-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Appetite Sours Late

- MNI POLITICAL RISK - US Leaders Eye Stopgap To Avoid Gov Shutdown

- MNI SECUIRTY: Lukashenko: Putin Not Pushing Belarus To Enter War With Ukraine

- MNI US-ISRAEL: Blinken And Dermer Discuss "Importance Of Deescalating Tensions"

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Markets Roundup: Late Risk Off Bouys' Rates

- Still weaker but well off midday lows now, Treasury futures are have rebounded over the last hour (TYU3 109-11.5 -6.5), partially a risk-off move as stocks continue to weaken, SPX Eminis back to late June levels (4387.0 -33.0)

- Curves maintaining steeper profiles with short end rates outperforming: 3m10Y +6.865 -113.724, 2Y10Y +4.652 at -67.252. Robust volumes for late summer trade: TYU3 over 1.5M. Of note, 30Y yield had climbed past late Dec 2022 high to 4.4219% in the first half, a level last seen in late June 2011, is currently at 4.4043%.

- Earlier, Treasury futures traded lower after Philadelphia Fed Business Outlook comes out higher than expected at 12.0 vs. -10.0 est, prices paid 20.8 vs. 9.5 prior. Weekly claims largely in-line with expectations: -11k to 239k vs. 240k est while continuing claims climbs to 1.716M vs. 1.700M est.

- With data out of the way early (and no data Friday) Treasury futures managed to recover by midmorning, front month 10Y futures marking 109-20.5 high amid a combination of two-way position, option hedging and early cycle Sep/Dec quarterly futures rolling. Nascent support evaporated going into the European close with rates marking session lows on similar moves in Gilts and Bunds.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00203 to 5.31398 (+.00350/k)

- 3M +0.00053 to 5.37976 (+0.01519/wk)

- 6M -0.00074 to 5.44112 (+0.02604/wk)

- 12M -0.00909 to 5.37645 (+0.07063/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% volume: $251B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.391T

- Broad General Collateral Rate (BGCR): 5.28%, $550B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $538B

- (rate, volume levels reflect prior session)

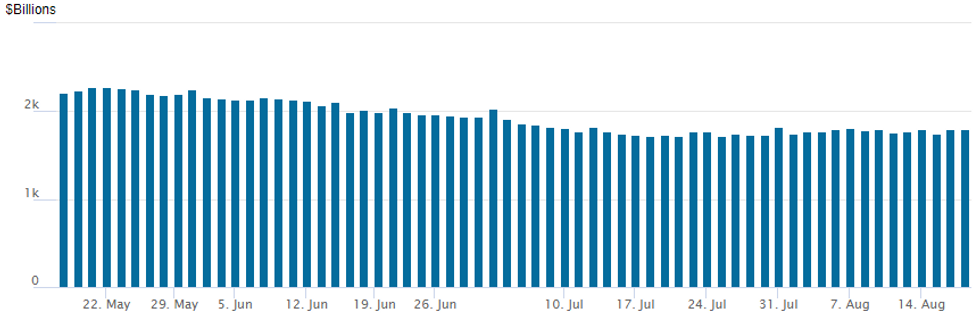

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operations continue to see-saw around 1.75-1.80T: the latest slips to to $1,794.120B, w/101 counterparties, compared to $1,796.725B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

With few exceptions Thursday, better SOFR call trade was reported with underlying futures in Whites trading firmer in late trade. Mixed Treasury options seeing better put volume in 5s, 10s and 30s as bonds lead a curve steepening sell-off, 30Y yield 4.4239% the highest level since Sep 2011. Rate hike projections through year end are firmer following yesterday's more hawkish than expected July FOMC minutes: Sep 20 FOMC is 12% w/ implied rate change of +3.0bp to 5.359%. November cumulative of +10.6bp at 5.435, December cumulative of 8.4bp at 5.413%. Fed terminal at 5.43% in Nov'23.

