Tue's level; 5YY 0.8829 high puts it back to April 13 mid-session.

- The 2-Yr yield is up 1.2bps at 0.1798%, 5-Yr is up 5.2bps at 0.8813%, 10-Yr is up 5.7bps at 1.6234%, and 30-Yr is up 5.3bps at 2.2927%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.07400% (+0.00062/wk)

- 1 Month -0.00075 to 0.11025% (-0.00075/wk)

- 3 Month -0.00687 to 0.17713% (-0.00425/wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month +0.01237 to 0.21425% (+0.01012/wk)

- 1 Year +0.00063 to 0.28263% (+0.00175/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $276B

- Secured Overnight Financing Rate (SOFR): 0.01%, $875B

- Broad General Collateral Rate (BGCR): 0.01%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- No buy operations Tuesday and Wednesday, Pause for FOMC

- Next scheduled purchases:

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

MONTH-END EXTENSION ESTS: Preliminary Barclays/Bbg Extension Estimates for US

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.08 | 0.13 |

| Agencies | 0.06 | 0.04 | 0.03 |

| Credit | 0.07 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.15 |

| High Yield | 0.09 | 0.11 | 0.08 |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +20,000 short Dec 97 calls, 2.0 vs. 99.555/0.17%

- 2,000 short Oct 97/98 1x2 call spds, 0.0

- +10,000 Blue Sep 95 calls, 1.0

- +5,000 Blue Jun 83/88 put over risk reversals, 1.0

- -1,000 long Green Jun'23 93/96 1x3 call spds, 1.0

- +4,000 Green May 91 puts, 1.0 vs. 98.315/0.08%

- +30,000 (appr 10k screen) short Sep 99.68/99.75 call spds, 3.0

- +20,000 Blue Sep 80/90 put over risk reversals 1.5 vs. 98.545/0.40% -- ongoing position build >60K

- 4,000 short Dec 97 calls, 2.0

- +2,500 Gold Dec 72/75 put spds, 5.5

- Overnight trade

- 3,500 Green Jun 91/92/93 call flys, 2.5

- 2,750 Green Sep 91/92 call spds vs. 82/87 put spds, 1.5 net

- 2,000 Green Dec 88/90/92/93 call condors, 3.5

- +4,600 USM 160 calls, 45

- -1,700 TYM 130.75/133.25 strangles, 23

- +1,000 TYM 133/133.5 2x3 call spds, 6

- 1,800 TYN 131.5 straddles, 158

- +6,100 FVN 123 puts, 24.5

- Overnight trade

- +2,000 wk2 FV 122.75/123/123.25/123.5 put condors, 2.5

EGBs-GILTS CASH CLOSE: BTPs Widen On Issuance

Gilts underperformed with a parallel shift in the curve Tuesday, while Bunds were basically unchanged. Periphery spreads drifted wider.

- BTPs led the periphery widening (and the session's price action), amid today's auctions of short-term/linkers and dual-tranche USD issuance syndication, and ahead of auctions tomorrow of up to E7.25bln of BTPs / E1.25bln of CCTeu.

- 10-Yr BTP yields fell just short of 2021 peak of 0.842% (day's high was 0.832%).

- UK sold E6bn of 30-Yr Gilt via syndication. EIB announced a mandate for a E100mn digital bond based on the Ethereum blockchain.

- Otherwise most attention is on the US Fed decision Wednesday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.688%, 5-Yr is up 0.1bps at -0.599%, 10-Yr is up 0.4bps at -0.249%, and 30-Yr is up 0.4bps at 0.292%.

- UK: The 2-Yr yield is up 1.4bps at 0.065%, 5-Yr is up 1.7bps at 0.344%, 10-Yr is up 1.8bps at 0.774%, and 30-Yr is up 1.8bps at 1.301%.

- Italian BTP spread up 1.8bps at 107bps / Spanish spread up 1.1bps at 66.5bps

OPTIONS/EUROPE SUMMARY: Blue Euribor Downside Theme Continues

Tuesday's options flow included:

- RXM1 171.50 call bought for 42 in 1k

- RXM1 171/170 1x2 put spread sold at -1 in 1k

- RXN1 170/169.50/169/168.50p condor, bought for 3.5 in 2.5k

- 2RZ1 100.00/100.50 combo bought for 0.25 in 29.5 (+put) (v 100.35, 40d)

- 3RM1 100.125p sold at 2.5 in 5k (v 100.235)

- 3RQ1 100.12/100/99.87p ladder, bought for flat in 3k

- 3RU1 100/99.75/99.50p fly 1x2x1.5, bought for 2.5 in 10.5k total so far.

