-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS: Tsy Yields Climbing Ahead PPI

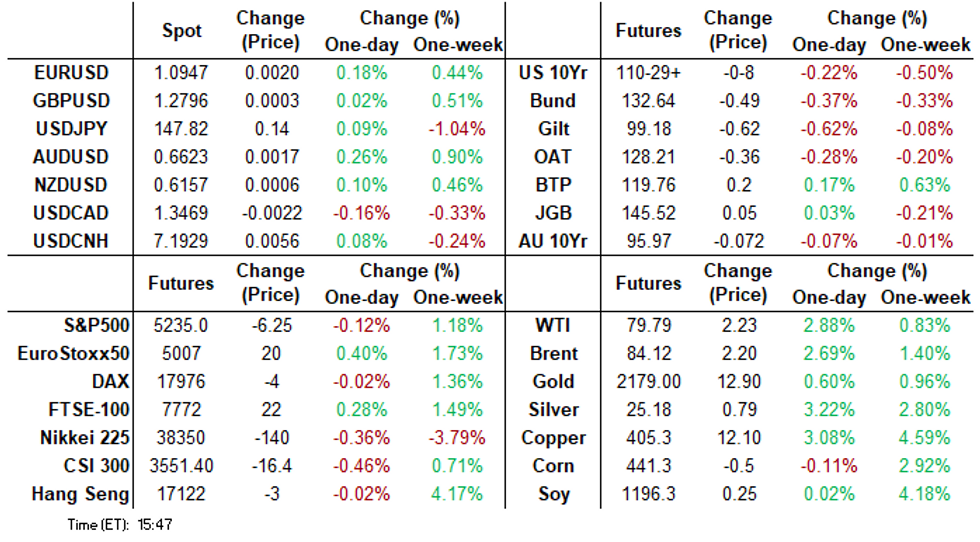

- Treasuries held weaker levels, near lows in the lead up to Thursday's PPI and Retail Sales Data.

- Carry-over FI weakness on the back of Tuesday's in-line to higher CPI inflation measure.

- Projected rate cut pricing over the next three FOMC meetings continued to recede.

US TSYS Tsys Under Pressure Ahead Thursday PPI, Retail Sales

- Treasury futures extended lows in late NY trade, Jun'23 10Y futures through yesterday's low of 111-02.5 to 110-29 (-8.5), focus on technical support at 110-21 (Low Mar 4). Tsy 10Y yield climbs to 4.1957%, curves near steady to late Tuesday levels, 2s10s +.317 at -43.443.

- No particular headline driver, limited data on the day: MBA Mortgage Applications at 7.1% vs. 9.7% prior. Carryover weakness after Tuesday's higher than hoped for CPI inflation data in the lead up to Thursday's PPI and Retail sales

- Projected rate cut pricing over the next three meetings evaporating: March 2024 chance of 25bp rate cut currently -0.8% w/ cumulative of -0.02bp at 5.328%; May 2024 at -12.4% vs. -14.5% late Tuesday w/ cumulative -3.3bp at 5.297%; June 2024 -59.5% vs. -63% late Tuesday w/ cumulative cut -18.2bp at 5.148%. July'24 cumulative -31.2bp at 4.993%.

- Treasury futures pared losses briefly (USM4 120-17, -7 vs. 120-04 low) after $22B 30Y auction (912810TX6) re-open stops through for the fourth consecutive time: 4.331% high yield vs. 4.352% WI; 2.47x bid-to-cover vs. 2.40x in the prior month. Indirect take-up 69.29% vs. 70.70% prior; direct bidder take-up climbs to 16.77% vs. 14.49% prior; primary dealer take-up 13.93% vs. 14.52%.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00011 to 5.32533 (+0.00663/wk)

- 3M +0.00411 to 5.32927 (+0.00843/wk)

- 6M +0.01749 to 5.25075 (+0.02091/wk)

- 12M +0.02823 to 5.01058 (+0.02364/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.699T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $684B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $676B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $259B

