-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Pricing Large Employment Miss?

US TSYS: Late Bond Surge Extends Session Highs, Pricing in Employ Miss?

Long end 30Y Bond futures surged to new session highs heading into the close, 30YY slipped to 2.0329% low, before retracing slightly. No specific driver or headline for the move. White House officials say Pres Biden to "meet with the House Democratic caucus about his legislative agenda at 1530ET.- Rather muted start to new month/quarter -- end to the week as interest in next week Friday's Sep employment report heats up. Current mean estimate holding around +500k job gains, from a dozen economists polled by Bbg.

- Stark contrast to potential for a huge tail event miss of as much as -818k MNI reported as estimated by StL Fed economist Max Dvorkin late Thursday. Excerpt:

- U.S. hiring in September "could be weak or even negative" in September, according to a St. Louis Fed analysis of real-time employment data from the scheduling software company Homebase, showing a seasonally-adjusted decline of 818,000 jobs, a St. Louis Fed economist told MNI.

- The model forecasts changes in employment as measured by the BLS's household survey, which tracks closely the headline payrolls figures from the BLS's establishment survey. A smaller drop of 500,000 jobs was forecast by the model without seasonal adjustment, the worst since January.

- Exercising caution, decent amount of position squaring well ahead the data. If a huge miss occurs, rates will retrace higher as tapering expectations are priced out of the curve. A large upside beat -- tapering remains in play and perhaps accelerates timing of rate hikes. By the bell, 2-Yr yield is down 1.2bps at 0.2638%, 5-Yr is down 3.4bps at 0.9312%, 10-Yr is down 2.4bps at 1.4633%, and 30-Yr is down 0.9bps at 2.0357%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00025 at 0.07438% (-0.00238/wk)

- 1 Month -0.00500 to 0.07525% (-0.00988/wk)

- 3 Month +0.00300 to 0.13313% (+0.00088/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00150 to 0.15700% (+0.00162/wk)

- 1 Year -0.00175 to 0.23488% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $52B

- Daily Overnight Bank Funding Rate: 0.06% volume: $137B

- Secured Overnight Financing Rate (SOFR): 0.05%, $939B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $322B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $14.378B submission

- Next scheduled purchases

- Mon 10/04 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 10/05 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Wed 10/06 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/07 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

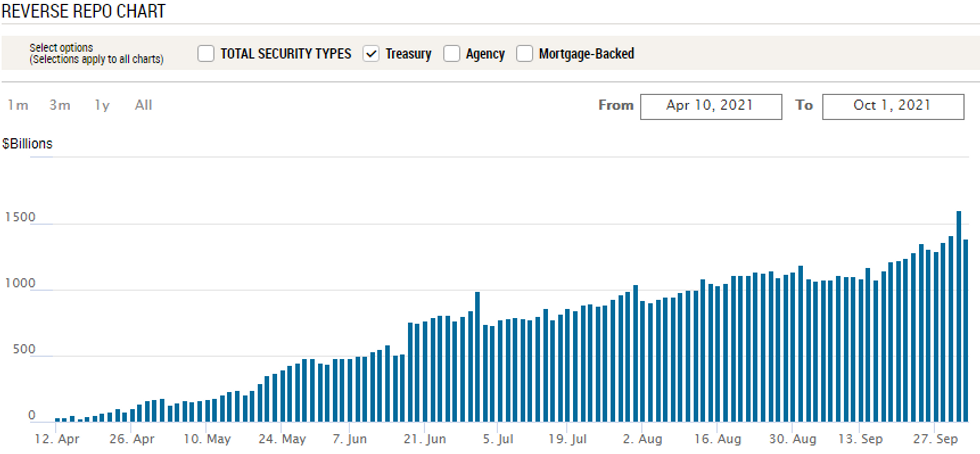

FED Reverse Repo Operation Usage Decline As New Month Gets Underway

NY Federal Reserve/MNI

NY Fed reverse repo usage declines to $1,385.991B from 75 counterparties vs. Thursday's record high $1,604.881B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +15,000 Blue Dec 99.00 calls, 1.5 vs. 98.475/0.05%

- +5,000 short Nov 99.50/99.56/99.68 call flys, 1.0

- Overnight trade

- 4,000 Blue Nov 98.00/98.12/98.25/98.37 put condors

- 2,000 short Mar 99.62/99.87 call spds

- 10,000 wk2 TY 131.5/132 2x1 put spds, 3

- Block, -17,355 TYX 132 puts, 32 vs.

