-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Liftoff Framework Gets Clearer

US TSY SUMMARY: Hawks Sharpen Liftoff Framework

Tsys drift not far above the narrow range that held through muted overnight trade, mixed levels after the bell with the long end outperforming on decent overnight volumes (TYU1>1.6M).- Sharply weaker than expected July ADP private employ data (+330K vs. +683K est) helped kick off a rally that held into midmorning.

- Market support evaporated quickly on one-two punch of data and Fed speak: surge in July ISM Services PMI to record high of 64.1 followed by comments from Fed VC Clarida virtual event where he sees see upside risk to his inflation projection, says "2023 rate liftoff consistent with framework."

- Additional comments from Fed Vice Chair Clarida on taper / hike timing:

- If my baseline materializes, could see myself supporting announcement of a taper later this year.

- Decisions to taper and to hike rates are completely separate. Not thinking about hiking rates. Rate hikes not on my (and I don't think Committee's) radar screen.

- Tsys sold off/extended session lows over the next hour (incidentally, so did German Bunds, equities and WTI crude). Discounting the data and mon-pol comments, rates drew short cover support back to mildly mixed range through the NY close, focus on Friday's July NFP (+870k est vs. +850k in June).

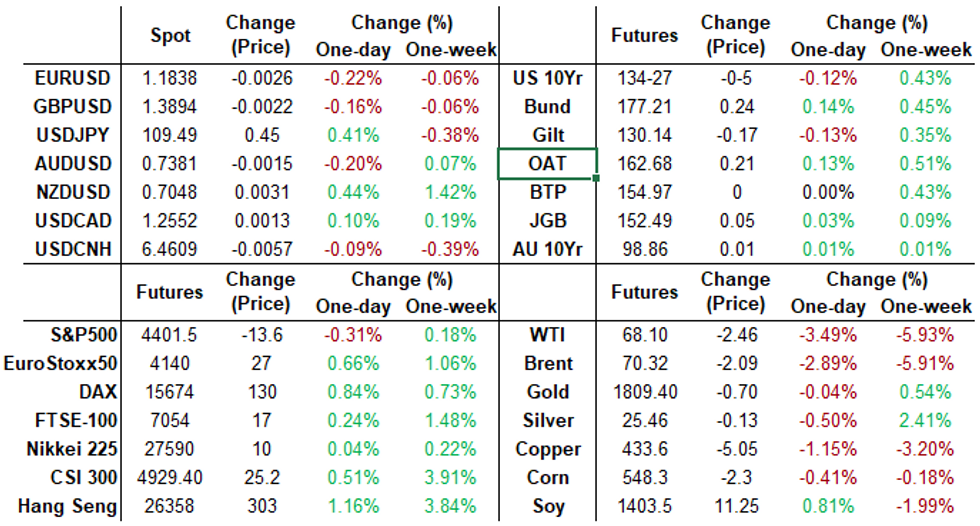

- The 2-Yr yield is up 1.2bps at 0.1822%, 5-Yr is up 2.9bps at 0.6761%, 10-Yr is up 1.3bps at 1.1854%, and 30-Yr is up 0.1bps at 1.842%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00012 at 0.08150% (+0.00462/wk)

- 1 Month -0.00113 to 0.08925% (-0.00125/wk)

- 3 Month +0.00037 to 0.12175% (+0.00400/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00013 to 0.15500% (+0.00188/wk)

- 1 Year -0.00225 to 0.22988% (-0.00525/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08% volume: $245B

- Secured Overnight Financing Rate (SOFR): 0.05%, $974B

- Broad General Collateral Rate (BGCR): 0.05%, $382B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $8.120B submission

- Next scheduled purchases

- Thu 8/05 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $931.755B from 69 counterparties vs. $909.442B on Tuesday. Compares to last Friday's new record high of $1.039.394B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +36,000 Blue Sep 98.25/98.50/98.75 put flys vs. -12,000 Blue Sep 99.00/99.12 call spd, 8.0 net db on the 3x1 downside skew package

- +10,000 Green Sep 99.25/99.37 call spds 1.5 over 99.0/99.12 put spds

- +11,000 Jun 99.81/99.87 put spds, 3.0 vs. 99.815

- over 7,000 short Sep 99.50/99.62/99.75 put flys, 1.5

- +4,000 Green Dec 98.75/98.87 put spds 1.5cr over Green Dec 99.50 calls

- +2,500 Green Sep 99.00/99.12/99.25 put flys, 1.75 legs

- +30,000 Green Sep 99.50/99.62/99.75 call flys, 1.0

- +10,000 Green Oct 99.37 calls, 5.5

- -2,500 Green Dec 99.37/99.50 put spds, 3.0

- +5,000 Green Sep 99.25/99.37 1x2 call spds, 0.75 (+10k at 1.0 Tue)

