-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Jobs Gain Tempers Rate Cut Pricing

- Treasuries gapped lower after the May employment figures come out stronger than expected Friday.

- Additional metrics such as a gain in the unemployment rate and a sharp drop in 55+ male participation tempered overall opinion of the data to a wash.

- Projected rate cut pricing by year end fell from almost two 25bp rate cuts to to just over one.

- Cross asset moves: stocks bounced with S&P Eminis and Nasdaq indexes both marked new all-time highs, Gold tumbled over $75 amid reports that China has ceased it's 18-month buy program.

US TSYS May Jobs Gain, Unemployment Rate Rise; Focus on CPI, FOMC Next Wed

- Broadly weaker after the bell, Treasuries have actually traded sideways since the initial gap sell-off following the higher than expected jobs gain of 272k (+180k est), offset slightly by -15k 2-month revisions.

- Amid the dip in 55+ labor market participation (0.2pp to 38.2%) which drove the overall unexpected dip in May: it was in turn driven by a drop in Male 55+ participation to 43.4% (43.7% prior), with female participation -0.1pp to 33.6%. That's the lowest 55+ male participation rate seen since 2005 - which will act as a constraint on labor supply, which may concern the FOMC.

- Treasury futures actually extended session highs briefly, Sep'24 10Y (TYU4) tapping 110-21 before falling to 109-09.5 -- the widest gap move since April's CPI release. The 10Y contract traded in a 7 tic range since the data, trades -1-02 at 109-09.5 after the bell.

- Cash yields are broadly higher: 2s +.1585 at 4.8826%, 10s +.1406 at 4.4276%, 30s +.1118 at 4.5470%, while curves are running flatter: 2s10s -1.381 at -45.498, 5s30s -4.450 at 8.974.

- Late year rate cut projections have receded vs. late Thursday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -8% w/ cumulative at -2.3bp (-5.9bp) at 5.307%, Sep'24 cumulative -13.7bp (-21.3bp), Nov'24 cumulative -20.3bp (-30.7bp), Dec'24 -37.4bp (-49.7bp).

- Looking ahead, main focus is on CPI inflation data for May Wednesday morning, followed by the FOMC policy announcement at 1400ET that afternoon.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00134 to 5.32764 (-0.00217/wk)

- 3M -0.00045 to 5.33399 (-0.00885/wk)

- 6M -0.00380 to 5.27129 (-0.04290/wk)

- 12M -0.02019 to 5.07210 (-0.12987/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $2.008T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $771B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $750B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $285B

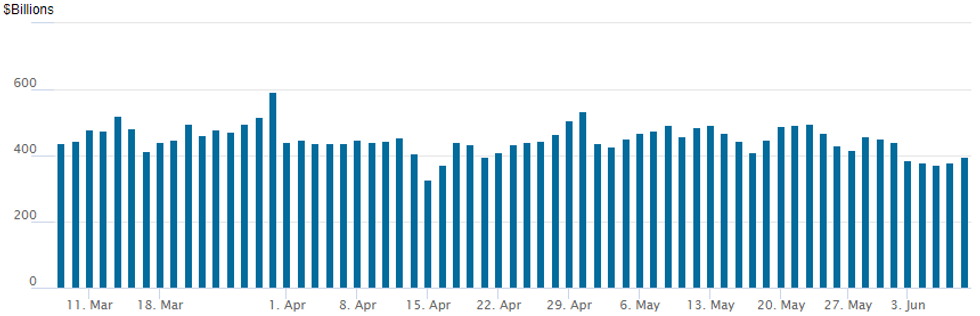

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $395.462B from $378.125B prior; number of counterparties slips to 69 from 72. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed Friday, downside put buying strong as underlying futures gapped lower after the higher than expected jobs gain, while calls turned two-way. In-line with the post-data sell-off, late year rate cut projections have receded vs. late Thursday levels (*): June 2024 at -1.3% w/ cumulative rate cut -.3bp at 5.328%, July'24 at -8% w/ cumulative at -2.3bp (-5.9bp) at 5.307%, Sep'24 cumulative -13.7bp (-21.3bp), Nov'24 cumulative -20.3bp (-30.7bp), Dec'24 -37.4bp (-49.7bp)

- SOFR Options:

- Block, 10,000 0QN4 95.68 puts, 15.0 vs SFRU5 95.70/0.50%

- +3,000 SFRH5 95.50 straddles, 70.0 ref 95.315

- -6,000 SFRQ4 95.00/95.12 call spds, 1.0 ref 94.82

- +5,000 SFRZ4 96.25/96.87 call spds, 2.0 ref 95.065

- 9,000 SFRU4 94.81/94.87/95.00/95.06 call condors ref 94.82

- -5,000 SFRN4/SFRQ4 95.00 call spds, 1.75

- -5,000 SFRU4 95.12/95.25 cal spds 0.75 ref 94.82

- +6,000 SFRN4 94.62/94.75 put spds vs. SFRU4 94.68/94.75 put spds 1.0/Sep over

- Block, 8,000 SFRZ4 95.56/95.68 call spds, 1.5 ref 95.07

- Block, 10,000 SFRV4 95.50/95.75 call spds 3.75 ref 95.17

- +4,000 SFRZ5 97.50/98.50 call spds vs. 94.62 puts, 8 vs

- 12,000 0QM4 95.75/95.87/95.93 broken call flys ref 95.665- to -.67

- 3,000 SFRN4 95.12/95.37 1x2 call spds ref 94.885

- 5,000 SFRN4 95.00/95.06 call spds ref 94.885

- 3,300 SFRM4 94.68/94.75 call spds ref 94.675

- Block, 2,500 SFRZ5/SFRH6 93.75/94.25/94.75 put fly strip, 9.0 total

- 3,000 SFRZ5 96.50/97.50 call spds ref 96.015

- 6,500 0QM4 95.87/96.00 call spds ref 95.67

- Treasury Options:

- 6,000 TYQ4 107 puts, 15 ref 109-13.5

- 9,275 USQ4 124/130 1x2 call spds ref 117-16

- 20,000 wk2 5Y 106.75/107/107.5/107.75 call condors ref 106-03.5

- 8,000 TYN4 107.5/108.5 put spds, 9 ref 109-12

- 4,000 TYN4 107.5 puts, 3 ref 109-10

- 3,200 wk2 TY 108/108.75 2x1 put spds, 5 ref 109-14

- 2,000 TYU4 111/113.5 call sapds, 17 ref 109-14

- 5,000 FVQ4 105/105.5/106/106.5 put condors ref 106-05.5

- 2,500 TYN4 108/109 2x1 put spds 10 ref 109-14

- Block, -7,500 wk2 FV 106.25 calls, 19 vs. 106-06/0.47%

- -10,000 TYN4 109.25/111.25 strangles, 32

- 2,500 TYN4 108/109 put spds

- 3,150 FVN4 107.5/108.5 call spds ref 106-23

- 1,500 TYQ4 108.5 puts, 24 ref 110-09

- 1,500 USN4 116.5/118 put spds, 27 ref 119-05

- 2,500 TYN4 109.25/111.25 strangles, ref 110-09

- 1,100 FQV4 107.75 calls, ref 106-23

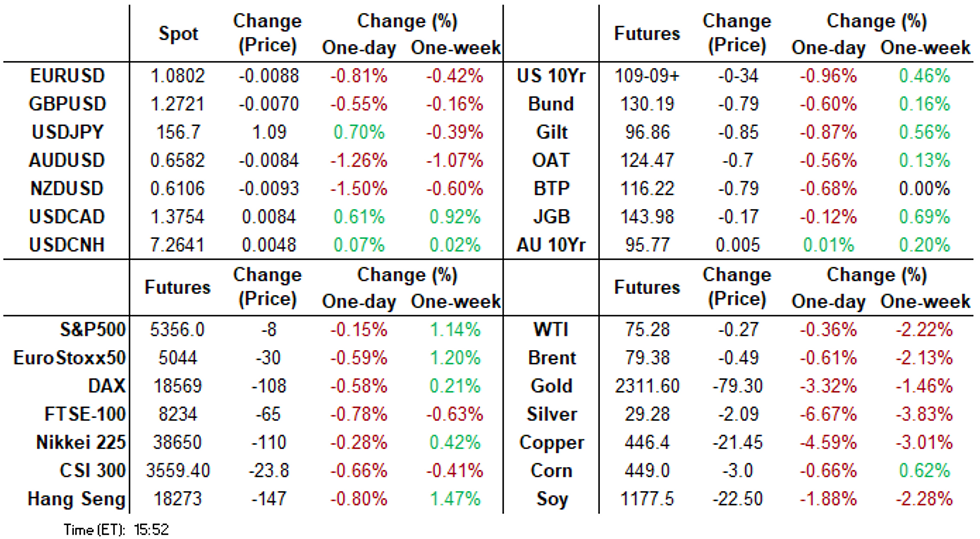

FOREX: USD Rallies to Best Levels Since Early May Post-NFP

- US yields rose 10-15bps across the curve on the back of the stronger-than-expected US labour market report, prompting a ~0.8% rally in the BBDXY which reached its highest level since early May.

