-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Delivers Anticipated 50Bp Hike

HIGHLIGHTS

- POWELL: GETTING CLOSE TO SUFFICIENTLY RESTRICTIVE RATES

- US PIVOTS ON CARBON CAPTURE FUNDING FOR ENHANCED OIL RECOVERY, Bbg

- POWELL: ECONOMY HAS SLOWED SIGNIFICANTLY FROM LAST YEAR'S PACE, Bbg

- POWELL: LABOR MARKET REMAINS EXTREMELY TIGHT, Bbg

US TSYS: Bonds Extending Highs

Bonds leading Tsy futures higher after the bell, 30YY tapped 3.5154% low before bouncing to 3.5202% at the moment. Short end still lagging w/ yield curves flatter but off lows as Fed Chairman Powell ends his press conference Q&A session. 2s10s currently -2.576 at -74.909.- Bonds initially lead the bounce back above pre-FOMC levels as Fed Chairman Powell answered question over size and pace of future hikes to bring inflation back to 2%. After raising 425bp this year, Powell said "we're into restrictive territory, it's now not so important how fast we go. It's far more important to think what is the ultimate level and then at a certain point, the question will become how long do we remain restrictive."

- Trying to anticipate another step-down in rate hikes, pundits working themselves into knots over best estimate "as of today" comment as opening the door to a 25bp hike in early 2023 if inflation data continues to soften.

- Stocks slower to react, did rebound to mildly higher by the FI close are weaker, holding inside session range: ESH3 -40.0 at 4015.0.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 3.81586% (-0.00214/wk)

- 1M +0.00843 to 4.32629% (+0.05600/wk)

- 3M -0.03271 to 4.73629% (+0.00315/wk)*/**

- 6M -0.08042 to 5.12529% (-0.01442/wk)

- 12M -0.14443 to 5.40686% (-0.09257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $100B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.051T

- Broad General Collateral Rate (BGCR): 3.76%, $412B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $391B

- (rate, volume levels reflect prior session)

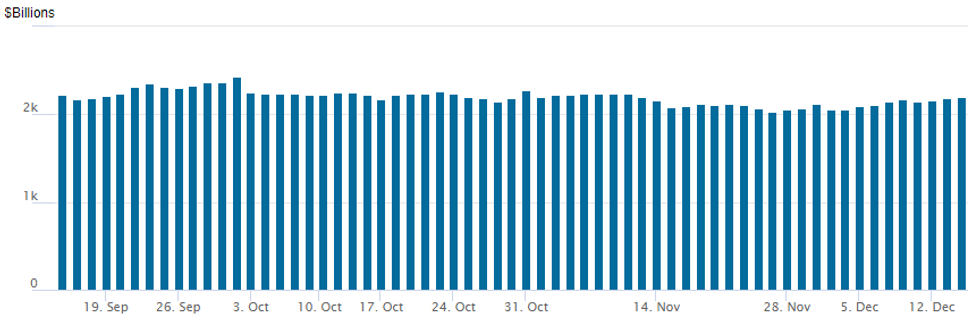

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,192.864B w/ 97 counterparties vs. $2,180.676B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Well ahead of the Fed's anticipated 50bp rate hike Wed, robust option volumes revolved around consistent upside call and call spread buying in SOFR options throughout the session - anticipating further deflation signals in 2023 to spur further step-down from the Fed.SOFR Options:

- Block, 10,000 0QM 95.00/95.50 put spds, 5.5

- Block, 12,500 SFRH 94.81/94.87/94.93/95.00 put condors, 0.5, wings over ref 95.175

