-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rate Cuts Rise/Curves Twist Steeper

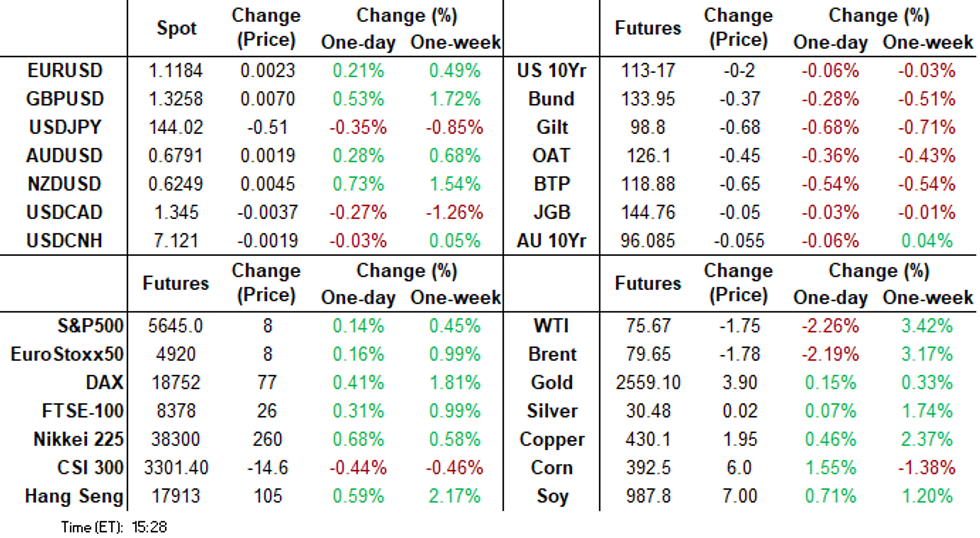

- Short end lead Treasuries off early session lows Tuesday, curves twist steeper as rate cut pricing into year end regained momentum, just over 100bp priced in be the December 18 FOMC.

- Heavy SOFR call option structure buying on the day, targeting a 50bp rate cut at the September 18 FOMC.

- Heavy Treasury futures volume continues with Dec'24 taking lead quarterly this Friday.

US TSYS Extending Late Session Highs

- Initially led by the short end after London went home, shorts continue to unwind in late trade after the decent Treasury 2Y auction stopped through .6bp.

- The Sep'24 10Y contract trades at a session high of 113-19 (unch) compared to 113-30.5 early overnight. Initial technical resistance at 114-03/114-16 (High Aug 6 / 76.4% of the Aug 5 - 8 pullback).

- Curves twist steeper with the short end outperforming, 2s10s currently +4.328 at -7.860 after dis-inverting briefly on August 5 to +1.475. The 5s30s curve currently +3.032 at 46.715.

- In conjunction with the creeping short end bid -- projected rate cut pricing through year end has gained vs. early Tuesday levels: Sep'24 cumulative -34.1bp (-31.8bp), Nov'24 cumulative -67.4bp (-64.7bp), Dec'24 -104.6bp (-99.2bp).

- Heavy session Tsy futures volumes tied to Sep'24/Dec'24 roll efforts, 2s near 80% complete, 10s 70% complete.

- Looking ahead to Wednesday: data limited to MBA Mortgage Applications at 0700ET. US Treasury auctions include $28B 2Y FRN re-open (91282CLA7) and 17W Bill sales at 1130ET, $70B 5Y note sale (91282CLK5) at 1300ET.

