-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Large March Jobs Down Revision

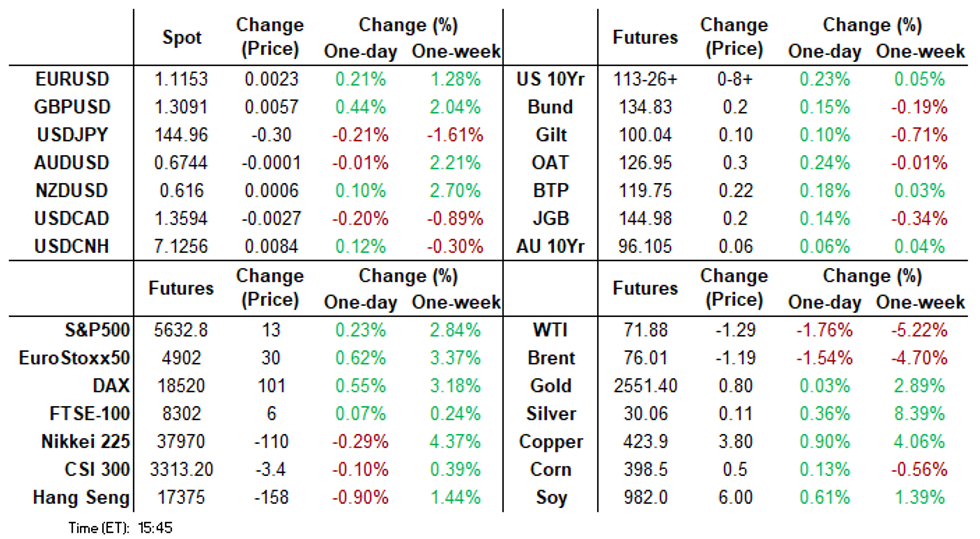

- Treasuries saw a moderately volatile session following the delayed BLS payrolls benchmark down revision of 818k.

- Tsy futures pared back gains after see-sawing higher into the dovish July FOMC minutes where several officials saw a cut in July as plausible.

- The USD index (-0.49%) trades at fresh yearly lows, having extended below 101.00 in recent trade.

US TSYS Lrg BLS March Job Down Revision, Dovish July FOMC Minutes Weigh on Tsys

- Treasuries saw a moderately volatile session following the delayed BLS prelim annual payrolls benchmark down revision of 818k jobs to the Mar'24 statistics.

- After taking more than 30 minutes for official public confirmation, the BLS reports that the preliminary benchmark payrolls revision is a very large -818k. It implies seasonally adjusted average monthly payrolls growth through the twelve months to Mar 2024 was closer to 174k rather than 242k seen in the current vintage.

- Futures pared back gains after see-sawing higher into the dovish July FOMC minutes, Sep'24 10Y futures +8 at 113-26 vs. 114-01 high, 10Y yield at 3.7897% vs. 3.7595% low.

- As expected, the July FOMC minutes (link) signalled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July. There weren't many clues in the minutes on future monetary policy beyond that, with no mention for example of a potential >25bp cut.

- Projected rate cuts through year end gained vs. early Wednesday levels (*): Sep'24 cumulative -33.6bp (-33.3bp), Nov'24 cumulative -65.7bp (-64.4bp), Dec'24 -101.3bp (-98.3bp).

- Focus turns to the KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday morning.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00287 to 5.30858 (-0.02710/wk)

- 3M -0.01932 to 5.10176 (-0.02665/wk)

- 6M -0.01759 to 4.81009 (-0.02960/wk)

- 12M -0.03949 to 4.33885 (-0.04975/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $2.101T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $784B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $765B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $90B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $257B

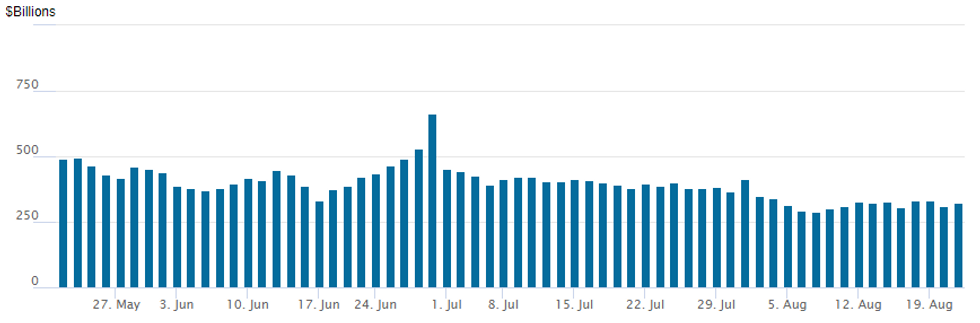

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage rebounds to $321.329B from $310.819B Tuesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties slips to 66 from 77 prior.

US SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option flow remained mixed after a moderately volatile session following the delayed BLS prelim annual payrolls benchmark revision. Futures are paring back gains after see-sawing higher into the dovish July FOMC minutes. Projected rate cuts through year end gained vs. early Wednesday levels (*): Sep'24 cumulative -33.6bp (-33.3bp), Nov'24 cumulative -65.7bp (-64.4bp), Dec'24 -101.3bp (-98.3bp).- SOFR Options:

- +10,000 SFRU4 95.06/95.12/95.18 put tree, 0.25/10K (9511) *total volume in the SFRU4 95.12 call is over 106,000 in late trade

- +8,000 SFRV4 95.43 puts 2.25 ref 95.755

- +7,000 SFRU4 95.31/95.37 call spds, 0.5 vs. 95.10/0.05%

- -9,000 SFRZ4 97.00/98.50 2x3 call spds 5.25 ref 95.775

- +7,000 SFRZ4 96.12/96.25/96.37 call flys 0.5 ref 95.765

- +10,000 SFRV4 94.50/94.56 put spds 2.0 ref 95.77

- +5,000 SFRU4 95.06/95.18 2x3 call spds 3.0 ref 95.08

- +3,000 0QZ4 96.75 straddles, 65.0 ref 96.865

- Block, 10,000 SFRU4 95.31/95.50 call spds, 0.75 ref 95.09

- +20,000 SFRU4 95.37/95.43 call spds, 0.25 ref 95.085

- -30,000 SFRH5 96.75/97.75 call spds 12.0 ref 96.235

- -20,000 SFRZ4 96.00/97.00 2x3 call spds 15.0 ref 95.735

- +6,000 SFRU4 95.00/95.12/95.25 call flys, 1.75 ref 95.0875

- 10,000 SFRU4 95.06/95.12/95.18 call flys, 2.0 ref 95.0825

- 2,500 0QU4 96.87/97.25 call spds vs. 96.43/96.50 put spds ref 96.685

- 20,000 SFRU4 95.00/95.12/95.25 call flys ref 95.07

- 4,000 SFRU4 95.18/95.37 call spds ref 95.08

- Treasury Options:

- 10,000 TYV4 114/116.5/117 call trees, 44 ref 114-19

- over 6,000 TYV4 111.5 puts

- 2,500 FVV4 108.75 puts ref 109-20.5

- 1,750 FVX 111/111.5 call spds

BONDS: EGBs-GILTS CASH CLOSE: Core Yields Edge Lower For Third Day

Core European yields closed lower Wednesday for the third day this week.

- After a modestly constructive start on limited data and newsflow, Bund and Gilt yields fluctuated in mid-afternoon as the release of US payroll revisions proved messy.

- Ultimately core FI gained going into the European cash close, as the delayed data release showed downward revisions on the high end of expectations.

- ECB's Panetta noted that a "phase of loosening" likely laid ahead, while the UK saw higher-than-expected public sector net borrowing. Neither had much tangible market impact.

- The German and UK curves leaned bull steeper, while EGB periphery spreads tightened modestly.

- The main focus for the week continues to be on Thurs/Fri, which bring August flash PMIs, Eurozone national accounts/negotiated wages, and the Fed's Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 2.357%, 5-Yr is down 3.6bps at 2.106%, 10-Yr is down 2.4bps at 2.191%, and 30-Yr is down 0.8bps at 2.429%.

- UK: The 2-Yr yield is down 2.7bps at 3.664%, 5-Yr is down 3.2bps at 3.701%, 10-Yr is down 2.4bps at 3.891%, and 30-Yr is down 1.3bps at 4.441%.

- Italian BTP spread down 1.1bps at 136.7bps / Spanish down 1.4bps at 81.3bps

EGB OPTIONS: Rate Options Flow Picks Up

Wednesday's Europe rates/bond options flow included:

- OEV4 120.50/121.25/121.75c fly, bought for 6 in 1.5k

- RXV4 136/137cs, bought for 16 in 1k

- ERX4 96.87/96.75ps 1x2, bought for 1.5 in 6k

- ERX4 96.87/96.75/96.62/96.50p condor, bought for 3 in 8.88k

- ERZ496.62/96.75cs, bought for 1.25 in 7k total

- ERM5 98.00/98.50cs Sold at 8 in 4k

- 0RU4 97.75/97.87/98.12c ladder bought for 2.5 in 2k

- SFIH5 96.00/96.25/96.50c ladder bought for 0.25 in 5.5k total

FOREX Greenback Continues Downward Trend, USD Index at Year’s Lows

- A volatile session for currencies in which a chaotic release of the BLS payrolls benchmark revisions provided only a momentary hiccup for an otherwise steady session of greenback selling. As expected, the July FOMC minutes signalled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July, which has paved the way for an extension of dollar weakness as we approach the APAC crossover.

- As such, the USD index (-0.49%) trades at fresh yearly lows, having extended below 101.00 in recent trade, significantly narrowing the gap to the Dec 2023 lows of 100.62. GBP stands out as one of the key beneficiaries in G10, with the ongoing bid for equities providing further optimism to higher beta currencies.

- A close at current or higher levels would be the firmest close for GBPUSD since July last year, and brings the pair within striking distance of the 1.3142 bull trigger. While USD weakness has certainly played a part so far this week, today stands out on the GBP strength more broadly, with EURGBP testing 100-dma support at 0.8510 and looking vulnerable on any break of 0.8504, the 50% retracement for the upleg off the mid-July low.

