MNI ASIA MARKETS ANALYSIS: Growth Scare Buoys Tsys, Crude Weak

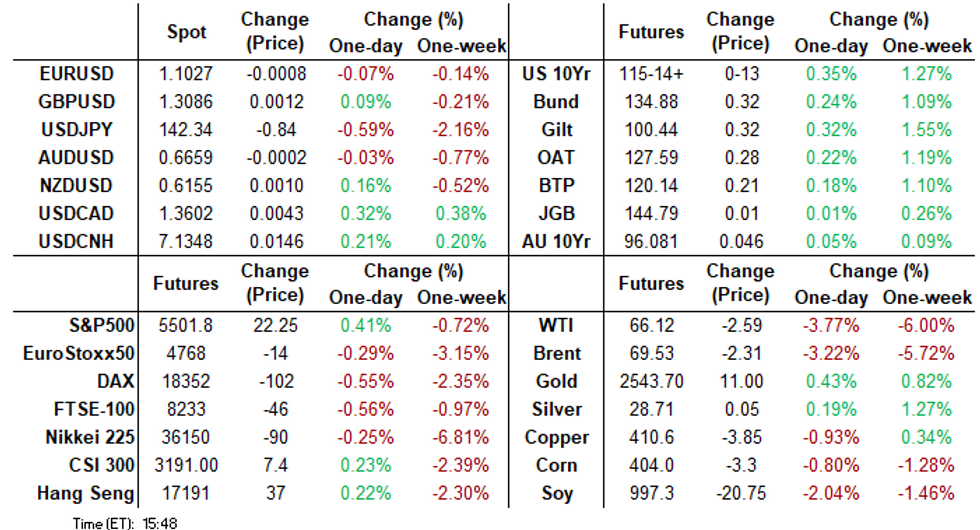

- Treasury curves bull steepened Tuesday, partially driven by a "growth scare" as crude prices, basic materials and financial share prices fell.

- Energy sector shares were weighed by a drop in crude prices (WTI -3.18 at 65.53) amid continued surplus overhang concerns.

- Banks and financial services weighed on the Financial sector, Ally Financial falling more than 18% amid concerns over lagging interest and fee income.

- Focus turns to Wednesday's CPI inflation measure for clues to next week's FOMC policy announcement.

US Tsy Futures Near Late Highs, Rate Cut Projections Gradually Gaining

- Treasuries climbed steadily off early session lows Tuesday, late profit taking sees futures 2-3 points off session highs. Projected rate cuts through year end have regained some ground after receding Monday into early Tuesday (*): Sep'24 cumulative -33.5bp (-32.7bp), Nov'24 cumulative -73.3bp (-71.8bp), Dec'24 -115.4bp (-112.0bp).

- Dec'24 10Y futures currently trade +12 at 115-13.5 vs. 115-16 high, shy of 115-19 technical resistance (High Aug 5 and the bull trigger). 10Y yield -.0563 at 3.6442%. Curves mildly steeper after disinverting last Friday (climbing to highest level since June 2022 early Monday at 7.405), 2s10s currently +.805 at +3.765.

- No economic data on today, markets await Wednesday's CPI, PPI inflation measure on Thursday. Core non-housing service inflation is expected to see at least a repeat of the 0.21% M/M from July, with six analysts between 0.20-0.35% M/M.

- The Federal Reserve's top banking regulator Michael Barr on Tuesday said the biggest U.S. banks would face a 9% increase in capital requirements in a re-proposal of Basel endgame and G-SIB surcharge rules.

- For other large banks that are not G-SIBs, Barr said the impact from the re-proposal would mainly result from the inclusion of unrealized gain and losses on their securities in regulatory capital, estimated to be equivalent to a 3% to 4% increase in capital requirements over the long run, according to prepared remarks.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00684 to 5.11077 (+0.00093/wk)

- 3M +0.02334 to 4.94886 (+0.01022/wk)

- 6M +0.02067 to 4.57888 (-0.01311/wk)

- 12M -0.00101 to 3.99443 (-0.05917/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.094T

- Broad General Collateral Rate (BGCR): 5.32% (-0.01), volume: $800B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $768B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

