-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-On Ahead July Employment Report

US TSY SUMMARY: Risk-On Ahead July Employment Report

Tsys trading weaker after the bell, just off midday lows on modest risk-on tone with equities firmer (ESU1 +16.0). Generally sedate summer trade persisted while traders turn focus on Fed Gov Waller virtual event on digital currency, MN Fed Pres Kashkari at 1600ET, and Fri's headline July employment data (+870k est vs. +850k prior).- Futures had pared gains ahead weekly claims, drew two-way flurry on light volume on more-or-less in-line read (385k vs. 383k est). Futures bounce off early session low with Tsys holding mixed briefly. Support for bonds evaporated soon after, intermediates lead the sell-off into midday.

- Fed Gov Waller discussed Central Bank digital currency conf before going off script during Q&A -- touched on inflation, Fri's employment data:

- SAYS HIS OUTLOOK FOR U.S. ECONOMY IS VERY OPTIMISTIC, Bbg

- EXPECTS JULY EMPLOY REPORT WILL SHOW VERY HIGH JOBS, Bbg

- INFLATION IS AN UPSIDE RISK, Bbg

Short preview of NFP estimates breakdown on Bbg:

- Median est of +870k with 64 economists responding

- Range of +350k low to +1.2M high

- 13 economists estimate over +1M

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00250 at 0.07900% (+0.00212/wk)

- 1 Month +0.00650 to 0.09575% (+0.00525/wk)

- 3 Month +0.00363 to 0.12538% (+0.00763/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00650 to 0.14850% (-0.00462/wk)

- 1 Year +0.00175 to 0.23163% (-0.00350/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $926B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $353B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.931B submission

- Next scheduled purchase

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $944.335B from 70 counterparties vs. $931.775B on Wednesday. Compares to last Friday's new record high of $1.039.394B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 long Green Sep'23 98.00 puts, 11.5 vs. 99.16/0.14%

- +20,000 Green Dec 98.50/98.75 put spds, 3.75 legs

- -5,000 Blue Oct 98.62/98.87 call spds, 13.5

- 1,000 Green Nov 98.75/99.00 5x4 put spds, 21.0 vs. 99.12/0.60%

- seller Red Jun/Green Sep/Green Dec 99.25/99.75/100.25 iron fly strips, 86

- Block, +40,000 Green Mar 98.25/98.75 put spds, 8.5

- Overnight trade

- Block, 8,290 Blue Sep 98.62/98.87 put spds, 8.0 vs. 98.87/0.29%

- 1,500 Blue Sep 98.00/98.12/98.25/98.37 put condors

- 2,000 Green Dec 98.25/98.87 5x2 put spds

- 5,000 TYU 133.5/134 2x1 put spds, 10 net/2-legs over

- Block, +8,660 TYU 132.5/TYX 132 put spds, 26

- +3,000 USV 162 puts, 112-113

- Overnight trade

- over 19,000 TYU 133.75 puts -- part tied to 133.75/134.5 2x1 put spd

- 11,500 TYU 135.5 calls, 19-20

- 7,900 TYU 135.25 calls, 24-26

- over 13,500 FVU 123.75 puts, 7-8

- 3,500 FVU 124.75 calls, 13

- 2,000 USU 168/169.5 call spds

EGBs-GILTS CASH CLOSE: Bear Flattening Around Split BoE Decision

The Gilt curve bear flattened Thursday while periphery spreads tightened sharply.

- The BoE outcome was largely as expected, including a split 7-1 vote, though as our Policy Team put it, their tightening strategy review "opens the door to earlier QT". Gilts weakened sharply after the decision but had fully recovered by the time the press conference started an hour later.

- The afternoon saw global core FI weaken anew though, with Bunds coming off session highs and Gilts retesting Wednesday's lows.

- Earlier, German factory orders beat expectations. In supply, Spain sold E4.7bln of Bono/Obli, while France sold E7.5bln of LT OAT.

- Friday sees Belgium conduct an ORI for E0.5bln. Most attention will be on US payrolls data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.5bps at -0.776%, 5-Yr is up 0.6bps at -0.762%, 10-Yr is up 0.3bps at -0.498%, and 30-Yr is down 0.7bps at -0.047%.