- +4,000 short Sep 99.56/99.68/99.75 put flys, 0.5

- 10,000 TYU 133.5/134.5 put spds

- +10,000 FVU 123.5/124 put spds, 5 vs. 124-18.25/0.13%

- -4,000 TYU 132 puts, 7

- +5,000 TYU 137.25 calls, 5

- +1,000 TYZ 131/132/133/134 put condors, 11

- +1,000 TYU 132/133 put spds, 4

- +14,000 TYU 134 puts, 18

- 6,500 TYV 132 puts, 14

- 7,300 TYU 133.25 puts, 7

EGBs-GILTS CASH CLOSE: USTs Drag Bunds And Gilts Off Highs

Early gains in the European space reversed sharply in the afternoon on US factors: US ISM Services hit a record high in July, and Fed's Clarida said he saw conditions in place for a 2023 Fed hike.

- Early in the session, European FI rallied as ECB's Kazaks said a decision on PEPP's future in September would be "premature". Later in the session, MNI published a sources story noting that a decision is not expected until later in the autumn at the earliest.

- This led German 10Y yields to lowest levels since early Feb (through -0.50%), but this reversed on the US headlines. Bunds ended up outperforming though, with yields edging lower into the close.

- Spanish and Italian Services PMIs both disappointed. Eurozone final PMI was revised lower from flash but UK's was revised higher.

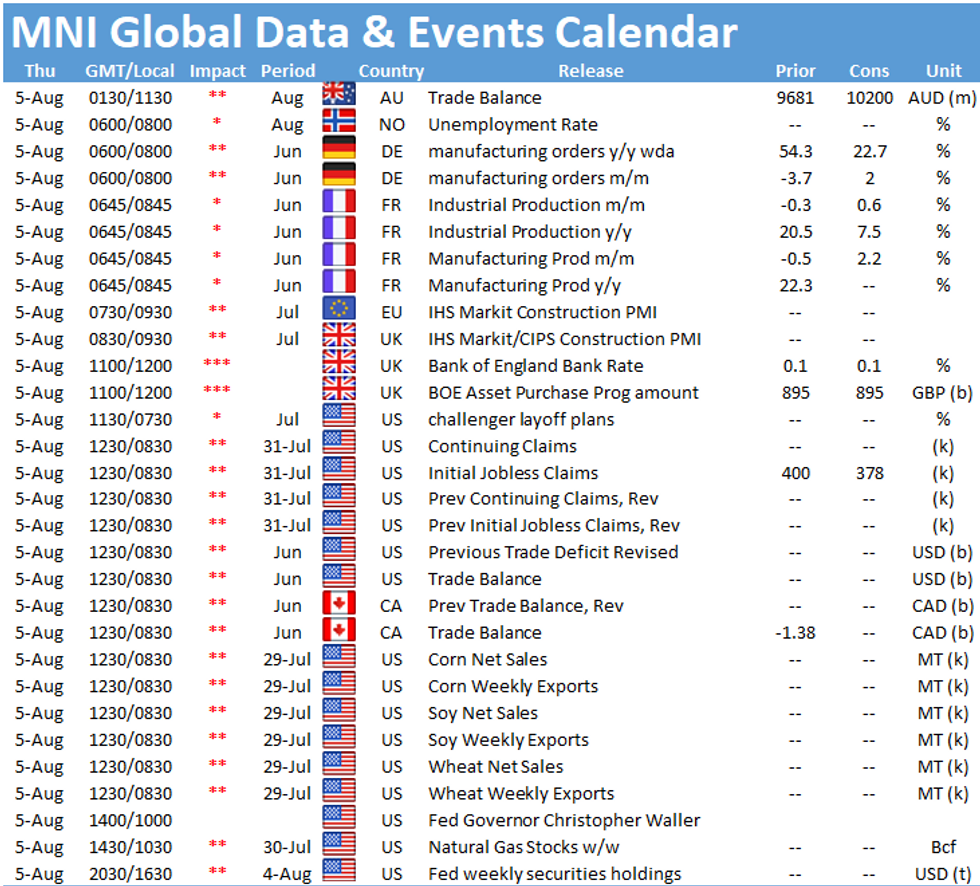

- Thursday's focus is the BoE decision - our preview went out earlier today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.781%, 5-Yr is down 2bps at -0.768%, 10-Yr is down 1.9bps at -0.501%, and 30-Yr is down 2.9bps at -0.04%.

- UK: The 2-Yr yield is up 0.6bps at 0.063%, 5-Yr is down 0.6bps at 0.224%, 10-Yr is down 0.8bps at 0.512%, and 30-Yr is down 1.3bps at 0.933%.