- Block, +26,611 TYZ 131 puts, 33 -- delta neutral spd

- +4,000 TYZ 130 puts, 18, 131-31 ref

- +18,000 TYX 131 puts, 14-16

- +3,000 wk2 130.5/131 put spds, 4

- Overnight trade

- +6,000 TYX 130.75/131.5 put spds even over 132.75 calls

- +2,000 TYX 129/130/131 put flys, 6

- 2,000 FVX 122/122.5/123 put flys

EGBs-GILTS CASH CLOSE: Gilts Underperform Again To Close The Week

Gilts were stronger Friday but underperformed Bunds yet again, with periphery EGB spreads tighter to end the week.

- Price action came on strong volumes and was dictated largely by weaker equities setting a risk-off tone, with largely in-line PMI and inflation data not moving the needle much in the morning. That said, a strong US ISM number saw core FI weaken in the European afternoon.

- The 10Y segment on both the German and UK curves outperformed, with the Gilt/Bund spread widening to a fresh 5-yr high (124bp at one point).

- After hours Friday, S&P rates France. The ESM, Austria, Germany, Spain, France and Belgium are all due to issue bonds next week, while Industrial Production data takes centre stage.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.5bps at -0.704%, 5-Yr is down 2.3bps at -0.579%, 10-Yr is down 2.3bps at -0.222%, and 30-Yr is down 1.7bps at 0.259%.

- UK: The 2-Yr yield is down 0.6bps at 0.404%, 5-Yr is down 0.9bps at 0.629%, 10-Yr is down 1.4bps at 1.008%, and 30-Yr is down 0.2bps at 1.372%.

- Italian BTP spread down 1.9bps at 103.8bps / Spanish down 1bps at 64.8bps

EGB Options: SONIA And Long-Dated Euribor Downside Feature

Friday's European rates / bond options flow included:

