-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - ECB Opt For Moderation

HIGHLIGHTS:

- ECB go for 'moderately lower' pace of PEPP purchases

- Solid demand at 30yr auction leads to flatter US curve

- Fed members look through NFP volatility

US TSYS SUMMARY: Solid 30y Auction Sees Yields Slide, Curve Flatten

- Throughout European and early US hours, Treasury futures traded inside the minor uptrend posted off the week's Tuesday lows, with a firm EGB market adding some upside impetus. This move accelerated following the 30yr re-opening, which saw solid demand evident in the higher-than-average bid/cover and a steep decline in dealer takedown at just 13.1% against an 18% average.

- 10y yields slid sharply on release of the results, pressing below 1.30% to narrow the gap with last Friday's NFP-induced 1.2617%.

- The solid showing from the 30yr line saw the longer-end outperform, resulting in a flatter curve from the belly outwards.

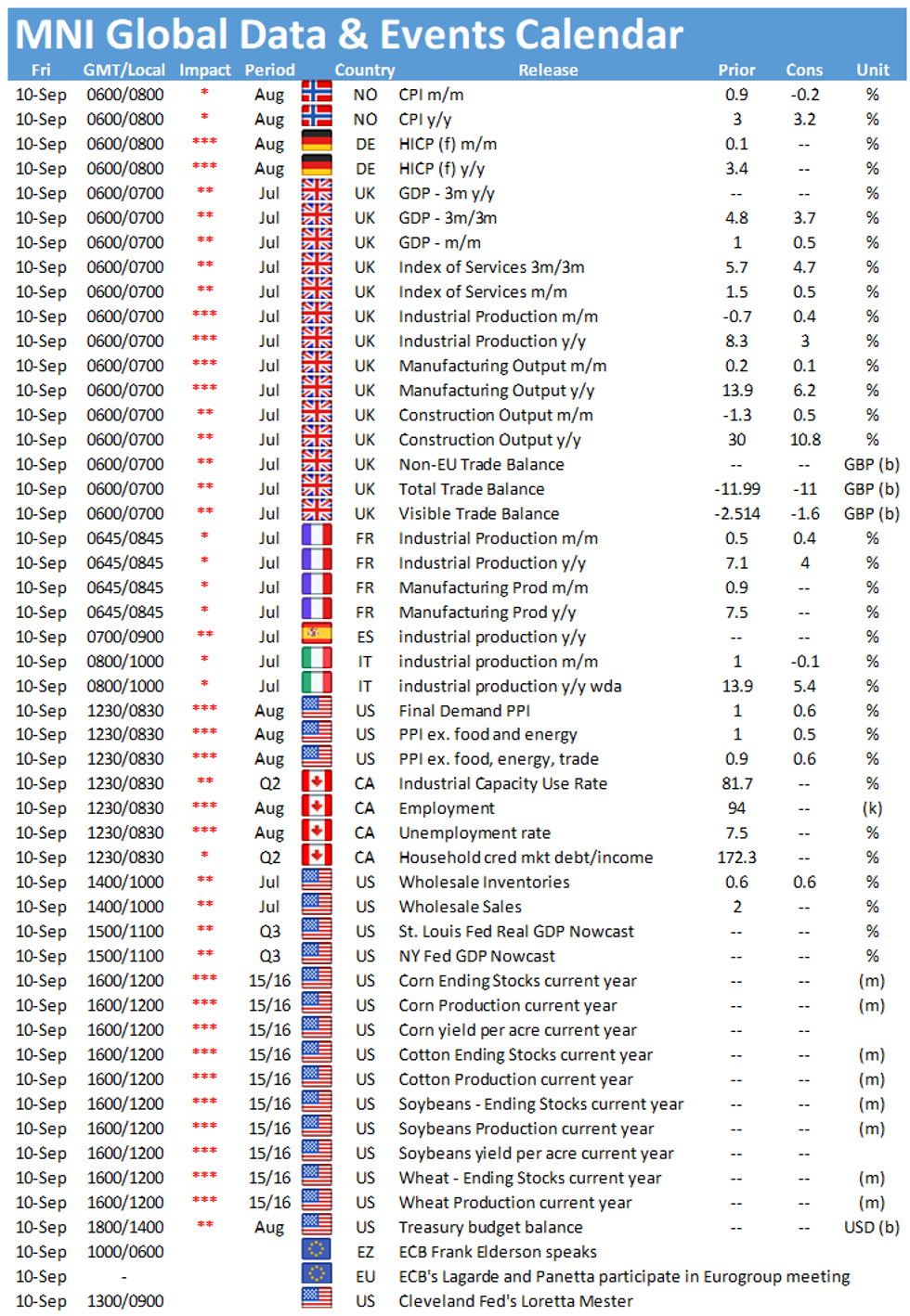

- PPI data takes focus Friday, with markets expecting factory gate prices to bump up to 8.2% on a final demand basis, and 6.6% ex-food & energy.