- SOFR Options:

- +10,000 0QV3 95.00/95.25 put spds vs. 2QV3 95.37/95.62 put spds, .25 net flattener

- Block, 5,000 0QZ3 96.87 calls, 7.5 vs. 95.78/0.12%

- +7,500 OQZ3 95.37/96.00 call-over risk reversals, 8.0 net vs. 95.775/0.70%

- +10,000 SFRH4 95.50/96.50 call spds, 8.0 ref 94.80

- Block, 5,000 SFRZ3 94.50/94.81 1x2 call spds vs. 94.60/0.07%

- 8,000 SFRU3 94.56/94.62 call spds, ref 94.585

- 2,000 2QH4 97.00/97.50 call spds, ref 96.185

- 5,000 SFRM4 95.50/96.50 call spds ref 95.075

- 2,000 0QU3 95.68/95.81 call spds ref 95.425

- Treasury Options:

- 3,000 TYU3 109.5/110.5/112 broken call flys, 10 ref 109-05.5

- 7,500 TYU3 110.25/111 1x2 call spds, 3 net ref 109-07

- 2,300 TYV3 107.5/109.5 put spds 20 over TYV3 112 calls ref 109-24

- 3,000 TYV3 117 calls, 2 ref 109-23.5

- 2,000 TYU3 107/108.5 put spds

- 10,000 TYU3 108.5 puts, 12 ref 109-12.5

- Block, 30,000 TYU3 107/108.5 put spds, 10 vs. 109-13/0.20%

- 1,500 TYU3 107.75/108.25/108.75 put flys ref 109-08.5

- over 3,400 TYU3 110.25 calls, 13 last ref 109-12.5

- 2,000 TYU3 110.25 calls, 12 ref 109-06.5

- 3,000 TYV3 108 puts, 28 last

- 5,000 TYU3 108/109 put spds, 21 ref 109-06.5

- 1,000 FVX 107.5 calls, 33

- 2,500 USV3 112 puts, 21 last

- 2,400 USV3 116 puts, 61 last

- 4,000 3MQ3 108.5/108.75 put spds ref 109-10.5

EGBs-GILTS CASH CLOSE: Long End Closes On A Weak Note

Gilts sold off sharply again Thursday with UK 10Y yields hitting the highest levels in 15 years, cheapening further vs Bunds as BoE hike pricing picked up.

- Both the UK and German curves bear steepened in a session with very limited data and newsflow, with overnight events including the slightly hawkish-leaning FOMC minutes and a terrible long-end Japanese bond auction weighing into the open.

- Periphery spreads were little changed, with Spanish bonds showing little reaction to a key parliamentary vote win by PM Sanchez (more here).

- As global rates sold off, BoE terminal hike pricing eclipsed 6.10% for the first time since early August, and 10Y Gilts closed at their widest spread to Bunds since Oct 2022, and the highest outright yield level since 2008.

- The yield rise at the end of the session into the cash close suggests potential anxiety over Friday's pre-open retail sales release, given the first 2 of the week's 3 key UK data points (CPI, wages) were more inflationary than expected.

- Other than that, the only key item on Friday's schedule is final Eurozone CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.2bps at 3.107%, 5-Yr is up 4.1bps at 2.704%, 10-Yr is up 5.9bps at 2.709%, and 30-Yr is up 6.3bps at 2.792%.

- UK: The 2-Yr yield is up 7.3bps at 5.276%, 5-Yr is up 9.1bps at 4.755%, 10-Yr is up 10bps at 4.746%, and 30-Yr is up 9.8bps at 4.932%.

- Italian BTP spread up 0.3bps at 170.5bps / Spanish up 0.1bps at 105.1bps

EGB Options: Several Sonia Call Condors Trade Thursday

Thursday's Europe rates / bond options flow included:

- DUU3 105.20/105.40 1x2 call spread paper paid 1.25 on 5.4K

- RXX3 123.00/120.50 put spread paper paid 14.5 on 6K

- ERU3 96.00/96.125/96.25 call fly bought for 2.5 in 2k and 3k

- SFIV3 94.15/94.25/94.35/94.55 call condor bought for 1.5 in 2.5k

- SFIZ3 94.40/94.50/94.60/94.70 call condor paper paid 1.5 on~5K

- SFIV/X3 94.40/94.50/94.60/94.70 call condor strip, paper paid 3.25 on 3K

FOREX EURUSD Presses Fresh Session Lows, Bearish Extension For EURGBP

- Worth noting that EURUSD (-0.17) has made fresh session lows in recent trade below 1.0860 as the pair extends the intra-day pullback to around 60 pips and appears to have settled around this level approaching the APAC crossover. The July 6 low at 1.0834 remains the key level on the downside.