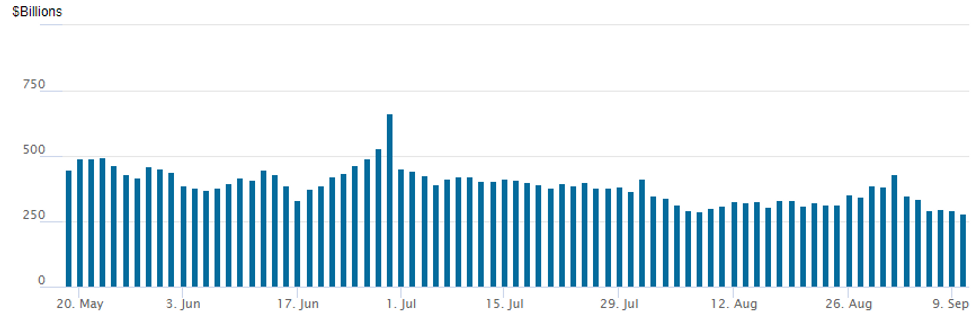

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage falls to new multi-year low of $281.392B (early May 2021 levels) vs. $292.158B on Monday. Number of counterparties rises to 60 from 57.

US SOFR/TREASURY OPTION SUMMARY

Upside call volume remained strong Tuesday, mostly position adds as option accounts continued to position for more aggressive rate cuts, as much as 125bp by year end. Large Dec'24 SOFR call spread sale a notable exception as paper unwound buy from early July. Large Tsy 10Y midcurve call buy that expires this Friday looking for a miss in CPI/PPI inflation measures. Projected rate cuts through year end have regained some ground after receding Monday into early Tuesday (*): Sep'24 cumulative -33.5bp (-32.7bp), Nov'24 cumulative -73.3bp (-71.8bp), Dec'24 -115.4bp (-112.0bp).- SOFR Options: Reminder, Sep options expire Friday

- -3,000 SFRU4 95.12 straddles, 6.75 vs. 95.10/0.30%

- +10,000 SFRH5 95.75/96.00 put spds 5.25 vs. 96.535/0.10%

- -10,000 SFRZ4 95.62/96.06/97.00 call flys vs. 95.37/95.50 put spds, 9.25 net vs. 95.90/0.17%

- -50,000 SFRZ4 95.25/95.50 call spds 23.0 ref 95.50 (while the calls, outright and on spread have seen a lot of trade since this summer, todays sale likely an unwind after paper bought over 80,000 on July 10 at 6.5 vs. 95.21/0.20%)

- Block, 6,000 SFRU4 95.12/95.25 1x2 call spds vs. 95.06 puts, 0.0 ref 95.10

- Block/screen, -30,000 SFRZ4 96.00 calls, 14.5 vs. 95.905/0.42%

- -4,000 SFRU4 95.00/95.12/95.25 call flys, 6.25 ref 95.0975

- -3,000 SFRU4 95.00/95.12/95.18/95.31 call condors, 7.0 ref 95.10

- over 23,000 SFRZ4 96.00/96.62 call spds

- Block, -7,000 0QH5 96.00/96.25 put spds, 2.5 vs. 97.18/0.06%

- Block, 9,000 0QM5 95.50/96.00 put spds, 4.0 vs. 97.13/0.06%

- 1,500 SFRZ4 95.87/96.12/96.38 call flys ref 95.905

- Block, 5,000 SFRH5 96.50/97.00 call spds vs. 2QH5 97.50/98.00 call spds, 6.0 net/steepener

- over -10,000 SFRU4 95.12 calls, 2.0 ref 95.0975

- 1,000 SFRU4 95.00/95.06/95.12 2x3x1 put flys ref 95.0975

- Treasury Options:

- +10,000 TYX4 113.5 puts, 21

- +10,000 TYV4 114.25/116.25 call over risk reversals, 1.0 vs. 115-07.5/0.45%

- 3,000 FVV4 111.5/112.25 call spds, 3.5 ref 110-15.75

- 4,350 wk2 TY 115.5 calls, 8 ref 114-28.5

- +53,000 wk2 TY 115 calls, 21, opener, expire Friday

- 1,250 USV4 120/122 put spds ref 125-28

BONDS: EGBs-GILTS CASH CLOSE: Curve Bellies Outperform As Gains Extend

Core European instruments extended gains to a 6th consecutive session Tuesday.

