-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS: Tsys Hold Range, Stocks New Highs

- MNI SECURITY: North Korea Rejects US Offer Of Nuclear Talks

- MNI WHEAT: Erdogan Hopes Foreign Ministers Meeting Can Lead To Grain Deal Progress

- TSY SEC YELLEN: I DON'T EXPECT A US RECESSION; LABOR MARKET IS STRONG, Bbg

Key Links: MNI PODCAST: FedSpeak - Home Supply Fear Trumps BOC Rate Hikes / MNI Europe Pi (Positioning Indicator): Schatz Shorts Fading / US Treasury Auction Calendar

US TSYS: Markets Roundup: Narrow Inside Range to Start New Week

- Typical summer session, muted action after last last week's full docket of CPI, PPI and Retail Sales. Light volumes with Japan out for one day holiday, Treasury futures traded inside narrow session range, 5s-10s outperforming mildly lower intermediates by the close. Curves a touch flatter.

- Limited reaction to small beat for July Empire Fed manufacturing index as it dipped to +1.1 (cons -3.5) after +6.6, close compared to some recent surprises.

- Remember this is a particularly volatile measure, with a standard deviation for its monthly change since 2021 at a very wide 23pts (and 28pts since 2022), but two months at broadly similar levels has been unusual compared to its typical pattern of lurching lower again.

- The Federal Reserve is in media blackout in regards to policy, through July 27, the day after the next FOMC.

- Projected rate hike expectations holding steady: July 26 FOMC is 93.6% w/ implied rate of +23.4bp to 5.313%. September cumulative of +26.6bp at 5.345%, November cumulative of 32.1bp at 5.399%, and December cumulative of 25.8bp at 5.337%. Fed terminal holding at 5.40% in Nov'23.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01617 to 5.24611 (+.05293 total last wk)

- 3M +0.01023 to 5.32012 (+.01451 total last wk)

- 6M +0.02081 to 5.39635 (-.03946 total last wk)

- 12M +0.03891 to 5.29292 (-.20041 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $115B

- Daily Overnight Bank Funding Rate: 5.07% volume: $270B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.448T

- Broad General Collateral Rate (BGCR): 5.03%, $598B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $590B

- (rate, volume levels reflect prior session)

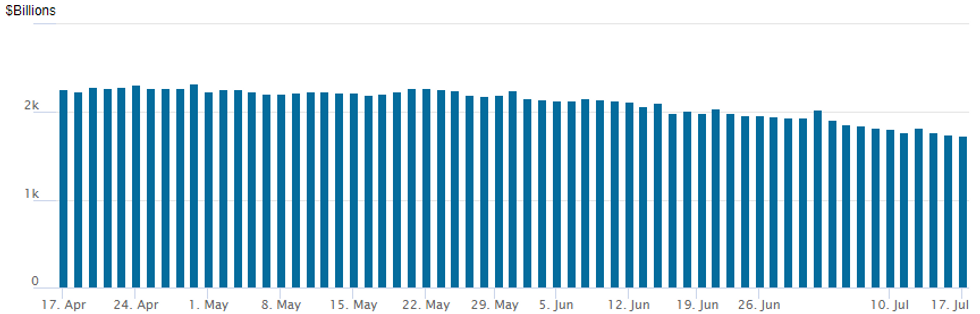

FED Reverse Repo Operation

NY Federal REserve/MNI

The latest operation falls to $1,728.322B (lowest since early May'22), w/ 98 counterparties, compared to $1,740.777B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Upside calls drew more interest on light overall volume Monday, a muted start to the week with Japan out for one day holiday, and no significant data. Underlying futures traded mildly higher on a narrow range, lead quarterly Jun'23 SOFR steady with projected rate hike expectation: July 26 FOMC is 93.6% w/ implied rate of +23.4bp to 5.313%

- SOFR Options:

- over 5,200 OQU3 97.00 calls 2.5 ref 95.835

- -5,000 2QH3 95.75/97.75 call over risk reversals, 0.0 net vs. 96.75/0.40%

- +4,000 OQZ3 95.37/96.00 2x1 put spds, 7.0 ref 96.17

- 4,000 SFRH4 97.00/94.50 call spds vs. 2QH4 98.50/99.00 call spds, Green Aug'24 bought over, 0.5 net db on bull curve flattener

