-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: CPI Miss Rekindles Rate Cut Pricing

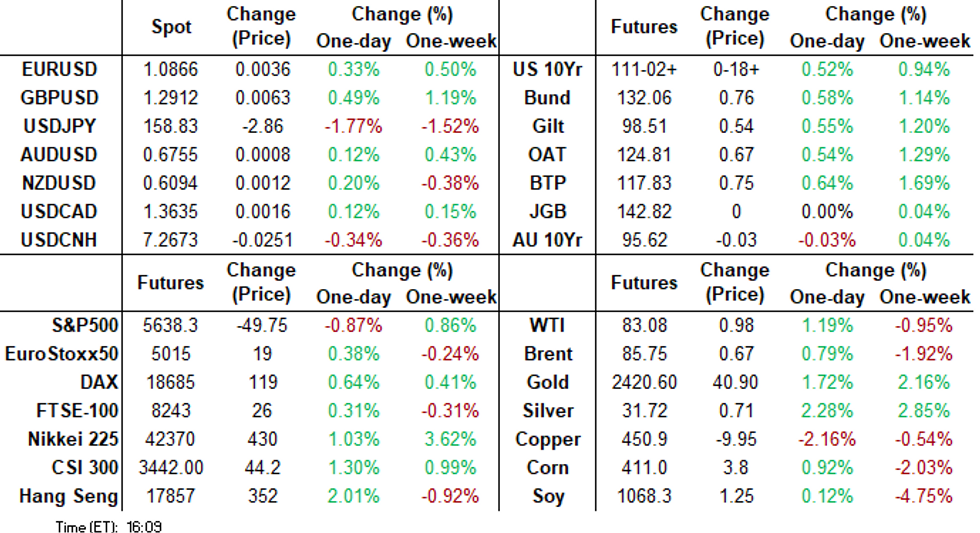

- Treasuries gapped higher as the lower than expected CPI data showed inflation cooled in June.

- Supercore (services ex-housing) inflation printed negative again, the first back-to-back deflations since Aug-Sep 2021.

- USDJPY plummeted amid market speculation the Bank of Japan may have intervened in the currency given the aggressive moves following the data.

US TSYS June CPI Inflation Miss Rekindles Rate Cut Pricing, Little Fed Pushback

- Treasury futures gapped higher after June CPI inflation data came out lower than expected, curves bull steepened as rate cut pricing into year end gained momentum.

- Supercore (services ex-housing) inflation printed negative again, at -0.05% (-0.04% prior), vs +0.27% expected, for the first back-to-back deflations since Aug-Sep 2021 (the lowest analyst expectation we'd seen was Nomura's +0.15%). Overall core services printed just +0.13%, vs +0.32% MNI avg (and 0.22% May), the lowest since August 2021.

- Overshadowed by the surprisingly soft CPI report, jobless claims data offered the first week since early May with both initial and continuing claims coming in lower than expected.

- Little pushback from the Fed: San Francisco Fed President Mary Daly said Thursday that policy "adjustments" appear to be warranted at some point because the central bank's dual mandate goals are coming into better balance, while saying the exact timing of a move is less important than keeping the economy on track.

- Treasury support waned slightly after the $22B 30Y auction reopen (912810AU4) tailed 2.1bp: 4.405% high yield vs. 4.384% WI; 2.30x bid-to-cover vs. 2.49x in the prior month.

- Focus turns to Friday's June PPI and UofM Sentiment and the start of the latest equity earnings cycle: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup headlining.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00007 to 5.32880 (+0.00137/wk)

- 3M -0.00272 to 5.30137 (-0.00552/wk)

- 6M -0.00883 to 5.20508 (-0.02139/wk)

- 12M -0.01435 to 4.94460 (-0.06089/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $1.949T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $767B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $745B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $257B