- OEZ1 135.25/135.50/135.75c ladder, bought for 5 in 1k

- RXZ1 171.5/173.5cs vs 169.5/167.5ps, bought the ps for half in 2k

- 3RF2 99.75/99.50ps, bought for 1.5 in 3k

- 3RH2 99.62/99.37ps , bought for 1.5 in 3k

- SFIZ1 99.80/99.85/99.90c fly, bought for 1 in 2.5k

- SF1H2 99.75/99.80/99.85/99.90c condor, bought for 1 in 3k

- SFIG2 with SFIH2 99.60/99.50/99.40/99.30p condor strip, bought for 4in 1k

- 2LZ1 99.25/99.37cs 1x2, bought for half in 5k

- 3LZ1 99.25/99.00ps, sold at 18 in 10k

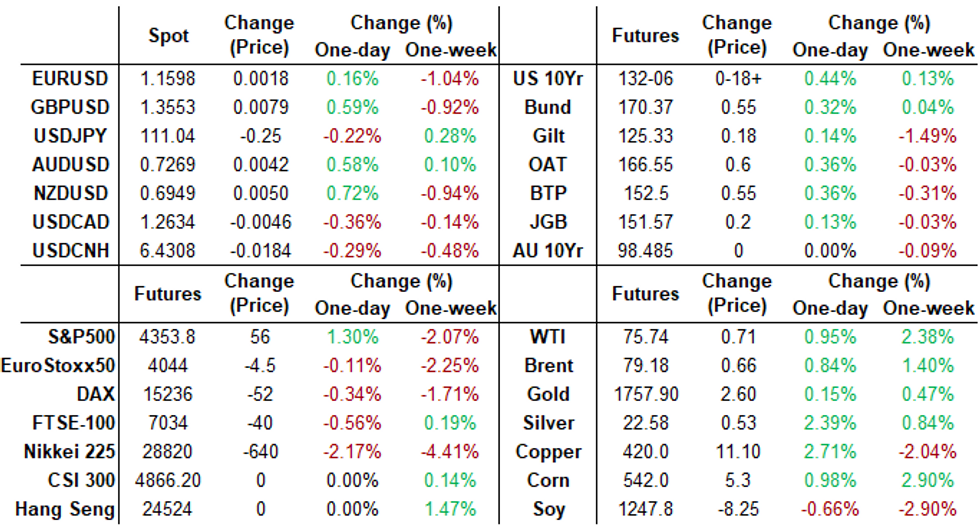

FOREX: USD Secures Fourth Weekly Gain

- Despite a pullback into the Friday close, the greenback secured a fourth consecutive weekly gain, with the USD Index holding above the 94 handle well into the close. Friday's modest pullback put the greenback at the bottom of the G10 pile amid mild profit-taking, shrugging off better-than-expected PCE and ISM Manufacturing figures.

- Currencies among the hardest hit this week managed to bounce smartly into the Friday close, with NOK and GBP among the strongest performers Friday, but among the weakest performers on the week.

- Equity markets were mixed Friday, with a slip lower in headline European indices helping support JPY for much of the session, a trend which cemented itself further with the show back below Y111.00.

- Focus in the coming week turns to the nonfarm payrolls release for September, which could seal the Fed's intentions to taper asset purchases ahead of the end of 2021. Rate decisions from the Australian and Indian central banks are also due.

FOREX: Expiries for Oct04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E854mln), $1.1530-40(E801mln), $1.1560-75(E687mln), $1.1600(E884mln), $1.1650(E807mln), $1.1700-15(E2.2bln), $1.1740-55(E1.4bln)

- USD/JPY: Y111.25-30($710mln)

- AUD/USD: $0.7250(A$742mln)

EQUITIES: US, Europe Diverge, E-mini S&P Holds Below 100-DMA

- Wall Street started October well, with the Dow Jones and S&P 500 adding over 0.5% apiece - although the NASDAQ lagged. The e-mini S&P suffered further losses across European and Asia-Pac hours, touching 4260 - the lowest levels since mid-July. A solid set of ISM Manufacturing and PCE data helped indices recover off lows, but prices held south of the 4341.33 100-dma.

- Across the S&P 500, energy names led the way higher thanks to further stability in WTI and Brent crude oil prices. Communication Services also traded well, thanks to solid gains in the likes of Walt Disney, Twitter and Alphabet.

- Stock markets in Europe underperformed their US counterparts, with the UK's FTSE-100 leading losses to close lower by 0.8%. Downside was more mild in Germany's DAX and France's CAC-40.

COMMODITIES: Gold Finishes Week at Top-End of Recent Range

- Price action was relatively contained Friday, with WTI and Brent crude futures holding within the week's range.

- JPMorgan joined other sell-side outfits looking for further resilience in energy prices over the winter months as they upped their year-end Brent forecast to $84/bbl from $78/bbl previously.

- WTI remains below Tuesday's high of $76.67. Dips are considered corrective and a bullish theme remains intact. The recent break of resistance at $73.58,the Jul 6 high and bull trigger confirmed a resumption of the uptrend. The focus is on $78.24 next, a Fibonacci projection with scope seen for a climb towards the psychological $80.00 level further out. On the downside, firm support is seen at $73.58.

- Gold traded more favorably, with the yellow metal holding close toward the top-end of the week's range, keeping the outlook positive headed into the coming week and - most importantly - the September nonfarm payrolls release.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.