MNI ASIA MARKETS ANALYSIS: 50Bp Cut Next Week Recedes Post CPI

- MNI FED: Key Inter-Meeting Fed Speak: Hawk-Dove Spectrum Shifts Dovish

- MNI US: Harris With Slight Edge In Toss-Up Race, YouGov MRP Poll

- MNI US: Johnson Scraps Government Funding Plan Amid Republican Skepticism

- MNI US DATA: CPI: Another Report Reducing Odds Of A 50bp Cut Next Week

US

FED (MNI): Key Inter-Meeting Fed Speak: Hawk-Dove Spectrum Shifts Dovish

Others toward the hawkish end of the spectrum including Atlanta’s Bostic and Minnesota’s Kashkari have made statements that appear open-minded with regard to the size and pace of cuts, though it appears that this will very much be data dependent. Moderates/doves appear to prefer a prudent approach with no pre-commitment on the timing or magnitude of cuts. As Waller summed it up: "I am open-minded about the size and pace of cuts, which will be based on what the data tell us about the evolution of the economy".

- Others have used similar language on the anticipated approach to cuts: SF’s Daly: "gradualism"; Philadelphia’s Harker: "methodical"; Kashkari "more measured".

- We have shifted all FOMC participants to the more dovish end of the spectrum to reflect that all members are likely to see at least some policy easing as warranted.

- Note that at the September FOMC, Beth Hammack will vote for the first time as Cleveland Fed President, after taking over from Loretta Mester in August. In our Hawk-Dove matrix, she is assumed to be a median participant.

NEWS

US (MNI): Harris With Slight Edge In Toss-Up Race, YouGov MRP Poll

YouGov has publishedits first ‘multilevel regression with post-stratification’ (MRP) model of the 2024 presidential election, concluding that Harris has a very slight lead over Trump.

- YouGov: “This is the first release of our model estimating 2024 presidential election votes in every state, based upon nearly 100,000 recent interviews of registered voters. We show Kamala Harris leading Donald Trump by 50% to 47% just before their first debate. However, the race will be determined by who wins the most electoral votes, not popular votes, and, as it currently stands, the race is a toss-up. We have Harris leading in 22 states and Washington D.C. with 256 electoral votes and Trump leading in 25 states with 235 electoral vote.”

US POLITICAL RISK (MNI): Harris Puts In Assured Debate Performance

The consensus view amongst pundits is that Vice President Kamala Harris comfortably won her first presidential debate with former President Donald Trump. In stark contrast to Biden’s faltering debate performance in June, Harris effectively controlled the tone of the debate right from the start, when she demonstrably shook hands with Trump. Whereas Trump appeared composed next to Biden, Harris’ needling unsettled Trump to the extent he missed opportunities to land effective attacks on Harris’ vulnerabilities.

US (MNI): Johnson Scraps Government Funding Plan Amid Republican Skepticism

Capitol Hill sources reporting that House Speaker Mike Johnson (R-LA) has abandoned his plan to fund the federal government for six months, paired with the contentious SAVE Act. Johnson said, ahead of a vote on the package today that was widely expected to fail, that House Republican leadership needs to work through the weekend to “build consensus.”

US (MNI): Speaker Johnson Faces Uphill Battle To Pass Government Funding Package

House Speaker Mike Johnson (R-LA) faces a difficult decision on how to approach his plan to fund the government, with an informal whip count indicating he doesn't have the votes to pass his six-month extension, paired with the SAVE Act bill - a Democrat-opposed bill that would compel Americans to present citizenship ID when registering to vote.

US TSYS: Focus Turns From Core CPI Gain to PPI, Weekly Claims

- Treasuries look to finish well off lows following a volatile first half on an unexpected gain in Core CPI inflation metrics.

- Dec'24 10Y Tsy futures are -2.5 after the bell at 115-12 vs. 115-02 low, curves flatter but off lows, 2s10s -3.190 at 1.216 vs. -1.535 low.

