-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

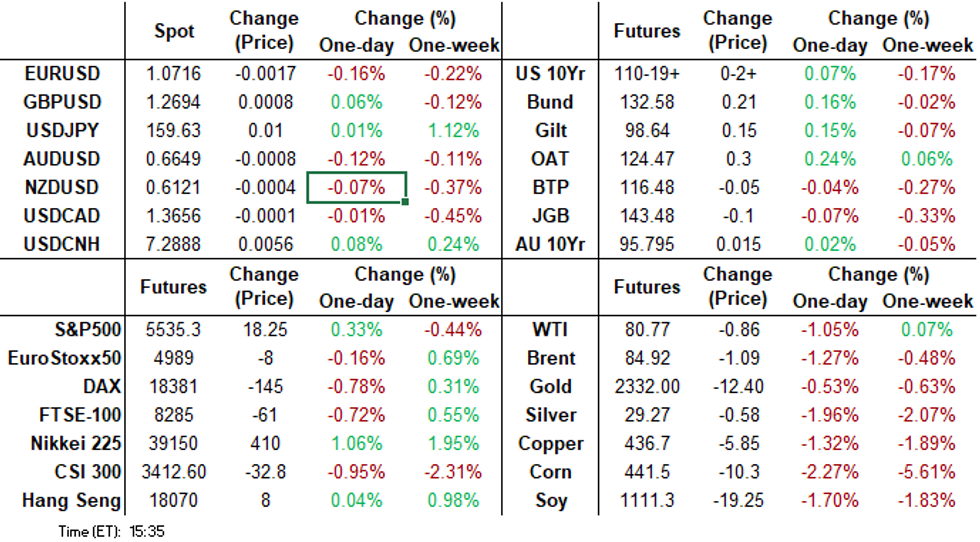

Free AccessMNI ASIA MARKETS ANALYSIS: Awaiting PCE Inflation Data

HIGHLIGHTS

Treasuries pared early gains more in reaction to higher than expected Canada core CPI data than to US data.

FI markets held a narrow range on moderate two way flow, cautiously awaiting this week's US PCE inflation data.

Fed Governor Bowman said it will likely be "some time" before the U.S. can begin lowering interest rates.

US TSYS Off Lows, Tsys Discounting Fed Gov Bowman Opinion on Rate Cut Wait Time

- Treasury futures pared early morning gains, trading near steady after near in-line FHFA House Price Index MoM (0.2% vs. 0.3% est, prior down revised to 0.0% from 0.1%). More of a reaction to higher than expected Canada core CPI data as rates extended modest lows into midday.

- Contributing to the pressure, Federal Reserve Governor Michelle Bowman Tuesday said it will likely be "some time" before the U.S. central bank can begin lowering interest rates, warning that U.S. monetary policy over the coming months could diverge from that of other advanced economies.

- Large 2Y/10Y-utra bond flattener blocked at 0942:00ET: -28,000 TUU4 102-05.25, sell through 102-05.62 post time bid, DV01 $1.06M vs. +12,000 UXYU4 114-12.5, post time offer, DV01 $1.09M.

- Tsy Sep'24 10Y futures have drifted off lows in late trade, near the middle of the session range after the bell: TYU4 +2.5 at 110-19.5, 10Y yield 4.2282%, -.0039.

- Look Ahead: New Home Sales, 5Y Auction on Wednesday, main focus on PCE inflation data in the latter half of the week.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00244 to 5.34594 (+0.00071/wk)

- 3M -0.00117 to 5.33939 (-0.00516/wk)

- 6M -0.00306 to 5.26830 (-0.00728/wk)

- 12M -0.00372 to 5.04090 (-0.01075/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.992T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $755B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $737B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

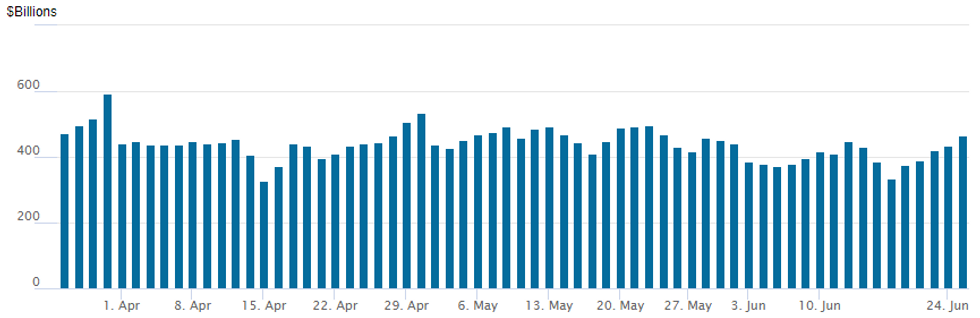

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $466.310B from $435.916B on Monday; number of counterparties at 74. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Treasury and SOFR options saw a modest pick-up in downside put structure buying Tuesday, underlying futures mildly higher, off midday lows by the bell. Projected rate cut pricing through year end are running steady mildly lower vs. morning levels: July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.4bp, Nov'24 cumulative -27.1bp, Dec'24 -46.8bp. Salient flow includes:SOFR Options:

- +20,000 SFRU4 94.06 puts, 0.25 ref 94.845

- +10,000 SFRU5 95.25/95.75 2x1 put spds 3.5 cr ref 95.915

- +20,000 SFRH5 96.75/97.75 call spds, 4.75

- 4,500 SFRZ4 94.81/95.00/95.25 2x3x1 put flys

- 5,800 SFRZ4 95.06/95.12/95.18/95.25 call condors

- +5,000 SFRU4 94.56/94.81/94.93 put fly 1.25 vs. 94.85

- -2,500 0QZ4 96.50/3QZ4 96.75 call spds 2.0

- +3,000 SFRN4 94.68/94.93/95.31/95.56 iron condor, 10.5 vs. 94.845/0.75%

- +10,000 SFRH5 96.00/0QH5 97.00 call spds 0.5

- 4,000 SFRH5 95.50/95.75 call spds vs. 0QH5 96.62/96.87 call spds

- 4,000 SFRU4 95.25/95.62 call spds, 0.5 ref 94.85

- 5,000 TYQ4 108 puts, 6 ref 110-16.5

- 5,000 TYU4 112 calls, 36 ref 110-21.5

- 3,000 FVQ4 108 calls, 11.5 last

EGBs-GILTS CASH CLOSE: Further Flattening

EGBs and Gilts closed Tuesday mixed, with curve flattening evident for the second consecutive session.

- After a constructive start to the day, albeit within the ranges seen since late last week, European yields ticked higher in early afternoon following stronger-than-expected Canadian CPI.

- The UK and German curves twist flattened, with a second consecutive session of short-end underperformance. Bunds modestly outperformed Gilts.

- Periphery EGB spreads closed modestly wider amid a broader subdued risk tone, partially reversing Monday's tightening.

- Wednesday's schedule includes UK CPI and German/French consumer confidence data. The week's focus continues to be Euro national level inflation data on Friday - MNI's preview will be published on Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at 2.809%, 5-Yr is down 0.6bps at 2.424%, 10-Yr is down 0.8bps at 2.411%, and 30-Yr is down 1.4bps at 2.601%.

- UK: The 2-Yr yield is up 2.1bps at 4.211%, 5-Yr is up 1.1bps at 3.952%, 10-Yr is down 0.2bps at 4.079%, and 30-Yr is down 0.8bps at 4.576%.

- Italian BTP spread up 0.7bps at 151.7bps / Spanish up 0.1bps at 85.9bps

EU Options Significant Sonia Condor Activity Of Note Tuesday

Tuesday's Europe rates/bond options flow included:

- RXQ4 135/136cs with 135.50/136.50cs strip sold at 24 in 3k

- SFIX4 95.30/95.40/95.50/95.60c condor, 13k total

- SFIZ4 95.00/95.10/95.20 put ladders bought for 0.75 in 2k

- ERU4 96.50/96.875/97.25 c fly, sold at 4 in 7.5k

- ERZ4 96.87/97.12 call spread paper paid 4.5 on 5K

FOREX: Euro Reverses Monday Advance as Markets Await More Significant Event Risk

- G10 currencies have shown only moderate adjustments Tuesday, as the USD index (+0.20%) reversed the majority of Monday’s move lower. In similar vein, EURUSD finds itself down 0.26%, oscillating either side of 1.0700 as French political risks continue to linger in the background.

- GBP/USD's early progress off the Monday low had the pair again testing 1.2700 and further gains through 1.2724 would form the beginnings of a reversal pattern off the recent low and support at the 50-dma. GBP’s resilience on Tuesday has seen EURGBP edge lower once more, having respected resistance around 0.8475 in the prior session.

- The greenback bid has helped USDJPY rise roughly 50 pips from session lows of 159.19 to once again narrow the gap to the psychological 160.00 mark. For now, the technical trend in USD/JPY remains bullish, but the intraday volatility noted during the Monday session shows markets remain subject to corrective pullbacks, especially against the backdrop of rising verbal intervention once more.