- After an slightly weak start to the day, Gilts and Bunds gained in afternoon trade on apparent global growth concerns, as broad-based weakness in commodities led by oil boosted safe-haven assets.

- Earlier, a largely in-line UK labour market report did not provide much to move expectations for the BoE, while final German CPI was inline.

- Curve bellies outperformed in Germany and the UK. Periphery EGB spreads were little changed.

- Most attention Wednesday will be on US CPI, but before that we get monthly UK activity data.

- Looking beyond that, a 25bps cut at Thursday's ECB meeting is unanimously expected (and priced in), leaving focus on the policy guidance and revised projections. (MNI's ECB preview is here.)

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.6bps at 2.178%, 5-Yr is down 4.1bps at 1.993%, 10-Yr is down 3.7bps at 2.131%, and 30-Yr is down 2.6bps at 2.406%.

- UK: The 2-Yr yield is down 2.9bps at 3.86%, 5-Yr is down 3.8bps at 3.685%, 10-Yr is down 3.7bps at 3.819%, and 30-Yr is down 2.6bps at 4.398%.

- Italian BTP spread unchanged at 145.2bps / Spanish bond spread down 0.2bps at 82.7bps

EGB OPTIONS: Pre-ECB Euro Rates Trade Leans To Upside

Tuesday's Europe rates/bond options flow included:

- Bull steepener: ERZ4 97.00/97.12 1x1.5 call spread paper paid 1 on 24K vs 0RZ4 98.00/98.25 1x1.5 call spread at 4.25. The position netted out receiving -3.25, buying the front.

- ERH5 97.87/98.00cs vs 97.12/97.00ps, bought the cs for 0.75 in 12.5k

- ERH5 98.12/98.87cs bought for 5 in 20k

- 0RU4 98.00/98.25cs, bought for 4.5 in 5k.

- SFIX4 95.65/95.55/95.35 broken p fly, bought for flat in 2k.

- SFIZ4 95.50/95.40/95.30p fly, bought for 1.75 in 2k.

FOREX: USDJPY Reverts Lower with US Yields as CPI Awaited

- Another day, another volatile session for the Japanese yen. Continuing to be steered by core fixed income markets, a treasury led rally on Friday boosted the Japanese yen substantially. USDJPY fell roughly 150 pips from session highs, falling as low as 142.20 as US two-year yields dipped below 3.6%. Price action sees the gap narrow to the key support area around 141.70, an area of critical focus heading into tomorrow’s US data.

- In similar vein across the low yielders/funders, the Swiss Franc has been on the front foot, with EURCHF currently down 0.45% as we approach the APAC crossover. The cross looks set to close at the lowest level since Aug 06 and takes us closer to the year’s lowest levels, where some market analysts believed the SNB may have stepped in to curb excessive CHF strength.

- The very front-end of the USD vol curve is unsurprisingly bid headed into tomorrow's US inflation print, with overnight EUR/USD implied cresting at 9.5 points this morning. That's still comfortably north of the running August average (6.1 points), but not far off half the prevailing levels ahead of Friday's NFP print.

- This gels well with the view that the Fed are leaning more heavily on the employment aspect of the dual mandate - likely making markets less sensitive to tomorrow's inflation print relative to Friday's labour market report.

- Today's pick up in vols pushes the break-even on an overnight straddle to ~40 pips, meaning a hawkish CPI print tomorrow would press the pair toward the key area of support identified on the 15min candle charts at 1.0970-77. Below here, Fibonacci retracement support resides at 1.0878.

- All the focus Wednesday on US inflation data and note that the releases will land firmly within the Fed’s blackout period ahead of the Sep 17-18 meeting.

Equities Roundup: Late Recovery While Banks, Energy Still Lagging

- Stocks bounced off midday lows, Dow Industrials still in the red in late Tuesday trade with Energy and Financial sector shares underperforming. Currently, the DJIA trades down 123.75 points (-0.3%) at 40707.45, S&P E-Minis up 16.25 points (0.3%) at 5496, Nasdaq up 110.6 points (0.7%) at 16995.3.

- Energy sector shares were weighed by a drop in crude prices (WTI -2.73 at 65.98) amid ongoing surplus overhang concerns: APA -5.44%, Diamondback Energy -4.96%, Exxon Mobil -3.69%.