- Moving in tandem, EUR/USD shows through the mid-December, extending to a high of 1.1175 at typing. Underlying drivers here remain the broad USD weakness (especially given the single currency’s weighting in the usd index) this week as well as the bullish underlying techs in the pair: moving average studies remain in a bull-mode set-up, highlighting a rising trend. 1.1201 is the next objective for the move, the 1.50 projection of the Jun 26 - Jul 17 - Aug 1 price swing.

- The next test for the Euro’s outperformance will be Thursday’s release of Eurozone PMI’s, where markets will look for the continuation of the dynamic highlighted by President Lagarde in the ECB's July meeting press conference, with services driving the Eurozone’s gradual recovery in economic activity. Jobless claims and existing home sales highlight the US calendar.

FOREX OPTIONS: Expiries for Aug22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0905-20(E1.8bln), $1.1040-50(E801mln), $1.1065-80(E869mln), $1.1100-20(E2.5bln)

- USD/JPY: Y145.70($1.2bln), Y146.20($1.1bln), Y148.00($1.1bln), Y148.65($1.5bln)

- EUR/GBP: Gbp0.8475-85(E1.1bln)

- EUR/JPY: Y159.95-00(E1.4bln)

- AUD/USD: $0.6630-50(A$2.6bln), $0.6660-70(A$1.2bln), $0.6750-60(A$839mln)

- NZD/USD: $0.5940-55(N$1.3bln)

Late Equities Roundup: Gains Tempered Post-FOMC Minutes

- Stocks are making moderate gains in late Wednesday trade, nearly testing midmorning highs after the dovish leaning July FOMC minutes spurred some profit taking. Currently, the DJIA trades up 29.01 points (0.07%) at 40863.93, S&P E-Minis up 15 points (0.27%) at 5634.5, Nasdaq up 63.4 points (0.4%) at 17879.33.

- Materials and Consumer Discretionary sector shares led gainers in late trade, the former buoyed by: Albemarle +4.84%, Mosaic +2.81%, Steel Dynamics +2.66%. Durables and apparel stocks supported the Consumer Discretionary sector: TJX +5.61%, Ross Stores +4.11%, DR Horton +3.84%.

- On the flipside, listed banks weighed on the Financials: Franklin Resources -7.65%, American Express -2.78%, Citigroup -1.58%. Interactive media and entertainment followed suit: Warner Brothers -1.09%, Google -0.78%, Charter Communications -0.55%.

- Late cycle corporate earnings expected this week: after today's close, Urban Outfitters, Agilent Technologies, Synopsys, Snowflake and Zoom Video Communications; Wednesday; Peloton, Advance Auto Parts, Williams-Sonoma, Ross Stores and Intuit on Thursday; Dollar Tree and Veradigm Inc on Friday.

EQUITY TECHS: E-MINI S&P: (U4) Bull Cycle Remains In Play

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and Key resistance

- RES 1: 5664.00 High Jul 18

- PRICE: 5633.50 @ 1518 ET Aug 21

- SUP 1: 5476.18 50-day EMA

- SUP 2: 5319.50 Low Aug 9

- SUP 3: 5182.00 Low Aug 8

- SUP 4: 5120.00 Low Aug 5 and the bear trigger

S&P E-Minis traded higher Tuesday, reinforcing the current bull cycle and, confirming once again an extension of the reversal that started Aug 5. Price has cleared resistance at 2600.75, the Aug 1 high and this signals scope for an extension towards key resistance and the bull trigger at 5721.25, the Jul 16 high. A break would resume the primary uptrend. On the downside, support to watch lies at 5476.18, the 50-day EMA.

COMMODITIES: WTI Crude Futures Extend Selloff to Near Seven Month Lows

- WTI crude oil looks set to close at its lowest level since January despite a report showing U.S. inventories fell last week. The focus remains on weak China demand and easing international tensions amid hopes of a Gaza ceasefire deal and no retaliatory strike by Iran so far.

- The latest move down undermines a recent bullish theme and this has exposed key support at $71.67, the Aug 5 low and the bear trigger. A break would resume the downtrend that started Apr 12.

- For natural gas, Henry Hub is losing ground today although remains in the $2.1/mmbtu and $2.3/mmbtu range seen since Aug. 9. Although temperatures are rising in the coming days, there are expectations that cooling demand will begin to abate which will weigh on gas-fired power.

- In precious metals, Gold is broadly unchanged on the session and technical conditions remain bullish for the yellow metal after delivering an all-time high on Tuesday. The recent breach of resistance at $2483.7, the Jul 17 high, confirmed a resumption of the primary uptrend. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend. The focus is on a climb towards $2536.4 next, a Fibonacci projection.

- Iron ore rose for a third day - recovering more of its 9% plunge last week - on signs Chinese authorities will take more steps to try and revive the country’s waning property market. Copper futures also rose 1%, hovering just below the early August highs.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 22/08/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 22/08/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/08/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2024 | 1130/1330 |  | EU | Account of ECB MonPol meeting in July | |

| 22/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 22/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/08/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/08/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/08/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/08/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.