- UK: The 2-Yr yield is up 2.9bps at 0.092%, 5-Yr is up 1bps at 0.234%, 10-Yr is up 1.2bps at 0.524%, and 30-Yr is up 0.2bps at 0.935%.

- Italian BTP spread down 2.6bps at 102.8bps / Spanish down 2.8bps at 70.3bps

OPTIONS/Sterling And Euribor Downside Feature

Thursday's European rate/bond options flow included:

- RXV1 176c for bought for 46.5, to sell the RXU1 178c at 46 in 6,562

- 0RZ1 100.12p, bought for half in 30k

- 2LZ1 99.25/99.00ps, bought for 2.75 in 4.5k

- 0LZ1 99.50/99.37ps 1x2, bought for half in 5k

- SFIH2 99.80/99.70 put spread (vs 99.83, d17) bought for 2.5 in 15k

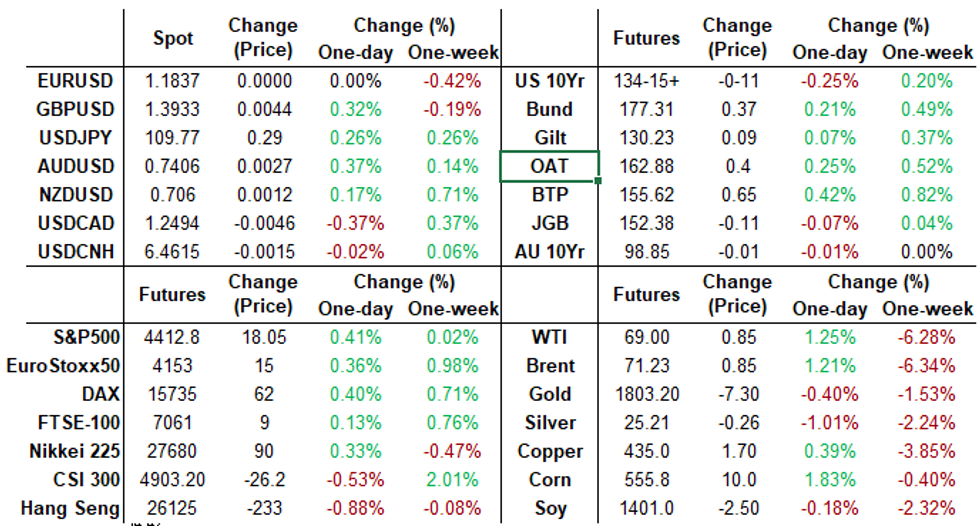

FOREX: Major Pairs Subdued Ahead Of U.S. Employment Data

- The Greenback is broadly unchanged on Thursday as markets tentatively await July jobs data from the U.S on Friday. EURUSD managed just a 29-pip daily trading range.

- USDJPY firmed a quarter of a percent, narrowly extending Wednesday's strong bounce following the ISM services data. Gains for the pair remain to be considered corrective with firm short-term resistance at 110.70, Jul 14 high, a break of which would alter the picture.

- The Bank of England MPC decision spurred some volatility in GBP but the price swings amounted to little. GBPUSD held onto gains seen prior to the decision/statement, settling around 1.3930 (+0.3%).

- Similar gains were seen for AUD and CAD, as oil prices steadied and commodity indices approach the close in the green.

- Overnight RBA's Lowe is due to testify before the House of Representatives Standing Committee, before the release of the RBA's Monetary Policy Statement.

