-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Latching Onto Dovish CB Comments

- MNI US: Schumer Expected To Start Process On CR To Avert Govt Shutdown Today

- CHICAGO FED GOOLSBEE: STILL ON 'GOLDEN PATH' TO LOWER INFLATION: Rtrs

- LAGARDE: RATE CUTS CAN START ONCE DATA CONFIRM INFLATION PATH, Rtrs

- RICHMOND FED BARKIN: REPEATS WON'T PREJUDGE DECISION ON MARCH RATE CUT, Bbg

- RICHMOND FED BARKIN: PAYING CLOSE ATTENTION TO 1-TO-3-MONTH PCE INFLATION, Bbg

- ECB'S VUJCIC: WE EXPECT A SOFT LANDING FOR EURO ZONE, Bbg

Key Links:MNI BRIEF: US December CPI Stickier Than Expectations / MNI US: Still Stubborn Service Inflation But Market Reluctant To Stray Too Far From March Cut / MNI INTERVIEW: Aggressive Wage Bargaining To Extend BOC Hold / MNI BRIEF: Real Wage Rises Supporting Growth, Recovery- Vujcic / MNI BRIEF: ECB Could Cut 50bps If Supported By Data - Vujcic

US TSYS 10Y Yield Back Below 4% Ahead PPI

- Treasury futures near late session highs but still shy of this morning's initial knee-jerk bid following more-or-less in-line CPI inflation data: CPI MoM (0.3% vs. 0.2% est), YoY (3.4% vs. 3.2% est); Ex Food and Energy MoM (0.3% vs. 0.3% est), YoY (3.9% vs. 3.8% est).

- Tsys climbed off midmorning lows in a positive reaction to Croatian National Bank governor Boris Vujcic comment at a MNI Connect webcast that the ECB should cut interest rate in 25bps increments, although 50bps moves should not be excluded if warranted by incoming data.

- Tsys ignored Cleveland Fed Mester comment that March is probably too early for a rate cut, focusing on dovish comments from Richmond Fed Barkin: needs convincing evidence inflation is stabilizing, but is open to cutting "once inflation on track to 2%".

- FI market bounce seems rather tepid, however, as markets await tomorrow morning's PPI data before committing. MN Fed President Kashkari speaks about economic conditions tomorrow as well (1000ET).

- Modest post-auction support as short sets reversed ($21B 30Y auction reopen (912810TV0) stops through for the second consecutive time: 4.229% high yield vs. 4.231% WI; 2.37x bid-to-cover vs. 2.43x in the prior month (2.38x 5-auction average.

- Curves near two-month highs: 2s10s taps -27.670, last seen November 7. Meanwhile, 10Y yield slipped below 4% late to 3.9847 (-.0436). Initial technical resistance for Mar'24 10Y futures up above at 112-19 (High Jan 4); support holds at 111-06+ (Low Jan 05).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00103 to 5.33316 (-0.00608/wk)

- 3M -0.01247 to 5.31399 (-0.01527/wk)

- 6M -0.02909 to 5.15565 (-0.03719/wk)

- 12M -0.04015 to 4.80295 (-0.05155/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.660T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $677B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $665B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $247B

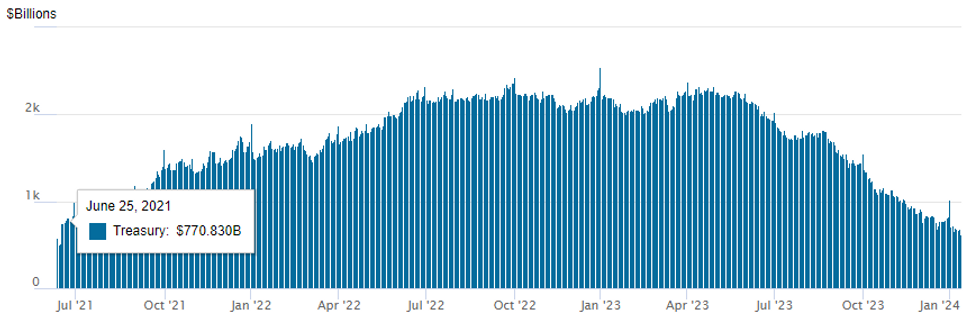

FED REVERSE REPO OPERATION: New Lows

NY Federal Reserve/MNI

- RRP usage inches falls to $626.370B vs. $679.961B Wednesday, today's usage marks the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties slips to 76 from 79 on Wednesday, compares to Tuesday's 72 -- the lowest since January 5, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR option volumes remained robust Thursday. Call structure/rate cut positioning continued while some late put structures were reported, fading the late session rally as projected rate cuts for early 2024 gained slightly: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -68.8% vs. -64.0% late Wednesday w/ cumulative of -17.8bp at 5.150%, May 2024 chance of cut 99.3% vs. 90.9% late Wednesday, cumulative -42.9bp at 4.900%. June 2024 back to fully pricing in the first 25bp cut w/ cumulative -69.4bp at 4.635%. Fed terminal at 5.3275% in Jan'24.- SOFR Options: Reminder, January options expire tomorrow

