-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI ASIA MARKETS ANALYSIS: Limited React to Atlanta Fed Bostic

- MNI FED: Bostic ('24): Fed Can Let Restrictive Policy Continue To Work In "Orderly" Process

- ATLANTA FED BOSTIC: RISE IN UNEMPLOYMENT HAS BEEN "FAR LESS" THAN WHAT WOULD TYPICALLY BE THE CASE GIVEN THE REDUCTION IN INFLATION; FED IS IN "A VERY STRONG POSITION" RIGHT NOW - Reuters News

- MNI White House: Funding Agreement "Moves US Closer To Preventing Govt Shutdown"

- PBOC VOWS TO USE VARIOUS MONETARY TOOLS TO BOOST CREDIT: XINHUA

- MNI SLOVAKIA: Former PM Pellegrini To Run For President, Election On 23 Mar

Key Links: MNI US EARNINGS SCHEDULE - Big Banks Kick Off Q1, With Mixed Performance Expected / MNI UST Issuance Deep Dive: Jan 2024 / US Employment Insight, Jan'24: Hawkish But Less So Than First Met The Eye

Tsys Off Midday Highs, 10Y Yield Back Over 4%, Limited React to Bostic

- Still bid, Treasury futures continue to scale off midday highs after the bell (TYH4 +7.5 at 111-30.5, 10Y yield 4.0096%, -.0361). Block sales helped get things rolling, in addition to flurry of late rate lock selling as corporate supply resumes ($15.9B total for Monday).

- No significant reaction to latest Atlanta Fed Bostic comments, says "Fed is in a very strong position right now, can let restrictive policy continue to work to slow inflation", still sees two 25bp rate cuts this year.

- Projected rate cuts for early 2024 have gained slightly: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -62% w/ cumulative of -16.6bp at 5.163%, May 2024 chance of cut 90.9% vs. -86.8% this morning, cumulative -39.4bp at 4.935%. Fed terminal at 5.3275% in Jan'24.

- Current TYH4 at 112-02 (+11), well inside technicals: resistance at 112-19 (High Jan 4) vs. 111-06+ support (Low Jan 05). Curves flatter: 3M10Y -5.565 at -140.036, 2Y10Y -1.167 at -34.875. 10Y yield holding just below 4% at 3.9945% (-.0512).

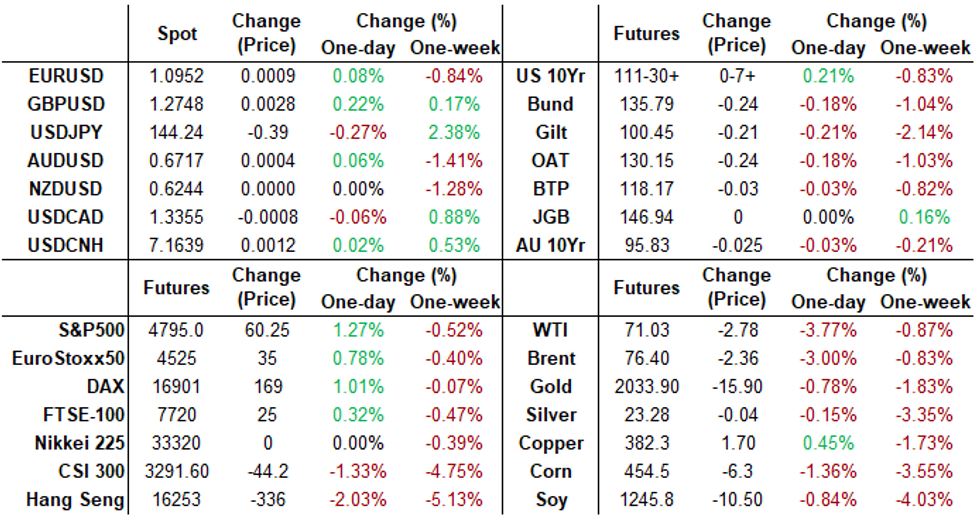

- Cross asset roundup: crude remains weaker/off lows (WTI -2.81 at 71.00), Gold weaker -18.27 at 2027.18., S&P Eminis near highs +58.0 at 4792.75.