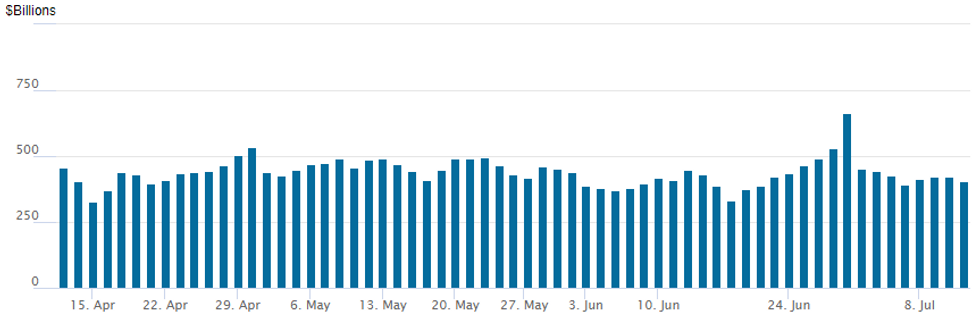

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $403.708B from $422.147B on Wednesday. Number of counterparties: 71 from 76 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Heavy SOFR and Treasury options leaned bullish Thursday as underlying futures held strong gains in the aftermath of this morning's lower than expected June CPI inflation data. The bull steepening rally that saw 2- and 5Y yields slip to mid-March levels, also saw projected rate cut pricing into year end gain momentum: July'24 at -4.5% w/ cumulative at -2.1bp at 5.307%, Sep'24 cumulative -24.9bp (-18.6bp pre-data), Nov'24 cumulative -40.1bp (-31bp pre-data), Dec'24 -61.5bp (-50.5bp pre-data). Salient flow includes:

- SOFR Options:

- +5,000 SFRU4 95.18/95.31 call spds 0.5 ref 94.94

- +5,000 SFRU4 95.00/95.12 call spds vs 94.75 puts +1.0 ref 94.945

- +15,000 SFRZ4 95.00/95.18/95.37 call flys 5.25 ref 95.315

- +10,000 SFRH5 95.37/95.75 2x1 put spds +3.5-3.75 ref 95.66

- -6,000 SFRQ4 94.87 puts 2.25 vs. 94.92/0.26%

- +5,000 SFRQ4 95.00/95.12 call spds, 1.0 ref 94.93

- 8,000 SFRU4 95.06/95.12 call spds, 0.62 ref 94.93

- -5,000 SFRU4 94.68/94.81/95.00 call flys, 0.75 vs. 94.91/0.24%

- +10,000 SFRZ4 95.50 calls, 11.5 vs. 95.31/0.34%

- +5,000 SFRZ4 94.93/95.06/95.25/95.37 call condors 4.5 ref 95.295

- -5,000 0QU4 96.25/965.0 call spds, 8 ref 96.19

- -5,000 SFRZ4 94.75/95.00 put spds .25 over 95.50/95.75 calls spd

- Block, 5,000 SFRU4 94.68/94.93 put spds, 5.5

- 5,000 SFRU4 94.75/94.87 put spds ref 94.93

- Block, 8,000 SFRU4 95.12/95.25 call spds, 0.75 vs. 94.94/0.05%

- Block, -60,000 SFRZ4 94.75 puts, 2.0 from 0750-0801ET, more on screen

- Block, 4,000 SFRV4 95.37/95.87 call spds 5.5 vs. 95.23/0.10%

- Block, 4,000 SFRZ4 95.00 puts, 8.0 ref 95.195/0.20%

- 10,000 0QU4 96.37/96.87 call spds vs. 2QU4 96.75/97.25 call spds

- 4,000 SFRZ4 94.93 puts ref 95.20

- Block, 3,000 SFRZ4 95.00 puts, 8.0 ref 95.205

- 3,000 SFRZ4 94.87/95.00 put spds vs. 95.25/95.37 call spds ref 95.20

- 10,000 SFRZ4 95.25/95.37/95.50 call flys ref 95.205

- 7,000 SFRZ4 95.25/95.37/95.50/95.62 call condors

- 6,000 SFRZ4 95.00/95.25/95.50 call flys

- Treasury Options:

- -13,000 TYU4 107/108/109 put trees, 3 ref 111-06.5 to -05

- 2,000 TYU4 111.5 straddles, 152

- 2,000 TYU4 111 straddles, 147

- 1,500 TYU4 108/109.5 2x1 put spds

- 14,000 wk2 FV 107.75 calls, 0.5 ref 106-29 to -29.25

- Block, 4,000 wk1 TY 109.5/110.5/111.5 call flys, expire Aug 2

- 5,500 wk2 TY 111.5/111.75 call spds, expire tomorrow

- 4,700 TYU4 109.5 puts, 31 ref 110-16.5

- 4,800 TYQ4 111.25 calls, 14 ref 110-15 to -14.5

- 17,000 TYQ4 111/111.5 call spds, 9 ref 110-13

EGBs-GILTS CASH CLOSE: Soft US CPI Drives European Bull Steepening

European curves bull steepened Thursday as a downside US inflation surprise drove a dovish repricing in central bank cut expectations.

