-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: FED SEP Drops Dot to One in 2024

- Treasuries gapped higher after lower May CPI inflation metrics renewed hopes of 50bp rate cuts by year end.

- Today's lower CPI shows progress, building confidence, but still not enough to warrant looser policy at this time.

- Rate cut projections moderated after the FOMC steady rate announcement, dot plot down to one cut in 2024 (vs. two exp) vs. three in March.

US TSYS:

- Still well bid, Treasury futures continue to scale back support after Chairman Powell stated the "economic outlook is uncertain" while the Fed remains "highly attentive to inflation risks. Today's lower CPI shows progress, helping building confidence - it's still not enough to warrant looser policy at this time.

- Sep'24 10Y Treasury futures are currently trading +21.5 at 110-07. Key short-term resistance remains at 110-21 (High Jun 7). Key short-term technical support well below at 109-00.5 (Low Jun 10).

- Cash yields remain lower: 5s -.1145 at 4.3038, 10s -.1074 at 4.2966%, 30s -.0846 at 4.4519%, while curves remain mixed: 2s10s -1.456 at -44.668, 5s30s +3.515 at 15.162.

- Rate cut projections recede vs. pre-FOMC levels (*): July'24 at -10% (-14%) w/ cumulative at -2.5bp (-3.8bp) at 5.302%, Sep'24 cumulative -17bp (-20.9bp), Nov'24 cumulative -26.8bp (-31.7bp), Dec'24 -45.5bp (-50.7bp).

- Focus turns to Thursday's PPI Final Demand, weekly jobless claims and $22B 30Y Bond auction reopen.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00029 to 5.33046 (+0.00282/wk)

- 3M -0.00019 to 5.34661 (+0.01262/wk)

- 6M -0.00508 to 5.30741 (+0.03612/wk)

- 12M -0.01333 to 5.14544 (+0.07334/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.946T

- Broad General Collateral Rate (BGCR): 5.31% (-0.01), volume: $750B

- Tri-Party General Collateral Rate (TGCR): 5.31% (-0.01), volume: $735B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

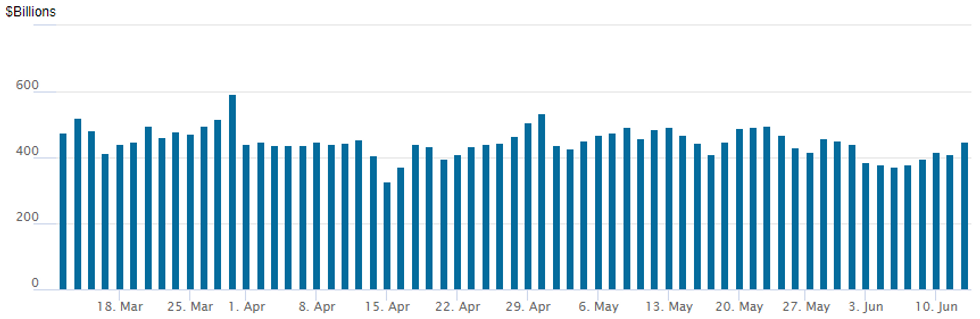

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $447.574B from $410.449B prior; number of counterparties at 77. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Heavy SOFR and Treasury option volumes reported Wednesday, largely bullish after this morning's lower than expected May CPI inflation data buoyed underlying rate futures while year end rate cuts climbed to 50bp in the first half. Chairman Powell's press conference saw rate cut projections receded slightly vs. pre-FOMC levels (*): July'24 at -10% (-14%) w/ cumulative at -2.5bp (-3.8bp) at 5.302%, Sep'24 cumulative -17bp (-20.9bp), Nov'24 cumulative -26.8bp (-31.7bp), Dec'24 -45.5bp (-50.7bp).

- SOFR Options:

- Block, 10,000 SFRU4 95.12/95.18 call spds 0.5 ref 94.88

- +10,000 SFRU4 94.62/94.68 put spds 0.5 ref 94.88

- +15,000 SFRU4 95.12/95.18 call spds 0.5 ref 94.88

- Block, +15,000 SFRN4 94.93/95.06 1x2 call spds 0.0 ref 94.885

- -5,000 SFRU4 95.12/96.12 call spds vs 0QM4 95.87 calls, 0.0

- +10,000 SFRN4 95.12/95.25 call spds 0.5 ref 94.885

- +10,000 SFRN4 95.12 calls 1.5 ref 94.895

- -10,000 SFRM5 93.75/94.25 put spds 1.5 ref 95.775

- -10,000 SFRZ4 95.00 puts, 10.5 vs. 95.21/0.34%

- -5,000 SFRU4 95.06/95.50 call spds 2.0 ref 94.89

- +7,000 SFRH6 93.75/94.25/94.75 put fly 4.0 ref 96.22

- +10,000 SFRN4 95.06/95.18 call spds 0.75 ref 94.89

- -10,000 SFRU4 94.87/94.93 call spds vs 94.81 puts 2.0 ref 94.89

- -10,000 SFRU4 94.93 puts 11.0 ref 9489

- -15,000 SFRU4 94.81/94.93 call spds, 6.5 after +5k earlier at 4.5

- -10,000 SFRU4 94.81 puts, 4.5 ref 94.89

- -2,500 SFRZ4 95.18 straddles, 41.0 ref 95.195

- Block, 5,000 SFRZ5 93.75/94.25/94.75 put flys, 4.5

- Blocks, 20,000 SFRH6 93.75/94.25/94.75 put flys 4.0-4.5 ref 96.21 to -.205

- +25,000 SFRU4 94.81/94.87 call spds, 3.5 ref 94.88

- -10,000 SFRU4 94.93 puts, 11.0 vs. 94.89

- -10,000 SFRN4 94.87 puts, 4.75 vs. 94.885

- -10,000 SFRQ4 94.87 puts, 6.5 ref 94.89

- -10,000 SFRQ4 94.81 puts, 3.5 ref 94.89

- -10,000 SFRQ4 95.00 puts, 15.5 ref

- 2,500 0QM4 95.50/95.87 2x3 call spds w/ 0QN4 95.62/96.00 2x3 call spds

- +5,000 SFRU4 94.81/94.93 call spds, 4.5 ref 94.82

- Block, 3,000 SFRQ4 94.75/94.87 put spds, 7.0 ref 94.825

- Block, 4,395 SFRX4 94.56/94.62/94.68/94.75 put condors, 1.5 vs. 95.045/0.05%

- Treasury Options:

- +25,000 wk2 10Y 110/111 strangles, 5 vs. 110-20/0.52%

- 8,500 USN4 115/116/117 put flys, 5 net ref 119-18

- 9,000 FVN4 107.25/107.75 call spds vs. wk2 FV 106.75/107 call spds

- 32,000 wk2 FV 107 calls, 8-8.5 vs. 106-26.25/0.40%

- 2,000 TYN4 108/108.75 put spds

- over 6,000 TYN4 109/110.5 strangles ref 109-18

- 5,200 TYN4 107.5 puts ref 109-18.5

- 3,700 Wednesday weekly 10Y 108.5/108.75 put spds

- 6,100 FVN4 107 calls ref 106-08.5

- over 6,500 FVN4 106.5 calls

- 5,000 wk2 5Y 107.5/108 call spds ref 106-08.75

FOREX: Cautious Powell Stokes Greenback Reversal

- The greenback has been regaining lost ground throughout the June FOMC press conference as Chair Powell confirmed participants had access to the May CPI data before finalising their economic projections that point to just one Fed cut in 2024.

- The cautious tone of the Fed Chair and the consistent reminder of focusing on the totality of the data has seen USDJPY climb around one big figure and back towards the 157.00 mark, although the pair remains shy of the pre-CPI levels around 157.20.

- A more subdued reaction for EURUSD which sits just 50 pips off the session highs of 1.0852 and holds onto the bulk of today’s rally. Today’s sharp reversal higher sees the pair back above the 20- and 50-day EMAs. A continuation higher would undermine the recent bearish theme and instead signal scope for a test of key short-term resistance at 1.0916, the Jun 4 high.

- There have been similar size reactions seen for both AUDUSD and NZDUSD as equities remain in the green for now. AUDUSD remains up 0.90% approaching the APAC crossover.

- Recent swings in price action mean that for now, the pair remains inside a range. Key resistance has been defined at 0.6714, the May 16 high and key support lies at 0.6576, the Jun 10. The two price points also represent key short-term directional triggers.

- Moves come ahead of Thursday’s Australian employment figures, which will be the highlight of the APAC docket. Focus will then turn to US PPI data and Friday’s Bank of Japan decision.