- Market focus remains on CPI/PPI inflation measures this Thursday/Friday respectively.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00153 to 5.33771 (-0.00447 total last wk)

- 3M -0.00352 to 5.32574 (-0.00005 total last wk)

- 6M -0.00857 to 5.18427 (+0.01476 total last wk)

- 12M 10.00669 to 4.84781 (+0.03521 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.674T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $692B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $84B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

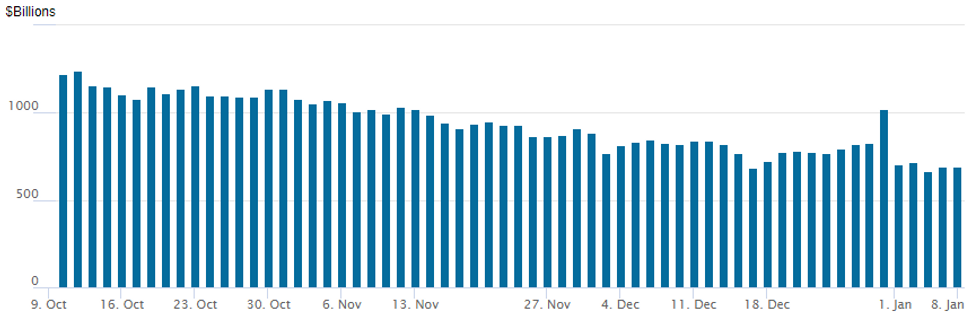

FED REVERSE REPO OPERATION

NY Federal Reeserve/MNI

- RRP usage recedes to $691.485B vs. $694.478B Friday -- compares to $664.899B on Thursday -- the lowest level since mid-June 2021.

- The number of counterparties falls back to 78, the lowest since April 2022.

SOFR/TREASURY OPTION SUMMARY

Consistently better SOFR call structures drove Monday's option volume. Rate cut position builds reported even before underlying futures bounced off early session lows. Projected rate cuts for early 2024 have gained slightly: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -63% w/ cumulative of -16.9bp at 5.160%, May 2024 chance of cut 91.9% vs. -86.8% this morning, cumulative -39.9bp at 4.930%. Fed terminal at 5.3275% in Jan'24.

- SOFR Options:

- +10,000 SFRH4 94.75/95.00 strangles, 9.5 vs. 94.945/0.26%

- Block, 5,000 SFRJ4 94.87/95.06 put spds, 4.0 ref 95.38/0.15%

- +10,000 SFRJ4 95.62/95.75/95.87/96.00 call condors, 1.25 vs. 95.365/0.10%

- +10,000 SFRJ4 94.68/94.87 2x1 put spds, 0.5 ref 95.355

- 18,000 0QM4 97.00 calls ref 96.535 to -.54

- +5,000 SFRM4 95.62/95.75/95.87/96.00 call condors, 1.0 ref 95.33

- +4,000 SFRZ4 96.25/96.75/97.75 broken call flys on 2x3x1 ratio, 15.0 net

- Blocks, 7,500 SFRM4 94.87 puts, 5.5 vs. 95.33/0.19% adds to 20k on screen

- 7,700 SFRU4 96.25/97.00/97.50 broken call flys ref 95.695

- 4,000 SFRJ4 94.68/94.93/95.75/96.00 call condors ref 95.325

- over 10,000 SFRH 95.00 call/SFRM4 95.00 puts

- 35,000 SFRH4 94.87/95.00/95.12 call flys ref 94.925 to -.915

- 8,000 2QJ4 96.00 puts, 5.0 ref 96.67/0.18%

- 3,800 0QH4 95.00/95.50/95.75/96.00 broken put condors ref 96.365

- 4,000 SFRJ4 95.12/95.37/95.62 call flys ref 95.335

- 8,200 SFRU4 96.50/97.00 call spds ref 95.715

- 7,000 SFRF4 94.93/95.00/95.06 call flys ref 94.92

- 6,000 SFRG4 94.75/95.00/95.25 call flys ref 94.92

- 4,000 SFRJ4 95.37 calls ref 95.325 ref 95.325/0.45%

- 4,000 SFRH4 94.56/94.68/94.81 put flys ref 94.915

- 3,000 SFRH4 95.00 calls ref 94.92/0.38%

- Treasury Options:

- +6,400 TYH4 107/110.5 put spds ref 111-24 vs.