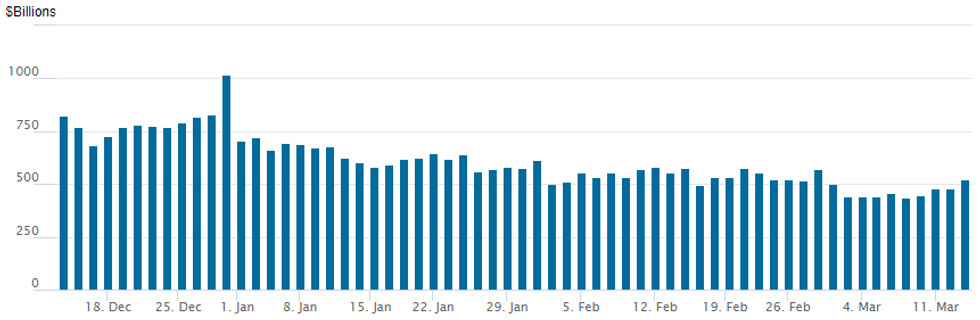

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $521.738B from $476.862B on Tuesday, compares to $436.754B last Thursday - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties inches up to 77 vs. 73 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade segued from mixed to much better downside put spread buying Wednesday as underlying futures trade weaker ahead tomorrow's PPI data.

- Projected rate cut pricing over the next three meetings evaporating: March 2024 chance of 25bp rate cut currently -0.8% w/ cumulative of -0.02bp at 5.328%; May 2024 at -12.4% vs. -14.5% late Tuesday w/ cumulative -3.3bp at 5.297%; June 2024 -59.5% vs. -63% late Tuesday w/ cumulative cut -18.2bp at 5.148%. July'24 cumulative -31.2bp at 4.993%.

- SOFR Options:

- Block, +16,000 SFRM4 94.75/94.87 put spds, 5.5 vs. 94.89/0.25%

- Block/screen, +50,000 SFRH5 95.00/95.50/96.00 put flys, 11.0-10.5 ref 95.80 to -.795

- -4,000 SRM4 94.93/95.25 call spds 4.25 ref 9488.5

- +5,000 SRU6 96.62 calls 66.5 ref 9645

- +6,000 SRZ5 96.50 calls 57.5 ref 9635.5

- +4,000 SRM5 96.25 calls 46 ref 9604.5

- -2,000 SRH5 95.87 vs SRM5 96.37 straddle spds 32.5

- +5,000 SRN4 95.75 calls vs SRU4 95.62/96.50 call spds 0.0 Sep over

- +3,000 SRH5 95.00/95.50 put spds vs. SRH5 96.25/97.00 call spds 0.0

- +3,000 SFRH5 96.25/97.50 1x2 call spds, 11.5 vs. 95.80/0.10%

- +10,000 0QH4 95.68 puts, 1.5 vs. 95.77/0.10%

- +7,500 SFRM4 95.00/95.12/95.25 call flys, 0.25

- Update, 30,000 SFRK4 94.81/94.93/95.06 call flys ref 94.895 to -.885

- 2,500 SFRJ4 95.25/95.37 call spds ref 94.88

- Block, 2,500 SHRH4 94.68/94.75/94.87 broken put trees, 10.25 ref 94.6725

- 5,000 SFRK4 94.81/94.93 call spds ref 94.885

- 3,000 0QH4 95.68/95.75 put spds ref 95.81

- Block, 4,000 SFRM4 94.81/94.93/95.12/95.25 call condors, 5.5 ref 94.90

- Treasury Options:

- over 50,000 TYJ4 109.25/110.5 put spds, 13-14 vs. 110-31.5 to 111-01/0.25

- 2,000 FVM4 109.75/110/110.5/111 broken call condors,

- over 10,000 FVK4 108 calls earlier

- -3,000 TYK4 109/112.5 strangles, 43

- Block, +8,000 TYK4 113 calls, 18 vs. 111-03.5/0.08%

- 3,000 TUJ4 102.37 calls ref 102-13.5 to -13.12

- 3,300 FVJ4 107 puts, 11-12 ref 107-11.25

EGBs-GILTS CASH CLOSE: BTP Spreads Tighten Further

Gilts underperformed Bunds Wednesday, with follow through from the prior session's above-expected US inflation data and heavy supply helping drive core FI weakness.

