-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Back Where We Started the Week

- Treasuries gapped lower in an apparent overreaction to lower than expected (noisy) weekly jobless claims data.

- Curves bear flattened while projected rate cuts through year end continued to ease off early week highs.

- Stocks pulled higher on the day, near highs for the week, lent to the nascent risk-on tone.

US TSYS Overreacting to Lower Than Expected Weekly Jobless Data

- Treasuries reversed early gains/gapped lower after weekly jobless claims came out lower than anticipated, continuing claims mildly higher -- tempered by down-revision of prior.

- A surprisingly large hawkish reaction to weekly jobless claims data that show little sign of an improvement in underlying terms, but do at least rule out a very latest deterioration for the labor market. Initial jobless claims were lower than expected in the week to Aug 3, at a seasonally adjusted 233k (cons 240k) as they retreated from a slightly upward revised 250k (initial 249k).

- Treasury futures remain near lows after Wholesale Trade Sales comes out lower than expected, Inventories in-line. Tsy Sep'24 10Y futures trade -8 at 112-20.5, vs. 112-16.5 low -- through technical support at 112-21 (Low Aug 2). Next support level well below at 111-30 (20D EMA). 10Y yield back over 4.0% to 4.0108% high. Eye on technical support at 112-21 Low Aug 2.

- Projected rate cut pricing into year end off early morning levels (*): Sep'24 cumulative -40.5bp (-44.8bp), Nov'24 cumulative -71.5bp (-77.6bp), Dec'24 -103.2bp (-109.3bp).

- Look ahead: No scheduled data, Fed speak or Tsy supply Friday. Next week sees PPI, CPI, Retail Sales, Home sales data and UofM inflation expectations.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00165 to 5.32666 (-0.02538/wk)

- 3M -0.00133 to 5.10283 (-0.12490/wk)

- 6M +0.00011 to 4.78487 (-0.22276/wk)

- 12M +0.01322 to 4.32457 (-0.27151/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $2.042T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $809B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $789B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $231B

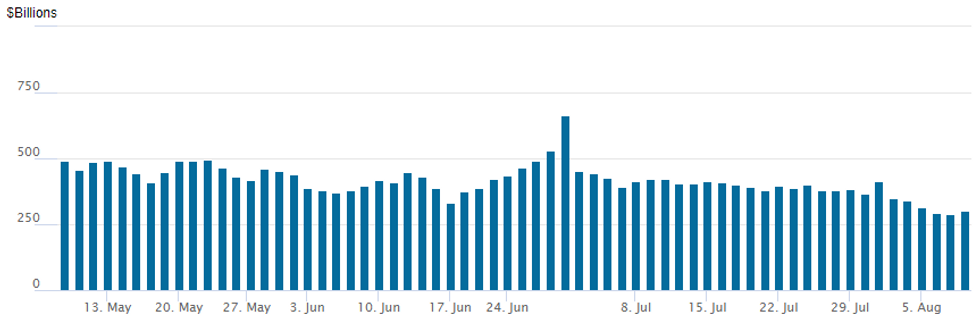

FED Reverse Repo Operation:

NY Federal Reserve/MNI

RRP usage rebounds back above $300B to $303.159B today, from $286.660B on Wednesday -- lowest since mid-May 2021. Number of counterparties climbs to 58 from 52 prior.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options looked mixed late Thursday, but still favored upside calls in the second half while underlying futures see-sawed near lows (TYU4 -7 at 112-21.5). Projected rate cut pricing into year end off early morning levels (*): Sep'24 cumulative -40.5bp (-44.8bp), Nov'24 cumulative -71.5bp (-77.6bp), Dec'24 -103.2bp (-109.3bp).

