-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2Y Treasury Yields Back Below 5% After Powell

Highlights:

- Treasuries pare gains but hold a sizeable rally, primarily on Fed Chair Powell saying it's unlikely the next rate move will be a hike

- Fed Funds futures have shifted closer to fully pricing a first cut in November again

- The USD index slid in sympathy with yields through Powell's press conference although has stabilized for roughly 0.3% lower on the day.

- Equities have seen a sharp reversal of strong gains from earlier in the Q&A, supporting the bearish cycle seen in the S&P 500 e-mini

- WTI has dropped below $80/bbl after a larger than expected build in US crude stocks

US TSYS: Post Powell Gains Pared, Closer To First Cut Fully Priced In Nov Again

- Treasuries have pared gains seen during Powell’s Q&A but hold richer both since the initial decision and on the day.

- 2Y yields lead declines on the day with -8.3bps (4.95%), with the curve switching from flattening pre-FOMC to steeper with 2s10s at -32.4bps rising more than 4bps since the decision.

- TYM4 at 107-29 sits ~8 ticks higher since the announcement although is off an earlier high of 108-06+ seen in a continuation after Powell said it was unlikely the next move would be a hike.

- It pushed through yesterday's high for above pre-ECI levels but stopped short of resistance at 108-11 (20-day EMA).

- Fed Funds implied rates sit 6.5bps lower for end-2024 since the decision. Pertinent cumulative cuts: 16bp Sep (from 13bp), 23bp Nov (from 19bp) and 35bp Dec (from 28.5bp).

US FI Options: Hawkish SOFR Put Fly Buying Continued Pre-FOMC

Wednesday's US rates/bond options flow included:

- SFRZ5 94.75/94.25/93.75p fly, bought for 5 in 47.75k today earlier. This structure is building up to over 100k, as this was previously bought for 4 in 50k (on 18th April), and 4.5 in 10k (23rd April).

- SFRM4 94.75/94.81cs, bought for 0.75 in 10k (on block, 0.70 synth, ref 94.79, 5 del).

- SFRM4 94.62/94.50ps sold at half in 10k

- SFRZ4 94.87/94.62/94.37p fly, sold at 6.25 in 7k

- SFRM4 94.75/94.81cs, traded half in 10k

- SFRU4 94.56/94.43/94.31p fly, traded half in 9k

- SFRU4 94.81c, traded 12.5 in 4k

- SFRV4 94.25/94.00ps traded 1.5 in 14k

- SFRZ4 94.68p traded 13 in 4k

- SFRZ4 96/97cs, bought for 4.5 in 3k

- 0QU4 95.12/95.00ps traded 4.5 in 5k

- 2QZ4 96.37c traded 17.5 in 8.5k, also traded 17.5 in 5k on Block

- 0QM4 95.75/95.50/95.25p ladder sold the 1 at half in 5k

- TYM4 108c, bought for '35 in ~3k

EGBS-GILTS CASH CLOSE: UK Curve Marginally Bear Steepens

The UK curve marginally bear steepened Wednesday, with EGBs closed for the May 1 holiday.

- Gilts started trade on the back foot, with yields jumping at the open on spillover from US Treasury weakness overnight.

- A soft 10Y Gilt auction weighed mid-morning.

- Yields peaked around midday London time, pulling back in the afternoon on mixed US data (soft private sector wage growth, job openings, and ISM manufacturing/versus strong ISM prices paid).

- That left attention on the Federal Reserve decision and press conference after the cash close.

- Thursday morning's schedule includes final April PMIs.

Closing Yields:

- UK: The 2-Yr yield is up 0.5bps at 4.511%, 5-Yr is up 1.4bps at 4.265%, 10-Yr is up 1.9bps at 4.366%, and 30-Yr is up 1.7bps at 4.804%.

- EGBs Cash Trading Closed

EU FI OPTIONS: Sonia Put Spread Selling Wednesday

Wednesday's Europe rates/bond options flow included:

- SFIM4 94.90/94.70ps, sold at 5 in 3k.