- Scheduled Fed speak includes Fed Gov Waller at a payments conf in Mumbai (text, Q&A) at 0115ET while Atl Fed Bostic will discuss his economic outlook (no text, Q&A) later in the evening at 1800ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00050 to 5.25213 (-0.08017 total last wk)

- 3M +0.00088 to 5.06109 (-0.06732 total last wk)

- 6M -0.00549 to 4.74244 (-0.09176 total last wk)

- 12M -0.02341 to 4.23762 (-0.12757 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.01), volume: $2.039T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $787B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $766B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.33% (+0.01), volume: $264B

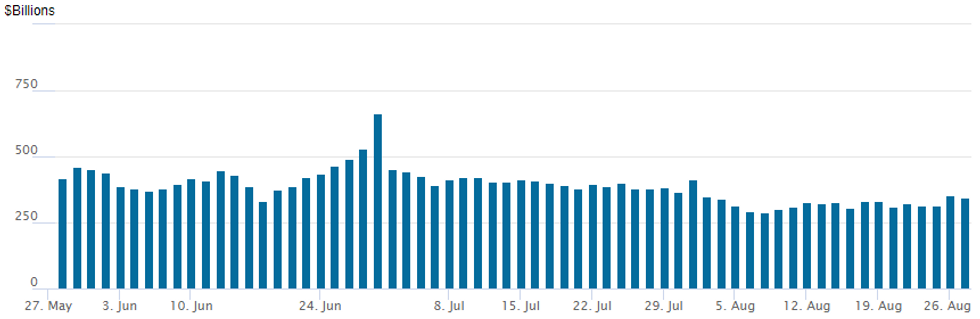

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $344.045B from $353.557B Monday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties at 68 from 63 prior.

US SOFR/TREASURY OPTION SUMMARY

Heavy SOFR and Treasury call option volume overnight, focus on Sep 50bp rate cut hedge in SOFR options via call condors (over 50k so far) and call flys -- Sep'24 SOFR options expire on September 13, the Friday before the next FOMC annc on September 18. Short end has led a creeping crawl off midmorning lows while projected rate cuts through year end have gained vs. early Tuesday levels: Sep'24 cumulative -34.1bp (-31.8bp), Nov'24 cumulative -67.4bp (-64.7bp), Dec'24 -104.6bp (-99.2bp).- SOFR Options:

- -20,000 SFRZ4 96.00/97.00 2x3 call spds, 16.0 ref 95.785

- -7,000 SFRZ4 95.31/95.43 call spds, 10.25 ref 95.775

- -10,000 SFRU4 94.81/94.93 call spds, 12.0 ref 95.0875

- +10,000 SFRX4/SFRZ4 95.87/96.00 call spd/spd, 0.25 net vs. 95.78/0.05%

- +5,000 SFRU4 95.06/95.12/95.18 call flys, 0.25 ref 95.07

- +10,000 SFRU4 95.18/95.37/95.56 call flys, 2.0 ref 95.0675

- +5,000 SFRU4 95.06/95.12/95.18/95.25 call condors, 0.5 ref 95.07

- +20,000 SFRU4 95.25/95.31/95.43 call flys, 0.5 ref 95.07

- +51,000 SFRU4 95.18/95.25/95.31/95.37 call condors, 1.0 ref 95.07 to -.065

- +35,000 SFRU4 95.12/95.18/95.25/95.31 call condors, 1.0 ref 95.07

- +20,000 SFRU4 95.25/95.31/95.43 call flys, 0.5 ref 95.07

- 9,500 SFRU4 95.12/95.18/95.25 call flys ref 95.0675, 0.25

- 5,000 SFRZ4 95.8/96.06/96.31 call flys ref 95.75

- 10,000 SFRU4 95.12/95.18 call spds ref 95.07

- 4,000 SFRV4 95.37/95.50 put spds ref 95.745

- 7,500 SFRX4 95.25/95.37 call spds ref 95.745

- 7,500 SFRU4 95.31/95.56 call spds ref 95.0675

- Block, 10,000 SFRM5 97.00/97.18 call spds, 4.5

- Block, 2,500 SFRZ4 95.93/96.25 5x6 call spds, 20.0

- Block, 2,500 SFRZ4 95.31/95.56 call spds, 0.5

- 5,000 SFRU4 95.06/95.12/95.18 call flys

- Treasury Options:

- Block, 9,000 TUV4 102.62/102.75 put spds .5 vs. 103-22/0.02%

- +17,000 TYV 114 calls, 49 vs. 113-29.5/0.50%

- +50,000 wk1 TY 114 calls, 33 vs. 113-30/0.49%

- 7,000 TYV4 113/114 2x1 put spds ref 114-02.5

BONDS: EGBs-GILTS CASH CLOSE: Long-End Fully Reverses Jackson Hole Rally

European curves bear steepened Tuesday, as last Friday's rally continued to reverse.

