-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Friday Focus Feb Jobs

US TSYS: Focus On Friday's Feb Jobs Data

Rates held steady to mildly mixed after the close Thursday, relative calm ahead Friday's Feb employment data (+415k est vs. +467k prior), geopol headlines tied to Russia war in Ukraine kept markets on edge, however.- Tsys holding modest gains across most of the curve, short end weaker as prospect of rate hikes revitalized following Fed Chairman Powell's two-day policy testimony on the Hill. Note, lead Eurodollar futures EDH2 under heavy pressure late: -.0975 to 99.2575 as prospect of 50bp liftoff climbed ahead Fri's Feb employ data.

- Stocks gapped off lows early in the second half amid headlines over third round of peace talks between Russia and Ukraine with the possibility of a cease fire. Russian officials expressed "support for humanitarian corridors for civilians" and agreeing on "possible ceasefire around those corridors".

- Crude oil prices fell back after reports that the return of Iranian supplies to an extremely tight market is near, after the Brent 1st future earlier stopped just short of hitting $120/bbl.

- Policy tie-in: Fed Chairman Powell at Senate testimony: "WHAT MATTERS FOR INFLATION IS HOW LONG OIL PRICE RISE LASTS ... $10 RISE IN OIL IS ABOUT 2 TENTHS ON INFLATION AS A RULE OF THUMB" Bbg. This yet again brings up potential of stagflation as inflation soars but the Fed does not raise rates as economy growth slows. Stay tuned.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 at 0.07900% (+0.00186/wk)

- 1 Month +0.04671 to 0.28914% (+0.05857/wk)

- 3 Month +0.06100 to 0.58314% (+0.06014/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.09414 to 0.89000% (+0.06129/wk)

- 1 Year +0.11357 to 1.33186% (+0.00115/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.023T

- Broad General Collateral Rate (BGCR): 0.05%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $355B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 7Y-10Y, $1.599B accepted vs. $5.794B submission

- Next scheduled purchases

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

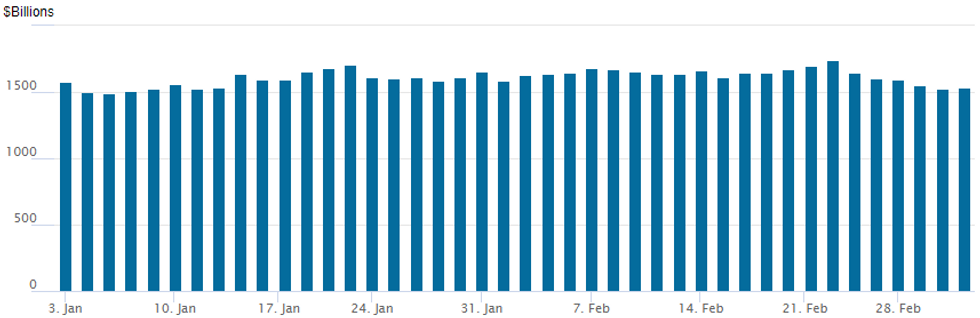

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $1,533.992B w/ 78 counterparties vs. $1,526.211B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar/Treasury Option Roundup, Back to Chance of 50Bp LiftoffFed Chair Powell headline "TOO EARLY TO SAY IF RUSSIA CHANGES FED RATES PATH" could be viewed with a hawkish light if he is thinking in terms of pre-invasion pricing -- in which case short end still needs to trade lower to match last Friday's levels. Cleveland Fed Mester concurs that Russia's war in Ukraine adds unwanted uncertainty, but it's "`CRITICALLY IMPORTANT' FED GETS INFLATION UNDER CONTROL" she said on CNBC Thursday Morning.

- March'22 Eurodollar futures remain under heavy pressure: EDH2 -0.095 at 99.26 at the moment, 99.255 low! Ongoing interest in buying downside insurance, outright or funded as Whites (EDH2-EDZ2) remain under heavy pressure: -0.095-0.055. Salient put trade:

- Block +10,000 Dec 98.00/98.25 put spds, 6.0 over 98.75/99.00 call spds

- 5,000 Dec 97.75/98.00/98.25 put flys

- Ongoing buyer Dec 97.50/97.75/98.00/98.25 put condors, appr +80k/wk 4.5-5.0

- 5,000 short Apr 97.75/98.00/98.25 put flys

- 5,000 short Apr 97.62/97.75/97.87 put flys adds to O/N trade

- +20,000 Green Apr SOFR 97.37/97.62/97.87 put flys, 2.5 vs. 98.24/0.05%

- +1,000 SFRM2 98.62/99.12 2x1 put spds, 10.0

- 9,000 Apr 98.50/98.75 2x1 put spds

- Block, 10,000 Dec 98.00/98.25 put spds, 6.0 over 98.75/99.00 call spds

- 5,000 Dec 97.75/98.00/98.25 put flys

- Ongoing buyer Dec 97.50/97.75/98.00/98.25 put condors, appr +80k/wk 4.5-5.0

- 5,000 short Apr 97.62/97.75/97.87 put flys adds to O/N trade

- Overnight trade

- 2,000 short Jun 97.25/97.50/97.62/97.87 put condors

- 6,500 short Mar 98.18 calls

- 5,000 short Sep 99.12/99.25/99.50 put flys

- 2,000 short Apr 97.62/97.75/97.87 put flys

- Block, 10,000 Sep 98.75/99.00 call spds, 8.5 vs. 98.515/0.10% at 0600:24ET

- 10,000 Green Mar 97.75/97.87/98.00/98.12 call condors

- 11,900 TYJ 128.5/130 call spds, 19

- +2,000 TYM 131 calls, 33

- 2,500 USJ 157 calls, 147

- 2,000 USK 147/151 put spds, 31

- 1,500 USK 168/170 call spds

- Overnight trade

- 2,500 TYJ 125.25/125.75/126.25 put flys

- 15,000 FVJ 119/119.5 call spds

- Blocks, -15,000 FVJ 119.5 calls, 15-13

FOREX: Dollar Index Maintains Ascent, EURAUD Breaches 1.5275 Support

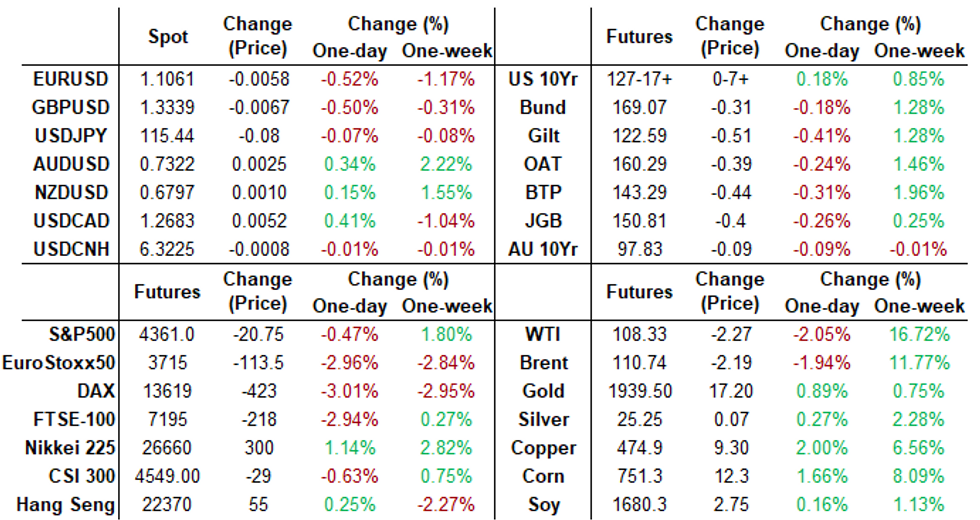

- The dollar index continued its supportive price action, making a fresh 21-month high of 97.95. The greenback strength was best reflected by weakness in EUR and CAD. With a more mixed session for commodities and major US equity benchmarks close to unchanged, JPY and CHF also remained close to Wednesday’s closing levels.

- The break lower in EURUSD confirms a resumption of the broader bearish sequence of lower lows and lower highs, in line with a bearish moving average set-up. Having briefly tested 1.1040, a Fibonacci retracement, the next support level to focus on is 1.0976, 2.00 projection of the Jan - Jun - May ‘21 price swing.

- AUD is a notable standout, continuing the recent streak of outperformance and threatening to close above key resistance at the 200-dma. 0.7326 marked the bull trigger, and further progress should bring attention to 0.7365, 2.0% 10-dma envelope.

- EURAUD fell just shy of 1%, which completes a 10th consecutive losing session for the pair, reaching the lowest levels since 2017. Losses were exacerbated below 1.5275 which represented the lows in 2018 and 2021, an important technical development.

- Aussie and Eurozone retail sales are on Friday’s data docket, however, clear focus is on the US employment report. Consensus is for another strong report including rapid wage growth and falling unemployment as participation remains steady, whilst hours worked are expected to bounce after taking most of the Omicron hit last month.