- SFIZ4 95.20/95.00ps sold at 8.75 in 4k / SFIZ4 95.10/95.00ps sold at 4 in 2k (potentially rolling strikes)

- SFIZ4 94.90/95.10/95.90/96.10 iron Condor, sold at 9.5 in 2k

FOREX: Greenback Under Pressure Despite Hawkish Fed Tweaks

- Immediate two-way price action for US treasuries in the aftermath of the May Fed statement release was echoed in currency markets. A very moderate pop higher for the greenback failed to garner any momentum and the USD index saw a swift reversal to fresh session lows.

- As Chair Powell’s press conference continued, the greenback slid in sympathy with US yields as Fed Powell emphasised the well anchored longer-term expectations and highlighted it is unlikely that the next policy move would be a hike. With the market potentially setting a high hawkish bar heading into the today’s meeting, the most recent greenback optimism faded.

- USDJPY traded as low as 157.01, 98 pips off the overnight highs and EURUSD narrowed the gap towards the week’s best levels, briefly operating back above 1.0730.

- Markets have since stabilised a touch and the USD index is roughly 0.3% lower as we approach the APAC crossover.

- With equities buoyant throughout the late US session, AUD and NZD are outperforming, both up close to 0.75% on the session.

- Initial resistance for AUDUSD has been defined at 0.6587, Monday’s high. Clearance of this level would be bullish and signal scope for a climb towards 0.6644, the Apr 9 high.

- Bank of Japan minutes highlights the APAC docket on Thursday before Swiss CPI will be in focus during the European session. Jobless claims in the US will provide a warm-up for the US employment report scheduled on Friday.

US STOCKS: A Sharp Reversal Of Powell Driven Gains

- US stock markets have seen a sharp reversal of earlier Powell Q&A-driven gains, larger relatively speaking than the paring seen in Treasuries.

- ESM4 is back at 5060.25 (-0.15%) for only ~10pts higher post-FOMC, off its high of 5126.75 in a move closer to resistance at 5132.17 (20-day EMA). The contract is seen in a bearish cycle with support at 5022.25 (Apr 25 low) after which lies the bear trigger at 4963.50 (Apr 19 low).

- As before the FOMC, gains are led by utilities (+1.2%) across a range of names and communication services (+1.0%). The press conference has done little for energy (-1.5%) with WTI still below $80 after earlier inventory data, but IT (-0.8%) pares losses although is still under pressure courtesy of semiconductors.

- In particular, Nvidia remains -2.8% vs -5% earlier, with declines attributed to concerns for the broader sector outlook after AMD’s presentation (AMD -8.6%).

- The Nasdaq 100 underperforms (-0.4%) whilst the Russell 2000 (+0.4%) and Dow Jones (+0.3%) outperform.

COMMODITIES: Crude Futures Slump Over 3% On Session

- WTI has fallen to its lowest level since early March after a larger than expected build in US crude stocks in the latest EIA data. Crude hit new intraday lows after the FOMC held rates steady and a slightly weaker dollar did little to support oil prices.

- WTI JUN 24 is down 3.26% at 79.26$/bbl. Price has breached key support at the 50-day EMA, at $81.23. A clear break of this average would strengthen a short-term bearish theme and highlight scope for a deeper correction. This would open $76.07, the Mar 11 low.

- OPEC’s crude production was steady at 26.81m b/d in April, leaving the bloc’s latest cuts incomplete, Bloomberg said.

- Precious metals have been well supported, with more optimistic price action bolstered by the post-fed reaction for US yields and the greenback. Both spot gold and silver are exhibiting gains of around 1.25% on Wednesday.

- Note that the most recent short-term bear cycle has been allowing a significant overbought condition to unwind. Key resistance and the bull trigger remains much higher, at $2431.5, the recent Apr 12 high.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX

1M 5.32021 0.00429

3M 5.33272 0.00458

6M 5.32645 0.01494

12M 5.26313 0.02859

Source BBG/CME

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.34%, 0.02%, $1831B

* Broad General Collateral Rate (BGCR): 5.31%, no change, $718B

* Tri-Party General Collateral Rate (TGCR): 5.31%, no change, $701B

A 2bp increase for SOFR at month-end

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $82B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $241B

Effective Fed Funds rate unchanged

FED: RRP Uptake Pulls Back After Month-End Build

- RRP uptake retreated to $438bn today, a $96bn decline having ramped higher ahead of April’s month-end.