- SOFR Options:

- Block, 5,000 0QU4 96.50 puts, 5.0 vs. 96.745/0.30%

- +10,000 SFRH5 96.25/96.50 call spds 1.5 over SFRH5 95.50/95.75 put spds

- -7,000 SFRZ5 93.75/94.25/94.75 put flys, 1.5 ref 96.73

- -4,000 0QZ4 96.25/96.75 call spds vs. 3QZ4 96.50/96.75 call spds, 5.75 net

- Block, 5,000 SFRZ4 95.50/95.75 call spds 11.5 ref 95.74

- Block, 5,000 SFRH5 96.00/96.31 3x2 put spds, 11.5

- -5,000 SFRQ4 95.00/95.12 call spds w/ SFRU4 95.00/95.18 call spd strip, 17.5

- +5,000 0QH4 96.00 puts sv 3QH4 96.00 puts 1.5 net/flattener

- +5,000 SFRZ4 95.75/96.00 call spds 7.5 ref 95.73

- +5,000 0QV4 96.00/96.50 put spds v 2QV4 96.06/96.56 put spds 1.5

- +5,000 SFRU4 95.00 puts, 2.0

- -5,000 2QU4/3QU4 97.00/98.50 call spd spd, 3.0 net cr flattener

- +4,000 SFRV4/SFRX4 95.87/96.00/96.12 call fly strip, 2.25

- over -32,000 SFRU4 95.25 calls, 9.0 ref 95.20 (closer, OI>293k)

- 6,000 SFRU4 95.18/95.31/95.43 call flys ref 95.21

- over -40,000 SFRZ4 95.25/95.50 call spds, 19.5 ref 95.855 to -.85 (closer, OI 325k-365k)

- 2,000 SFRZ4 95.06/95.18/95.31 put flys ref 95.875

- Treasury Options:

- Block/screen, +18,000 Monday weekly 10Y 112 puts, 3

- Block, 12,500 TYU4 112 vs. TYV4 116 1x2 call spds, 25 net vs. 112-24/0.30%

- 9,000 TYV4 115.5 calls, 25 ref 113-06.5

- 1,500 FVU4 110/111 2x3 call spds 7.5 ref 108-21.25

- 1,500 TYU4 111/111.75/112.5 put flys ref 112-23

- 7,500 wk3 TY 114/114.5 2x3 call spds, 8 net ref 113-06.5 (exp Aug 16)

- +6,000 TYU4 113.5/114.5 call spds vs. 112.5 puts, 0.0-2.0 ref 113-09

- over 10,500 FVU4 111.5 calls, 3 last ref 108-31.75

- 3,000 wk2 FV 108.5/108.75 put spds expire tomorrow

FOREX: Solid Session for Equities Weighs on EURAUD

- The strong performance for major equity benchmarks on Thursday has further supported a reversal of the sharp risk off moves in currency markets earlier in the week. As such the risk sensitive AUD has outperformed, bolstered by early hawkish rhetoric from RBA Governor Bullock.

- As such, AUDUSD stands 0.90% in the green and moderate pressure on the single currency sees EURAUD slide over 1%. As a reminder, this cross reached the highest level since H1 2020 on Monday and has swiftly reversed 3.6% since this peak. Price action was underpinned by a hawkish tilt to the RBA Governor’s comments earlier in the session, indicating the committee won’t “hesitate” to hike if needed.

- In similar vein, MXNJPY has risen 1.23% on Thursday and continues to be the most sensitive currency pair to adjustments in risk sentiment, owing to the severe carry trade unwind in recent weeks. USDMXN is down 0.90% ahead of this evening’s Banxico decision, which remains a close call.

- Elsewhere, lower-than-expected initial jobless claims in the US provided USDJPY with a firm boost. Markets have grabbed onto the faintest signs of strength (233k vs 240k exp) in the labour market to further undo the sharp moves in the aftermath of last week’s unemployment report.

- USDJPY gapped higher on the release, rising from just above the 146.00 mark to print as high as 147.54. The first topside level is at 147.90 before initial resistance is found at 149.77, the Aug 2 high.

- Risk-on also weighed further on the Swiss Franc with both EURCHF and USDCHF rising around 0.5%.

- China CPI/PPI will be in focus overnight before Canada employment data caps off the event risk this week.