- EURGBP is also registering a 0.2% loss on the day, which would extend its losing streak to 5 consecutive trading days. Importantly, the cross has broken a key short-term support level of 0.8544, the Jul 27 low. A sustained break would strengthen current bearish conditions and signal scope for weakness towards 0.8504, the Jul 11 low and a bear trigger.

- Data remaining for the week could also have an impact here with UK July retail sales due on Friday, as well as the final reading of July Eurozone CPI.

- There was some notable CNH volatility earlier in the session following the news on state bank intervention to curb yuan depreciation. USDCNH trades as low as 7.2970 on the back of the headlines, briefly piercing 7.3043 support, the Aug 16 low.

- Despite this volatile move for CNH following the news, G10 currency adjustments have been limited on Thursday, with a dearth of tier-one economic data points and markets potentially shifting the focus to next week’s Jackson Hole Symposium.

Expiries for Aug18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E1.3bln), $1.0900(E1.4bln), $1.0925(E701mln), $1.1000(E1.0bln), $1.1100(E1.1bln)

- USD/JPY: Y145.00($832mln)

- GBP/USD: $1.2700(Gbp637mln), $1.2785-00(Gbp557mln)

- USD/CAD: C$1.3550($590mln)

Late Equity Roundup: SPX Back To Late June Levels

- Stocks indexes continue their wayward path off late July highs, S&P E-Mini futures currently down 31 points (-0.7%) at 4389.25 extending a selloff back to late June levels, DJIA down 254.03 points (-0.73%) at 34512.16, Nasdaq down 134.9 points (-1%) at 13341.32.

- No outright headline driver, but trading desks posit yesterday's more hawkish than expected July FOMC minutes continues to sap risk appetites.

- Laggers: Consumer Discretionary and Consumer Staples sectors displaced Information Technology as leading laggers in the second half. Consumer durables and automakers weighed on Discretionary sector in late trade: DR Horton -4.28%, Pulte Group -4%, Lennar -3.95 while Tesla receded 2.15%. Distributors weighed on Consumer Staples: Walgreens/Boots -3.5%, Costco -2.0, Walmart -1.85% (despite beating earnings and trading higher this morning).

- Leading gainers: Energy sector shares outperformed for the second day running Thursday, partially tied to a bounce in crude prices (WTI +0.87 at 80.25). Oil and gas shares outpaced equipment and services shares in the first half: EQT Corp +2.8%, Exxon Mobil +2.25%, Conoco Philips +1.7%, Marathon +1.5%.

- Materials and Communication Services sectors were next up, metals and mining shares buoyed the former: Freeport-McMoRan +1.95%. Communication sector buoyed by Google +1.2%, and Charter Communication +.6%.

E-MINI S&P TECHS: (U3) Bearish Price Action

- RES 4: 4634.50 High Jul 27 and the bull trigger

- RES 3: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 2: 4560.75 High Aug 4

- RES 1: 4506.36 20-day EMA

- PRICE: 4386.00 @ 1515 ET Aug 17

- SUP 1: 4378.50 Intraday low

- SUP 2: 4368.50 Low Jun 26

- SUP 3: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SEP 4: 3874.75 Low Mar 13

A bearish theme in the E-mini S&P contract remains intact and this week’s move lower has reinforced current conditions. The contract has cleared the 50-day EMA and breached channel support drawn from the Mar 13 low - the base is at 4467.06 today. The clear breakout signals scope for a continuation lower and opens the 4400.00 handle next. Initial firm resistance to watch is at the 20-day EMA - at 4506.36.

COMMODITIES

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 18/08/2023 | 0800/1000 |  | EU | ECB's Lane appears in ECB podcast | |

| 18/08/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2023 | 0900/0500 | * |  | US | Business Inventories |

| 18/08/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2023 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.