- It’s the lowest since the $410bn on Apr 22 whilst it remains off mid-April’s recent low of $327bn.

- The 69 counterparties is the lowest since Apr 19 and compares to the low of 62 on Apr 15.

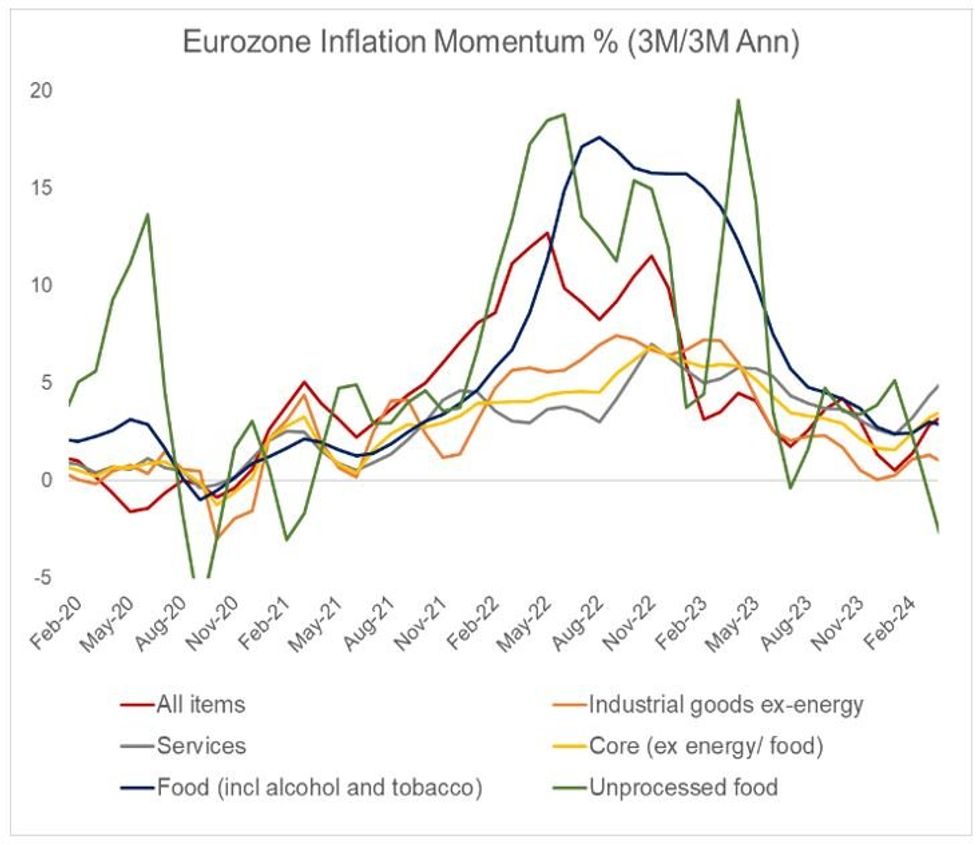

MNI Eurozone Inflation Insight - April 2024

EXECUTIVE SUMMARY

June Cut Still On Cards In Spite of Momentum Uptick

The Eurozone April flash inflation round saw services inflation finally fall below 4.0% Y/Y (where it had been stuck at for the 5 months prior). However, the 3.7% Y/Y services print was actually higher than many analysts had forecasted coming into the release.- This meant that the wider Eurozone core inflation metric surprised to the upside at 2.7% Y/Y (vs 2.6% cons). The ECB’s seasonally adjusted series also pointed to an increase in core inflation momentum in April, particularly in services.

- For the ECB, the April inflation metrics are unlikely to stand in the way of the well-signalled June rate cut. However, recent trends in inflation momentum will have a bearing on rate decisions beyond June.