FX: Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-20(E1.4bln), $1.1300-15(E1.2bln), $1.1325-30(E681mln)

- USD/JPY: Y114.00($1.5bln), Y115.00($675mln), Y116.00($680mln)

- EUR/GBP: Gbp0.8530(E610mln)

- AUD/USD: $0.7030(A$1.2bln), $0.7300(A$841mln)

- USD/CAD: C$1.2495($520mln), C$1.2595-00($1.2bln), C$1.2700($1.4bln), C$1.2800($831mln)

- USD/CAD: C$1.2700-20($1.6bln)

Late Equity Roundup, Mildly Weaker Ahead Fri's Headline Jobs Data

SPX eminis selling off ahead FI close, ESH2 still off late morning lows currently at 4359.0. No obvious headline driver with SPX still inside session range, while Tsys holding modest gains across most of the curve, short end weaker as prospect of rate hikes revitalized following Fed Chairman Powell's two-day policy testimony on the Hill. Note, lead Eurodollar futures EDH2 under heavy pressure late: -.0975 to 99.2575 as prospect of 50bp liftoff climbed ahead Fri's Feb employ data.

- Stocks gapped off lows early in the second half amid headlines over third round of peace talks between Russia and Ukraine with the possibility of a cease fire. Russian officials expressed "support for humanitarian corridors for civilians" and agreeing on "possible ceasefire around those corridors".

- Support for stocks short lived with major indexes weaker after the FI close:

- DJIA -122.24 points (-0.36%) at 33760.78; Nasdaq -244.7 points (-1.8%) at 13506.86; S&P E-Mini Future down 27.5 points (-0.63%) at 4353.0.

- On SPX, Consumer Discretionary sector continued to lag -2.54%, Information Technology -1.33%; while Utilities sector outperformed +1.71%.

- Geopol headlines and wide range of risk exposure to Russia a main factor to consider while Friday's Feb employment data will give markets a clearer idea over near-term Fed policy.

- RES 4: 4671.75 High Jan 18

- RES 3: 4586.00 High Feb 2 and a key resistance

- RES 2: 4478.43 50-day EMA

- RES 1: 4418.75 Intraday high

- PRICE: 4409.50 @ 14:27 GMT Mar 3

- SUP 1: 4227.50/4101.75 Low Feb 25 / Low Feb 24 and a bear trigger

- SUP 2: 4055.60 Low May 19 2021 (cont)

- SUP 3: 4029.25 Low May 13 2021 (cont)

- SUP 4: 3990.50 0.764 proj of the Jan 4 - 24 - Feb 2 price swing

COMMODITIES: Gold Consolidates Gains As Dollar Strength Tempers Rally

- Gold prices have been consolidating on Thursday as markets assess the impact of rising yields versus the obvious economic risks from Russia’s invasion of Ukraine, which are underpinning haven demand for the yellow metal.

- “Gold is a bystander today with the negative impact of Powell’s statement on rates, growth and inflation being more or less offset by the continued conflict focus and general strength across the whole commodity sector,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. (BBG)

- It is worth noting that broad dollar strength continues to be a headwind for gold. The USD index came within close proximity of the 98.00 mark earlier today and this marked a 21-month high for the index.

- Additionally, existing holders appear to be selling into rallies, according to Adrian Ash, head of research at brokerage BullionVault. “This is not a one-way street. There is clearly a lot of selling pressure in the physical market,” he said. “The price is being capped.”

- With that said, the technical outlook appears supportive with price remaining above key short-term support at the Feb 24 low of $1878.4 low. A sustained break above the top of the bull channel, which intersects at $1942.6, would reinforce bullish conditions and pave the way for strength towards the Feb 24 high of $1974.3.

- Indeed, markets will also be playing close attention to tomorrow’s US employment report where consensus is for another strong report including rapid wage growth and falling unemployment as participation remains steady, whilst hours worked are expected to bounce after taking most of the Omicron hit last month.

- Crude oil prices fell back after reports that the return of Iranian supplies to an extremely tight market is near, after the Brent 1st future earlier stopped just short of hitting $120/bbl.

- WTI is -2.6% at $107.7, approaching initial support of yesterday’s low of $105.18, a break of which could open $95.32 (Mar 1 low).

- The most active strikes in the Apr’22 contract have been $120/bbl calls for the second day running.

- Brent is -2.3% at $110.34, sitting more comfortably above yesterday’s low of $106.83.

- Gold meanwhile is +0.4% at $1936.2 as markets assess the impact of rising yields versus the obvious economic risks from Russia's invasion of Ukraine underpinning haven demand.

- It continues to sit well above key short-term support of $1878.4 (Feb 24 low), needed to break to suggest a deeper pullback within the bull channel, whilst it edges nearer to yesterday’s high of $1950.1.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/03/2022 | 0700/0800 | ** |  | DE | trade balance |

| 04/03/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/03/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/03/2022 | 0900/1000 | *** |  | IT | GDP (f) |

| 04/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/03/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/03/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/03/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.