-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI ASIA MARKETS ANALYSIS: Focus Turns to Employment Data

- MNI US-EU: Dombrovskis To Meet With US Officials On Metals And Critical Minerals

- MNI SPAIN: EU Court Rules Against Catalan Separatist, Risks Pre-Election Tensions

- MNI MIDEAST: US Navy Responds As Iran Attempts Tanker Seizures, Shots Fired

- MNI EU: Migration Likely To Dominate EU Agenda As Scales Shift Right

US TSYS: Little React to June FOMC Minutes, Rates Near Lows

- US rates finished broadly weaker, near late session lows Wednesday, as attention quickly turned to employment data (ADP early Thu, NFP Fri) that drove yields higher in the run up to the June FOMC minutes is back in focus. ADP Employment Change 225k est vs. 278k prior; Change in Nonfarm Payrolls 225k est vs. 339k prior.

- "Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate," the report said. “Some participants indicated that they favored raising the target range for the federal funds rate 25 basis points at this meeting or that they could have supported such a proposal.”

- Front month 10Y futures just marked 111-10.5 low (-19.5; yld 3.9434% high) before bouncing to 111-13 after the bell. Key technical support remains at 110-27+, the Mar 2 low. Curves remain steeper with short end rates outperforming (2s10s +7.831 at -100.717).

- There has been very little change in implied Fed rates with the dust settled on the FOMC minutes, which revealed that “some” participants favored hiking 25bps last month or could have supported such a proposal.

- FOMC-dated OIS sits with a 21.5bp hike for the Jul 26 decision, building to a cumulative 33bp of hikes to a terminal 5.40% in November, before 4bp of cuts to year-end and 51bp of cuts to Jun’24.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00293 to 5.14533 (+.06004 total last wk)

- 3M +0.00802 to 5.27676 (+.03768 total last wk)

- 6M +0.00087 to 5.38174 (+.06243 total last wk)

- 12M +0.01327 to 5.38481 (+.12649 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.579T

- Broad General Collateral Rate (BGCR): 5.05%, $575B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $565B

- (rate, volume levels reflect prior session)

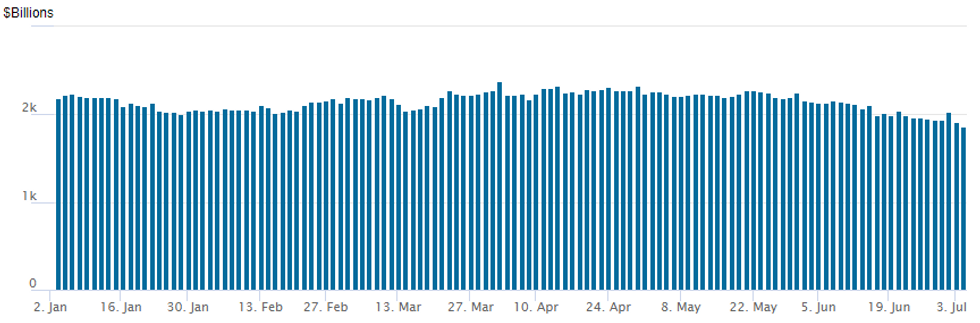

FED Reverse Repo Operation: Lowest Since May'22

NY Federal reserve/MNI

NY Fed reverse repo usage falls to $1,867.061B, lowest since May'22, w/ 102 counterparties, compared to $1,909.639B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Rather robust option volume traded in the lead-up to Wednesday's June FOMC minutes, early call interest segued to puts as underlying futures continued to extend lows (10Y yield marked 3.9434% high) , apparently in anticipation of a stronger than estimated employment data. Salient trade includes:

- SOFR Options:

- 5,000 SFRZ3 96.00/96.50/97.00/97.50 call condors ref 94.64

- 5,000 SFRU3 98.25/99.75 put spds

- Block, 10,000 SFRZ3 94.37/94.62/94.87/95.12 call condors, 6.5 vs. 94.65/0.08%

- -18,000 SFRZ3 95.50/96.00/96.50 call flys, 1.25 vs. 94.64/0.02%

- -2,100 SFRZ3 96.00/97.12 1x2 call spds, 0.5-1.0

- 4,000 SFRH4 94.87/95.87 call spds vs. 2QH4 96.87/97.87 call spds

- 6,000 SFRM4 96.00/97.00/98.00 call flys ref 95.23

- 2,500 OQU3 95.75 calls, ref 95.605

- Block/screen, 8,000 SFRZ3 93.75/94.00 put spds, 1.75 (16.7k blocked Tue)

- Block, 5,000 SFRH4 97.50/98.00 call spds, 2.0 ref 94.86 vs.