- With the highly anticipated US June CPI release coming in softer than expected, global FI rallied sharply in the European afternoon session.

- Earlier in the session, Gilts had weakened after firmer-than-expected UK GDP data, and follow-through from hawkish rhetoric late Wednesday from BoE's Pill and Mann.

- Bunds outperformed Gilts on the day, with both the UK and German curves bull steepening.

- In sympathy with US Fed cut repricing, an August BoE cut is now back to around a 50/50 proposition, vs closer to 40% pre-CPI. While the ECB still isn't seen moving at its meeting next week, September cumulative cut pricing pushed up to close to 90%, vs under 80% pre-US CPI.

- The 10Y OAT/Bund spread reversed early tightening to close basically flat. Periphery EGB spreads closed mixed and little changed overall.

- Friday's European calendar sees few impactful events (final French and Spanish inflation), with US inflation data (PPI) once again likely to be at the fore.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10.5bps at 2.792%, 5-Yr is down 8.7bps at 2.439%, 10-Yr is down 7bps at 2.463%, and 30-Yr is down 3.7bps at 2.658%.

- UK: The 2-Yr yield is down 5.5bps at 4.068%, 5-Yr is down 5.8bps at 3.922%, 10-Yr is down 5.2bps at 4.074%, and 30-Yr is down 4.7bps at 4.589%.

- Italian BTP spread unchanged at 132.1bps / Spanish bond spread up 0.6bps at 76.9bps

EGB Options: Mostly Call Structure Buying Thursday

Thursday's Europe rates/bond options flow included:

- RXQ4 134/135cs bought for 3.5 in 6.2k

- RXU4 133.50/134.50cs, bought for 14 in 2.11k

- 0RN4 97.25/97.50/97.62c fly sold at 1.75 in 3k

- SFIQ4 95.10/95.20/95.35c fly, bought for 3.25% in 1.5k

FOREX USDJPY Plummets Post Soft US CPI, Potential Intervention Exacerbates Decline

- Despite the broad-based greenback weakness in the aftermath of the weaker-than-expected US CPI report for June, all the focus is on the Japanese Yen. Market speculation is that the Bank of Japan may have intervened in the currency given the aggressive moves following the data.

- USDJPY had initially sold off around 90 pips following the release from 161.58 to 160.65. However, shortly after the data release, USDJPY took a very aggressive next leg lower, printing as low as 157.44 in short order before stabilizing. The pair is 1.9% lower on the session.

- Lower core yields and a positioning squeeze will have undoubtedly been working in favour of the Japanese yen, however, the relative outperformance and subsequent commentary from Japanese officials point to the high likelihood of central bank intervention. For reference, Japan’s Kanda said recent moves are not reflecting fundamentals and are not stable, without giving an explicit reference to the MOF taking action.

- The pair has traded through the 20-day EMA and this exposed the next important support at 158.11, the trendline drawn from the Dec 28 low last year. The line has been pierced, a clear break is required to highlight a potential reversal. This would open 156.83, a Fibonacci retracement.

- Elsewhere, the USD index sits 0.6% in the red, and the likes of EURUSD and GBPUSD are holding onto moderate gains as we approach the APAC crossover. EURGBP continues to edge further away from 0.8500, underpinning the bearish technical conditions. Below here, 0.8397, the Jun 14 low represents the bear trigger.

- China trade data is due overnight, before US PPI and prelim UMich sentiment and inflation expectations data round off the week’s calendar.