- Data was fairly limited, with the session's highlight - UK activity data - in line with expectations, and a Eurozone IP miss shrugged off.

- Focus was moreso on heavy auction supply (BTPs, Bund, PGBs, and Gilt linkers among others).

- The outcome of the ECB’s operational framework review brought no notable hawkish surprises, and pointed to slightly easier refinancing conditions versus most expectations.

- The latter dynamic helped periphery EGBs outperform, with 10Y BTP spreads compressing further to the tightest to Bunds in 2.5 years.

- The UK curve bear steepened on the day, with the belly outperforming on a weak German curve.

- Thursday sees multiple ECB speakers (including Schnabel and Knot), alongside largely 2nd tier European data (including final Spanish inflation).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4bps at 2.887%, 5-Yr is up 3.3bps at 2.392%, 10-Yr is up 3.6bps at 2.366%, and 30-Yr is up 5bps at 2.522%.

- UK: The 2-Yr yield is up 5.3bps at 4.273%, 5-Yr is up 7bps at 3.941%, 10-Yr is up 7.5bps at 4.021%, and 30-Yr is up 6.4bps at 4.467%.

- Italian BTP spread down 5bps at 122.9bps / Spanish down 1.6bps at 79.5bps

EGB Options: Sonia Put Fly Selling Continues Wednesday

Wednesday's Europe rates/bond options flow included:

- RXJ4 134/135cs, bought for 15 in 3k

- ERM4 96.25/96.37/96.5096.62c condor bought for 6.25 in 6k

- ERZ4 97.25/96.75/96.00 broken p fly, bought for 13 in 10k

- ERU4 97.50c, was bought for 4 in 8k

- SFIM4 95.05/94.90/94.65p fly sold at 4 in 10.5k (around ~33k has been sold this week)

- SFIM4 95.45/95.55/95.65/95.75c condor sold at flat in 6.25k

FOREX Greenback Edging Lower, USDMXN Extends Decline To Seven-Month Low

- While equities consolidate at their elevated levels, the short-term path of least resistance remains lower for the greenback, and as such, the USD index is down 0.20% on Wednesday. Ranges and intra-day G10 adjustments have been contained on the session as the dust settled post US CPI and markets await US PPI and Retail Sales data tomorrow.

- However, the solid risk environment continues to bolster the likes of AUD and NZD, with EURUSD also rising 0.25% to trade back above 1.0950, with the pullback earlier in the week appearing to be a correction and a flag formation - a bullish continuation pattern. A resumption of gains would pave the way for a climb towards 1.0998 next, the Jan 5 high. The 76.4% retracement of the Dec 28 - Feb 14 bear leg is at 1.1034. On the downside, initial firm support to watch is 1.0853, the 50-day EMA.

- Emerging market currencies were the main beneficiaries on Wednesday, as the low volatility, high carry trades continued to be favoured. While the HUF and CLP were among the best performers, the Mexican peso made some significant technical progress, prompting USDMXN to trade at a fresh seven-month low. Price action continues to narrow the gap to 16.6262, the Jul 28 2023 low, a breach of which would place the pair at the lowest level since late 2015.

- AUDJPY (+0.37%) trades within reach of the day's highs - but short of the best levels seen last week at 98.21. Strength and clearance here would make cycle highs at 99.06 the next key resistance - but unlikely to come into range in the near-term outside of major dovish BoJ / hawkish RBA surprises next week.

- US PPI, Retail Sales and unemployment claims data headlines Thursday’s economic data calendar, ahead of next week’s busy central bank docket.

