-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI ASIA MARKETS ANALYSIS: Tsys Lowers Marketable Borrow Ests

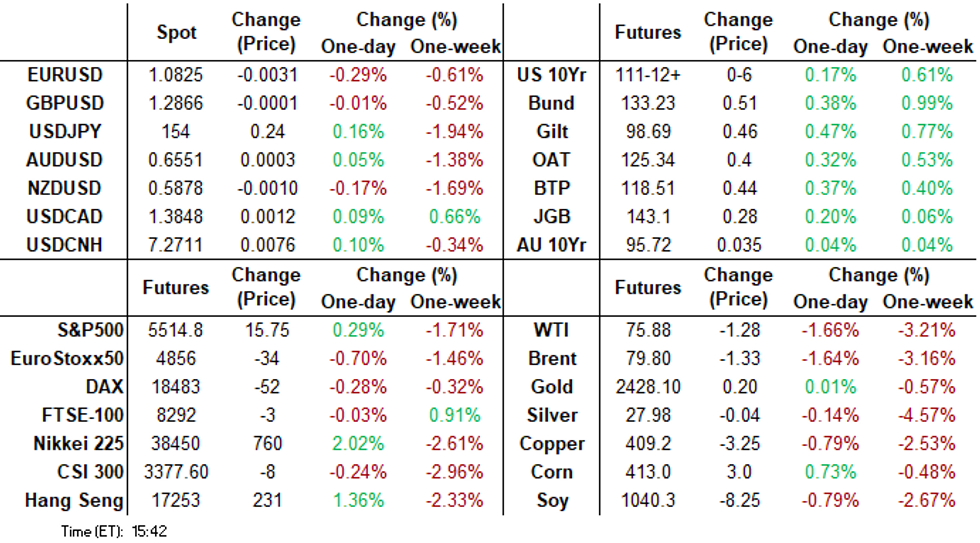

- Treasuries look to finish the week opener modestly higher, main focus on Wednesday's FOMC and Friday's NFP.

- Treasury futures gained slightly after the Tsy borrow estimate decline from $847B to $740B announced.

- Cross asset roundup, stocks mildly higher (Eminis +10.0 at 5509.0), crude trades weaker (WTI -1.35 at 75.81), Gold weaker (-7.60 at 2379.59).

US Tsys Firmer, Inside Session Range After Tsy Lowers Borrow Estimates

- Treasuries are modestly higher after the bell, holding to a narrow session range, brief bounce after the Tsy borrow estimate decline from $847B to $740B announced.

- There were no major surprises in Treasury's Marketable Borrowing Estimates (link), as the Treasury Department appears to take a middle-of-the-road approach on cash building ahead of the reinstatement of the debt ceiling at the start of 2025.

- The TSY quarterly refunding annc is scheduled for Wednesday at 0830ET, along with ADP, PMI and the next FOMC policy annc. Friday sees the July nonfarm payrolls data.

- Tsy Sep'24 10Y futures trade +5.5 at 111-12 vs. 111-16.5 high -- initial technical resistance followed by 111-17.5 (1.382 of Apr 25-May 16-29 swing). Curves continue to scale back from last week's steepening, 2s10s -2.129 at -21.274.

- Projected rate cut pricing into year end look steady to mildly mixed vs. late Friday levels (*) -- Nov and Dec a touch: July'24 at -4% w/ cumulative at -1bp at 5.319%, Sep'24 cumulative -28.2bp (-28.4bp), Nov'24 cumulative -43.9bp (-45.1bp), Dec'24 -67bp (-67.9bp).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00299 to 5.34371 (+0.00027 total last wk)

- 3M -0.00326 to 5.25211 (-0.02762 total last wk)

- 6M -0.00376 to 5.08769 (-0.04323 total last wk)

- 12M -0.00248 to 4.75042 (-0.04736 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.00), volume: $2.027T

- Broad General Collateral Rate (BGCR): 5.34% (+0.00), volume: $806B

- Tri-Party General Collateral Rate (TGCR): 5.34% (+0.00), volume: $779B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $223B

