-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Still In Play After Soft CPI

- MNI BRIEF: Senate Committee Supports Biden's Fed Nominees

- MNI CHINA-RUSSIA: Kremlin: Putin Visit To China On The Agenda

- MNI NATO: Zelensky Accepts Decision To Slow Walk Ukraine's NATO Membership

- MNI SECURITY: US Top Army Gen Nominee: ATACM Missiles Would Be Helpful For Ukraine

- FED BARKIN: BACKING OFF TOO SOON WOULD REQUIRE FED TO DO EVEN MORE, Bbg

- FED KASHKARI: ENTRENCHED INFLATION COULD PROMPT FED TO HIKE FURTHER, Bbg

US TSYS: CPI Inflation Metric Cools, PPI Up Next

- Treasury futures have traded sideways since noon after extending highs in the hours following lower than expected June CPI: MoM (0.2% vs. 0.3% est), YoY (3.0% vs. 3.1% est); Ex Food and Energy MoM (0.2% vs. 0.3% est), YoY (4.8% vs. 5.0% est).

- Traders debated whether it's a trend shift or a one-off move as a proportion of volatile categories (lodging, airfare and used cars) accounted for the slow-down in core inflation.

- Some moderately hawkish Fed speak from Barkin ("comfortable with more hikes") and Kashkari ("entrenched inflation could prompt Fed to hike further") did little to stem the post-data rally. Reminder, Fed goes into policy blackout this Friday at midnight.

- Cross asset summary: Equities are in the green but off high (SPX eminis +33.0 at 4506.5), US$ index broadly lower (DXY -1.208 at 100.524). Curves steeper but well off highs after some late block selling in 2s. Currently, 2s10s +2.798 at -88.096 vs. -83.371 high) compares to 40+ year inverted low of -111.0 tapped in March.

- Short end rally saw projected rate hike by year end recede slightly: July 26 FOMC is 89% w/ implied rate of +22.2bp to 5.298%. September cumulative of 26.2bp vs. +28bp earlier at 5.338%, November cumulative of 30.9 vs 35bp at 5.425%, December cumulative 25.3 vs. 30bp at 5.380%.

- Treasury futures slip off highs briefly, rebound after the $32B 10Y note auction re-open (91282CHC8) tails: 3.857% high yield vs. 3.850% WI; 2.53x bid-to-cover vs. 2.36x prior

- Focus turns to Thursday's weekly claims and June PPI.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00579 to 5.20222 (+.02521/wk)

- 3M +0.00996 to 5.31105 (+.01258/wk)

- 6M +0.00863 to 5.41106 (-.00394/wk)

- 12M -0.00199 to 5.38328 (-.07114/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $121B

- Daily Overnight Bank Funding Rate: 5.06% volume: $274B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.439T

- Broad General Collateral Rate (BGCR): 5.04%, $590B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $582B

- (rate, volume levels reflect prior session)

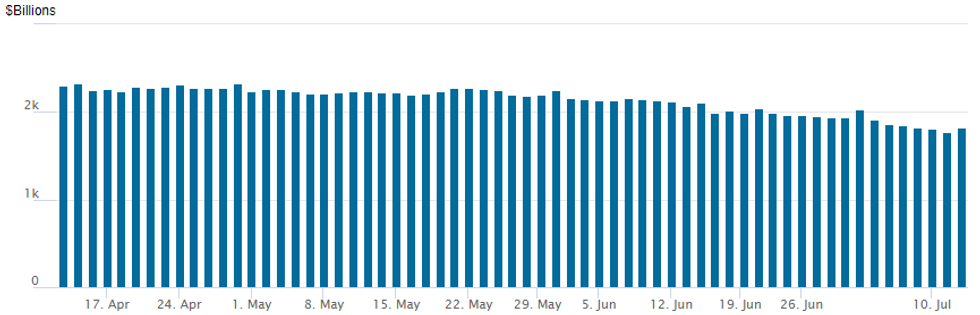

FED Reverse Repo Operation: First Bounce Since June 30

NY Federal Reserve/MNI

Latest operation bounces to $1,820.146B, w/ 102 counterparties, compared to $1,775.796B in the prior session (lowest since early May'22). The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- Fixed income options traded more mixed, leaning toward Tsy calls early Wednesday compared to better downside put trade Tuesday. Scale buying year end upside call spreads (+50k SFRZ3 95.50/96.50 call spds and +30,000 SFRZ3 95.75/96.75 call spds) were reported post-data as projected rate hike pricing eases, markets discounting mildly hawkish comments from Richmond Fed Barkin this morning. Put volume picked up in the second half as accounts faded the strength of the rally, anticipating a retrace in the days to come. Salient trade includes:

- SOFR Options:

- Block/screen 20,000 SFRZ3 94.56/94.68/94.81 put flys,

- Block, 8,000 SFRZ3 94.37/95.00 put spds, 38.5 ref 94.685

- 7,000 SFRZ3 94.00/94.12/94.25 put flys

- Block 7,500 SFRZ3 94.56/94.68/94.81 put flys, 1.5

- Update, +20,000 SFRH4 96.00/97.00 call spds, 10.0

- Block, 25,000 SFRU3 94.62/94.87 2x1 put spds, 14.0 ref 94.615

- Block, 5,000 SFRM4 96.00/OQM4 97.00 call spds, 1.0 net steepener

- +10,000 SFRZ3 94.00/94.12/94.25 put flys, 1.0

- 30,000 SFRZ3 95.75/96.75 call spds, 3.5 ref 94.67

- +50,000 SFRZ3 95.50/96.50 call spds, 4.5-5.0

- -3,600 SFRH4 93.37/93.75 put spds

- -10,000 SFRU3 94.37/94.50 2x1 put spds, 1.0

- 3,000 OQN3 95.43/95.50 put spds, 1.0 ref 95.675

- Block, 2,500 OQH4 95.00/96.00 put spds 3.5 over SFRH4 94.62 puts covered

- 4,000 OQZ3 94.50 puts ref 96.00

- 6,000 OQU3 95.50/2QU3 96.12 put spds

- +16,000 OQV3 95.62/95.87 put spds vs. 2QV3 96.12/96.37 put spds, 1.0 net db, flattener

- 1,500 SFRH4 94.87/95.87 call spds vs. 2QH4 96.87/97.87 call spds

- 7,500 SFRU3 94.50 puts, 0.5 ref 94.58

- 2,000 SFRN3 94.50/94.56 put spds ref 94.58

- 5,200 SFRN3 94.50 puts ref 94.585

- 4,000 SFRQ3 94.62/94.68/94.75/94.81 call condors ref 94.59

- 13,000 SFRQ3 94.56/94.62/94.68 call flys ref 94.58 to -.59

- Treasury Options:

- 4,000 FVU3 105.5/106/107 2x3x1 put flys

- over 8,500 FVQ3 108.25 calls, 3.5 last ref 107-06

- over 5,600 TYU3 111 calls, 137 last ref 111-28

- 3,000 TYU3 108/109 put spds, 6 ref 111-29

- 2,000 wk2 TY 110.25/111/111.5 wk2 10Y broken put flys

- 3,000 wk2 TY 112.5 calls, 4 ref 111-14.5

- 4,800 FVQ 108 calls, 4.5 ref 106-26.5 to -26.75

- 2,500 TYU3 114.5/115.5 3x2 (wrong-way) call spds ref 111-18

- 1,250 TYU3 112.5/114.5/115.5 broken call flys on 1x3x2 ratio ref 111-17.5

- over 3,500 TYQ3 110 puts, 6 ref 111-16

- 6,000 FVQ3 108.25 calls, 3 ref 106-26 to -27.5

- 5,000 TYQ3 110.5/111.25 put spds 0.0 over TYQ 112.25 calls ref 111--16 (adds to over 6,000 traded Tue)

- 1,500 FVU3 108 calls, 25 ref 106-24

- 1,500 FVQ3 108.5 calls ref 106-24

EGBs-GILTS CASH CLOSE: UK Short End Leads Rally

Gilts outperformed Bunds Wednesday, as global core FI soared following a softer-than-expected US June inflation reading.