- The stronger parts of the survey dominated when it came to initial market reaction, with hawkish repricing driven by the much firmer-than-expected NFP release and strong wage numbers.

- USDJPY rallied as much as ~150pips, briefly piercing 157.00 to narrow the gap to key resistance at 157.71, the May 29 high. While we have moderately eased off the day’s best levels, price remains 0.6% higher and above the June 4 high.

- The kneejerk move lower in equities aided weakness in the likes of AUD and NZD, though the recovery in the major benchmarks to pre-data levels since then has not impeded downside momentum for the antipodeans. AUDUSD looks set to close below 0.66 for the first time since May 8, a handle whereby the 50-day EMA also closely intersects. A clear break here could signal scope for a deeper retracement to 0.6558, the May 8 low.

- NZD is the weakest performer in G10, closely followed by NOK and SEK which have each recorded losses of around 1.4% against the greenback.

- Price action in EURUSD has been comparatively more subdued, though the pair still sits 0.75% lower, just above the 1.08 handle at typing. Support to watch lies at 1.0788, the May 30 low, a breach of which may call into question the recent bull cycle.

Late Equities Roundup: Eminis Off New All-Time High, Financials Lead

- Off post-NFP lows, stocks marched higher in the second half before profit taking tempered support with indexes mildly lower after the bell. S&P Eminis made new all-time high of 5385.5 while the DJIA remains well off mid-May all time high of 40,065.18. Currently, the DJIA is down 24.63 points (-0.06%) at 38889.44, S&P E-Minis down 6.5 points (-0.12%) at 5363, Nasdaq down 52.1 points (-0.3%) at 17138.41.

- Financial and Industrial sector shares continued to lead gainers in late trade, banks and insurance providers supported the former: Capital One +3.15%, Discover Financial Services +2.49%, Travelers +2.07% while JP Morgan gained 1.85%. Industrials sector led by 3M Co +3.48%, United Rentals +2.27%, WW Grainger +2.05%.

- On the flipside, Real Estate and Materials sectors continued to underperform, investment trusts, particularly office and hotel REITs weighed on the former: Boston Properties -2.42%, American Tower -2.19%, Alexandria Real Estate -1.58%. Metals and mining shares weighed on the Materials sector - partially due to Gold falling over $75.0 amid reports China has curbed their 18-month buying program: Newmont -4.92%, Freeport-McMoRan -3.38% while Steel Dynamics declined 1.75%.

- Looking ahead to next week's notable earnings releases: Autodesk, Casey's General Store, Oracle, Broadcom, and Adobe.

E-MINI S&P TECHS: (M4) Trend Signals Remain Bullish

- RES 4: 5462.77 2.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5400.00 Round number resistance

- RES 1: 5385.50 intra-day High Jun 7

- PRICE: 5354.75 @ 14:23 BST Jun 7

- SUP 1: 5290.83/5205.50 20-day EMA / Low May 31 and key support

- SUP 2: 5155.75 Low May 6

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact and this week’s gains reinforce this set-up. The contract has traded above 5368.25, the May 23 high and bull trigger. The move confirms a resumption of the uptrend. A continuation higher would signal scope for a climb towards the 5400.00 handle next. On the downside, key short-term support has been defined at 5205.50, the May 31 low. Clearance of this level is required to signal a short-term reversal.

COMMODITIES Gold, Silver Fall Following Robust US Employment Data

- Gold has fallen by 3.1% today to $2,302/oz, as investors further discount prospects for Fed interest rate cuts, following the stronger-than-expected US employment data.

- The move takes the yellow metal to its lowest level since May 06, 6% below the record high reached on May 20.

- Latest data also show that the PBoC didn’t buy any gold in May, the first time China has opted not to add to its reserves since October 2022.

- A short-term bear cycle in gold remains in play for now, although the medium-term trend structure is bullish. The 50-day EMA at $2314.4 has been pierced, opening $2,277.4, the May 03 low and a pivot support.

- Meanwhile, silver is underperforming and is down by 6.7% on the day at $29.2/oz, its lowest level since May 15.

- For silver, support at the 20-day EMA has been breached. The next level to monitor is $28.6827, the 50-day EMA.

- Copper is also down by 4.5% to $447/lb, its lowest since May 02.

- Crude markets are headed for the close broadly unchanged on the day and down around 2% on the week. The strengthening in the US dollar following the payrolls data has been adding pressure today.

- WTI Jul 24 is trading at $75.5/bbl.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2024 | 2301/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 10/06/2024 | 2350/0850 | ** |  | JP | GDP (r) |

| 10/06/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/06/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/06/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2024 | - |  | JP | Economy Watchers Survey | |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/06/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.