- U.S. core CPI surprised higher in August on a housing inflation rebound, rising 0.281% last month against expectations for a 0.2% increase. Headline CPI added 0.187%, in line with expectations, the Bureau of Labor Statistics said Wednesday. That brings the 12-month rate for headline and core CPI inflation to 2.5% and 3.2%, respectively.

- Owners' equivalent rent rose 0.50% last month, its strongest increase since January. Rent inflation slowed a tad to 0.37% from 0.49% the previous month. Core services prices excluding housing costs, or supercore CPI, accelerated to a 0.328% increase over the month from 0.207% in July.

- Projected rate cuts through year end remain soft vs. pre-data levels (*): Sep'24 cumulative -28.5bp (-32.7bp), Nov'24 cumulative -65.1bp (-72.5bp), Dec'24 -105.3bp (-114.5bp).

- While chances of a 50bp rate hike has fallen off, markets still have Thursday's PPI and weekly claims data to absorb.

OVERNIGHT DATA

US DATA (MNI): CPI: Another Report Reducing Odds Of A 50bp Cut Next Week

Core CPI was easily stronger than expected in August at 0.28% M/M (cons 0.20%) after 0.165% in July and a particularly soft 0.06% in June. One area that is odd is that the core M/M beat expectations but the Y/Y was much closer at 3.20% Y/Y. There are differences in the Bbg surveys (65 for M/M vs 51 for Y/Y) but we saw similar expectations in our survey which included unrounded estimates. It could suggest some seasonal adjustment quirks were at play.

- Core services were out and out stronger than expected, with OER at 0.50% M/M (analyst av 0.30) on widespread regional strength and primary rents at 0.37% M/M (analyst av 0.30) whilst ex-housing core increased 0.33% M/M (limited analyst av 0.25, range 0.20-0.35) after 0.21%.

- On rental inflation, we noted in the preview that June has been the only month in recent years with weighted rental inflation back at the 0.27% M/M averaged pre-pandemic. July saw an acceleration to 0.39% M/M before a further increase to 0.47% M/M in today’s data.

- The impact from “supercore” inflation coming in at the high end of expectations was limited by some potentially softer implications for core PCE, conditional on tomorrow’s PPI report.

- Core goods offered the most dovish aspect of the report, with used cars falling roughly as expected (-1.0% M/M after -2.3% with potential increases ahead) but ex-used cars seeing another -0.1% M/M decline despite higher input costs amidst a relative tightening in supply chain pressures.

US DATA (MNI): Analyst "Miss" On Core CPI Driven By Housing, Airfares, Lodging

Analyst expectations for August core CPI were too low (0.20% M/M MNI median vs 0.28% actual), in turn driven by underestimating housing inflation. See table below.

- The analyst median expectation of core services was 0.30% M/M, but this registered 0.41% on the back of OER (0.50%, 0.20pp above expected) and tenants' rents (0.37%, 0.07pp above expected).

- Analysts also underestimated the rebounds in lodging and airfares, though auto insurance prices missed expectations to the downside.

- However, analysts did not anticipate such a strong degree of core goods deflation, at -0.17% (vs -0.11% expected), even with used cars (-1.0% M/M) coming in roughly as expected.

- Looking at headline CPI: the key headline categories of food (0.12% M/M, 0.1pp below expectations) and energy (-0.8% M/M, 0.2pp below expectations) came in below-expected (gasoline was roughly in line at -0.6% M/M). But the overall headline CPI expectation of 0.17% M/M was exceeded by 0.02pp nonetheless, due to the core categories coming in on the high side.

US DATA (MNI): CPI Core & Supercore Latest Trends

Core CPI (SA): % M/M: 0.281 in Aug'24 after 0.165 in Jul'24; % 3mth ar: 2.1 in Aug'24 after 1.6 in Jul'24; % 6mth after: 2.7 in Aug'24 after 2.8 in Jul'24

CPI Core Services Non-Housing (SA): % M/M: 0.328 in Aug'24 after 0.207 in Jul'24; % 3mth ar: 2 in Aug'24 after 0.5 in Jul'24; % 6mth ar: 3.1 in Aug'24 after 3.4 in Jul'24

Source: Bloomberg, MNI

US DATA (MNI): Still Only Limited Boost In New Purchase Mortgage Applications

MBA composite mortgage applications increased a seasonally adjusted 1.4% last week after the 1.6% the week prior. New purchase applications led the way again (1.8% after 3.3%) whilst refis lifted after a recent softer patch (0.9% after -0.3%) although that is following a marked step higher back in early August.