- -3,200 TYG4 111.75 straddles vs. +1,600 wk2 TY 111.75 straddles, 20-21 net package

- 3,000 FVH4 106.25/107.25 put spds vs. 109.25/110.75 call spds ref 107-29.5

- Blocks, 12,000 wk2 TY 111 puts, 11 vs. wk3 TY 110.75 puts, 14 ref 111-23.5

EGBs-GILTS CASH CLOSE: Short-End/Belly Retrace Recent Losses

Gilts and Bunds partially recovered Friday's losses in Monday trade, gaining some traction late in the session after a weak start.

- While poor German factory data had little positive impact on core FI, the afternoon rally looked Treasury-led, with 10Y yields pulling back on speculation Fed QT would be tapered soon, and amid a sharp drop in oil prices.

- The short-ends/bellies of the UK and German curves outperformed, following their relative underperformance late last week.

- Periphery spreads tightened modestly as risk assets gained, with SPGBs outperforming. Italy announced a 7/30Y BTP dual-tranche syndication.

- On Tuesday we get German industrial production and Eurozone/Italian labour market data, with supply from the Netherlands, Austria, and the UK, and with Belgium and Italy announcing syndications today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2bps at 2.548%, 5-Yr is down 2.7bps at 2.075%, 10-Yr is down 2bps at 2.136%, and 30-Yr is down 1bps at 2.366%.

- UK: The 2-Yr yield is down 2.7bps at 4.215%, 5-Yr is down 2.6bps at 3.73%, 10-Yr is down 1.5bps at 3.772%, and 30-Yr is down 1bps at 4.386%.

- Italian BTP spread down 1.2bps at 168.3bps / Spanish down 1.4bps at 98.1bps

EGB Options: Brisk Euro Rates Trade Activity To Start The Week

Monday's Europe rates/bond options flow included:

- DUH4 106.50/106.80/107.10 call fly paper paid 3 on 5K

- OEG4 116.50/116.00/115.50p fly, bought for 1.5 in 4k

- ERF4 96.25p, sold at 1.5 in 5k

- ERG4 96.37/96.25ps 1x2 sold at 3.25 in 10k

- ERH4 96.25^ sold at 17.5 in 6k and for 18 in 5k

- ERM4 96.87/97.00/97.12c fly, bought for 1 in 10k

FOREX USD Moderately Softer In Line With Lower US Yields/Bolstered Equity Markets

- US yields extending their post-payrolls reversal lower to start the week, as well as a strong rally for major equity indices have moderately weighed on the USD index, which is seen 0.20% lower as we approach the APAC crossover.

- The softer USD has been most noticeable in a strong turnaround in USDJPY, which after printing as high as 144.92 shortly after the open, briefly traded below Friday’s worst levels to print 143.66. The pair is only down 0.34%, having recovered back above 144.00, however, the trend outlook remains bearish and recent gains appear to be a correction. The move lower from Friday’s high means that resistance around the 50-day EMA - at 145.32 - is intact for now.

- The price action helped prop EURUSD back toward the post-payrolls high on Friday at 1.0998 - which marks the interim resistance in the pair, while markets focus on 1.2770 in GBPUSD. In emerging markets, currencies have been outperforming, aiding MXN, HUF to lead the charge as positioning is eagerly monitored ahead of Thursday's key US CPI print.

- Across G10, intra-day fx adjustments have been contained overall, perhaps with the key data later in the week sapping momentum somewhat. NOK scans as the worst performer, taking its cues from WTI crude futures ( -3.8%) heading for their lowest close since Jan. 2 as demand pessimism sweeps the market.

