-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA MARKETS ANALYSIS: War Cooling Fed Hawks?

US TSYS: Rates Off Lows, Equities Stage Late Rebound as Brent Crude Sours

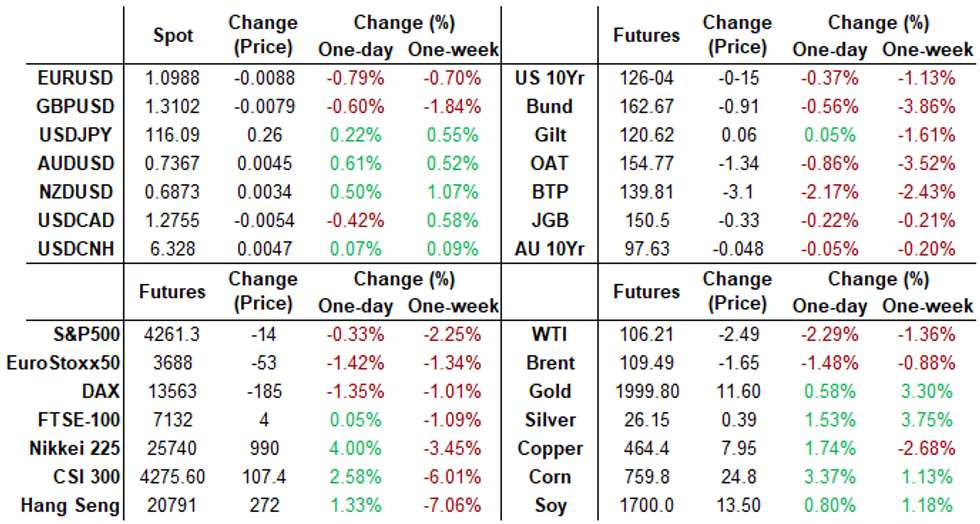

Rates held weaker levels after Thursday's close -- but off lows -- a variety of factors in play after 30YY tapped 2.4006% high while 10YY tapped 2.0179%, yield curves bounced off flatter levels.

- FI markets reversed gains during early London trade, extended lows across the curve into late morning after ECB policy annc kept rates steady but accelerated asset purchase wind down. The "hawkish hold" message looks to conclude QE in third quarter "If the incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of our net asset purchases."

- ECB presser w/Pres Lagarde helped yields take another leg higher on comments such as "persistence of higher price expectations uncertain" and of course "war is a substantial upside risk to inflation". Cold comfort(?): money markets not seeing "sever strain" as a result of sanctions on Russia.

- Relatively muted react to hot CPI coming out as expected +0.8% MoM, 7.9% YoY, core YoY +6.4%, highest inflation levels since the early '80s.

- While inflation metrics remain worrying, uncertainty due to Russia's war in Ukraine is starting to cool down more hawkish forward policy views with Fed eager to address rising inflation -- but not wanting to paint themselves into a corner.

- Tys pare losses after strong $20B 30Y auction re-open (912810TD0), Bond sale trades through 2.5bp on 2.375% high yield vs. 2.400% WI; 2.46x bid-to-cover vs. 2.30x last month.

- Cross assets: Still weaker, stocks quietly bounced back near midmorning highs in SPX eminis: 4251.5 (-15.25) -- traders citied renewed selling in oil as Brent extends session to 111.04, WTI to 105.82.

- After the bell, 2-Yr yield is up 3.5bps at 1.7145%, 5-Yr is up 5.3bps at 1.9313%, 10-Yr is up 4.4bps at 1.9969%, and 30-Yr is up 4.5bps at 2.3797%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 at 0.07929% (+0.00115/wk)

- 1 Month +0.03529 to 0.38700% (+0.07686/wk)

- 3 Month +0.05786 to 0.80286% (+0.19272/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.05800 to 1.10286% (+0.16343/wk)

- 1 Year +0.04829 to 1.53486% (+0.18200/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $246B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $952B

- Broad General Collateral Rate (BGCR): 0.05%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $357B

- (rate, volume levels reflect prior session)