- 12,000 SFRM4 94.75/95.00 2x1 put spds ref 95.44

- 6,000 SFRH4 94.31/94.43/94.56/94.68 put condors

- +5,000 SFRH4 94.62/94.68/94.75/94.81 put condors, 1.75

- Block, 6,000 0QF4 96.12/96.25 put spds, 1.0 ref 96.40

- 3,100 0QK4 96.87/97.37/97.87 call flys ref 96.415

- 2,500 SFRM4 95.62/96.12/96.50 call flys

- 8,000 SFRU4 95.75/95.87 call spds vs. 95.18/95.31 put spds

- Block, 4,000 0QG 96.37/96.62 call spds 9.0 over 0QG4 95.37/95.62 put spds

- Block, +35,000 0QG 96.50/96.75 call spds 6.5 over 0QG4 95.50/95.75 put spds vs. SFRH5 96.41/0.20%

- 16,000 SFRG4 95.00/95.06 call spds ref 94.93

- 16,000 SFRF4 94.93/95.00 1x2 call spds ref 94.93

- Blocks, +17,000 SFRH4 95.06/95.12 call spds ref 94.93

- 2,500 SFRM4 95.62/95.87 call spds ref 95.37

- 2,500 SFRU4 97.00/98.00 2x3 call spds ref 95.745

- 2,000 SFRJ4 95.75/96.25 call spds ref 95.36

- 2,000 SFRJ4 95.37/95.62/95.87 call trees

- Treasury Options:

- 2,500 FVG4 108.5 calls, 20 ref 108-12.75

- -10,000 TYG4/TYH4 110.5 put calendar spreads, 22 ref 111-27.5/0.14%

- 2,500 TYG4 111/112.5 call spds over TYG4 110/111 put spds

EGBs-GILTS CASH CLOSE: BTPs Outperform As Vujcic Opines On 50bp Cuts

Periphery spreads tightened for a 4rd consecutive session Thursday, with core EGBs/Gilts trading mixed as US inflation developments weighed.

- Global yields jumped led by Treasuries after US December inflation readings came in slightly higher than expected.

- But subsequent to US CPI, an MNI event with Croatia's/ECB's Vujcic saw a dovish turn in market pricing when he said that half-point rate cuts should not be ruled out if justified by incoming data.

- On the day, the German curve twist steepened marginally, with the short end benefiting from a pullback in ECB hike pricing expectations cued by the Vujcic comments. The UK curve leaned bear steeper.

- Periphery spreads maintained their narrowing made at the open, after a brief tick higher on US CPI. BTP/Bund closed below 160bp, at the same level as the Dec 22 close (157.1bp).

- ECB's Lagarde speaks after the cash close; Friday's early highlight is UK GDP/activity data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.626%, 5-Yr is down 1.7bps at 2.153%, 10-Yr is down 1.0bps at 2.236%, and 30-Yr is up 0.8bps at 2.426%.

- UK: The 2-Yr yield is up 2bps at 4.255%, 5-Yr is up 0.2bps at 3.757%, 10-Yr is up 2.3bps at 3.842%, and 30-Yr is up 2.5bps at 4.44%.

- Italian BTP spread down 2.6bps at 157.1bps / Spanish down 2.1bps at 91.8bps

EGB Options: Mixed Trade Includes Near-Term ECB-Related Downside

Thursday's Europe rates/bond options flow included:

- SFIM4 95.15/95.25/95.35/95.45c condor, bought for 1.5 in 2k

- SFIJ4 95.50/95.70/95.90 call fly paper paid 2 on 10K

- ERJ4 96.50/96.62/96.75/97.00 'broken' call condor Bought for 1.75 in 8k

- ERH4 96.25/96.375/96.50 call fly vs 96.00 put, pays 1.25 in 6.5k (vs 96.625)

- Bund downside, covers the ECB decision on Jan 25:

- RXG4 131.50p, bought for 6.5 and 7 in 10k

- RXG4 131.00p, bought for 5 in 7k

- RXG4 130.50p, bought for 3.5 and 4 in 8k

FOREX Initial Greenback Spike Faded as Treasuries Yields Reverse Lower

- Stubbornly above-estimate inflation data from the US prompted a quick spike for the greenback on Thursday, with early declines for the USD index quickly erased. However, topside momentum was kept in check as US yields began to reverse lower across the remainder of the US session and the DXY has been edging back towards unchanged levels as we approach the APAC crossover.

- USDJPY reached as high as 146.41 in the aftermath of the CPI release, extending the 2024 recovery. However, with two-year treasury yields touching a year-to-date low in recent trade, USDJPY is edging lower in sympathy. Pre-data lows of 145.14 will act as the immediate target, however, it is worth noting a key short-term support has been defined much lower at 143.42, the Jan 9 low.