- New purchase applications are starting to show marginally more traction after sizeable declines in mortgage rates, although they are only back to July levels.

- The 30Y conforming mortgage rate fell 14bps to 6.29%, down a full 100bps from the recent high of 7.29% from April for its lowest since Feb 2023.

- The regular-jumbo loan spread lifted slightly from -30bps to -27bps but remains depressed in a sign of some relative tightening in standards to larger loans.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 29.73 points (0.07%) at 40769.54

- S&P E-Mini Future up 34.75 points (0.63%) at 5540.5

- Nasdaq up 296.3 points (1.7%) at 17327.21

- US 10-Yr yield is up 1.1 bps at 3.6534%

- US Dec 10-Yr futures are down 4/32 at 115-10.5

- EURUSD down 0.0001 (-0.01%) at 1.1019

- USDJPY down 0.13 (-0.09%) at 142.31

- WTI Crude Oil (front-month) up $1.34 (2.04%) at $67.09

- Gold is down $6.43 (-0.26%) at $2510.33

- European bourses closing levels:

- EuroStoxx 50 up 16.38 points (0.35%) at 4763.58

- FTSE 100 down 12.04 points (-0.15%) at 8193.94

- German DAX up 64.35 points (0.35%) at 18330.27

- French CAC 40 down 10.72 points (-0.14%) at 7396.83

US TREASURY FUTURES CLOSE

- 3M10Y -2.194, -135.873 (L: -139.015 / H: -131.214)

- 2Y10Y -3.418, 0.988 (L: -1.535 / H: 5.703)

- 2Y30Y -4.569, 32.124 (L: 28.621 / H: 37.87)

- 5Y30Y -2.047, 51.768 (L: 48.945 / H: 55.106)

- Current futures levels:

- Dec 2-Yr futures down 2.25/32 at 104-10.25 (L: 104-07.125 / H: 104-16.125)

- Dec 5-Yr futures down 2.75/32 at 110-18.75 (L: 110-12.25 / H: 110-28.75)

- Dec 10-Yr futures down 4/32 at 115-10.5 (L: 115-02 / H: 115-23.5)

- Dec 30-Yr futures down 5/32 at 126-24 (L: 126-10 / H: 127-14)

- Dec Ultra futures down 7/32 at 137-0 (L: 136-15 / H: 137-30)

US 10YR FUTURE TECHS: (Z4) Trades Through The Bull Trigger

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-23+ Intraday high

- PRICE: 115-09 @ 1455ET Sep 11

- SUP 1: 114-27+/06+ Low Sep 10 / 20-day EMA

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-12 Low Sep 3

- SUP 4: 113-03+ 50-day EMA

The trend needle in Treasuries continues to point north and this week’s gains reinforce this theme. Today’s initial rally has resulted in a print above key resistance and the bull trigger at 115-19, the Aug 5 high. The move higher confirms a resumption of the uptrend and paves the way for a climb towards the 116.00 handle. MA studies remain in a bull-mode position, highlighting a clear M/T uptrend. Firm support is seen at 114-06+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.063 at 95.050

- Dec 24 -0.085 at 95.855

- Mar 25 -0.070 at 96.525

- Jun 25 -0.045 at 96.905

- Red Pack (Sep 25-Jun 26) -0.03 to -0.02

- Green Pack (Sep 26-Jun 27) -0.015 to -0.01

- Blue Pack (Sep 27-Jun 28) -0.01 to steady

- Gold Pack (Sep 28-Jun 29) -0.005 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.01485 to 5.09592 (-0.01392/wk)