FX OPTIONS: Expiries for Jul12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E2.5bln), $1.0650(E1.6bln), $1.0685-00(E2.5bln), $1.0800(E1.7bln), $1.0820-25(E910mln), $1.0850(E968mln), $1.0870-75(E588mln), $1.0890-00(E991mln)

- USD/JPY: Y160.50($1.2bln), Y161.95-00($1.3bln)

- AUD/USD: $0.6790-00(A$965mln)

- USD/CAD: C$1.3630-50($2.2bln)

Late Equities Roundup: Off Lows, DJIA Outperforming

- Stocks are mostly weaker in late Thursday trade, off second half lows with the Dow outperforming. S&P Eminis and Nasdaq consolidated after climbing new all-time highs (5,707.75 and 18,661.46 respectively) after this morning's lower CPI data showed a decline in inflation metrics for June.

- Currently, the DJIA is up 41.07 points (0.1%) at 39762.84, S&P E-Minis down 44.75 points (-0.79%) at 5643.25, Nasdaq down 330.2 points (-1.8%) at 18317.35.

- Information Technology and Communication services sectors continued to underperform in late trade, semiconductor makers reversing midweek gains: Lam Research -5.42%, Applied Materials -4.74%, Nvidia -4.6%.

- Interactive media and entertainment shares weighed on the Communication services sector: Meta -4.37%, Netflix -4.02% Google -2.67%.

- Conversely, Real Estate and Utilities sectors continued to lead gainers in late trade, estate management shares stronger: SBA Comm +6.90%, Alexandria Real Estate +6.27%, CoStar Group +4.9%. Water and gas shares supported the Utilities sector: AES Corp +3.85%, Dominion Energy +3.47%, American Water Works +2.55%.

- Reminder, banks kick off the latest equity earnings cycle tomorrow: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup headlining.

E-MINI S&P TECHS: (U4) Bullish Trend Sequence Extends

- RES 4: 5764.00 3.50 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5741.34 3.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5713.31 3.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5707.75 Intraday high

- PRICE: 5642.50 @ 1500 ET Jul 11

- SUP 1: 5630.75 Low Jul 10

- SUP 2: 5551.21/5445.59 20- and 50-day EMA values

- SUP 3: 5267.75 Low May 31 and key support

- SUP 4: 5213.25 Low May 6

The trend condition in S&P E-Minis is bullish and the contract has traded to a fresh trend high once again today. The continuation higher confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. Moving average studies are in a clear bull-mode set-up too and this continues to highlight positive market sentiment. Sights are on the 5713.31, a Fibonacci projection. Firm support is at 5551.21, the 20-day EMA.

COMMODITIES Gold Rallies As Fed Rate Cut Hopes Grow, Oil Trading Higher

- Spot gold has risen by 1.8% to $2,415/oz today, taking it to its highest level since May 22.

- The yellow metal rallied following today’s soft US June CPI data, which showed back-to-back declines for "supercore" prices, increasing prospects for an earlier Fed rate cut.

- Today’s gains reinforce short-term bullish conditions, resulting in a breach of $2,387.8, the Jun 7 high. This has opened key resistance at $2,450.1, the May 20 high.

- In contrast, copper has fallen by 2.1% to $451/lb, bringing the red metal to its lowest since July 03.

- Prices declined as inventories in London Metal Exchange warehouses rose to a fresh two-year high.

- Analysts at Macquarie said that a broad rise in stockpiles suggests that surpluses are emerging across the industrial metals markets, at a time when demand is typically strongest.

- Meanwhile, crude is set to close higher after struggling for clear direction during the day. Yesterday’s EIA stock draw has been supportive, while a gradual reopening of operation on the USGC will assuage concerns for longer-term disruption.

- WTI Aug 24 is up 0.6% at $82.6/bbl.

- WTI futures have recovered from yesterday’s low and the recent bear leg appears to have been a correction.

- Sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $79.91, the 50-day EMA.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 12/07/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 12/07/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/07/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/07/2024 | - | *** |  | CN | Trade |

| 12/07/2024 | - | *** |  | CN | Money Supply |

| 12/07/2024 | - | *** |  | CN | New Loans |

| 12/07/2024 | - | *** |  | CN | Social Financing |

| 12/07/2024 | 1230/0830 | *** |  | US | PPI |

| 12/07/2024 | 1230/0830 | * |  | CA | Building Permits |

| 12/07/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 12/07/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 12/07/2024 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.