- Italian BTP spread up 0.6bps at 105.4bps / Spanish up 1.6bps at 73.1bps

OPTIONS/Cautious Options Trade Ahead Of BoE Thursday

Wednesday's European rate/bond options flow included:

- ERU2 100.50/100.37ps, bought for 2.5 in 5k

- 3RU1 100.25/100ps vs 2RU1 100.37p, bought the blue for 0.25 in 2.5k

- 3RZ1 100.37/100.50/100.62c fly 1x3x2, bought for 1.5 in 1k

- SFIZ1 99.95/100cs 1x2, sold the 1 at -0.25 in 1k

FOREX: ISM Services/Fed's Clarida Spark Dollar Squeeze

- Following a miss in US ADP employment, the USD had been underperforming with broad dollar indices roughly 0.3% softer, following the data.

- Comments from Federal Reserve's Richard Clarida, perceived as marginally hawkish, coupled with the strong beat in US ISM Services data (particularly the inflation component) sparked a sharp greenback recovery, which then extended through the best levels of the day.

- The Vice Chair said the central bank could begin to raise interest rates in early 2023 if employment and inflation continue to progress as expected. Stating the inflation outlook risks remain to the upside, the US dollar continued its upward trajectory.

- The most significant squeeze was seen in USDJPY. Hovering just off the 108.72 lows, the pair spiked back above 109 as fresh shorts were covered and the rally extended to fresh highs of 109.67, erasing much of the week's selloff.

- EURUSD fell short of resistance at 1.0910 and slipped rapidly to the worst levels in 5 days sub-1.1850. The dollar index remains up 0.2%.

- Similar moves were seen in the greenback against, GBP, AUD and CHF, however CAD and NZD held more narrow ranges throughout US hours.

- Kiwi remains top of the G10 pile as overnight gains were consolidated following New Zealand's labour market data beating expectations across the board and another round of hawkish RBNZ repricing.

- Headline event risk on Thursday includes the Bank of England MPC meeting where the sequencing review will require particular attention. Smaller items on the calendar include Aussie trade balance, German factory orders and US initial jobless claims.

FX/Expiries for Aug05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.2bln), $1.1825-30(E1bln), $1.1850-60(E3.4bln), $1.1885-00(E1.5bln), $1.1905-25(E958mln), $1.2000(E602mln)

- USD/JPY: Y109.00-05($878mln), Y109.15-30($1.3bln), Y109.35-50($1.4bln), Y110.00($584mln)

- AUD/USD: $0.7480-90(A$532mln)

- USD/CAD: C$1.2470($658mln), $C1.2525($721mln), C$1.2550($1.1bln)

PIPELINE: Raytheon Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/04 $2B #Raytheon Tech 10Y +75a, 30Y +100a

- 08/04 $1.5B #Barclays Plc 7Y 4.375%

- 08/04 $1B #Brunswick 3NC1 +60a, 10Y +130a

- 08/04 $500M #Summit Digital 10Y +187.5

- 08/04 $650M Chemours 8.25NC3.25

EQUITIES: Stocks Hit Shaky Ground as Clarida Signals Support for Taper

- In his first comments in over six weeks, Fed's Clarida waded in on the taper debate Wednesday, signalling that he sees an announcement on the slowdown of asset purchases in 2021, with rates beginning to rise from 2023 onwards. This brought forward market expectations for an early 2023 rate hike, weighing on equities in tandem.

- The e-mini S&P slipped around 20 points off the Tuesday highs, but the week's lows at 4365.25 were untroubled and still provide some support going forward.

- The energy and utilities sectors were the underperformers thanks to the pullback in oil prices, with WTI and Brent crude futures circling the lowest levels since mid-July.

- Notable individual performers included Moderna (+7%), with markets positioning ahead of results due tomorrow as well as General Motors, who slid over 8% after missing profit expectations this quarter.

COMMODITIES: Energy, Industrials Offered as Stock Rally Slows

- Oil benchmarks and industrial metals slipped Wednesday, with most contracts touching multi-week lows as markets narrowed in on comments from Fed's Clarida, who spoke in favour of a 2021 taper and talked up the likelihood of rate liftoff in 2023. This brought forward market pricing for a first Fed rate hike, weighing on global equities and commodities in the process.

- Brent futures remain weak, edging to new weekly lows and prompting a sharp deterioration in the outlook. The move below the 50-day EMA looks convincing, with support now exposed at 70.52 initially as well as the Jul 20 low and bear trigger at 66.91/43.

- Gold staged a decent intraday rally, but the rally faltered ahead of resistance, keeping the near-term outlook neutral. has faded off last week's highs, but remains in recovery mode after printing 1790.0 in mid-July. The outlook is bullish and the recent pullback was considered corrective. Price still needs to clear $1834.1, Jul 15 high to confirm a resumption of the bull cycle.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.