-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - November 2024

MNI POLITICAL RISK - Trump Initiates Tariff Negotiations

MNI ASIA MARKETS ANALYSIS: Focus Turns To Friday's NFP

- Treasuries ratcheted higher after a deluge of decently dovish data Wednesday, mainly a large ISM Services miss as new orders plunged.

- Rates maintained support into the early close ahead of the 4th of July Holiday, no react to the June FOMC minutes despite "several" voters eyeing a potential rate hike if inflation persists.

- US markets closed Thursday for the US Independence Day holiday, focus on Friday's June employment data.

US TSYS Tsys Well Bid Post Minutes, Focus Turns to Friday's NFP

- Treasuries held near session highs into the early pre-4th of July holiday close, little reaction to the FOMC June minutes release -- nothing new that hasn't been relayed by Fed speakers the last couple weeks:

- “Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably back to 2%,” the minutes said. “A number of participants remarked that monetary policy should stand ready to respond to unexpected economic weakness.” Most FOMC members – but not all -- believe monetary policy is restrictive and helping to gradually cool the economy and lower inflation.

- Wednesday saw a deluge of data, initial support after ADP employment modestly lower than expected in June at 150k (cons 165k) after a slightly upward revised 157k (initial 152k) in May.

- Initial jobless claims were slightly higher than expected at 238k (sa, cons 235k) in the week to Jun 29 after a marginally upward revised 234k (initial 233k).

- Main mover: Treasuries gapped higher after ISM Services index data came out lower than expected (48.8 vs. 52.6). Still well off last week's levels, Tsys are back near late Friday's prices: TYU4 tapped 110-04 high - through initial technical resistance of 109-30 (20-day EMA), trades109-29 last (+14), next resistance at 110-16 (Jun 28 high), before settling back to 109-30.5 after the bell.

- Focus turns to the next headline employment data release on Friday morning.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00019 to 5.33211 (-0.00506/wk)

- 3M -0.00391 to 5.31426 (-0.01034/wk)

- 6M -0.01578 to 5.23696 (-0.01775/wk)

- 12M -0.02996 to 5.02033 (-0.01971/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (-0.05), volume: $2.110T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $758B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $744B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

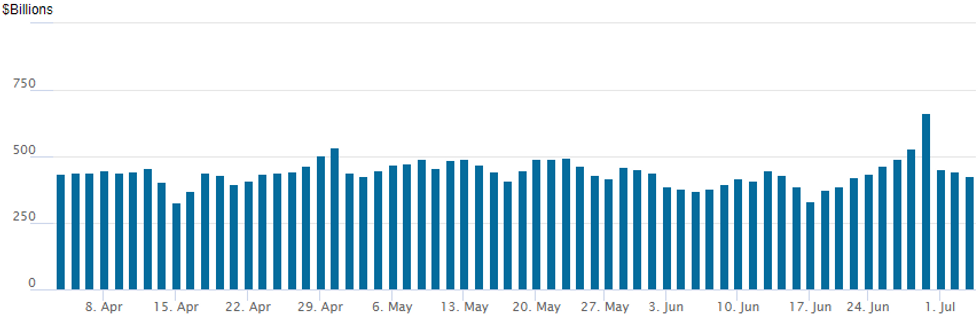

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage continues to recede from last Friday's month-end high of $664.570B, the latest read at $425,898B from $443.369B prior. Number of counterparties falls to 70 from 78 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR options leaned toward better upside call trade while Treasury options appeared more mixed as underlying futures traded near highs after the heavy data deluge on shortened pre-holiday session. Projected rate cut pricing through year end have rebounded vs. this morning's lows (*): July'24 at -8.5% w/ cumulative at -2.1bp at 5.307%, Sep'24 cumulative -19.6bp (-17.4bp), Nov'24 cumulative -29.1bp (-26.1bp), Dec'24 -47.5bp (-43.9bp). Salient flow includes:

- SOFR Options:

- +10,000 0QZ4 96.00/96.50 call spds 1x2 .5 ref 96.065

- +5,000 SFRM5 95.12/95.37/95.62 put flys 2.75 ref 95.705

- +5,000 SFRU4 94.62/94.75/94.87 put flys 2.5 ref 94.85

- -7,000 SFRU4 94.87 calls, 6.0 ref 94.855

- -5,000 SFRU4 94.87/95.00/95.12 call flys with

- -5,000 SFRU4 94.81/94.93/95.00/95.12 call fly condord -5K @7.25

- Block, +20,000 SFRU4 94.75/94.81/94.87/94.93 call condors, 1.5 ref 94.85

- +2,500 SFRZ5 95.00/96.00 put spds, 36.0

- +5,000 SFRU4 94.87/95.00/95.12 call flys, 2.5 ref 94.845

- 1,250 SFRU4 94.81/94.87/95.00 2x3x1 put flys

- 1,500 SFRV4 95.12/95.25/95.37 call flys

- Treasury Options:

- 10,000 TYQ4 108 put, 7 ref 110-02

- +15,000 Wednesday weekly TY 109.5/110.5 strangles, 25-26.5 (expire July 10)

- 5,000 TYQ4 105/106 put spds ref

- 6,000 TYU4 110 straddles, 211

- 1,000 FVU4 107/108.5/110 call flys

- 2,000 USQ4 112 puts, 10 ref 116-27

- 1,200 TYQ4 111.5/113/114.5 call flys ref 109-15

- over 3,000 TYU4 112 calls, 16 last

- Block, +5,000 TYQ4 110.5 calls, 19 ref 109-13

- 1,400 TYQ4 110.5/111 call spds ref 109-14.5

EGBs-GILTS CASH CLOSE: OAT And BTP Spreads Tighten For 3rd Straight Day

The German and UK curves flattened Wednesday, with periphery / semi-core EGB spreads tightening for the 3rd consecutive session.

- Core EGBs/Gilts were flat/lower in the morning, with weakness concentrated in at the short end. Then in the afternoon, Treasuries jumped on weak US data including a contractionary ISM Services reading, with the rally spilling over into European FI.

- The 10Y Oat/Bund spread fell another 3bp to 68bp and is now 15bp tighter on the week following Sunday's first-round elections. One trigger: 200 candidates from centrist/left-wing parties have withdrawn from second round elections in order to limit right-wing gains.

- BTP and GGB spreads continued compressing in sympathy. Gilts outperformed Bunds.

- Bank of Latvia Gov Kazaks, and separately Eurosystem sources, told MNI that the ECB was on track to achieve its 2% inflation target.

- The main focus on Thursday will be the UK election (MNI's preview here), though results will only begin to come in after the market close. We also get the accounts of the ECB's June meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 2.918%, 5-Yr is down 1.9bps at 2.561%, 10-Yr is down 1.8bps at 2.585%, and 30-Yr is down 5.6bps at 2.743%.

- UK: The 2-Yr yield is down 1.9bps at 4.17%, 5-Yr is down 5.5bps at 4.026%, 10-Yr is down 7.6bps at 4.172%, and 30-Yr is down 8.2bps at 4.665%.

- Italian BTP spread down 5.5bps at 139.7bps / Greek down 5.1bps at 106.9bps

EGB Options: Large Sonia Call Condor Buying Features Ahead Of UK Election

Wednesday's Europe rates/bond options flow included:

- ERU4 96.50/96.37/96.25p fly, bought for 2.25 in 6k

- ERV4 96.62/96.75/96.87c fly, bought for 2.75 in 2.5k

- ERV4 96.50/96.37/96.25p fly bought for 1.5 in 4k

- ERZ4 96.75/96.87cs 1x1.25, bought the 1 for 1.5 in 5k

- ERZ4 96.87^ vs 96.75p, sold the straddle at 15.75 in 4k

- ERH5 97.25/97.75cs bought for 5.5 in 5k

- SFIQ4 95.00/95.05/95.10/95.15c condor is still being bought for 1, looks like14.5k total

FOREX Greenback Weakens Following Soft ISM, AUDUSD Breaches Resistance

- The greenback came under pressure on Wednesday amid US ISM Services index data coming in far weaker than expected in June at 48.8 (est. 52.7). It more than reverses the 4.4pt increase in May, leaving it at its lowest since May’20. The USD index is 0.45% lower as we approach the APAC crossover ahead of tomorrow’s US Independence Day holiday.

- Gains for major equity indices have underpinned strong moves higher in both AUD and GBP, while the Norwegian Krona is the best performer in G10.

- AUDUSD has made a notable breach of key resistance at 0.6714, the May 16 high. We highlighted that this was an area that could come under threat given the AU/US two-year yield differential is currently close to January levels when AUDUSD was trading above 0.68. The pair reached as high as 0.6734 before retracing roughly 20 pips as the US session winds down. We noted a breach of this level may be required to build momentum for AUD crosses, explored further here.

- USDJPY registered an impressive 117 pip range on the day. Initially, the pair rose to a fresh cycle high at 161.95 before pulling back a touch ahead of the data. With longer-dated US yields extending as much as 8-9bps lower, USDJPY had a sharp move to the downside, briefly reaching 160.78. However, in contrast to other G10 pairs, the greenback bounced back strongly, with USDJPY rising over 75 pips off the lows before consolidating back around 161.50.