- Block, 20,000 SFRU 95.00/95.50 1x2 call spds, 6.5 net ref 95.445

- 3,000 SFRF/SFRG 95.37 call calendar spds, 1.5 ref 95.135

- 3,500 SFRH 95.31/95.43/95.56 call trees, 1.0 ref 95.14

- Block, 3,000 SFRH3 95.37/95.50/95.56 call flys, 1.5 vs. 95.235/0.05%

- Block, 5,000 SFRH3 95.50/95.62 2x3 call spds, 0.5

- Block, 5,000 0QM 95.87/96.50 2x1 put spds, total volume >15k

- Block, 4,000 SFRZ 95.50 calls, 1.25 ref 95.50

- Block, 4,000 0QH 96.75/97.00/97.62 broken call trees, 3.0 ref 96.205

- 1,200 SFRF 95.06/95.18/95.25/95.374 call condors

- 1,000 SFRH 95.25/95.37/95.50 call flys ref 95.195

- 7,500 SFRJ 95.50 calls, ref 95.22

- Block, 5,000 SFRG 95.25/95.43 1x2 call spds, 2.25 ref 95.195

- Block, 5,000 0QG3 96.68/96.93/97.43 call trees, 3.0 ref 96.215

- Block, 1,250 SFRH 95.18/95.31/95.43 call flys, 2.5 ref 95.20

- Block, 20,000 SFRU 96.00/96.75 call spds, 12.0 ref 95.42-.43

- Block, 2,500 0QG3 96.43/96.93/97.43 call trees, 10.0 ref 96.205

- Block, 4,000 0QH 96.68/96.93/97.50 call trees, 2.75/splits

- 4,500 2QH 95.50/96.00/96.50 put flys

- Block, 5,000 SFRU 94.75/95.00 put spds vs. 95.75/96.00 call spds, even ref 95.43

- Block, 3,500 SFRF 94.56/94.68/94.93 put flys, 1.0 ref 95.21

- Block, 2,500 0QH 96.50/97.00/97.50 call flys, 7.5 ref 96.22

- Block, 3,000 0QZ2 95.87/96.00 call spds 1.5 over 95.50 puts vs. 95.755

- 2,000 SFRH 94.81/94.87/95.93/95.00 put condors

Treasury Options: - +5,000 TYF 113 puts, 10-11 ref 114-10

- 18,853 FVF 109.5 puts, 25 ref 109-18

- 2,700 FVF 108.25/109.5 put spds, 46.5 ref 109-17.75

- 5,000 TUH3 104/104.5/105 call flys, 3 ref 103-03.5

EGBs-GILTS CASH CLOSE: UK Short End Gains With Central Bank Moves Eyed

German and UK yields were mostly lower Wednesday, though there was some weakness evident further down curves and in periphery EGBs ahead of multiple major central bank decisions.

- The UK short-end outperformed following weaker-than-expected CPI data this morning pull down terminal BoE rate hike pricing (4.56%, back to last Friday's levels pre-wage data).

- Periphery EGB spreads continue to widen from their knee-jerk post US-CPI narrowing, with one eye on Thursday's ECB decision that could include details on balance sheet runoff plans.

- Immediate post-cash close attention is on the US Fed decision; market pricing for the BoE and ECB rate hikes Thursday is firmly on 50bp increases.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at 2.133%, 5-Yr is down 1.1bps at 1.933%, 10-Yr is up 1.5bps at 1.94%, and 30-Yr is up 9.2bps at 1.844%.

- UK: The 2-Yr yield is down 6.8bps at 3.451%, 5-Yr is down 4.7bps at 3.297%, 10-Yr is up 1.4bps at 3.315%, and 30-Yr is down 2bps at 3.696%.

- Italian BTP spread up 5bps at 192.6bps / Spanish up 2.2bps at 103.2bps

EGB Options: Mostly Upside Plays Pre-Fed, BoE, ECB

Wednesday's Europe rates / bond options flow included:

- OEG3 120.00/120.50cs bought for 17 in 2.5k

- OEG3 117/116ps sold at 12 in 10k

- RXG3 139/137/136 broken put fly sold at 36.5 in 5k

- IKG3 126.50/128cs, bought for 5 in ~5.95k

FOREX: Initial Greenback Strength Reverses, USD Set To Extend Downtrend

- An initial reaction higher in US yields and lower equities boosted the greenback with the USD index surging back to unchanged on the day, rising roughly 0.4% upon the FOMC statement release. However, throughout the press conference, this early optimism was faded and the USD index (-0.48%) is making fresh lows as we approach the APAC crossover.

