-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS:Corporate Bond Issuance Hits 2s & 3s

- MNI Yellen To Warn Of Supply Chain Risks In Major Inflation Reduction Act Speech

- MNI US: White House Struggles To Sell Inflation Reduction Act To Voters

- US Weighs Making Banks Issue Long-Term Debt to Bolster Stability, Bbg

- Morningstar: Country Garden: Fair Value Trimmed on Increasing Likelihood of Default and Subdued Profitability

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Markets Roundup: Exogenous Risk, Deal Tied Hedging Weigh on Tsys

- Treasury futures are trading mildly weaker again, back near the middle of the session range. Treasury futures quickly reversed early session gains, rising yields partially tied to Hong Kong real estate developer/services company Country Garden's sell-off post MS downgrade overnight.

- Rate lock hedges vs. Bank of America $5B debt issued in 2s and 3s added to curve flattening (2Y10Y -3.262 at -77.717) pressure in the front end (total of $9B high grade corporate debt to price Monday).

- No data or Fed speakers Monday, data resumes Tuesday with Retail Sales, import/export index and TIC flows. Minutes for July FOMC this Wednesday.

- Meanwhile, according to Punchbowl, “House Republicans have a conference call tonight at [18:00 ET 23:00 BST] to discuss FY2024 government funding, the thorniest issue they’ll face this fall [and] Speaker Kevin McCarthy [R-CA] is hosting his annual retreat in Jackson Hole, Wyo., this week.”

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00213 to 5.31261 (-.00976 total last wk)

- 3M +0.00726 to 5.37183 (-0.00601 total last wk)

- 6M +0.01688 to 5.43196 (-0.01911 total last wk)

- 12M +0.04862 to 5.35444 (-0.05653 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.31% volume: $271B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.347T

- Broad General Collateral Rate (BGCR): 5.28%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $547B

- (rate, volume levels reflect prior session)

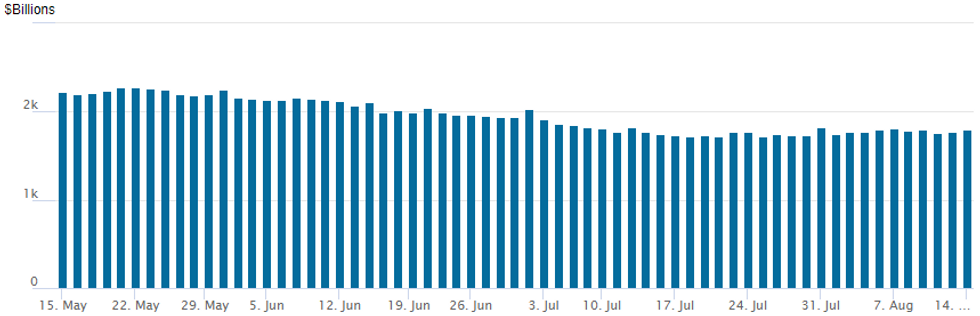

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The latest operation climbs to $1,799.311B, w/103 counterparties, compared to $1,773.236B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Mixed FI options trade remained mixed Monday, overall volumes improved as SOFR and Treasury puts outpaced calls by midmorning as underlying futures sold off. Second half derivatives trade turned muted as underlying futures bounced off lows but remained weaker in the short end. Rate hike projections through year end firmed slightly, Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.1bp at 5.430, December cumulative of 8.4bp at 5.410%. Fed terminal climbed to 5.43% in Nov'23.

- SOFR Options:

- Block, total 20,000 SFRH4 94.00/94.37 put spds vs. SFRM5 94.75/95.00 put spds, 6.5 net, Red Jun'25 over

- Block, total +20,000 SFRH4 94.87/95.37 call spds vs. SFRM5 96.50/97.00 call spds, 7.5 net, Red Jun'25 over

- Block, 5,000 SFRZ4 95.25/95.75/96.25 put flys, 6.5 ref 95.775

- 2,500 0QU3 95.37/95.50 put spds

- +5,000 SFRZ3 94.37/94.62/94.75 broken put tree, 5.25/1-leg over

- +3,000 SFRH4 97.00/98.50 call spds .75 over 0QH4 98.00/99.50 call spds, .75

- 7,000 2QU3 97.37/97.50 call spds ref 96.245

- 1,500 SFRZ3 94.75/95.25 call spds ref 94.59

- 5,000 SFRF4 94.18/94.37/94.56 put flys ref 94.83

- Block/screen, 8,000 SFRM4 96.00/97.00/98.00 call flys, 7.0 ref 95.175 to -.18

- Block, 2,500 SFRZ3 95.75 calls, 4.0 vs. 94.63/0.09%

- 6,000 0QV3 95.62/95.87 put spds vs. 2QV3 96.12/96.37 put spds,

- 2,000 SFRV3 94.25/95.37 strangles or combos, ref 94.605

- 1,300 SFRU3 94.25/94.50 put spds ref 94.5875

- Treasury Options:

- 2,500 FVU3 106.75/107.5/108.25 call flys ref 106-06.25

- 4,000 TYV3 114/116 call spds

- 2,000 TYV3 110.5/TYZ3 109 put spds 7 ref 110-19

- 4,200 FVU3 105.75 puts, 18 ref 106-01

- 2,000 FVU3 107/107.5 call spds, 3.5 ref 106-05.75

- over 6,000 3MQ3 109 puts 6

- 2,400 TYU3 110.25 calls, 35 last

- over 6,700 TYU3 111 calls, 18-11 109-25.5 last

- 2,400 TYU3 110 puts, 31 last

- 1,500 TYU3 108.5/109.5 put spds ref 110-07.5

- 1,500 TYWQ3 109.5/110 put spds, 11 ref 110-08.5

- 5,000 FVWQ3 105.5/105.75 put spds, 1 ref 106-06.75

EGBs-GILTS CASH CLOSE: 30Y Yields Stand Out Despite Bear Flattening

The German and UK curves bear flattened to start the week amid limited trading volumes, with US Treasuries leading the selloff rather than any Europe-specific catalysts.

- UK yields hit the highest levels since July across the curve, with the exception of 30Y yields which hit the highest since Oct 2022.

- German yields remained within recent ranges but 30Y yields briefly hit the highest since Jan 2014 (2.727%).

- BoE hike pricing picked up sharply (ECB peak rates edged higher to lesser extent) ahead of Tuesday's main highlights of UK jobs data (we put out a short preview of this today) and German ZEW, with UK CPI Wednesday the main event of the week.

- Periphery spreads were mixed, befitting a mixed day for risk assets - Greece outperformed, with Italy underperforming.

- Reminder that while markets remain open across Europe Tuesday, trading may be thinned by Assumption Day holidays observed in several countries.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.9bps at 3.078%, 5-Yr is up 2.2bps at 2.652%, 10-Yr is up 1.4bps at 2.637%, and 30-Yr is up 0.3bps at 2.709%.

- UK: The 2-Yr yield is up 4.9bps at 5.081%, 5-Yr is up 4.1bps at 4.571%, 10-Yr is up 3.9bps at 4.566%, and 30-Yr is up 2.5bps at 4.753%.

- Italian BTP spread up 1.2bps at 164.2bps / Greek down 2.1bps at 126bps

EGB Options: Downside Bought, Upside Unwound To Start The Week

Monday's Europe rates / bond options flow included:

- DUU3 104.90/104.70 put spread bought for 6.25 in 5k

- ERH4 96.125/96.75 1x1.5 call spread sold at 12.75 in 4.25k (vs 96.16)

- Buys 5k ERZ3 95.875/95.625 1x1.5 put spread vs selling 2.5k ERZ3 96.625 call -buys the put spread for 0.625

- Sells 5k SFIH4 94.00/94.30 call spread, buys 5k SFIH4 93.00/92.70 put spread -sells the call spread at 12.5. Hearing this is taking profit on a bullish position

FOREX USD/JPY Firms Further With Wider Yield Differential

- The front-end of the US yield curve extended higher in Monday trade, putting the US 2y yield within range of 5.00% (at one point touching 4.97%), a level last crossed at the beginning of July. This dictated play across currency markets, with the greenback firmer against all other G10 peers although off highs as fixed income markets pared some of those losses.

- Dollar strength played out via new highs in USD/JPY with an earlier 145.58, clearing levels seen earlier in 2023 to trade at Nov'22 levels and prices at which the Japanese authorities last intervened in the currency.

- Concurrently, the JPY trade-weighted index has continued to hit new pullback lows and is through the early July lowest levels - now clearing at levels not seen since the 1980s. Kanda, Japan's currency official, last stated the MoF would consider all options on "excessive" currency moves on July 21st. Trade-weighted JPY has fallen more than 2.5% since.

- Scandi currencies were the poorest performers as markets took a risk-off footing in response to reports out of China suggesting economic fragility is not contained to just the property sector, as a notable wealth manager missed payments to investors. The Hang Seng and Shanghai Composite both posted losses into the close.

- Focus Tuesday turns to RBA minutes, Chinese industrial production and retail sales for July as well as UK jobs, German ZEW, Canadian CPI and US retail sales releases. Fed's Kashkari is the sole CB speaker.