- Block, 5,000 SFRM4 96.50/97.25/98.00 call flys, 4.0 ref 95.20

- Treasury Options:

- Block, 7,500 TYU3 117 calls, 8 vs. 111-18.5/0.06%

- 5,700 TYU3 111 puts, 1-00 ref 111-15 total volume over 11,800

- Update, over 21,100 TYU3 114 calls, 32 ref 111-26 to -26.5

- 3,000 TYQ3 112 straddles, 1-20 ref 111-26.5

- 2,000 TYQ3 109/110.5 put spds, 10 ref 111-26

- 7,750 TYQ3 110.75 puts, 17 ref 111-28.5

- 3,190 FVU3 107/108.5 1x2 call spds ref 106-28

- 1,800 FVU3 107.5 calls, 44.5 ref 106-31.5

- over 4,500 TYU3 110.5 puts ref 111-30.5

- 2,000 TYU3 115/117/119 call flys ref 111-31

- 4,000 TYQ 114/115 call spds ref 111-31

- over 4,500 TYQ3 110 puts, 7 ref 112-01.5

- 2,000 TYQ3 114/115 call spds ref 111-28.5

- over 12,900 TY weekly 111.5 puts, 12 ref 111-29.5

- 1,500 TYU3 107/114.5 strangles ref 111-29

- 2,500 FVQ3 108.5 calls, 6 ref 106-30

- 4,600 TYQ3 114 calls ref 112-00.5

- over 8,000 wk1 TY 112.5 calls, 11 ref 112-01.5

- 4,400 TYU3 109 puts ref 112-01

- 2,600 TYQ3 110.5 puts, ref 111-31

EGBs-GILTS CASH CLOSE: Selloff Defies Soft Eurozone Data (Again)

Bunds and Gilts reversed an intraday rally to finish lower Wednesday, with weakness accelerating into the cash close as the UK and German core curves bear steepened.

- The biggest data of the day appeared mostly dovish. French and Spanish industrial production on the one hand were above-expected, but the more important Spanish and Italian services PMIs disappointed, and an ECB survey showed a continued decline in eurozone consumers' 1-year inflation expectations.

- The release of downwardly revised Eurozone Composite final PMI alongside the soft ECB survey helped boost EGBs briefly, but other than that there was a lack of overt triggers for the weakness. That dynamic was similar to Monday's bear flattening on weak manufacturing PMI.

- One factor potentially weighing was plenty of supply looming Thursday including 10/20/30-year French OATs, 6/10/50-year Spanish Oblis.

- Overall UK instruments underperformed, with BoE terminal Bank Rate pricing hitting a fresh high above 6.4%. BTP spreads tightened, reversing Tuesday's widening (which was the biggest daily move in 2 months).

- Thursday's docket includes the BOE's decision maker panel survey, German factory orders and Eurozone retail sales.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.5bps at 3.236%, 5-Yr is up 0.9bps at 2.61%, 10-Yr is up 2.5bps at 2.478%, and 30-Yr is up 4.2bps at 2.49%.

- UK: The 2-Yr yield is up 5.8bps at 5.377%, 5-Yr is up 9bps at 4.778%, 10-Yr is up 7.8bps at 4.494%, and 30-Yr is up 6.6bps at 4.488%.

- Italian BTP spread down 5.7bps at 168.9bps / Spanish up 3.8bps at 105.4bps

EGB Options: Euribor Put Buying Features Wednesday

Wednesday's Europe rates / bond options flow included:

- ERU3 96.00p, bought for 5 in 10k.

- ERU3 96.12/96.00/95.87p ladder, bought for 5 in 4k

FOREX Higher Yields Through London Close Fuel USD Rebound

- The greenback started the European session generally firmer, but faded across the morning before a run higher for US yields helped underpin the currency and stage a solid bounce through the London close. The US 10y yield showed back above 3.90%, hitting the highest level since early March and dragging the greenback along with it.

- The firming USD was more notable against high beta currencies, helping tip AUD/USD back through the 200-, 100- and 50-dmas all touched on Wednesday. Prices are now chewing through the corrective bounce off 0.6596, which marks a key level for any further breakout lower.

- AUD/USD options markets were also among the few seeing above-average volumes, largely due to solid demand for downside hedges. Local media also continues to speculate on the identity of the next RBA governor after Lowe's term expires in September. An announcement is expected within two weeks, and current Treasury Secretary Kennedy is among the frontrunners, according to reports.

- USD/CNH traded firmer, bucking the trend observed since the beginning of the week. The moves come despite more pressure on large commercial banks to trim their rates on USD deposit facilities, with local media also stressing the availability of tools to ensure FX stability. Nonetheless, USD/CNH traded back above 7.26, narrowing the gap with the first topside level of 7.2857.