- Having strengthened in European morning trade, a solid drop in UK and German yields accelerated sharply on the US core CPI slowdown.

- While the rally paused briefly, it resumed after the expected 25bp hike from the Bank of Canada was out of the way.

- The UK short end soared as rates markets almost fully took out a 25bp hike from the BoE path (a sharp reversal after Tuesday's rise on UK wage data), with the curve bull steepening.

- Germany couldn't keep up, with ECB terminal rate pricing remaining fairly stubbornly riveted on 4.00%, but the belly outperforming with Bobl yields down ~12%.

- Periphery EGBs strengthened sharply following the US data amid a broader risk-on rally.

- Thursday's schedule begins with UK GDP and final June French inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.7bps at 3.229%, 5-Yr is down 11.6bps at 2.653%, 10-Yr is down 10.1bps at 2.578%, and 30-Yr is down 6.9bps at 2.591%.

- UK: The 2-Yr yield is down 19.7bps at 5.229%, 5-Yr is down 19.4bps at 4.692%, 10-Yr is down 14.9bps at 4.514%, and 30-Yr is down 9.2bps at 4.605%.

- Italian BTP spread down 5.7bps at 171.2bps / Greek down 3bps at 141bps

EGB Options: Put And Call Spreads Throughout Session, With Downside Unwound

Wednesday's Europe rates / bond options flow included:

- SFIH4 94.00/94.30 call spread vs. 93.00/92.70 put spread, paper pays 2.25 on 5K (buying the call spread)

- SFIZ3 94.20/94.10 put spread vs 94.40/94.50 call spread paper paid 5 on 12K to buy the put spread

- SFIZ3 93.55/93.30 put spread 12K given at 9.5 vs 93.66

- ERZ3 96.00/95.875/95.375 (skip strike) put ladder sold at 2.5 in 17.5k. Hearing unwind

- 0RU3 96.75/97.25 call spread bought for 6.25 in 2.5k

FOREX: Greenback Plummets Following Soft CPI Report, Antipodean FX Surges

- Broad USD weakness has prevailed across global currency markets on Wednesday following the softer-than-expected US CPI data, both for headline and core readings. The USD index has fallen 1.15% as we approach the APAC crossover, with narrowing yield differentials further bolstering the JPY and firmer risk sentiment providing particularly strong tailwinds for Antipodean FX.

- Both AUD & NZD have risen over 1.5% as the optimistic equity backdrop further complements the weaker greenback theme and underpins higher beta currencies. NZDUSD specifically has surged to a 7-week high, just hours after the RBNZ decision in which the central bank left policy unchanged for the first time since August 2021.

- USDJPY has also extended its most recent downtrend, with the lower core yields allowing the pair to widen the gap to around 700 pips from the 145.07 highs seen just two weeks ago. The recent sell-off has resulted in a break of both the 20- and 50-day EMAs and price is again inside the bull channel drawn from the Jan 16 low. The move signals scope for an extension towards support at 137.47, the 4.0% 10-dma envelope - not crossed since 2020.

- A notable mention for EURUSD which has risen to fresh highs for the year above 1.1125 and while GBP underperforms its G10 peers, cable did print a high of 1.3000, an important pivot point dating back to March 2022.

- UK GDP data kicks off Thursday’s data calendar, as well as industrial production for both the UK and the Eurozone. The ECB minutes will be published before markets look for further signals on US inflation within the June PPI report.

FX Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0820-25(E1.2bln), $1.0860-80(E1.9bln), $1.0885-00(E1.8bln), $1.0915-16(E1.2bln), $1.0925-45(E1.3bln), $1.0965-75(E556mln), $1.0985-00(E1.5bln), $1.1050-60(E989mln), $1.1080-00(E1.3bln), $1.1115-25(E1.1bln)

- USD/JPY: Y138.75($795mln), Y138.85-95($568mln), Y141.00($846mln), Y141.50($806mln), Y142.00($1.4bln)

- GBP/USD: $1.2850(Gbp506mln), $1.2875-85(Gbp825mln)

