-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA MARKETS ANALYSIS: Curves Twist Steeper, Stocks Falter

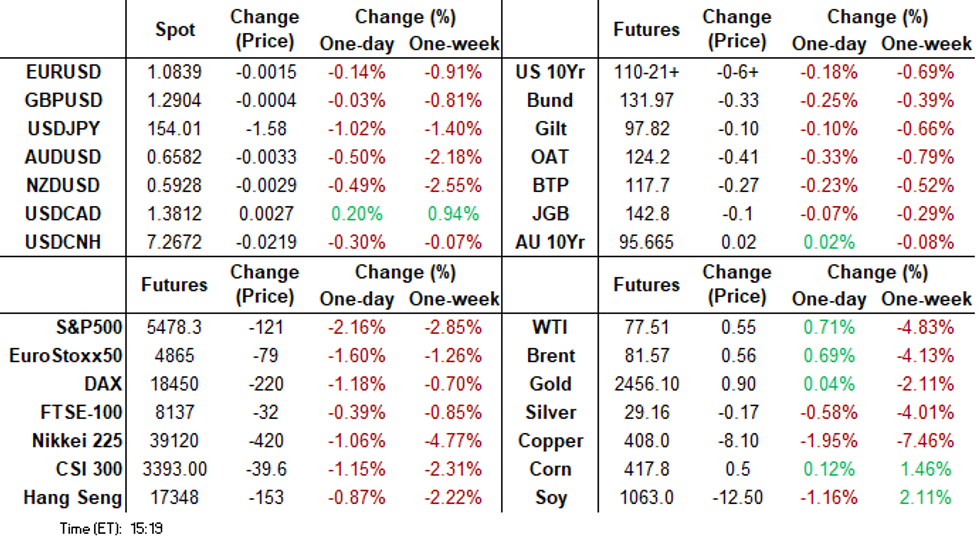

- Treasury curves twist steeper Wednesday, short end rates well bid after former NY Fed Pres Dudley suggested rate cuts warranted now, not later in the year.

- Stocks tumbled, Nasdaq -3.5% after disappointing corporate earnings and flash PMIs that showed a contraction in the manufacturing sector.

- JPY surged against all others in G10 Wednesday, as the short-covering triggered rally persisted to put USD/JPY through the 100-dma support and to the lowest levels since early May.

US TSYS Curves Twist to Least Inverted Levels Since Oct'23

- Treasury futures look to finish near late session lows Wednesday, curves twisting to the least inverted levels since October 2023 (2s10s tapped -13.040 high). After the bell, Sep'24 10Y futures traded -7 at 110-21 just below initial technical support of 110-21+ (20D EMA).

- Short end rates well bid after former NY Fed Pres Dudley suggested rate cuts warranted now, not later in the year. In turn: projected rate cut pricing into year end are gained vs. this morning's levels (*): July'24 at -5.5% w/ cumulative at -1.4bp at 5.315%, Sep'24 cumulative -27.3bp (-25bp), Nov'24 cumulative -42.8bp (-40.1bp), Dec'24 -65.3bp (-62.8bp).

- Treasury futures holding near early session highs, drawing modest sell interest after mixed Wholesale/Retail Inventories data, Advanced Goods Trade Balance slightly lower than expected.

- Futures remain mixed after lower than expected New Home Sales for June. Curves remain steeper with intermediates to long end underperforming since the mixed flash PMI data came out.

- Tsy futures pare gains slightly after the $70B 5Y note auction (91282CLC3) tail: drawing 4.121% high yield vs. 4.111% WI; 2.40x bid-to-cover vs. 2.36x for the prior auction.

- Focus turns to Thursday's GDP, Core PCE Weekly Claims and 7Y Note Sale.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00008 to 5.34958 (+0.00283/wk)

- 3M +0.00124 to 5.28460 (+0.00161/wk)

- 6M +0.00485 to 5.14408 (+0.00940/wk)

- 12M +0.01590 to 4.83735 (+0.03709/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.01), volume: $2.011T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $796B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $773B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $225B

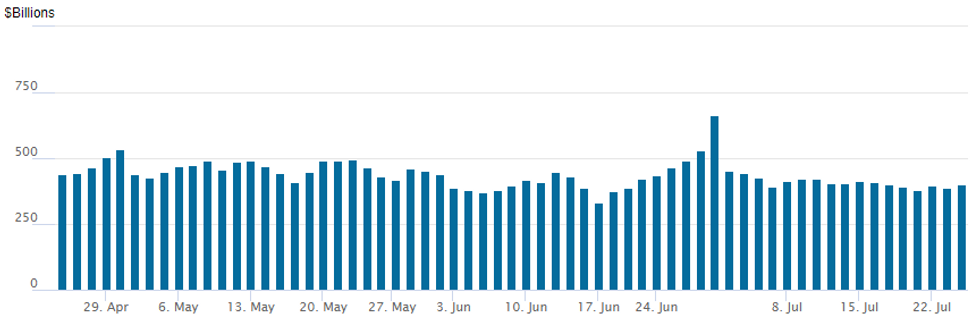

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage rebounds to $399.121B from $389.837B on Tuesday. Number of counterparties climbs to 75 from 64 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option flow remained mixed on net Wednesday, moderate pick-up in puts after better midday calls as underlying futures extend lows in late trade, curves climbing to the least inverted level since Oct'23. Projected rate cut pricing into year end are gained vs. this morning's levels (*): July'24 at -5.5% w/ cumulative at -1.4bp at 5.315%, Sep'24 cumulative -27.3bp (-25bp), Nov'24 cumulative -42.8bp (-40.1bp), Dec'24 -65.3bp (-62.8bp). Salient flow includes:

- SOFR Options:

- Block, 5,000 SFRQ4 94.93/95.06/95.18 put flys, 1.75 net

- +8,000 SFRZ4 94.87 puts, 1.5

- 2,500 SFRV4 95.12/95.18/95.31/95.37 call condors ref 95.365

- +6,000 SFRX4 95.31/95.43/95.50/95.62 call condors, 2.75 ref 95.355 to -.36

- +10,000 SFRV4 95.50/95.62/95.75 call flys, 1 vs. 9536/0.10%

- +4,000 SFRZ4 95.43/94.62 call spds vs. 95.355/0.14%

- -4,000 SFRZ4 95.50/95.75 call spds vs 94.87/95.12 call spds, 0.75 net

- +4,000 SFRU4 94.81/94.87/94.93 put flys 1.25 ref 94.94

- +5,000 SFRZ4 94.68/94.81 2x1 put spds vs. 95.325 to -33.5/0.05%

- -4,000 2QQ4 96.50/96.75/97.25 call flys 8.5, ref 96.515

- 16,000 SFRU4 94.68/94.81 2x1 put spds ref 95.355

- Block/screen, 10,000 SFRU4 95.12/95.25 call spds, 1.25 ref 94.945

- Block/pit, +17,000 SFRU4 95.00/95.06 call spds, 1.0 ref 94.94

- 4,400 SFRZ4 95.31/95.43/95.56 call flys, 2.12 ref 95.345

- 1,400 SFRH5 95.75/0QH5 3x2 call spd

- 10,100 SFRZ4 94.50/94.62/94.75/94.87 put condors, ref 95.33 to -33.5

- 1,200 0QV4 95.87/96.00 put spds vs. 0QZ4 96.31/96.68/97.06 call fly spd

- Treasury Options: Reminder, August options expire Friday

- +8,000 TYU4 113.5 calls, 6 vs. 110-27.5/0.05%

- -20,000 TYQ4 111.25 puts 38-37

- 1,500 FVQ4 107/107.25 call spds, 2.5 ref 107-17.5

- +7,000 TYQ4 111.25 calls, 7

- -5,000 TYU4 110/112.5 strangles, 37

- 6,000 TYU4 110.5/111.5/112.5 call flys ref 110-30.5

- 2,200 TYU4 111 calls, 44 ref 110-03

- over 2,100 FVQ4 108 calls, 0.5

- over 2,800 FVQ4 107 puts, 2.5

- 2,700 TYQ4 111.5 calls, 4 last

- 2,000 TYU4 108/109 put spds

- 1,200 TYQ4/wk1 TY 108.25/109.25/110.25 put fly spd

EGBs-GILTS CASH CLOSE: Curves Twist Steepen In Risk-Off Session

Short-end core EGBs and Gilts strengthened Wednesday, and periphery spreads widened for a 2nd consecutive session, amid a broader global risk-off move.

- The UK and German curves twist steepened on the day. An early rally at the long end following softer-than-expected Euro area PMI data eventually faded. Longer-end Gilts traded weakly throughout the morning (solid/mixed UK PMIs) with losses extending in the afternoon.

- In contrast, short-dated yields fell sharply as implied global central bank easing ticked up.

- This drove the UK 2s10s spread to the most positive since March 2023, and Germany's the least negative since Nov 2023.

- With equities pulling back amid an apparent unwind in the Japanese yen carry trade and soft earnings reports by major US corporates, periphery EGB spreads widened again, with high-beta BTPs and GGBs underperforming.

- German IFO is the highlight of Thursday morning's docket, in addition to other European confidence indicators and UK CBI Trends, and appearances by ECB's Nagel and Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.9bps at 2.655%, 5-Yr is down 2.7bps at 2.37%, 10-Yr is up 0.5bps at 2.444%, and 30-Yr is up 2.7bps at 2.661%.

- UK: The 2-Yr yield is down 3.6bps at 3.989%, 5-Yr is up 0.2bps at 3.942%, 10-Yr is up 3.2bps at 4.156%, and 30-Yr is up 3.7bps at 4.673%.