- Tokyo Core CPI will cross overnight before Australia retail sales for November. Swiss currency reserves will be published in European hours on Tuesday, alongside German industrial production and European unemployment figures. US and Canadian trade balance data is also scheduled.

Late Equity Roundup: Extending Highs

- Stocks are extending gains in the second half, DJIA gaining momentum late are up 134.2 points (0.36%) at 37598.02, S&P E-Mini future up 55.25 points (1.17%) at 4789.5, Nasdaq up 284.9 points (2%) at 14808.24.

- Leading gainers: Information Technology sector shares continue to outperform, buoyed by chip stocks amid continued AI-related demand: Advanced Micro Devices +5.75%, Nvidia +5.26%, Intel +3.34%. Meanwhile, Consumer Discretionary shares outpaced earlier Real Estate sector gains, broadline retailers led: Etsy +2.66%, Amazon and Bath & Body Works both +2.3%.

- Laggers: Energy and Financial sector stocks underperformed, energy and equipment servicer shares weighed on the former: Baker Hughes -3.92%, Schlumberger -3.59%, Haliburton -2.56%. Oil and gas shares were under pressure too as crude prices fell sharply (WTI -2.91 at 70.90): Marathon Oil -2.93%, EOG Energy -2.67, Exxon -2.27%.

- Banks unwound gains from the prior session: Bank of America -1.15%, Citigroup -1.1%, JPM -0.88%, Wells Fargo -0.33%. Reminder, banks lead the next quarterly earnings cycle that starts next week Friday with BlackRock, Bank of America, Wells Fargo, JPMorgan, Citigroup and Bank of NY Mellon.

E-MINI S&P TECHS: (H4) Key Support Remains Exposed

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4796.00/4841.50 High Jan 8 / High Dec 28 and the bull trigger

- PRICE: 4791.50 @ 1500 ET Jan 08

- SUP 1: 4702.00 Low Jan 05

- SUP 2: 4696.72 2.0% 10-dma Envelope

- SUP 3: 4841.50 50-day EMA

- SUP 4: 4594.00 Low Nov 30

The pullback in S&P E-Minis from recent highs has now cracked first material support at the 20-day EMA of 4745.34. This strengthens a short-term bearish threat and exposes 4696.72, the lower band of a MA envelope. A move through this support would expose the 50-day EMA, at 4650.64. The recent move lower is considered corrective and the primary uptrend remains intact. Key resistance and the bull trigger is 4841.50, the Dec 28 high.

COMMODITIES: Crude Slides On Demand Pessimism

- Crude oil futures have slumped today as demand pessimism sweeps the market. The cut in Saudi’s OSPs, robust non-OPEC supplies, and a fall in fund net-long positions indicate bearish sentiment.

- Saudi Arabia cut all official selling prices for all regions for February, with the price for Arab Light crude to Asia falling to the lowest level since November 2021, a price list showed.

- Libya’s NOC announced a force majeure with immediate effect for its Sharara oilfield on Sunday due to recent ongoing protests that began hitting production last Wed.

- Global crude floating storage held on tankers stationary for at least 7 days rose to 83.69mn bbls as of January 5 - up 2.1% from 81.94mn bbls a week prior according to Vortexa.

- WTI is -4.0% at $70.88 but still doesn’t test support at $69.28 (Jan 3 low) after which lies the bear trigger at $67.98 (Dec 13 low).

- Brent is -3.2% at $76.26, a sizeable step back closer to support at $74.79 (Jan 3 low) with still some way until the bear trigger at $71.21 (Jun 23 low).

- Gold is -0.85% at $2028.1 having earlier dipped below $2020 before retracing, and still with some buffer above support at the 50-day EMA of $2011.3.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/01/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/01/2024 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 09/01/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 09/01/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 09/01/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 09/01/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 09/01/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 09/01/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 09/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/01/2024 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/01/2024 | 1330/0830 | * |  | CA | Building Permits |

| 09/01/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 09/01/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 09/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/01/2024 | 1700/1200 |  | US | Fed Vice Chair Michael Barr | |

| 09/01/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.