- GBPUSD extended above initial firm resistance at 1.2740, the Jun 19 high, registering a fresh two-week high in the process as we approach tomorrow’s UK election. A sustained break of this level would highlight an early reversal signal which may target a move to 1.2860, the Jun 12 high.

- Separately, it is also worth noting, EURGBP failed to recover back above 0.8500 earlier in the week (also 50-day EMA). This remains a key technical pivot for the cross, and while remaining below this level on a closing basis the outlook remains bearish.

- Swiss CPI and the UK election highlight the economic calendar on Thursday. US markets will be closes for the July 04 holiday and focus remains on Friday’s NFP report.

FX OPTIONS: Expiries for Jul04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0770-80(E1.2bln), $1.0820-25(E600mln), $1.0885-00(E1.6bln)

- EUR/JPY: Y171.90(E1.0bln)

- GBP/USD: $1.2790-00(Gbp779mln)

- AUD/USD: $0.6750-55(A$598mln)

- NZD/USD: $0.6130(N$721mln)

- USD/CNY: Cny7.2500($885mln)

Late Equities Roundup: Chip Stocks Extend Gains

- Stocks are mostly higher into the early pre-4th of July holiday close, extending the top end of narrow session ranges while the DJIA continues to lag S&P Eminis and Nasdaq indexes. Currently, the DJIA is down 23.85 points (-0.06%) at 39308, S&P E-Minis up 22.75 points (0.41%) at 5591.5, Nasdaq up 159.5 points (0.9%) at 18188.3.

- Technology and Materials sectors continued outperform into the early close, semiconductor makers rebounding after seeing several consecutive sessions of profit taking, First Solar +5.85%, Nvidia +3.77% Broadcom +3.50% while Micron gains 2.31%. Metals and mining shares led the Materials sector with Newmont +4.32%, Freeport-McMoRan +4.01%.

- Health Care and Consumer Staples sectors remained weaker, pharmaceutical names weighing on the former for the second consecutive session: Gilead -2.40%, Incyte Corp and Regeneron Pharma both -2.27%. Retail, staples distribution shares traded weaker: Constellation Brands -4.09%, Walgreens Boots Alliance -3.33%, Dollar General -2.87%.

- Reminder, the latest equity earnings cycle kicks off in earnest Friday next week, banks headline: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup.

E-MINI S&P TECHS: (U4) Bullish Continuation Pattern

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5570.50 @ 14:37 BST Jul 3

- SUP 1: 5488.93/5397.39 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The trend condition in S&P E-Minis is unchanged and signals remain bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. Note that the recent pause in the trend still appears to be flag formation - a bullish continuation signal that reinforces current conditions. Sights are on 5594.66, a Fibonacci projection. Support to watch is 5496.53, the 20-day EMA.

COMMODITIES Gold, Silver Rally Following Soft US Data

- The softer-than-expected US labour market and ISM services survey data allowed gold to break above $2,360/oz briefly today as the USD weakened and Treasuries rallied, before gains were pared later in the session.

- Spot gold is currently up by 1.2% at $2,357/oz.

- From a technical perspective, gold is in consolidation mode, with initial firm resistance at $2,387.8, the Jun 7 high.

- Meanwhile, silver is outperforming and is up by 3.4% at $30.5/oz.

- For silver, first resistance to watch is $30.853, the Jun 21 high. A break would be a bullish development.

- Copper has rallied for a fourth successive session, gaining by 2.5% today to $453/lb.

- The metal has gained as investors assess possible stimulus in China and rate cuts in the US, with hopes that policymakers in China will announce some policy support at this month’s Third Plenum.

- For copper, a bearish corrective cycle that started May 20, remains in play, with support at $426.12, a Fibonacci retracement. Initial resistance to watch is $496.40, the Jun 4 high.

- WTI Aug 24 is up 0.7% at $83.4/bbl.

- A bull cycle in WTI futures remains in play, with attention on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $79.35, the 50-day EMA.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/07/2024 | 0130/1130 | ** |  | AU | Trade Balance |

| 04/07/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 04/07/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/07/2024 | 0630/0830 | *** |  | CH | CPI |

| 04/07/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 04/07/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 04/07/2024 | 0830/0930 |  | UK | Decision Making Panel Data | |

| 04/07/2024 | 0900/1100 |  | EU | ECB's Lane Lecture at University of Naples | |

| 04/07/2024 | - |  | UK | General Election | |

| 04/07/2024 | 1415/1615 |  | EU | ECB's Cipollone speech at 15th edition of National Statistics conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.