- Recent ECB-speak has highlighted the differences in opinion amongst policymakers on this topic, and the April data will support the hawkish contingent's calls for caution in the path ahead.

- Our review of April's preliminary Eurozone inflation data includes breakdowns and analysis of the national inflation prints, and some sell-side reactions.

FOR FULL PDF ANALYSIS:

MNI Norges Bank Preview - May 2024: Little Reason to Pivot

The Norges Bank are unanimously expected to leave the policy rate on hold at 4.50% once again.

- Following the hawkish-leaning March decision, recent developments provide little reason for the Norges Bank to deviate from its current guidance.

- As such, we expect the statement to continue guiding for rates to be held at current levels for “some time ahead”.

- Although Governor Wolden Bache noted at the March press conference that September was the most likely meeting for rates to be cut, we don’t expect this to be explicitly included in the policy statement.

- Analysts are unanimous in expecting no change to the policy rate, and generally expect little change to Norges Bank’s guidance (i.e. rates to stay at current levels for “some time ahead”). Some note the risk of the Norges Bank downplaying guidance for a September cut, or even a more hawkish tilt in the policy statement language. The NOK would strengthen in response to such a move.

For our full preview including a summary of sell-side views, see the PDF here:

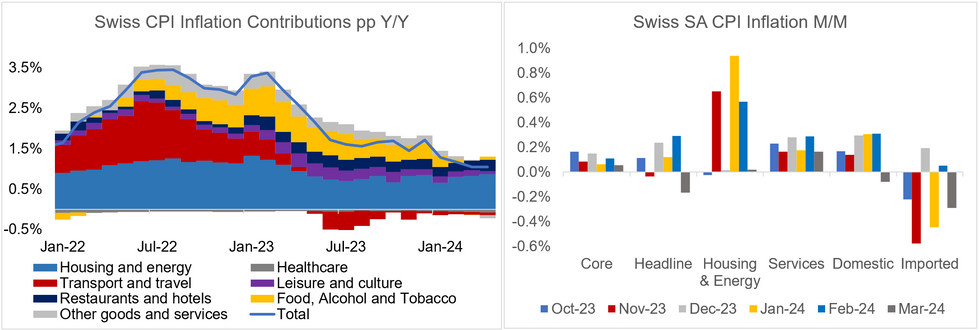

Switzerland April CPI Preview: Housing Inflation in Focus

Swiss headline CPI inflation (released May 2 at 0730BST/0830CET) is expected to have accelerated in April after three consecutive slowdowns, with consensus standing at +1.1% Y/Y and +0.1% M/M (vs +1.0% and 0.0% in March, respectively). Core CPI is expected to have decreased further, however - consensus stands at +0.9% Y/Y (vs +1.0% Mar).

- Three categories will be in particular focus: housing, services, and imported inflation.

- Housing inflation has been the main driver of services and broader inflation in recent months (housing and energy category contributed over 0.8pp to the figure in March, see chart).For the past months, an anticipated uptick in housing inflation has only partially materialised - but a further acceleration is expected starting in April, reflecting a mortgage reference rate increase from December.

- Specifically, Raiffeisen Bank expects rental price inflation to increase to up to 8% Y/Y in the course of 2024 (vs 2.7% Mar).

- Imported inflation meanwhile went negative in the last months on a yearly basis (-1.3% Mar, -1.0% Feb), influenced by the stronger CHF. With the franc weakening since January 2024, it's plausible that the disinflationary impulse from imports will slow or reverse.

- Given that both these drivers would contribute upwardly towards the core measure, its projected deceleration is not immediately obvious to us - one potential downside risk to core would be a longer lag from the recent CHF depreciation, or if housing inflation once again fails to accelerate.

- While a headline figure in line with the 1.1% Y/Y consensus would start off the quarter well below the SNB forecast for Q2 of 1.4%, the projected uptick by the SNB might materialize at a later point, particularly when considering the housing price dynamics from above. The SNB forecasts a further uptick in Q3 (1.5% Y/Y).

MNI, SECO

MNI, SECO

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.