- It appears that Powell’s remarks were unable to deter market participants from the most recent USD weakening trend following yesterday’s weaker than expected US CPI report.

- Despite the roughly 100 pip bounce for USDJPY, Tuesday's move lower signalled the end of the recent corrective phase that started on Dec 2 and the subsequent reversal potentially bolsters the likelihood of a continuation lower, opening 133.63, the Dec 2 low and bear trigger.

- A break of this level would confirm a resumption of the current downtrend and pave the way for a move towards 132.56, the Aug 15 low. The 20-day EMA, at 138.31, remains the first key short-term resistance.

- There are no standout performers across G10, with EUR, GBP and CHF all rising around a half a percent with the focus immediately turning to important central bank decisions on Thursday, including the Norges Bank, the SNB, the BOE and the ECB.

FX Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E3.5bln), $1.0500(E542mln), $1.0550(E526mln), $1.0600(E551mln), $1.0700(E1.7bln)

- USD/JPY: Y138.80-00($1.1bln)

- GBP/USD: $1.2350(Gbp1.5bln), $1.2450(Gbp693mln), $1.2495-00(Gbp574mln)

- USD/CAD: C$1.3500($659mln)

- USD/CNY: Cny6.9900-00($1.8bln), Cny7.1500($1.1bln)

E-MINI S&P (H3): Trend Needle Points North

- RES 4: 4361.00 High Aug 16 and a key M/T resistance

- RES 3: 4250.00 High Aug 26

- RES 2: 4194.25 High Sep 13 and a key resistance

- RES 1: 4180.00 High Dec 13

- PRICE: 4078.00 @ 1200ET Dec 15

- SUP 1: 3957.96/3945.75 50-day EMA / Low Dec 7 and key support

- SUP 2: 3782.750 Low Nov 9

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 Low Oct 21

A strong rally in the S&P E-Minis Tuesday saw price trade above 4142.50, Dec 1 high. The contract failed to hold onto its highs and also pulled back sharply. Despite the move lower, the outlook is bullish and yesterday’s high maintains the bullish sequence of higher highs and higher lows. A resumption of gains would open 4194.25, the Sep 13 high. Key support has been defined at 3945.75, Dec 7 low. This is just below the 50-day EMA, at 3957.96.

COMMODITIES: Crude Oil Bounce Buoyed By IEA Seeing Tight Supplies In 2023

- Crude oil rallies for a third day as it continued to bounce after last week’s double digit percentage slide, with oil-related headlines far outweighing any spillover from market fluctuations from the FOMC. Morgan Stanley sees Brent back around $110/bbl by mid-2023.

- There was earlier volatility seen around EIA inventory data, which saw a fall on a very large 10.2mln barrel increase in crude inventories. It quickly more than reversed the decline though and continued with the upward trend helped earlier by the IEA seeing oil prices possibly rising in 2023 as sanctions squeeze Russian supplies and demand beats earlier forecasts.

- WTI is +2.9% at $77.56, clearing both yesterday’s high of $76.37 and further resistance at the 20-day EMA of $77.52. It next opens $81.16 (50-day EMA).

- Brent is +2.9% at $82.93, clearing yesterday’s high of $81.28 and coming close to the 20-day EMA of $83.08.

- Gold is -0.3% at $1805.55 and after swinging along with Treasury yields on the FOMC is ultimately little changed from just beforehand. Having touched a fresh trend high, resistance remains at yesterday’s high of $1824.5.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/12/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 15/12/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/12/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/12/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/12/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/12/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/12/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 15/12/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 15/12/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | - |  | IE | Ireland Prime Minister Transition | |

| 15/12/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 15/12/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 15/12/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/12/2022 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 15/12/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/12/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 15/12/2022 | 1500/1000 | * |  | US | Business Inventories |

| 15/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/12/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2022 | 2100/1600 | ** |  | US | TICS |

| 16/12/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.