FX OPTIONS: Expiries for Jun13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-90(E2.1bln), $1.0740-50(E1.3bln), $1.0770-80(E3.7bln), $1.0835-40(E1.2bln), $1.0885-00(E2.4bln)

- USD/JPY: Y155.00-10($1.3bln), Y156.00-20($1.5bln), Y156.45-55($516mln), Y158.00-10($1.1bln)

- GBP/USD: $1.2750(Gbp594mln)

- AUD/USD: $0.6630(A$1.0bln)

- USD/CAD: C$1.3670-75($845mln)

- USD/CNY: Cny7.3000($1.0bln)

Late Equities Roundup: Off New Late Cycle Highs, DJIA Underperforming

- S&P Eminis and Nasdaq indexes managed to extend all-time highs briefly late Wednesday (5,454.5 and 17,724.57 respectively), pared gains after Chairman Powell ended his post FOMC press conference, the DJIA trading weaker: down 105.11 points (-0.27%) at 38646.31, S&P E-Minis up 36.75 points (0.68%) at 5420.75, Nasdaq up 233.8 points (1.3%) at 17579.39.

- Information Technology and Industrial sectors outperformed in late trade, hardware and semiconductor makers supporting the former, Oracle +13.39% after better than expected earnings & revenue growth, Skyworks +7.59%, Apple +6.09%, Autodesk +5.13%.

- Air and ground transportation shares buoyed the Industrial sector in the second half: Uber +5.56%, Delta Air +2.96%, American Air +2.44 while United gained 2.16%.

- Energy and Consumer Staples sectors continued to underperform in late trade, oil & gas shares weighing on the former: Valero -3.45%, Marathon Petroleum -3.0%, Chevron -2.39%.

- Household and personal product makers weighed on Consumer Staples: Estee Lauder -3.0%, Kenvue Inc -2.87%, Procter & Gamble -1.58%.

- Notable earnings releases after today's close: Broadcom, Adobe and Lennar Group late Thursday.

E-MINI S&P TECHS: (M4) Fresh Cycle Highs

- RES 4: 5500.00 Round number resistance

- RES 3: 5490.62 2.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5462.77 2.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5433.50 Intraday high

- PRICE: 5447.50 @ 1512 ET Jun 12

- SUP 1: 5311.70/5205.50 20-day EMA / Low May 31 and key support

- SUP 2: 5155.75 Low May 6

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact and the contract is trading higher today. Price has recently cleared 5368.25, the May 23 high and bull trigger. The move confirmed a resumption of the uptrend. The continuation higher has resulted in a break of the 5400.00 handle. This opens 5462.77 next, a Fibonacci projection. Key short-term support has been defined at 5205.50, the May 31 low. Initial support lies at 5311.70, the 20-day EMA.

COMMODITIES Stock Build Tapers WTI Crude Gains

- WTI has regained some ground after an unexpected build in US crude stocks pushed crude to near rangebound on the day. Upside support remains from a sharp fall in the USD index on the day, amid softer CPI data and the Fed holding rates steady.

- WTI Jul 24 is up 0.8% at $78.5/bbl.

- For now, short-term gains are considered corrective and the trend direction remains bearish. However, resistance at $78.37, the 50-day EMA, has been pierced and a clear break would expose $80.62, the May 1 high.

- On the downside, a resumption of weakness would open $71.33, the Feb 5 low.

- In contrast, Henry Hub is set for losses on the day as an approaching start up for the Mountain Valley pipeline spark hopes of more gas flowing from the Appalachia shale basin.

- US Natgas Jul 24 is down 2.8% at $3.04/mmbtu.

- Spot gold has edged up by 0.2% today to $2,321/oz.

- Last week’s sharp sell-off in gold reinforced a short-term bearish theme, which opened $2,277.4, the May 3 low. On the upside, initial resistance to watch is $2,387.8, the Jun 7 high.

- Meanwhile, silver is outperforming and is up by 1.0% on the day at $29.6/oz.

- For silver, support to watch lies at the 50-day EMA, at $28.783. For bulls, a reversal higher would refocus attention on key resistance at $32.518, the May 20 high.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 13/06/2024 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/06/2024 | - | *** |  | CN | Money Supply |

| 13/06/2024 | - | *** |  | CN | New Loans |

| 13/06/2024 | - | *** |  | CN | Social Financing |

| 13/06/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 13/06/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/06/2024 | 1230/0830 | *** |  | US | PPI |

| 13/06/2024 | 1230/0830 | * |  | CA | Household debt-to-income |

| 13/06/2024 | 1335/0935 |  | CA | BOC Deputy Kozicki speaks on balance sheet policies. | |

| 13/06/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/06/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/06/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/06/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.