FX Expiries for Aug15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800-10(E1.8bln), $1.0850(E740mln), $1.0900(E809mln), $1.0930-41(E2.0bln), $1.1000(E1.2bln)

- USD/JPY: Y143.50($1.0bln), Y144.00-05($560mln), Y145.00($731mln), Y146.00($898mln)

- EUR/GBP: Gbp0.8600-05(E614mln)

- AUD/NZD: N$1.0900(A$547mln)

- USD/CAD: C$1.3400($622mln)

- USD/CNY: Cny7.1000($2.1bln), Cny7.2400($1.1bln)

Late Equity Roundup: Chip Stocks Outperform

- Stocks trading mostly firmer, upper half of session range with DJIA underperforming. Modest rally in stocks led by a rebound in semiconductor stocks after better selling noted in the latter half of last week. Currently, DJIA shares are down -47.42 points (-0.13%) at 35232.47, S&P E-Mini future up 14 points (0.31%) at 4494.75, Nasdaq up 104.3 points (0.8%) at 13748.83.

- Leading gainers: Information Technology continued to outperform as chip makers drew ongoing support: Nvidia +6.25%, Micron +5.65%, Teledyne +4.85%. Communication Services also bounced after better selling late last week. Media and entertainment shares buoyed the former: with News Corp +1.4%, Twitter +1.2%, Google +0.75%.

- Laggers: Utilities and Real Estate sectors lagged Monday. Independent power and renewable energy shares trading weaker: AES -3%, Dominion Energy -2.15% while Edison Int slipped 1.8%. Real Estate shares weighed by Office and Residential REITS: Boston Properties -2.5%, Equity Residential -2.45%, Avalon Bay -2.35%.

- Meanwhile, quarterly earnings are winding down, this week's highlights include: Home Depot, Agilent Technologies, Target Corp, TJX Cos, Synopsys, Cisco Systems, Walmart, Applied Materials, Estee Lauder, Deere and Palo Alto Networks Inc.

E-MINI S&P TECHS: (U3) Bearish Extension Exposes Key Support

- RES 4: 4670.58 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 3: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 2: 4560.75 High Aug 4

- RES 1: 4523.60 20-day EMA

- PRICE: 4494.50 @ 1520 ET Aug 14

- SUP 1: 4459.00 Low Jul 14

- SUP 2: 4450.90 Bull channel base drawn from the Mar 13 low

- SUP 3: 4411.25 Low Jul 10

- SUP 4: 4368.50 Low Jun 26

Bearish conditions in the E-mini S&P contract remain intact despite a modest bounce in prices across the European morning. Price continues to trade closer to recent lows. Friday’s move lower resulted in a test of the 50-day EMA at 4462.48. A clear break of this average would expose 4450.90, the base of a bull channel drawn from the Mar 13 low. Clearance of this support would strengthen a bearish threat. Resistance to watch is 4560.75, Aug 4 high.

COMMODITIES Crude Nudges Lower Whilst Gold Takes Another Step Nearer Support

- Crude pulls back from highs seen last week as market focus turns to oil demand growth in China with concern for a worsening property sector ahead of official data released this week. Further, a push higher in Treasury yields and USD acted as a headwind for risk assets.

- Crude managed money net long positions remain stable, but diesel positioning continues to increase according to Friday’s CFTC data. The combined net long positions for Brent and WTI decreased slightly from the 15 week high seen the previous week, by -6k to 397k. ICE Gasoil net positions extended the recent gains up to the highest since March 2022 and Nymex diesel the highest since Feb 2022 amid tight global diesel markets.

- Crude in floating storage that has been stationary for at least seven days fell by 4.2% last week to 99.67mn bbl as of 11 August.

- WTI is -0.7% at $82.57 and keeps within technical ranges with resistance at $84.89 (Aug 10 high) and support at $78.69 (Aug 3 low).

- Brent is -0.6% at $86.26 and keeps to technical ranges with resistance at $88.10 (Aug 10 high) and support at $82.36 (Aug 3 low).

- Gold is -0.3% at $1908.69, coming under pressure from the aforementioned FI sell-off and US dollar strength. The yellow metal touched a low of $1902.78 to take another step closer to support at $1902.8 (Jul 6 low) before bouncing as Treasuries pared losses and the USD index pulled back off highs.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 15/08/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/08/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/08/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/08/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/08/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 15/08/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 15/08/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/08/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/08/2023 | 1230/0830 | *** |  | CA | CPI |

| 15/08/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/08/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/08/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/08/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/08/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/08/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/08/2023 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 15/08/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.