- The likes of AUD (-0.30%) and CHF (-0.27%) are marginal underperformers on Thursday, with equities weakness largely responsible for the Aussie leg.

- GBP retaining its position as the outperformer in 2024 against the dollar, rising 0.10% on the session and narrowing the gap with session highs around 127.75. With the trend outlook remaining bullish, attention is on resistance at 1.2827, the Dec 28 high and bull trigger. Clearance of this level <Cell 27, 0>would confirm a resumption of the uptrend and open 1.2881, a Fibonacci retracement point. Initial firm support lies at 1.2611, Jan 2 low.

- China CPI/PPI figures will be released on Friday as well as trade balance data for December. Attention then turns to UK growth figures and US December PPI data.

Late Equity Roundup: Near Steady, Shorts Covered Ahead Friday's PPI

- Stocks have been paring losses since marking session lows in late morning trade, indexes are near steady as Information Technology and Energy sector stocks continued to lead gainers. Dovish comments from Richmond Fed Barkin in the second half. Currently, DJIA is down 21.91 points (-0.06%) at 37675.66, S&P E-Mini future down 10.25 points (-0.21%) at 4810, Nasdaq down 9 points (-0.1%) at 14961.39.

- Leading gainers: Information Technology and Energy sectors continued to outperform, IT stocks supported by software makers while chip stocks pared gains: Salesforce +2.94%, Palo Alto Networks +2.5%, Cognizant Technology +1.79%. On the flipside, Seagate -2.15%, HP -0.96%, Zebra Tech -0.82%. Oil and gas shares advanced with crude prices (WTI off highs at 72.07 +0.70): Valero +2.45%, Marathon Petroleum +1.62%, Occidental +0.56%.

- Laggers: Utilities and Financial sectors continued to underperform, multi-energy shares weighing on the former: AES -3.81%, WEC Energy -3.43%, Alliant -3.1%. Bank shares weighed on Financials the day ahead of quarterly earnings: Citizens Financial -2.43%, Citizens Financial -2.27%, Huntington Bancshares -2.05%. Banks kick off the next quarterly earnings cycle tomorrow: BlackRock, Bank of America, Wells Fargo, JPMorgan, Citigroup and Bank of NY Mellon.

E-MINI S&P TECHS: (H4) Approaching The Bull Trigger

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4841.50 High Dec 28 and the bull trigger

- PRICE: 4808.00 @ 1520 ET Jan 11

- SUP 1: 4702.00 Low Jan 05

- SUP 2: 4694.00 2.0% 10-dma Envelope

- SUP 3: 4668.13 50-day EMA

- SUP 4: 4594.00 Low Nov 30

S&P E-Minis have recovered from last Friday’s low and the contract has traded higher today. Key resistance and the bull trigger is at 4841.50, the Dec 28 high. Clearance of this level would resume the uptrend and open 4854.75, a Fibonacci projection. Support at the 20-day EMA of 4760.92 has recently been pierced. A clear break of this average would strengthen a short-term bearish threat and open the 50-day EMA, at 4668.13.

COMMODITIES Crude Futures Retrace Bulk Off Earlier Gains, Gold Meets Support

- Crude continues to be trading higher on the day as US close approaches, although it has relinquished most of its gains having pushed closer to resistance levels.

- The US has demanded the immediate release of an oil tanker seized by Iran off the coast of Oman.

- The discount for Russian crude oil has widened by around 40% since the UK strengthened its enforcement of the price cap in October, a US Treasury official said Jan. 11

- The crucial Red Sea shipping route could take months to open according to Maersk’s chief executive Vincent Clerc speaking with the FT.

- Ecuador’s oil and gas sector was operating normally on Wednesday despite a large uptick in violence in the country this week the energy ministry said.

- WTI is +1.0% at $72.06 having pulled back from highs of $73.81. Resistance remains at $74.62 (50-day EMA).

- Brent is +0.8% at $77.4 off highs of $79.10 having pushed close to $79.41 (Jan 4 high) after which lies key resistance at $81.45 (Dec 26 high).

- Gold is -0.2% at $2020.8 having bottomed out at $2013.4 to test support at $2013.2 (50-day EMA) before being helped higher by a softer USD index.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 12/01/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 12/01/2024 | 0130/0930 | *** |  | CN | CPI |

| 12/01/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 12/01/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/01/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 12/01/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 12/01/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/01/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/01/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 12/01/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 12/01/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 12/01/2024 | 1230/1330 |  | EU | ECB's Lane Speech + Q&A at REBUILD Annual Conference | |

| 12/01/2024 | - | *** |  | CN | Trade |

| 12/01/2024 | - | *** |  | CN | Money Supply |

| 12/01/2024 | - | *** |  | CN | New Loans |

| 12/01/2024 | - | *** |  | CN | Social Financing |

| 12/01/2024 | 1330/0830 | *** |  | US | PPI |

| 12/01/2024 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2024 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.