- 3M -0.01757 to 4.93129 (-0.00735/wk)

- 6M -0.02531 to 4.55357 (-0.03842/wk)

- 12M -0.04090 to 3.95353 (-0.10007/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.161T

- Broad General Collateral Rate (BGCR): 5.31% (-0.01), volume: $808B

- Tri-Party General Collateral Rate (TGCR): 5.31% (-0.01), volume: $766B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

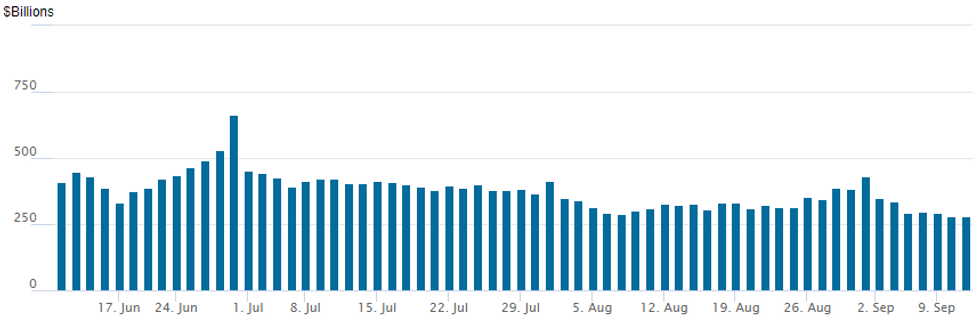

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage slips to new multi-year low of $279.215B (early May 2021 levels) vs. $281.392B on Monday. Number of counterparties at 58 from 60.

PIPELINE: Issuers Sidelined Around Inflation Data After $24B Priced Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 9/11 $715M *Perrigo 8NC3 6.125%

- 9/11 $2B Alliant Holdings $1B 7NC3, $1B 8NC3 investor calls

- $24.05B Priced Tuesday, $29.8B/wk

- 9/10 $7B *Oneok $1.25B 3Y +80, $600M 5Y +100, $1.25B 7Y +130, $1.6B 10Y +145, $1.5B 30Y +175, $800M 40Y +190

- 9/10 $2B *Bunge Ltd Finance $400M +3Y +65, $800M 5Y +80, $800M 10Y +105

- 9/10 $2B *Provence of Ontario 5Y SOFR+57

- 9/10 $2B *IADB 7Y SOFR+52

- 9/10 $2B *AfDB 5Y SOFR+41

- 9/10 $1.25B *APA Infrastructure $750M 10Y +165, $500M 20Y +182

- 9/10 $1.25B *Helmerich & Payne $350M 3Y +120, $350M 5Y +145, $550M 10Y +190

- 9/10 $1B *Nissan Motor $400M 3Y +185, $300M 3Y SOFR+205, 400M $5Y +215

- 9/10 $1B *CK Hutchinson $500M 5.5Y +95, $500M 10Y +115

- 9/10 $1B *Kommuninvest WNG 2027 SOFR+36

- 9/10 $1B *Blue Owl Credit +5Y +260

- 9/10 $800M *Wynn Resorts 8.5NC3 6.25%

- 9/10 $750M *IDB Invest +2Y SOFR+35

- 9/10 $500M *MassMutual 7Y +85

- 9/10 $500M *Macquarie Airfinance 5.5Y +172

BONDS: EGBs-GILTS CASH CLOSE: Yields Test August Lows Ahead of ECB

Risk-off trade remained the dominant theme Wednesday as Gilts and Bunds extended their yield drop to a 7th consecutive session.

- Bunds and Gilts opened firmer, owing partly to the overnight unwind of reflationary trades after Wednesday night's US presidential debate boosted VP Harris's bookmaker-implied winning probability. Softer than expected UK activity data also contributed.

- The key event was US CPI, the core component of which came in well above expectations. Coming against the backdrop of next week's Fed decision, this all but priced out a 50bp cut in favour of 25bp.