- USD strength was more notable in emerging markets, especially for USDMXN (+1.15%) as post-election volatility remains heightened ahead of Thursday’s Banxico decision. The current bull cycle in USDMXN remains in play and the pullback from the Jun 12 high still appears to be a correction. Support to watch lies at 17.9786, the 20-day EMA. It has been pierced, however, a clear break would be needed to expose the 50-day EMA at 17.5048.

- Australian CPI and US new home sales headline the data calendar on Wednesday before both the Riksbank and multiple emerging market central bank decisions on Thursday.

FX OPTIONS: Expiries for Jun26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E975mln), $1.0635(E1.6bln), $1.0675-80(E676mln), $1.0700-05(E1.6bln), $1.0725-30(E1.2bln), $1.0745-50(E2.0bln)

- USD/JPY: Y158.90-00($2.2bln), Y159.40-50($1.4bln), Y159.75($568mln), Y160.00($878mln)

- GBP/USD: $1.2635-55(Gbp855mln), $1.2700-05(Gbp730mln)

- AUD/USD: $0.6620-30(A$656mln), $0.6660(A$708mln)

- USD/CNY: Cny7.3000($1.3bln)

Late Equities Roundup

- Equities remain mixed after the bell, the Nasdaq outperforming as the DJIA completely reverses Monday's rally. Currently, the DJIA is down 254 points (-0.64%) at 39156.9, S&P E-Minis up 14.75 points (0.27%) at 5532, Nasdaq up 202.7 points (1.2%) at 17699.91.

- Information Technology and Communication Services sectors continued to lead gainers in late trade, Semiconductor stocks supported the IT sector as they recovered from better selling since last Friday: more than recovering from Monday's selling -- Nvidia trades +5.89% after Monday's near 5% decline. Meanwhile KLA Corp +2.99%, Monolithic Power +2.67%.

- interactive media and entertainment shares buoyed the former: Google +2.18%, Meta +12.15%, Meta +2.01% Charter Communications +1.26%.

- On the flipside, Real Estate and Materials sectors continued to underperform in late trades, investment trusts weighing on the former: Weyerhaeuser -2.67%, Healthpeak Properties -2.54%, SBA Communications -2.34%.

- Metals and mining shares weighed on the Materials sector: Nucor -2.69%, Steel Dynamics -2.09%, Newmont Corp -1.31%.

- The trend condition in S&P E-Minis is unchanged and remains bullish with the contract trading closer to its recent highs. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support to watch lies at 5458.51, the 20-day EMA.

E-MINI S&P TECHS: (U4) Trend Signals Remain Bullish

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5531.00 @ 1435 ET Jun 25

- SUP 1: 5458.51/5366.69 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The trend condition in S&P E-Minis is unchanged and remains bullish with the contract trading closer to its recent highs. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support to watch lies at 5458.51, the 20-day EMA.

COMMODITIES: Crude Eases Back, Gold, Silver Pierce Support

- WTI is headed for US close trading lower, with pressure from a stronger US dollar on the day. However, crude remains in the three-day trading range and expectations of a tighter balance over the summer is supportive.

- WTI Aug 24 is down 0.9% at $80.9/bbl.

- The OPEC production cut extension into Q3 and a potential summer boost to fuel demand are supporting prices despite the disappointing early summer demand data.

- For WTI futures, the recent move higher has resulted in a break of $80.11, the May 29 high and a key resistance. This paves the way for $82.24, a Fibonacci retracement point. Initial firm support to watch is $78.87, the 20-day EMA.

- Spot gold has fallen by 0.6% on Tuesday to $2,320/oz.

- Gold continues to trade below resistance and a bear threat remains present. The yellow metal has pierced the 50-day EMA at $2,318.3, below which a clear break would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

- Meanwhile, silver is underperforming, down 2.3% on the day at $28.9/oz. As a result, the gold-silver cross has risen to its highest level since May 17.

- Silver has now pierced support at $29.018, the 50-day EMA, opening $27.971, the May 13 low. A reversal higher would refocus attention on key resistance at $32.518, May 20 high.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2024 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 26/06/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/06/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 26/06/2024 | 0600/0800 | ** |  | SE | PPI |

| 26/06/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/06/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2024 | 1040/1240 |  | EU | ECB's Lane speech at Bank of Finland MonPol conference | |

| 26/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/06/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 26/06/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/06/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/06/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/06/2024 | 2000/2100 |  | UK | BBC Leaders Head-to-Head debate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.