- 3RU1 100/99.87/99.75p fly, bought for 1 in 1k

- 3RV1 99.87/99.62ps vs 100.25/100.37cs, bough the ps for -1 in 2.5k .... 3RH2 99.50/99.25ps vs 100.25/100.37cs, bought the ps for -1.5 in 2.5k. Receives 2.5 in 2.5k for the package

- 3LQ1 98.875/98.50 ps vs 99.25/99.375 cs, bought the ps for 0.25 in 2.5k

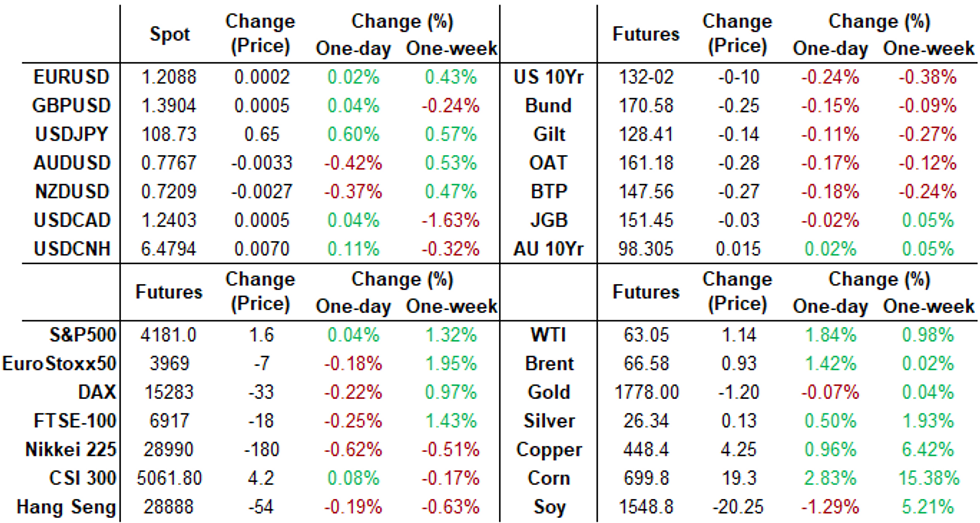

FOREX: USD/JPY Bounces Further Off Friday Low

- Despite flatlining equity markets, JPY edged back into a negative territory Tuesday, with USD/JPY picking up some upside momentum after the London close. This extends the bounce from Friday's lows to well over 100 pips, with the pair nearing in on the 38.2% retracement of the April downtick. JPY was comfortably the poorest performer in G10.

- The greenback held its ground after stabilising on Monday. The USD Index now trades either side of the 100-dma at 91.05 and will need to build a base above here to stage any broader recovery.