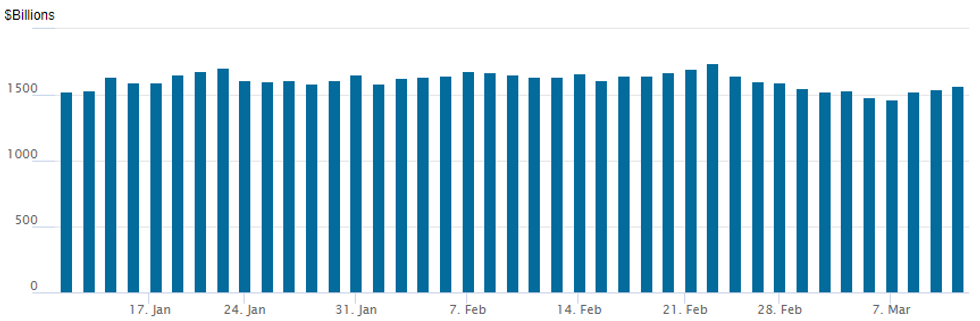

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,568.735B w/ 80 counterparties vs. $1,542.504B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar/Treasury Option Roundup, Call Buys For Less Aggressive FedConcerted tone change as underlying rate futures traded weaker again -- but off lows by the close. Surge in upside calls, outright and on spd as active accounts likely positioned for a less aggress hawkish tone from the Fed after they (most likely) hike next week on the 16th. Underlying theme: Russia war in Ukraine increasing uncertainty in markets, Fed less apt to prove current market pricing of 5-6 25bps hikes by year end.

- Some highlight trades included:

- +20,000 Jun 98.62 call over risk reversals, .25 vs. 98.625/100%

- Block, +25,000 short Jul 98.25 calls, 8.0 vs. 97.59/0.20%

- +12,000 May 98.62/98.75/98.93 broken call flys, 0.0

- Overnight: 30,000 Red Mar'23 98.75/99.50 call spds vs. 15,000 Red Mar'23 96.75 puts, 0.0 net/calls over.

- Note on puts, while there were a handful of long put unwinds, active accounts continue to maintain large downside put positions -- insurance for a wide array of hike scenarios through 2023.

- Block, +10,000 Dec 96.75/97.50/98.00/98.25 broken put condors, 1

- Block, +20,000 Jun 98.62 call over risk reversals, .25 vs. 98.625/100%

- Block, +25,000 short Jul 98.25 calls, 8.0 vs. 97.59/0.20%

- +12,000 May 98.62/98.75/98.93 broken call flys, 0.0

- +5,000 short Jun 96.87/97.25/97.50 put flys, 1.5

- Block, 20,000 short Mar 97.50/97.62 put spds, 1.5 at 0826:01ET

- Overnight trade

- 30,000 Red Mar'23 98.75/99.50 call spds vs. 15,000 Red Mar'23 96.75 puts, 0.0 net/calls over

- 12,000 Mar 99.12/99.18 put spds

- 2,000 Blue Mar 98.00 straddles

- 5,400 Mar 99.06 puts

- 4,000 Sep 97.00/97.75 put spds

- Block, +15,000 TYJ 126.25 calls, 42 vs. 126-04.5/0.47%

- 3,700 TYJ 129 calls, 8

- Overnight trade

- 8,500 TYJ 126.5 puts, 45

- 7,000 TYJ 129 calls, 10

- 1,800 TYK 126 put, 55

- Blocks, total 20,000 FVJ 118 puts, 44.5 vs. FVK 117 puts, 30 -- avg prices

EGBs-GILTS CASH CLOSE: ECB Hawkish Surprise

Thursday's ECB decision to accelerate its exit from asset purchases earlier than expected - with Pres Lagarde calling the Ukraine-Russia war a "substantial upside risk" to inflation.

- EGB curves bear flattened as rate hike expectations were brought forward: 2Y-5Y German bonds underperformed.

- Real yields rose sharply as breakeven inflation expectations slipped.

- BTPs underperformed, with 10Y spreads out over 16bps.

- Conversely, UK short-end yields headed lower.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.6bps at -0.381%, 5-Yr is up 10.9bps at -0.002%, 10-Yr is up 5.8bps at 0.274%, and 30-Yr is up 2.4bps at 0.451%.

- UK: The 2-Yr yield is down 6.5bps at 1.351%, 5-Yr is down 2.3bps at 1.303%, 10-Yr is down 0.3bps at 1.523%, and 30-Yr is up 0.9bps at 1.695%.

- Italian BTP spread up 16.6bps at 162.9bps / Spanish up 6.6bps at 99.3bps

EGB Options: Bobl Short Cover And Vol Buying On ECB Day

Thursday's Europe bond / rate options flow included:

- DUJ2 111.30/111.10ps, bought for 6.5 in 6k

- OEJ2 130.5/129.50ps, trades 22 in 1k

- OEJ2 135.50c, bought for 3 in 40k (short cover)

- OEJ2 131p bought for 21/22.5/24 in 6k

- OEK2 131.25 straddle bought for 183 in 2.25k

- RXJ2 161.50/159/156.5 put fly, bought for 26.5/27.0 2.75k

FOREX: Greenback Regains Poise As ECB-Induced EUR Spike Meets Tough Resistance

- The ECB’s Governing Council made the decision to slow its net asset purchases at a marginally quicker pace than they had previously assessed. This prompted a substantial wave of single currency demand, which saw EURUSD rip from around 1.1040 to highs of 1.1121 prior to President Lagarde addressing the press.