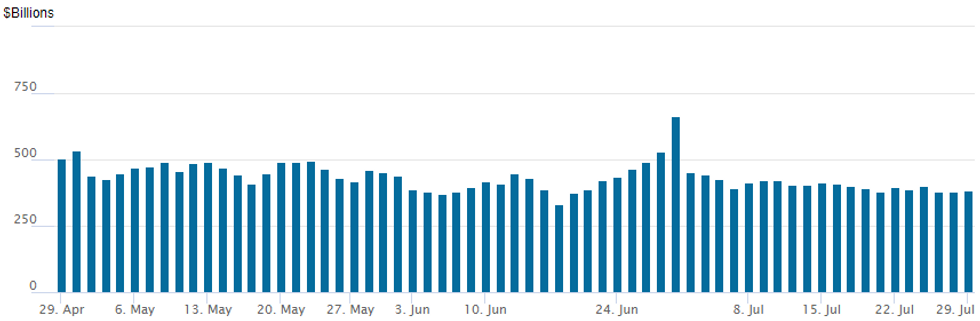

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage inches up to $385.281B from $381.257B on Friday. Number of counterparties at 68 from 70 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

With few exceptions, SOFR and Treasury options continued to favor upside calls Monday, carry-over from late last week on decent volumes. Underlying futures are trading firmer, focus on this Wednesday's FOMC policy annc. Projected rate cut pricing into year end look steady to mildly mixed vs. late Friday levels (*) -- Nov and Dec a touch: July'24 at -4% w/ cumulative at -1bp at 5.319%, Sep'24 cumulative -28.2bp (-28.4bp), Nov'24 cumulative -43.9bp (-45.1bp), Dec'24 -67bp (-67.9bp).- SOFR Options

- +5,000 SFRU4 94.93/95.00/95.06/95.12 call spds, 1.0 ref 94.955

- +5,000 SFRQ4 94.69/94.81/94.93 put flys, 2.62

- Block, +5,000 2QZ4 96.50 straddles 60.5 ref 96.58

- Block, 8,000 0QU4 95.75 puts, 2.5 ref 96.255

- Block, 3,000 2QZ4 96.75/97.00/97.25 call flys, 3.0 vs. 96.55/0.05%

- 2,000 SFRZ4 95.50/95.75 call spds

- 2,000 SFRV4 95.18/95.31/95.43 call flys ref 95.38

- 4,000 SFRQ4 94.93/95.06/95.12/95.25 call condors ref 94.97

- 1,500 0QU4 96.87/0QZ4 97.25 call spds

- 3,100 SFRU4 94.93/95.12/95.31 call flys, ref 94.97

- Treasury Options:

- -5,500 TYV4 110/114 strangle, 46 ref 111-25

- 5,000 USU4 116/117 put spds ref 120-01

- +6,600 TYU4 112.5 calls, 23 ref 111-15

- 1,100 USU4 124 calls vs. USU4 113/116 put spds ref 119-31

- +2,500 wk2 TY 110/113 call over risk reversals, 2 ref 111-14.5

- 2,000 FVU4 108/109/110 call flys ref 107-23

- 3,900 TYU4 109.5 calls & 3,500 TYU4 109.5 puts

- 11,000 TYU4 112/113 call spds, 18 ref 111-13.5

- 8,000 TYU 112 calls, 30-32

- 3,200 TYU4 110.25 puts vs. TYU4 112/113 call spds ref 111-13.5

- 1,650 Wednesday wkly 10Y 110.25/110.75/111.25 put flys, exp this Wednesday

- 3,300 TYU4 110.5/111.5 call spds ref 111-13

FOREX: EURUSD Falls to Three-Week Low Amid Weakness for European Equities

- Currency markets have adopted a moderate risk-off tone on Monday, despite a distinct lack of major external developments or datapoints. Weakness for European equity indices has prompted the USD index to rise 0.25%, and in tandem assisting EURUSD to reach a fresh three-week low.

- The pair has now broken below last week’s low of 1.0826 and pierced support around the 50-day EMA, at 1.0818. A clear break of the average would signal scope for a deeper retracement and open 1.0774, a Fibonacci retracement. For bulls, a reversal higher would highlight the end of the current corrective cycle and open the key resistance at 1.0948, the Jul 17 high.

- There was notable volatility for sterling ahead of comments made by Chancellor Reeves. Some early relative weakness briefly saw GBPUSD test as low as 1.2807, although the bulk of this move has now reversed. Price action saw EURGBP have a notable test of the 50-dma of 0.8461, however the cross now trades close to 50 pips below the morning high.

- Another volatile session for the Japanese Yen, in which after trading down as low as 153.02, USDJPY hovers nearer to the 154.00 handle as we approach the APAC crossover.