- Meanwhile, banks and financial services weighed on the Financial sector, Ally Financial falling over 18% amid increasing "credit challenges" while JP Morgan -5.12% after bank officials discussed interest income concerns during an earlier conference call, Citigroup -4.08%, Citizens Financial -3.97%.

- On the flipside, Real Estate and Information Technology sector shares outperformed, shares of specialized REITS supporting the former: Digital Realty +4.46%, Equinix +3.87%, Iron Mountain +2.64%. Renewed demand for high-end AI chips helped Oracle gain 11.09%, Broadcom +5.59%, AMD +2.63%.

EQUITY TECHS: E-MINI S&P: (U4) Bearish Corrective Cycle Still In Play

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and key resistance

- RES 1: 5538.47/5669.75 20-day EMA / High Sep 3 and a bull trigger

- PRICE: 5498.75@ 1512 ET Sep 11

- SUP 1: 5394.00 Low Sep 6

- SUP 2: 5367.50 Low Aug 13

- SUP 3: 5330.00 61.8% retracement of the Aug 5 - Sep 3 bull leg

- SUP 4: 5249.74 76.4% retracement of the Aug 5 - Sep 3 bull leg

Recent weakness in S&P E-Minis highlighted the start of a corrective cycle. The contract remains in a bear-mode condition, despite this week’s gains, and scope is seen for a deeper retracement near-term. An extension lower would open 5330.00, 61.8% retracement of the Aug 5 - Sep 3 bull leg. Key resistance has been defined at 5669.75, the Sep 3 high. Initial firm resistance to watch is 5538.47, the 20-day EMA.

COMMODITIES: Crude Lowest Since Dec 2021, Spot Gold Consolidates

- WTI is headed for its lowest close since December 2021 as the market’s bearish feel grows. A slight downward revision of demand growth from OPEC, coupled with continued weakness from the USA and China maintain price pressure.

- WTI Oct 24 is down 4.2% at $65.8/bbl.

- OPEC lowered its demand growth to 2.0m b/d for 2024, down 80k b/d compared to last month’s assessment, according to their August MOMR.

- WTI futures remain in a bearish condition, having pierced key support at $66.66. Next support is at $65.30 - 1.50 projection of the Apr 12 - Jun 4 - Jul 5 price swing.

- In contrast, spot gold has edged up by 0.4% to $2,516/oz today, as the yellow metal remains close to last month’s record high, ahead of key US CPI data tomorrow.

- Gold is in consolidation mode, although the trend condition is unchanged and the primary direction remains up, with sights on $2,536.4 next, a Fibonacci projection.

- Meanwhile, copper has fallen by 1% to $410/lb.

- Chile’s copper commission Cochilco today lowered its copper price forecast for this year to average $4.18/lb, from $4.30 previously, amidst a weaker demand outlook.

- A bear cycle in copper futures remains intact, with initial support seen at $396.45, the Aug 7 low. On the upside, a clear break of the 50-EMA at $423.34 would signal scope for stronger gains.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 11/09/2024 | 0600/0700 | ** |  | UK Monthly GDP |

| 11/09/2024 | 0600/0700 | ** |  | Trade Balance |

| 11/09/2024 | 0600/0700 | ** |  | Index of Services |

| 11/09/2024 | 0600/0700 | *** |  | Index of Production |

| 11/09/2024 | 0600/0700 | ** |  | Output in the Construction Industry |

| 11/09/2024 | 0900/1000 | ** |  | Gilt Outright Auction Result |

| 11/09/2024 | 1100/0700 | ** |  | MBA Weekly Applications Index |

| 11/09/2024 | 1230/0830 | *** |  | CPI |

| 11/09/2024 | 1230/0830 | * |  | Intl Investment Position |

| 11/09/2024 | 1400/1000 | * |  | Services Revenues |

| 11/09/2024 | 1400/1000 |  | MNI Connect Video Conference on ‘Fed Balance Sheet – Comparison with Other Central Banks’ | |

| 11/09/2024 | 1430/1030 | ** |  | DOE Weekly Crude Oil Stocks |

| 11/09/2024 | 1700/1300 | ** |  | US Note 10 Year Treasury Auction Result |