- Block, 5,000 OQV3 95.75/96.00 put spds 1.5 over 2QV3 96.25/96.50 put spds

- 1,000 SFRU3 94.37/94.50/94.62 put flys

- Treasury Options:

- over 4,400 TYQ3 112.75 calls, 15 last ref 112-16

- 2,000 TYU3 109/111/112/113 broken put condors

- 2,500 FVU3 108.5/109 call spds, 8.5 ref 107-17

- 4,000 FVU3 108.75/109 call spds, 4.5 ref 107-19

- 10,000 TYU3 113.5/115 call spds, 21

- 13,000 FVU3 109 calls from 17.5-19.5 ref 107-24.5

- 5,000 TYQ3 111/111.5 put spds, 3 ref 112-23 to -23.5

- 2,000 wk2 FV 108.25 calls ref 107-18.25

EGBs-GILTS CASH CLOSE: UK Curve Bull Steepens With Weds CPI Eyed

The UK curve bull steepened modestly Monday as BoE hike pricing pulled back, with the belly outperforming on the German curve.

- There was little in the way of impactful newsflow or data in the session, with Italian final inflation data in line. Overnight, soft Chinese GDP data spurred some risk-off moves, though a solid US Empire Manufacturing reading lent a slightly hawkish tone to afternoon trade.

- A quiet session kept Wednesday's crucial UK CPI reading in focus (MNI's Gilt Week Ahead is titled "Inflation, inflation, inflation".

- BoE terminal rate pricing reversed Friday's rise, dropping 9bp on the day, though high odds of an August 50bp hike vs 25bp raise remained steady at 75%.

- Periphery spreads widened slightly, with Greece a modest outperformer following solid primary budget figures for H1.

- Tuesday's docket is light, with ECB's Villeroy speaking, along with German Schatz and 2053 Gilt supply.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 3.189%, 5-Yr is down 3.2bps at 2.579%, 10-Yr is down 3.2bps at 2.48%, and 30-Yr is down 2.7bps at 2.506%.

- UK: The 2-Yr yield is down 3.8bps at 5.168%, 5-Yr is down 3.1bps at 4.556%, 10-Yr is down 1.3bps at 4.431%, and 30-Yr is unchanged at 4.556%.

- Italian BTP spread up 1.5bps at 167.4bps / Greek up 0.7bps at 145.9bps

EGB Options: Several Call Spread Trades

Monday's Europe rates / bond options flow included:

- ERZ3 96.75/97.25 call spread 5K given at 2.25

- ERH4 96.75/97.25 call spread bought for 5 in 3k (vs 96.03)

- ERH4 98.50/99.50 call spread sold at 1.75 in 7.5k

- ERM4 97.00/98.00/99.00 call fly paper paid 7 on 4K

- 0RV3 96.875/97.125 call spread bought for 6.75 in 2k (v 96.62)

FOREX Antipodean FX Remain Underperformers Despite Buoyant Equities

- CNH, AUD and NZD are the poorest performers across G10 on Monday following a softer-than-expected Chinese GDP release. While the data showed an acceleration from the Q1 print, it has prompted a number of sell-side firms to trim their growth expectation for this calendar year, with most trimming around 0.5ppts to forecast 5.0% annual growth this year.

- A moderate risk-off tone prevailed in early trade following the data, helping JPY and CHF screen among the strongest initial performers in G10, eventually filtering through to a stronger greenback as the US session kicked off.

- The greenback was then bolstered by a firmer-than-expected Empire State Manufacturing Index figure (+1.1 vs -3.5 estimate), prompting the USD index to trade to session highs back above the 100.00 mark. USDJPY had a notable recovery from the 138.00 overnight lows to reach as high 139.41. Despite the bounce, the bear cycle that started Jun 30 is still underway for the pair. The recent sell-off has resulted in a break of both the 20- and 50-day EMAs and price is back inside the bull channel drawn from the Jan 16 low. A continuation lower would open 136.57, the lower band of a moving average envelope.

- As the dust settled on a quiet Monday, equities resumed their strengthening trend and the USD slowly edged lower throughout the session and the DXY remains close to unchanged as we approach Tuesday’s APAC crossover.

- RBA minutes are due overnight before Tuesday’s release of Canadian CPI and US retail sales. The other notable release this week will be Wednesday’s release of UK CPI.