- German and Spanish CPI will be in focus Tuesday, ahead of US consumer confidence and JOLTS data. The data precedes a very busy economic calendar this week, including decisions from the Fed and BOE, as well as the US employment report Friday.

Late Equities Roundup: Off Lows, Autos, Fast Food, Media Outperform

- Stocks are drifting near steady to narrowly mixed in late trade -- recovering off late morning lows after the London close. Currently, the DJIA is down 23.14 points (-0.06%) at 40566.44, S&P E-Minis up 3.25 points (0.06%) at 5502.5, Nasdaq up 3.1 points (0%) at 17362.5.

- Consumer Discretionary and Communication Services continued to outperform in late trade, Tesla +5.47% supported the Consumer Discretionary sector as did McDonalds +4.02% and Deckers Outdoor Corp +3.13%. Media and Entertainment shares supported the Communication Services sector: Charter Communications +3.04%, Disney +2.64%, Comcast +2.18%.

- Energy and Information Technology sectors continued to underperform in late trade, weaker crude (WTI -1.35 at 75.81) weighing on oil and gas shares: EOG Resources -1.86%, Devon Energy -1.86%, APA -1.75%. Meanwhile, Information Technology sectors traded weaker: Enphase -5.1%, First Solar - 2.92%, Intel -1.26%. A notable exception was ON Semiconductor +12.5% after reporting better than expected earnings this morning.

- Earnings announcement expected after today's close include: SBA Communications, Welltower, Chesapeake Energy, Lattice Semiconductor and Sybmotic.

E-MINI S&P TECHS: (U4) Bearish Cycle

- RES 4: 5741.34 3.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5721.25 High Jul 16 and the bull trigger

- RES 2: 5629.75 High Jul 23

- RES 1: 5563.31 50-day EMA

- PRICE: 5502.75 @ 1450 ET Jul 29

- SUP 1: 5432.50 Low Jul 25

- SUP 2: 5413.55 3.0% 10-dma envelope

- SUP 3: 5370.62 50.0% retracement of the Apr 19 - Jul 16 bull leg

- SUP 4: 5267.75 Low May 31 and key support

S&P E-Minis traded lower last week and the move down resulted in a break of both the 20- and 50-day EMAs. This reinforces a short-term bearish cycle and signals scope for an extension near-term. Note that the move down is considered corrective. Potential is seen for a move towards 5413.55, the lower band of a MA envelope, ahead of 5370.62 a Fibonacci retracement. Key short-term resistance is 5629.75, the Jul 23 high.

COMMODITIES Crude Slides, Spot Gold Edges Lower

- WTI has lost ground today, falling to its lowest level since June 10. Crude is extending the recent bearish trend amid weak Chinese demand and OPEC’s planned supply boost from Q4.

- WTI Sep 24 is down by 1.8% at $75.8/bbl.

- After Venezuela’s President Maduro was declared the winner of Sunday’s presidential election, the US will determine whether to install future sanctions on the country based on whether Maduro’s government releases voting data.

- The recent move lower in WTI futures signals scope for an extension near-term. A resumption of the bear leg would open $72.23, the Jun 4 low.

- For bulls, a reversal higher would refocus attention on key resistance at $83.58, the Jul 5 high.

- Spot gold has edged down by 0.3% to $2,379/oz today, as the market awaits Wednesday’s FOMC rate decision.

- The yellow metal has recently pierced the 50-day EMA at $2,361.8, a clear break of which would signal scope for a deeper retracement towards $2,277.4, the May 3 low.

- For bulls, a reversal higher would refocus attention on $2,483.7, the Jul 17 high.

- Meanwhile, copper has slid another 0.9% to $409/lb.

- A clear break of $405.57, 76.4% of the Feb 9 - May 20 bull cycle, would set the scene for weakness towards $372.35, the Feb 9 low.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/07/2024 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/07/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 30/07/2024 | 0130/1130 | * |  | AU | Building Approvals |

| 30/07/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/07/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/07/2024 | 0600/0800 | *** |  | DE | GDP (p) |

| 30/07/2024 | - |  | US | FOMC Meeting | |

| 30/07/2024 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/07/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/07/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/07/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/07/2024 | 0800/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 30/07/2024 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/07/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/07/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/07/2024 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/07/2024 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/07/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/07/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/07/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/07/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/07/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/07/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/07/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 30/07/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 30/07/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.