- That initially saw short-end yields back up to session highs as global central bank cuts were priced out. But concerns over the broader macro impact of relatively tighter monetary policy won out in the end, ultimately helping revive the ongoing global growth slowdown-related bid for bonds.

- European yields tested the August lows. On the day, Gilts outperformed Bunds, with both curves seeing bull steepening.

- Periphery spreads narrowed slightly, led by GGBs and BTPs.

- Thursday's highlight is the ECB decision - a 25bp cut is unanimously expected and fully priced in - MNI's preview is here (PDF).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.6bps at 2.152%, 5-Yr is down 2.2bps at 1.971%, 10-Yr is down 1.9bps at 2.112%, and 30-Yr is down 1.1bps at 2.395%.

- UK: The 2-Yr yield is down 6.9bps at 3.791%, 5-Yr is down 7bps at 3.615%, 10-Yr is down 5.8bps at 3.761%, and 30-Yr is down 2.6bps at 4.372%.

- Italian BTP spread down 2.2bps at 143bps / Greek down 2.2bps at 102.7bps

FOREX: Volatile Swings Post US CPI, Daily Adjustments Contained

- The USD index tilts very marginally stronger on Wednesday, reflective of the higher front-end US yields, however, the small 0.1% move does not tell the entire story of an extremely volatile session for currencies, and namely the Japanese Yen.

- A lot of the action came before the US data with the US election debate and BOJ comments helping USDJPY print fresh lows on the year at 140.70, with narrowing yield differentials underpinning the move.

- Since then, a strong recovery ahead of and following the higher-than-expected US data saw USDJPY reach as high as 142.54 and subsequent volatile swings for both US yields and equities have prompted multiple 100 pip swings for the pair.

- The late recovery for major equity benchmarks to close to unchanged levels on the session (Nasdaq has risen 1%) has assisted USDJPY back above 142.00 as we approach the APAC crossover. 140.25, the Dec 28 low from last year remains key support and resistance is not seen until 143.71, the Sep 9 high.

- Ahead of tomorrow’s ECB, there has been similar price action for EURJPY which has yet to breach the lows seen in early August. As noted earlier, yield differentials with Japan continue to narrow and this is helping to underpin the bearish theme for the cross. Key support and the bear trigger at 154.42, the Aug 5 low.

- Elsewhere, CHF (-0.4%) has underperformed G10 peers, although weakness for the likes of GBP, AUD, CAD and NZD has also been evident, all falling around 0.3% against the dollar.

- As well as the ECB decision/presser, US PPI and jobless claims data will highlight Thursday’s docket.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 12/09/2024 | 0600/0800 | *** |  | Inflation Report |

| 12/09/2024 | 0700/0900 | *** |  | HICP (f) |

| 12/09/2024 | - |  | OBR Fiscal Risks and Sustainability Report | |

| 12/09/2024 | 1215/1415 | *** |  | ECB Deposit Rate |

| 12/09/2024 | 1215/1415 | *** |  | ECB Main Refi Rate |

| 12/09/2024 | 1215/1415 | *** |  | ECB Marginal Lending Rate |

| 12/09/2024 | 1230/0830 | *** |  | Jobless Claims |

| 12/09/2024 | 1230/0830 | ** |  | WASDE Weekly Import/Export |

| 12/09/2024 | 1230/0830 | *** |  | PPI |

| 12/09/2024 | 1230/0830 | * |  | Building Permits |

| 12/09/2024 | 1230/0830 | * |  | Household debt-to-income |

| 12/09/2024 | 1245/1445 |  | ECB Monetary Policy Press Conference | |

| 12/09/2024 | 1345/1545 |  | Eurosystem staff macroeconomic projections publications | |

| 12/09/2024 | 1415/1615 |  | ECB Podcast: Lagarde presents the latest monetary policy decisions | |

| 12/09/2024 | 1430/1030 | ** |  | Natural Gas Stocks |

| 12/09/2024 | 1600/1200 | *** |  | USDA Crop Estimates - WASDE |

| 12/09/2024 | 1700/1300 | *** |  | US Treasury Auction Result for 30 Year Bond |