- Weakness across European FI had no single obvious catalyst, with higher natural gas prices and bond issuance cited as factors.

- UK yields jumped from the open in the return from Monday's holiday closure, with Bunds weakening in steady fashion throughout the day, continuing the prior session's weakness.

- This left longer-end yields above levels seen just before last Friday's dovish Jackson Hole speech by Fed Chair Powell.

- Short-end yields have retained some of their fall, however: BoE Gov Bailey's comments at Jackson Hole last Friday pointed to a "steady" course, seemingly downplaying potential for sequential cuts.

- Periphery EGB spreads widened. BTPs were notable underperformers, with supply apparently weighing (Short-Term sales today, M-T/L-T auction Thursday).

- Wednesday's schedule includes French consumer confidence data and the ECB's monthly Eurozone monetary developments report, as well as a speech by BoE's Mann.

- The main focus of the week remains Eurozone inflation data on Thu/Fri.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.404%, 5-Yr is up 2.4bps at 2.186%, 10-Yr is up 4bps at 2.288%, and 30-Yr is up 5.4bps at 2.537%.

- UK: The 2-Yr yield is up 4.3bps at 4.109%, 5-Yr is up 5.4bps at 3.911%, 10-Yr is up 5.9bps at 3.998%, and 30-Yr is up 6.1bps at 4.51%.

- Italian BTP spread up 3.2bps at 138bps / Spanish up 1.9bps at 81.8bps

EGB OPTIONS: Quiet Post-Holiday Return To Sonia Trade

Tuesday's Europe rates/bond options flow included:

- ERX4 97.125/97.25cs vs 96.875/96.75ps, bought the cs for -1.25 (receive) in 2k

- SFIX4 95.45/95.55/95.65c fly, bought for 1.75 in 2k

FOREX: USD Index Loses Ground as US Front-End Yields Drop

- The US dollar steadily edged lower across Tuesday’s US session, mirroring the move seen in front-end yields in the US. As such, USDJPY has dipped below the 144 handle, extending its pull lower to around 125 pips from the earlier session highs.

- USDJPY conditions remain bearish, with the market seemingly willing to continue to sell dollar rallies and supports remained well defined at 143.45 and 141.70, the Aug 5 low.

- EURUSD sees some late strength, extending above the European peak to print a 1.1191 high, although daily ranges remain much more contained here.

- GBP continues to be among the best performers in G10, with GBP/USD's 1.3265 print today the highest since March 2022. GBP/USD's bull run sees higher highs printed in 12 of the past 14 sessions and spot has bridged the gap to its next target at 1.3261. Above here, attention will be on 1.3328, the 76.4% retracement of the Jun 2021 - Sep 2022 bear leg.

- Elsewhere, strength has also been seen for the likes of the Swiss Franc and Kiwi, which outperform in G10, amid the path of least resistance remaining lower for the greenback and the continued stable backdrop for major equity benchmarks.

- Australian CPI data is the major data point Wednesday, before Eurozone inflation data takes focus later in the week.

FX OPTIONS: Expiries for Aug28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650-60(E2.2bln), $1.0775-80(E894mln), $1.0850-60(E708mln), $1.0880-00(E1.9bln), $1.0920-25(E854mln), $1.1020-35(E1.5bln), $1.1085-05(E1.1bln), $1.1140-60(E1.3bln), $1.1175(E1.0bln), $1.1185-00(E1.3bln), $1.1225-30(E575mln)

- USD/JPY: Y145.25($1.4bln), Y145.50($2.1bln)

- USD/CNY: Cny7.1500($810mln)

Late Equities Roundup: Narrowly Mixed, Chip Stocks Leading

- Stocks are trading mildly mixed after the bell, S&P Eminis and the Nasdaq indexes narrowly outpacing the DJIA. Currently, the DJIA trades down 16.07 points (-0.04%) at 41242.35, S&P E-Minis up 4.75 points (0.08%) at 5643.5, Nasdaq up 29.8 points (0.2%) at 17762.92.