EGBs-GILTS CASH CLOSE: Bunds And BTPs Rally As Lagarde "Isn't Tapering"

Bunds rallied and BTPs outperformed as the ECB decision came basically in line with expectations, with the Governing Council set to "moderately lower" the PEPP purchase pace.

- As Pres Lagarde put it in the press conference, "the lady isn't tapering" - and Bund and BTP yields fell the most in months. BTP 10Y spreads narrowed to tightest since Aug 16 (102.1bp).

- There was a mild retracement near the cash close as Reuters cited sources saying the agreed PEPP target was E60-70B, which was in line with expected but perhaps dashing some lingering dovish hopes.

- Gilts strengthened but underperformed eurozone bonds.

- Friday's docket includes UK July GDP and appearances by ECB's Lagarde and Villeroy.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.5bps at -0.711%, 5-Yr is down 2.9bps at -0.661%, 10-Yr is down 3.8bps at -0.361%, and 30-Yr is down 3.9bps at 0.128%.

- UK: The 2-Yr yield is up 1.4bps at 0.224%, 5-Yr is up 1.4bps at 0.411%, 10-Yr is down 0.8bps at 0.736%, and 30-Yr is down 1.7bps at 1.063%.

- Italian BTP spread down 4.4bps at 103.1bps / Spanish down 2.5bps at 66.4bps

OPTION FLOW SUMMARY: Familiar Trades Return

Thursday's European rates / bond options flow included:

- DUZ1 112.30/40cs vs 112.10/112.00 ps, bought the cs for 0.75 in 2k (over 15k this week)

- 0RH2 100.375/100.125 put spread sold at 2.25 in 2.5k

- 2LZ1 99.50/99.75cs, bought for 2.25 in 10k (20k in past 2 sessions)

- 3LZ1 99.125/99.00/99.875 put fly bought for 1.75 in 2.5k

FOREX: GBP and Haven FX Lead G10 Charge As Dollar Strength Abates

- The greenback's ascent this week was halted on Thursday as US yields slipped lower and risk sentiment waned. JPY and CHF were the biggest movers, rallying just over 0.5% as equities also took a knock. The dollar index retreated 0.2%.

- Equally buoyant was GBP, that took its lead from a technically induced move lower in EURGBP during European hours, breaking back below 0.8560. Late dollar weakness helped GBPUSD (+0.5%) regain some poise towards the best levels of the week.

- Notably narrow range for EURUSD (1.1805-1.1841) over the ECB statement and press conference. The single currency firmed slightly off the lows on reports that ECB to buy 60-70bln in PEPP per month (with flexibility), coinciding with Bund futures rolling off the session highs.

- The minor Thursday uptick does little to change the overarching outlook and need to top resistance at 1.1909, the Jul 30 and Sep 3 high to progress higher. The support to watch is 1.1735, Aug 27 low. A move through this support would instead suggest the recent rally is over.

- European industrial production data features in a quiet early calendar, however US PPI and Canadian August employment may prompt some action, headlining the US session data docket.

FX OPTIONS: Expiries for Sep10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E981mln), $1.1800-10(E723mln), $1.1850(E1.4bln), $1.1875-95(E1.5bln)

- USD/JPY: Y110.00-10($1.2bln)

- EUR/JPY: Y130.00(E535mln)

- AUD/USD: $0.7350(A$663mln), $0.7400(A$704mln)

- USD/CAD: C$1.2510-15($886mln), C$1.2690-00($630mln)

EQUITIES: Stocks Settle Lower as Yields Prove Unsettling

- After starting the session on a more solid footing, equity markets deteriorated into the close as a sharp dip lower in US Treasury yields unsettled indices. The reversal back below 1.30% for the 10yr prompted a wave of risk-off across US markets as well as commodity prices, which pressed the e-mini S&P into negative territory just ahead of the close.

- The real estate and healthcare sectors led losses, with financials and materials the sole sectors to trade with gains.Another session of lower lows keeps the VIX supported, although the index ebbed off the week's best levels as futures stabilised.

COMMODITIES: WTI Testing 100-dma Support as China Opens Taps

- Oil markets traded in a choppy fashion Thursday, with markets eventually settling lower following reports that China had opened the taps on their national crude reserves in the latest move looking to rein in input costs and temper inflation.

- Given the frequency with which China have moved to temper metals prices using the same technique, a flattening of the WTI crude futures curve reflected the unease.

- The China-inspired move lower countered any bullish signals from the weekly DoE inventories data, which showed a sharp mark lower for refinery utilisation - with the lingering impact of Hurricane Ida still weighing on output.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.