- Matching perfectly with the January 28 low and breakdown point, the pair met firm touted resistance as markets awaited further details within the press conference.

- As the session developed markets began to analyse the ECB’s choice of language around rate hikes. Market participants interpreted the phrase "some time after the end of the net purchases and will be gradual", as a dovish balancing act, with Lagarde confirming this provides the ECB with optionality amid the obvious lingering uncertainties.

- Indeed, the Euro began to gradually unwind the notable spike and eventually made fresh session lows, with EURUSD extending back below 1.10 and hovering just above session lows of 1.0980 as of writing and the likes of EURAUD, EURCAD and EURNZD all down well over 1%.

- Given EURUSD’s path of least resistance throughout the second half of Thursday, the USD index sits 0.55% higher, erasing around half of yesterday’s losses.

- Growth data from the UK is the highlight of Friday’s European data calendar before Canadian February employment and US Michigan sentiment data round off the week.

FX: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-85(E710mln), $1.1200(E1.1bln)

- USD/JPY: Y114.00($525mln), Y114.50($1.2bln), Y114.75-90($1.3bln), Y115.25-30($1.1bln), Y115.75-90($1.4bln), Y116.00($1.9bln), Y116.15-25($1.1bln)

- AUD/USD: $0.7395-00(A$859mln)

- USD/CAD: C$1.2550($860mln), C$1.2710-25($617mln), C$1.2900($1.2bln)

Late Equity Roundup: Bouncing

Still in the red for now, stocks are quietly bouncing back near midmorning highs in SPX eminis from 4245.25 to 4242.0 (-24.5) at the moment -- traders citing renewed selling in oil as Brent extends session to 111.31.

- Dow (-0.53% at 33107.42) and Nasdaq (-1% at 13123.67) futures also paring losses. SPX emini futures remain comfortably between first technical support of 4094.25 Low Feb 24 and a bear trigger, and first resistance: 4335.19 20-day EMA.

- SPX leading/lagging sectors: despite the reversal in oil, Energy sector continues to lead gainers +2.65%, Consumer Discretionary sector +1.14% from steady earier; Information Technology sector still lagging but off lows -1.81% with semiconductor stocks broadly lower; Financials sector recedes -1.1%, Bank of NY Mellon (BK) -4.56% after CEO steps down.

- Dow laggers: Goldman Sachs takes lead -5.54 at 328.05; Apple -4.64 at 158.37 underperforming Microsoft -2.66 at 285.84.

- RES 4: 4663.50 High Jan 18

- RES 3: 4578.50 High Feb 9 and a key resistance

- RES 2: 4431.95-day EMA

- RES 1: 4335.19 20-day EMA

- PRICE: 4242.25 @ 1445ET Mar 10

- SUP 1: 4094.25 Low Feb 24 and a bear trigger

- SUP 2: 4055.60 Low May 19 2021 (cont)

- SUP 3: 4029.25 Low May 13 2021 (cont)

- SUP 4: 3983.25 1.00 proj of the Jan 4 - 24 - Feb 9 price swing

E-Mini S&P futures traded higher Wednesday however despite these gains, the contract remains vulnerable. Key support lies at 4094.25, the Feb 24 low. A break of this level would confirm a resumption of the downtrend. The 20-day EMA, at 4335.19, represents an important near-term resistance. Price has recently failed to hold above this EMA. A clear break of it though would suggest scope for a stronger corrective bounce.

COMMODITIES: Oil Continues To Unwind Overbought Conditions

- A more muted day after large swings of late, with crude oil prices continuing to decline after yesterday’s heavy unwinding of overbought conditions whilst gold edges higher.

- ICE raised the margin on Brent crude oil futures by 32%, potentially bearish for oil over the short-term. Separately, White House Press Secretary Psaki signalled it isn’t inclined to tap the Defense Production Act to spur energy production.

- WTI is -2.4% at $106.2, with support from the 20-day EMA of $101.8 and resistance at $115.24 (50% retracement of yesterday’s range).

- Brent is -1.8% at $109.2 compared with support at $104.23 (20-day EMA) and resistance at $117.73 (50% retracement of yesterday’s range).

- Gold is +0.2% at $1996.1 with safe-haven buying a larger driver than US CPI which came in exactly on expectations, albeit with some nuances. After small moves compared to recent swings, resistance remains at $2070.4 (Mar 8 high) whilst support is $1961.2 (Mar 7 low).

- European gas slumped -19-20%, helped by milder weather forecast and with some profit-taking, but remains up 75-80% ytd.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/03/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/03/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 11/03/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/03/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/03/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/03/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/03/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 11/03/2022 | 1330/0830 | ** |  | CA | Capacity Utilization |

| 11/03/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 11/03/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 11/03/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/03/2022 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.