- Information Technology and Financial sectors continued to lead gainers in late trade, semiconductor stocks recovering slightly after better selling over the last couple sessions: Monolithic Power +3.31%, Qualcomm +2.51%, Nvidia +1.66% (reporting quarterly earnings late Wednesday).

- Services companies buoyed the Financial sector: Fidelity National +1.56%, Berkshire Hathaway +1.43%, CME Group +1.39%.

- On the flipside, Energy and Utility sectors underperformed in late trade. Energy sector shares pared Monday gains tied to Libya's force majeure action that underpinned crude prices. With oil weaker today (WTI -1.73 at 75.69), APA Corp -2.28%, Valero -1.78%, Marathon -1.75%. Independent/multi-energy providers weighed on the Utility sector: AES -2.29%, Consolidated Edison -1.13%, Ameren -1.10%.

- Late cycle corporate earnings expected after today's close: Nordstrom Inc, SentinelOne Inc, PVH Corp and Semtech Corp.

EQUITY TECHS: E-MINI S&P: (U4) Bull Cycle Intact

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and Key resistance

- RES 1: 5669.00 High Aug 26

- PRICE: 5642.00 @ 1508 ET Aug 27

- SUP 1: 5499.152 50-day EMA

- SUP 2: 5438.75/5319.50 Low Aug 14 / 9

- SUP 3: 5182.00 Low Aug 8

- SUP 4: 5120.00 Low Aug 5 and the bear trigger

S&P E-Minis are unchanged. A bullish theme remains intact and the contract traded to a fresh cycle high Monday. Price has recently cleared 5600.75, Aug 1 high and this signals scope for an extension towards key resistance and the bull trigger at 5721.25, the Jul 16 high. A break would resume the primary uptrend. On the downside, support to watch lies at 5499.15, the 50-day EMA. A clear breach of it is required to instead highlight a potential bearish threat.

COMMODITIES: Crude Futures Retrace Monday’s Sharp Advance

- Crude markets have reversed yesterday’s rally in what market analysts attribute to a technical correction, noting the failure to breach the 200-day moving average during Monday’s session which now acts as a ceiling to the market.

- As a reminder, Libya’s eastern government announced on Monday it would shut down the country’s crude output and exports, prompting a surge in crude prices. Front month WTI is down 2.2% at 75.75$/bbl.

- The easing of recessionary concerns has helped industrial metals rise, with both iron ore and copper consolidating their sold recoveries in recent sessions. Onshore positives are from further rises in local steel futures, while carry over from lower inventory levels at China ports (from the end of last week) may also be helping sentiment.

- For precious metals, spot gold has been assisted higher by the lower US yields and accompanying greenback weakness, with the yellow metal hovering close to all-time highs.

- The recent breach of resistance at $2483.7, the Jul 17 high, confirmed a resumption of the primary uptrend. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend. The focus is on a climb towards $2536.4 next, a Fibonacci projection.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 28/08/2024 | 0130/1130 | *** |  AU AU | Quarterly construction work done |

| 28/08/2024 | 0130/1130 | *** |  AU AU | CPI Inflation Monthly |

| 28/08/2024 | 0600/1400 | ** |  CN CN | MNI China Liquidity Index (CLI) |

| 28/08/2024 | 0645/0845 | ** |  FR FR | Consumer Sentiment |

| 28/08/2024 | 0800/1000 | ** |  EU EU | M3 |

| 28/08/2024 | 0900/1000 | * |  GB GB | Index Linked Gilt Outright Auction Result |

| 28/08/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 28/08/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 28/08/2024 | 1530/1130 | ** |  US US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/08/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 5 Year Note |

| 28/08/2024 | 2200/1800 |  US US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.