Late Equities Roundup: Chip Stocks, REITS Weighing

- Stocks held moderately mixed levels in late trade, DJIA shares still outperformed weaker S&P and Nasdaq shares on a generally quiet session ahead Thursday's PPI and Retail Sales data. Currently, S&P E-Minis trades down 5.5 points (-0.1%) at 5235.75, Nasdaq down 58.3 points (-0.4%) at 16207.99, DJIA up 50.09 points (0.13%) at 39056.62.

- Laggers: Information Technology and Real Estate sectors underperformed in the second half. Chip stocks reversed prior session gains with Enphase -3.4%, Intel and Advanced Micro Devices -3.25%, Micron -3.08%. Real Estate investment trusts traded weaker late, particularly specialized and industrial REITS: Equinix -2.41%, Extra Space Storage -1.33%, Realty Income Corp -1.27%.

- Leading gainers: Energy and Materials sectors continued to outperform in late trade, oil and gas shares buoyed the Energy sector as crude prices rallied (WTI +2.32 at 79.88): Valero +5.82%, Marathon Petroleum +4.22%, APA +4.02%. Metals and mining stocks supported the Materials sector as gold also rebounded from Tuesday's sell-off (+13.50 at 2171.84): Freeport-McMoRan +8.23%, Steel Dynamics +2.19% Newmont +1.59%.

E-MINI S&P TECHS: (M4) Trend Needle Points North

- RES 4: 5321.43 3.0% Bollinger Band

- RES 3: 5300.00 Round number resistance

- RES 2: 5291.89 2.0% 10-dma envelope

- RES 1: 5257.25 High Mar 8

- PRICE: 5238.50 @ 1520 ET Mar 13

- SUP 1: 5147.25 20-day EMA

- SUP 2: 5031.12 50-day EMA

- SUP 3: 4994.25 Low Feb 13

- SUP 4: 4921.00 Low Jan 31

The trend condition in S&P E-Minis remains bullish and the latest pullback is considered corrective. Last week’s fresh highs reinforce current conditions. Note that price action continues to highlight the fact that corrections remain shallow. This is an important bullish signal highlighting positive market sentiment. Support to watch is 5147.25 the 20-day EMA. A clear break of this average would open 5031.12, the 50-day EMA. Sights are on 5300.00 next.

COMMODITIES Copper Rises to 11-Month High As Chinese Smelters Discuss Cuts

- Precious metals have risen on Wednesday, with spot gold rebounding by 0.8% to $2,175/oz on the session.

- The recent break above resistance at $2135.4, the Dec 4 high, signals scope for $2206.6 next, a Fibonacci projection. Firm support is at $2095.2, the 20-day EMA.

- Meanwhile, silver is outperforming today, rising by 3.5% to $25/oz. As a result, the gold/silver ratio is down sharply on the day, to its lowest level since Feb 19.

- Elsewhere, copper prices rose by 3.1% to $405/lb, reaching the highest level since April last year. The metal was supported by reports that Chinese smelters discussed steps including potential production cuts to cope with a plunge in processing fees.

- Crude futures are trading higher on the day amid potential supply disruptions from further drone attacks on Russian refineries and an unexpected draw in US crude stocks.

- WTI is back to its intraday high, up 3.0% at $79.9/bbl. Higher US refinery utilisation rates and rising gasoline demand are also likely to be supportive.

- The WTI futures trend condition remains bullish, with initial resistance at $80.85, the Mar 1 high, followed by $81.70, a Fibonacci retracement. On the downside, support to watch is $76.61, the 50-day EMA.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/03/2024 | 0700/0800 | *** |  | SE | Inflation Report |

| 14/03/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2024 | 0930/1030 |  | EU | ECB's Elderson at European Banking Federation meeting | |

| 14/03/2024 | 1100/1200 |  | EU | ECB's Schnabel Speech at MMCG meeting | |

| 14/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 14/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/03/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2024 | 1230/0830 | *** |  | US | PPI |

| 14/03/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 14/03/2024 | 1400/1000 | * |  | US | Business Inventories |

| 14/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/03/2024 | 1800/1900 |  | EU | ECB's De Guindos fireside chat at Foros |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.