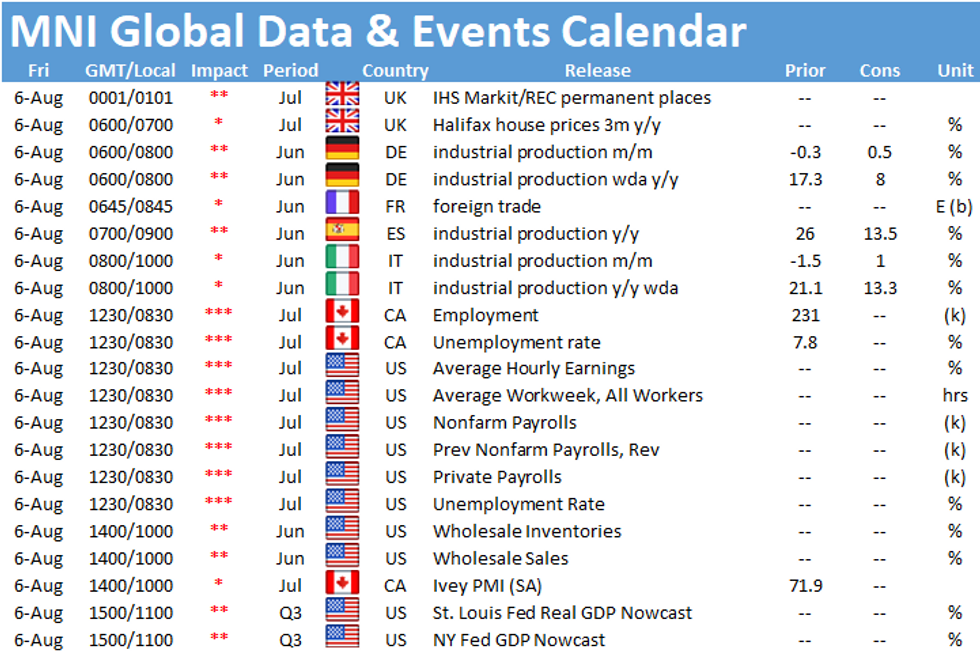

- Friday's docket will be headlined by US employment data where the current Bloomberg estimate expects +870k change in Non-farm payrolls and the unemployment rate to fall to 5.7%. Canadian employment data will also be published.

FX/Expiries for Aug06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E970mln), $1.1825(E625mln), $1.1895-00(E509mln)

- USD/JPY: Y109.50-70($608mln), Y110.00-10($626mln)

- EUR/GBP: Gbp0.8400(E890mln)

- AUD/USD: $0.7400(A$582mln)

- USD/CAD: C$1.2450-60($1.6bln), C$1.2525($1.1bln), C$1.2600($1.0bln)

- USD/CNY: Cny6.45($725mln)

PIPELINE: $5B Amgen 4Pt Leads Issuance, Still Waiting on Ford Motor Cr

- Date $MM Issuer (Priced *, Launch #)

- 08/05 $5B #Amgen 4pt: $1.25B 7Y +65, $1.25B 10Y+85, $1.15B 20Y+105, $1.35B 30Y+115

- 08/05 $1.7B #Westlake Chem $300M 3NC1 +55, $350M 20Y +125, $600M 30Y +140, $450M 40Y +165

- 08/05 $850M #So-Cal Edison $400M 2Y +50, $450M 3Y +60

- 08/05 $600M #Mid-America Appts, $300M each WNG 5Y +47, WNG 30Y +107

- 08/05 $Benchmark Ford Motor Co 5Y 2.875%a

EQUITIES: Stocks Return Higher After Mid-Week Pause

- Equities head into the Thursday close higher, with tech outperforming to boost the NASDAQ ahead the other main US indices. Stock futures are trading well, but the mid-week highs in the e-mini S&P remain in tact at 4419.75, just ahead of the alltime highs printed last week.

- Across the S&P 500, energy and financials are outperforming thanks to a stabilisation above the lows in oil prices and a modest steepening of the Treasury curve, but gains are mild as markets look ahead to Friday's payrolls release.

- Individual strength was seen in re-opening sensitive firms including Penn National Gaming, American Airlines and Norwegian Cruiselines, which have underperformed since mid-July over concerns surrounding the Delta variant of COVID.

- European trade was more mixed, with UK's FTSE-100 finishing modestly lower while continental markets enjoyed a higher close of between 0.3-0.5%.

COMMODITIES: Oil Arrests Decline, But Upside Limited

- Oil benchmarks head into the close on positive footing, with WTI and Brent crude futures higher by just over 1% apiece. Nonetheless, the bounce was preceded by lower lows for both contracts, meaning lower lows have now been printed for five consecutive sessions.

- Hawkish comments from the Israeli defense minister Gantz may have provided a floor for now, as he stated Israel would be willing to adopt a war footing with Iran should the situation require it.

- For Brent specifically, the move below the 50-day EMA this week looks convincing, with support now exposed at $66.43. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg.

- Trade in both gold and silver was more muted, although both metals entered lower territory amid positive equity performance and a bottoming out of the USD index.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.