- AUD/USD: $0.6780-00(A$1.4bln)

- USD/CAD: C$1.3200-10($748mln)

- USD/CNY: Cny7.1500($1.4bln)

Late Equities Roundup: SPX Highest Level Since May 2022, Materials Lead

- Stocks reacted positively to lower than expected COI inflation metrics Wednesday, continuing to extend gains in the second half with SPX Eminis climbing to the highest levels since mid-April 2022. At the moment, S&P E-Mini Future up 41.75 points (0.93%) at 4515.25, DJIA up 145.96 points (0.43%) at 34406.16, Nasdaq up 184.1 points (1.3%) at 13944.6.

- Leading gainers: Materials, Communication Services and Information Technology sectors are outperforming. Materials led on the back of strong gold prices (+25.0 at 1957.00) as mining stock marked strong gains: Newmont +4.35%, Freeport McMoRan +2.75%.

- Strong media and entertainment shares led Communication Services sector higher for the second day running: Match +3%, Meta +2.85%, Google +1.95%. Renewed demand by AI applications underpinned semiconductor shares: Enphase +5.15%, Monolithic Power +3.5%, Nvidia +3.15%.

- Laggers: Health Care, Industrials and Consumer Staples sectors underperformed. Pharmaceuticals and biotech shares outpaced health care and equipment makers: Centene -6%, Elevance Health -4.95%, Cigna -4.25%.

- The technical/bull theme in S&P E-minis bull theme remains intact. Today’s gains have resulted in a break of resistance at 4498.00, the Jun 30 high. This confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4532.08, a Fibonacci projection. First support lies at 4420.62, the 20-day EMA. Clearance of this level would be bearish.

E-MINI S&P TECHS: (U3) Clears Key Short-Term Resistance

- RES 4: 4576.62 2.50projection of the May 4 - 19 - 24 price swing

- RES 3: 4573.65 Bull channel top drawn from the Mar 13 low

- RES 2: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 1: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- PRICE: 4515.00 @ 1430 ET Jul 12

- SUP 1: 4420.62/4368.50 20-day EMA / Low Jun 26 and a key support

- SUP 2: 4336.46 50-day EMA

- SUP 3: 4327.06 Bull channel base drawn from the Mar 13 low

- SUP 4: 4269.50 Low Jun 2

A bull theme in S&P E-minis remains intact. Today’s gains have resulted in a break of resistance at 4498.00, the Jun 30 high. This confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4532.08, a Fibonacci projection. First support lies at 4420.62, the 20-day EMA. Clearance of this level would be bearish.

COMMODITIES: CPI-Induced USD Slide Sees Crude Rise, Gold Surge

- Crude prices traded above $80/bbl for the first time since May today before flittering either side of the level as the USD slid on softer than expected CPI data.

- It helped limit the impact of an unexpectedly large build in weekly US crude inventories later on (EIA weekly showed build of 5,946mn tons, vs estimated draw of 108mn tons).

- Later in the session, Bloomberg reported that Russia's Urals crude topped the G-7 price cap of $60/bbl for the first time. The price cap allows Russian oil to be transported with western ships and insurance only if it’s priced below the threshold.

- WTI is +1.5% at $75.99, clearing the key resistance at $75.70 (Jun 5 high) to open $76.35 (Apr 28 high) after which lies $78.62 (Apr 24 high).

- In options space, the day's most active WTI strikes for the CLQ3 have been $75/bbl calls, followed by $70/bbl puts.

- Brent is +1.2% at $80.36, clearing $79.94 (Fibo retrace of Apr 12 - May 4 downleg) and stopping three cents short of $80.58 (Apr 26 high).

- Gold is +1.3% at $1958.10 with the CPI miss helping it reverse an earlier small decline and pushing spot closer to resistance at $1968 (Jun 16 high).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/07/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/07/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/07/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/07/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/07/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/07/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/07/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/07/2023 | - | *** |  | CN | Trade |

| 13/07/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 13/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/07/2023 | 1230/0830 | *** |  | US | PPI |

| 13/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/07/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/07/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/07/2023 | 2245/1845 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.