- Italian BTP spread up 4.2bps at 135bps / Greek up 3.5bps at 103.4bps

EGB Options: Rate Combo And Call Structures Feature Wednesday

Wednesday's Europe rates/bond options flow included:

- DUQ4 106 calls, bought for 1.5 in 4k

- SFIU4 95.25/95.40/95.55 call fly, bought for 7.5 in 6k

- 0NZ4 95.70p / 96.50c, bought for 2.5 in 6k (buys the call, sells the put)

- ERU4 96.50/96.375/96.25 put fly, paper pays 2 in 7k

- ERZ4 96.875/97.125 call spread, bought for 4.25 in 4k

- ERZ4 97.00/97.125/97.25/97.375 call condor, paper pays 1.25 in 5.5k

- ERH5 96.625p / 97.75c, zero net cost in 7.5k (buys the put, sells the call)

- 0RQ4 97.00/97.125/97.25/97.50 call condor, paper pays 2.5 in 6k

FOREX: USD/JPY Slippage Triggers Oversold Condition For First Time in 18 Months

- JPY surged against all others in G10 Wednesday, as the short-covering triggered rally persisted to put USD/JPY through the 100-dma support and to the lowest levels since early May. This extends the gap with the cycle high posted pre-intervention to over 850 pips, and aids the JPY spot TWI's bounce to 5% off the cycle low.

- A poor showing from global equities worked in favour of haven currencies, and against growth proxies. Poorly received earnings reports from the likes of Alphabet and Tesla prompted sharp reversals in their share price, dragging the tech-heavy NASDAQ index lower by near 2.5% at some points of the session. As such, CHF rallied in tandem with JPY, adding more evidence to the argument that carry trade dynamics that dominated much of this year's currency trade are start to reverse.

- Antipodean currencies extends their recent spell of weakness, with added losses for industrial metals weighing further. AUD/USD's brief break below the 0.6587 200-dma was only saved by a turnaround for the greenback, as a bull-steepening of the US curve and outperformance in the short-end weighed on the dollar.

- Focus Thursday turns to Germany's IFO print for July, weekly jobless claims data from the US and the advanced Q2 GDP release. Both ECB's Nagel and ECB's Lagarde are set to speak.

Late Equities Roundup: Extending Lows

- The morning sell off in stocks accelerated in the second half, the Nasdaq back to mid-June levels. Stocks came under pressure after disappointing corporate earnings and flash PMIs that showed a contraction in the manufacturing sector.

- Currently, the DJIA is down 432.61 points (-1.07%) at 39927.42, S&P E-Minis down 119.75 points (-2.14%) at 5479.75, Nasdaq down 625.8 points (-3.5%) at 17371.54.

- Information Technology and Communication Services sectors underperformed in late trade, semiconductor stocks weighing on the former: Broadcom -6.21%, Qualcomm -5.97%, Nvidia -5.40%. Interactive media and entertainment continued to weigh on the latter: Alphabet, formerly Google trades -5.0%, Meta -4.96%, Match Group -3.25%.

- On the flipside, Utilities and Health Care sector shares led gainers in late trade, multi energy providers supporting the former: NextEra Energy +4.53%, Eversource +3.22%, Dominion Energy +2.47%. Meanwhile, pharmaceuticals buoyed Health Care: Bristol-Myers Squibb +3.39%, Thermo-Fisher +3.21%, Abbott Labs +2.86%.

- Reminder, Wednesday afternoon earnings announcements expected from: Whirlpool, Ford Motor Co, Chipotle Mexican Grill, O'Reilly Automotive, Republic Services, Waste Management, IBM, KLA Corp, Invitation Homes, Newmont, Teradyne, Ameriprise Financial, United Rentals, Globe Life, Edwards Lifesciences and Raymond James Financial.

COMMODITIES Crude Rises, Copper Falls For Eighth Consecutive Session

- Crude markets are maintaining gains during US hours after a larger than expected draw in US crude inventories according to the EIA weekly petroleum data.

- WTI Sep 24 is up 0.8% at $77.6/bbl.

- Key support for WTI futures sits at $72.23, the June 4 low. Initial key resistance to watch is $83.58, the Jul 5 high, and a break and close above this level is needed ahead of any test on the $84.36 bull trigger.

- Meanwhile, Henry Hub is trading lower today with downside pressure from strong US production levels and a slight reduction in expectations for near-term demand.

- US Natgas Aug 24 is down 3.3% at $2.11/mmbtu.

- Spot gold is currently down by 0.1% at $2,409/oz today, having traded as high as $2,432 earlier in the session.

- The medium-term trend for gold still points higher and the previous breach of key resistance at $2,450.1, the May 20 high, opens the $2,500.00 handle next. Initial support is at $2,393.8, the 20-day EMA.

- Meanwhile, copper remains under pressure amidst concerns about Chinese demand, with the red metal down another 1.7% to $409/lb today.

- Copper has now fallen for eight consecutive sessions and is down by 13% since July 5.

- For copper, the bearish corrective cycle persists, with attention on key support at $402.35, the March 27 low.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/07/2024 | 0800/1000 | ** |  | EU | M3 |

| 25/07/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2024 | - |  | EU | ECB's Cipollone at Rio de Janeiro G20 Fin min/central bank meeting | |

| 25/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 25/07/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/07/2024 | 1230/0830 | *** |  | US | GDP |

| 25/07/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 25/07/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 25/07/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/07/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/07/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/07/2024 | 1500/1700 |  | EU | ECB's Lagarde attends Paris Summit | |

| 25/07/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/07/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.