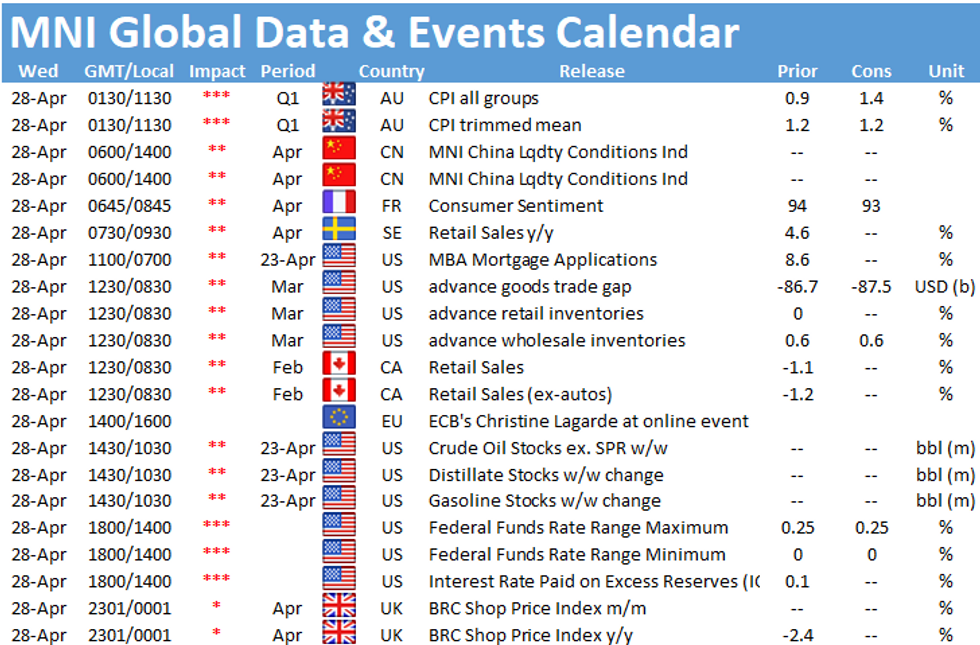

- Focus Wednesday rests on the FOMC. Their April decision is not seen as a major factor for markets at this juncture, with the board expected to stay the course on policy and steer clear of any discussion over the tapering of asset purchases.

- Data due Wednesday includes Australian CPI for Q1, Canadian retail sales and US trade balance data for March. Central bank speakers include ECB's Lagarde, Rehn and Schnabel as well as Fed Chair Powell's post-decision presser.

FX OPTIONS: Expiries for Apr28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E2.0bln), $1.1980-85(E1.8bln-EUR puts), $1.2000(E2.6bln, E2.35bln of EUR puts), $1.2030-41(E1.1bln), $1.2080(E772mln), $1.2100-05(E1.4bln), $1.2130-50(E2.0bln)

- USD/JPY: Y108.10-15($1.0bln-USD puts)

- EUR/GBP: Gbp0.8550-55(E500mln)

- AUD/USD: $0.7700(A$516mln), $0.7730-35(A$567mln), $0.7800-05(A$520mln)

- USD/CAD: C$1.2600($1.1bln-USD puts)

- USD/CNY: Cny6.60($683mln)

PIPELINE: $3.5B Italy 2Pt Priced

- Date $MM Issuer (Priced *, Launch #)

- 04/27 $5.5B #Citigroup $2B 4NC3 +63, $500M 4NC3 FRN SOFR, $3B 11NC10 +95 (adds to $2.5B issued mid-Jan; compares to $3.5B 6NC5 +275 issued early April 2020)

- 04/27 $3.5B *Italy $2B 3Y +50, $1.5B 30Y +195; $2B 3Y: re-offer price of 99.673%, equivalent to a 0.986% gross annual yld in US$; $1.5B 30Y: re-offer price of 98.897%, equivalent to a 3.938% gross annual yld in US$

- 04/27 $Benchmark Hyundai Motor Indonesia 5Y +135a

- 04/27 $Benchmark Development Bank of Kazakhstan 10Y investor calls

EQUITIES: Markets Lack Direction Ahead of the Fed

- Headline indices traded broadly flat Tuesday, with the S&P 500 trading 0.1% either side of the Monday close for the bulk of the day. This came despite the strength in the e-mini S&P ahead of the European open, which saw new record highs ushered in at 4192.50.

- Healthcare and utilities firms lagged, countered by strength in both the industrials and energy sectors across the S&P 500.

- Earnings remain a focus, with poor traded in both Tesla and 3M undermining recent upbeat reports. At the other end of the table, UPS and FedEx traded particularly well after the former firm comfortably beat expectations for Q1.

- After-market reports Tuesday include Alphabet, Microsoft, Starbucks and Visa.

COMMODITIES: Oil Benchmarks Consolidate Gains, Copper Marches On

- OPEC+ provided no surprises, sticking to the timeline for a phased easing of oil production restrictions from May to July. Forecasts for a more optimistic demand outlook kept crude benchmarks in positive territory. WTI crude futures consolidated gains back above $62, rising 0.87% on the session.

- Nonetheless, a resurgence of COVID in India remains a cause for concern and has clouded the outlook for energy demand. An OPEC+ statement also confirmed the June 1 date for the next meeting as expected.

- Subdued markets left precious metals close to yesterday's closing levels as we approach the FOMC decision on Wednesday. Spot gold lost 0.2% to trade at $1,777.40, in line with a marginally stronger dollar.

- Copper futures maintain a firmer tone and the active futures contract has traded higher again today (+1.08%) to a fresh trend high print of $452.50. This week's break of the Feb 25 high, 437.00, confirmed the resumption of the underlying uptrend. Supply anxieties relating to Chilean mining union protests continue to buoy the red metal.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.