Late Equity Roundup: Chip Makers, Entertainment Shares Outperforming

- Stocks continued to inch higher late Thursday, nearing highs for the week as this morning's weekly jobless claims help stocks shrug off Monday's rout. Currently, the DJIA trades up 701.6 points (1.81%) at 39464.91, S&P E-Minis up 122.5 points (2.34%) at 5350.25, Nasdaq up 479.2 points (3%) at 16674.71.

- Information Technology and Communication Services sectors led the broad based rally, semiconductor makers supporting the IT sector: Monolithic Power +10.26%, ON Semiconductor +8.61%, KLA Corp +7.71%. Interactive media and entertainment shares continued to support the Communication Services sector: Meta +3.33%, Netflix +3.26%, Google +2.78%.

- Meanwhile Utility and Real Estate sectors continued to lag the rally in late trade, gas and multi-energy providers pared midweek gains: Dominion Energy -1.11%, Eversource Energy -0.75%, Atmos Energy -0.72%. Specialized and residential estate trust shares lagged: American Tower -1.3%, Crown Castle -0.60%, Vici Properties -0.51%.

- Expected earnings announcements after the close include: Take-Two Interactive Software, Expedia Group, Sweetgreen Inc, Insulet Corp, Trade Desk Inc, Array Technologies, Five9, Paramount Global, Iovance Biotherapeutics Inc, Bloom Energy Corp and Gilead Sciences Inc.

E-MINI S&P TECHS: (U4) Trend Outlook Remains Bearish

- RES 4: 5721.25 High Jul 16 and Key resistance

- RES 3: 5600.75 High Aug 1

- RES 2: 5465.14 50-day EMA

- RES 1: 5359.25 High Aug 7 & 8

- PRICE: 5330.00 @ 1540 ET Aug 8

- SUP 1: 5120.00 Low Aug 5

- SUP 2: 5185 50.76.4% retracement of the Apr 19 - Jul 16 bull leg

- SUP 3: 5092.00 Low May 2

- SUP 4: 5020 Low Apr 19 and a key support

S&P E-Minis traded lower Monday, starting this week on a bearish note and this confirmed an extension of the bear cycle. The move down has resulted in a print below 5185.50, 76.4% of the Apr 19 - Jul 16 bear leg. A clear break of this level would open 5092.00 next, the May 2 low. Wednesday’s intraday high of 5359.25 marks initial resistance. The 50-day EMA, a firmer level, is at 5465.14. Gains are considered corrective - for now.

COMMODITIES Crude on the Rise, Precious Metals Rebound

- WTI has gained ground after more reassuring US jobless data stemmed some of the growing pessimism for the near-term macroeconomic outlook.

- WTI Sep 24 is up 1.5% at $76.3/bbl.

- Key resistance is seen at $78.88, the Aug 1 high. Short-term gains would allow an oversold condition to unwind. Key support lies at $72.23, the Jun 4 low.

- Spot gold has risen by 1.8% to $2,425/oz today, putting the yellow metal on course for its first gain in six sessions.

- Recent weakness in gold appears to be a correction. A resumption of gains would open $2,483.7, the Jul 17 high, while support is seen at the 50-day EMA, at $2,377.4.

- Silver has rallied by 3.4% to $27.5/oz.

- Initial firm resistance has been defined at $28.967, the 50-day EMA, while key support lies at $26.018, the May 2 low.

- Platinum has also risen by 2.0% to $936/oz, amidst the further recovery in risk sentiment today.

- Meanwhile, copper is up by 0.7% at $398/lb, lifting the red metal off the near five-month low reached yesterday.

- A bear cycle in copper futures remains intact and the clear break of $405.57, 76.4% of the Feb 9 - May 20 bull cycle, opens $372.35, the Feb 9 low. Initial firm resistance is $431.27 the 50-day EMA.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2024 | 0130/0930 | *** |  | CN | CPI |

| 09/08/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/08/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 09/08/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 09/08/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 09/08/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 09/08/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.