FX: Expiries for Jul18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-10(E4.5bln), $1.1225(E521mln)

- USD/JPY: Y139.50-70($543mln)

- GBP/USD: $1.3010(Gbp853mln)

- AUD/USD: $0.6800-15(A$1.1bln), $0.6850(A$957mln), $0.6875-95(A$1.2bln)

- USD/CAD: C$1.3240($526mln)

- USD/CNY: Cny7.1450-65($937mln), Cny7.1500($1.4bln)

Late Equity Roundup: Finishing Strong

- Stocks continue to grind higher Monday, SPX eminis breaching last Friday's high print (4559.25) - new best level since early April 2022. Currently, S&P E-Mini Future are up S&P E-Mini Future up 27.75 points (0.61%) at 4564.5 Nasdaq up 156.2 points (1.1%) at 14270.04, DJIA up 148.31 points (0.43%) at 34656.01.

- Leading gainers: Information Technology, Financials and Industrials sectors are outperforming. As has been the case for weeks, IT sector support driven by AI applications demand for semiconductors: First Solar +8.25%, Enphase +7.13%, SolarEdge +4.75, Monolithic Power +4.4%.

- Insurance providers continued to narrowly outpace banks, Arch Capital Group +4.75%, Progressive +4.4% and AIG +2.86%. Banks are trading firmer following start of latest earning cycle last Friday, Wells Fargo +3.55%, JP Morgan +2.47, Zion Bancorp +2.35.

- Laggers: Utilities, Real Estate and Communication Services sectors underperforming. Telecom shares weighed on the latter with ATT -6.75%, Verizon -7.65. ATT shares fall below $14.0, nearly 30-year low after Citi analysts downgraded the company, Keybank analysts downgraded Verizon.

- Look ahead: Banks resume earnings announcement tomorrow: Bank of New York Mellon, Bank of America, Charles Schwab, Morgan Stanley.

- Wednesday includes Citizens Financial, M&T Bank, Northern Trust, US Bancorp, Goldman Sachs, Discover Financial, Fifth Third Bancorp, KeyCorp, Truist Financial, Capital One, Comerica, Huntington Bancshares and American Express.

E-MINI S&P TECHS: (U3) Bulls Remain in Driver's Seat

- RES 3: 4584.42 Bull channel top drawn from the Mar 13 low

- RES 2: 4576.62 2.50 projection of the May 4 - 19 - 24 price swing

- RES 1: 4564.75 High Jul 17

- PRICE: 4562.00 @ 1515ET Jul 17

- SUP 1: 4439.81/4368.50 20-day EMA / Low Jun 26 and a key support

- SUP 2: 4351.02 50-day EMA

- SUP 3: 4337.83 Bull channel base drawn from the Mar 13 low

- SUP 4: 4269.50 Low Jun 2

A bull theme in S&P E-minis remains intact. This week’s rally has resulted in a break of resistance at 4498.00, the Jun 30 high. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4556.71, a Fibonacci projection. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES: Crude Oil Weighed By China Data and Libya Restarts

- MNI (London) -- Crude oil tried reversing earlier losses but hasn't been able to make the move stick, with European reaction to softer than expected China GDP and the resumption of production at key Libyan oil fields ultimately setting the tone for the day.

- Oil futures priced spiked earlier today after Reuters posted a headline that Saudi Arabia will extend its pledged output cut until the end of 2024. The alert was retracted shortly after as it was a repeat of news published on 4 June. Brent front month spiked to $80.64/bbl.

- WTI is -1.6% at $74.18, remaining above support at $72.31 (20-day EMA) whilst not troubling resistance at $78.03 (Fibo retracement of Apr 12 – May 4 bear leg).

- Brent is -1.7% at $78.50, above support at $76.98 (20-day EMA) but equally not testing resistance at $82.06 (Fibo retracement of Apr 12 – May 4 downleg).

- Gold is near unchanged at $1955.56 after a second relatively tame day for the US dollar awaiting tomorrow’s retail sales data. It continues to remain reasonably close to resistance at $1968.0 (Jun 16 high) with an intraday high nudging $1960, whilst support is seen at $1934.4 (20-day EMA).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 18/07/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/07/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/07/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/07/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 18/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/07/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 18/07/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/07/2023 | 1400/1000 | * |  | US | Business Inventories |

| 18/07/2023 | 1400/1000 |  | US | Fed's Michael Barr | |

| 18/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/07/2023 | 2000/1600 | ** |  | US | TICS |

| 19/07/2023 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.