- Focus for the Thursday session initially turns to Australian trade balance data, and German factory orders ahead of a slew of US releases: ADP Employment Change, ISM Services and weekly jobless claims are all on the docket. Fed's Logan and ECB's Nagel are also set to make appearances.

FX Expiries for Jul06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0595-00(E554mln), $1.0715-35(E1.8bln), $1.0800-20(E750mln), $1.0840-50(E534mln), $1.0889(E775mln)

- USD/JPY: Y144.00($2.4bln), Y145.00($1.1bln)

- USD/CAD: C$1.3200($722mln), C$1.3350($651mln), C$1.3400-10($711mln)

- USD/CNY: Cny7.2000($2.2bln)

Late Equity Roundup: Defensive Utility Shares Take Lead

- Stocks trading mildly weaker, well off early session lows as focus turns from an uninspiring June FOMC minutes release to employment data culminating with Friday's NFP. At the moment, S&P E-Mini Future down 6.75 points (-0.15%) at 4485.25, DJIA down 132.8 points (-0.39%) at 34285.9, Nasdaq down 11.9 points (-0.1%) at 13804.76.

- Leading gainers: Utilities have taken the lead in late trade followed by Communication Services and Real Estate sector shares as support for Information Technology shares ebbs. As to Utilities, independent power and renewable energy stocks rallied late: PG&E +3.6%, Consolidated Edison +2.3%, NRG Energy +2.0%. Media and entertainment shares continued to buoy Communication Services with Meta gaining 3.45%, Google +1.9%, Netflix +0.9% (GS upgraded shares as subscriber numbers increase).

- Laggers: Materials, Energy and Industrials underperformed in the first half, metals and mining stocks weaker (Gold trading -9.2 at 1916.28 late).

- The technical/bull theme in S&P E-minis remains intact despite today’s pullback. Last Friday’s gains reinforce a bullish condition. The contract has pierced key resistance and the bull trigger at 4493.75, the Jun 16 high.

- A clear break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4532.08, a Fibonacci projection. On the downside, key trend support has been defined at 4368.50, the Jun 26 low.

E-MINI S&P TECHS: (U3) Trend Needle Points North

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4546.73 Bull channel top drawn from the Mar 13 low

- RES 2: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 1: 4498.00 High Jun 30

- PRICE: 4487.00 @ 1500 ET Jul 5

- SUP 1: 4397.52/4368.50 20-day EMA / Low Jun 26 and a key support

- SUP 2: 4309.73 50-day EMA

- SUP 3: 4269.50 Low Jun 2

- SUP 4: 4216.00 Low May 31

A bull theme in S&P E-minis remains intact, despite today’s pullback. Last Friday’s gains reinforce a bullish condition. The contract has pierced key resistance and the bull trigger at 4493.75, the Jun 16 high. A clear break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4532.08, a Fibonacci projection. On the downside, key trend support has been defined at 4368.50, the Jun 26 low.

COMMODITIES: Crude Starts To Near Resistance As Tight Supply Wins Out

- Crude oil has seen further solid increases today as a tighter supply outlook wins out over softer demand concerns, with solid USD strength and rising Treasury yields doing little to dent latest increases.

- Earlier, Kuwait rowed back comments in Al Arabiya that it was requesting an OPEC+ quota increase whilst BofA retained its average 2023 price forecasts with Brent at $80/bbl and WTI at $70/bbl as the global oil supply balance should remain tight. It is seen supported by additional OPEC+ cuts, slower non-OPEC growth and rebounding demand from Asia.

- WTI sits in the order of +1.3% from late yesterday levels but with no formal close from Independence Day at $71.95 (+3.1% from Monday’s close). It moves closer to resistance at $72.72 (Jun 21 high) after which lies key resistance at $75.70 (Jun 5 high).

- Brent is +0.6% at $76.72 as it nears resistance at $77.25 (Jun 21 high) after which sits a bull trigger at $78.47 (Jun 5 high).

- Gold is -0.5% at $1916.25 as it comes under renewed pressure late on with the FOMC minutes failing to provide a dovish angle with a continued bid for the USD. It remains above support at $1893.1 (Jun 29 low).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/07/2023 | 0130/1130 | ** |  | AU | Trade Balance |

| 06/07/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/07/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/07/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/07/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 06/07/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/07/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 06/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/07/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/07/2023 | 1230/0830 | ** |  | US | Wholesale Trade |

| 06/07/2023 | 1245/0845 |  | US | Dallas Fed's Lorie Logan | |

| 06/07/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/07/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 06/07/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 06/07/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.